A home warranty can be an attractive option for homeowners seeking to protect themselves from unexpected repair costs associated with major home systems and appliances. Typically, these warranties cover repairs or replacements for items like heating and cooling systems, plumbing, electrical systems, and various appliances. While they can offer peace of mind and financial protection, there are significant advantages and disadvantages to consider before investing in a home warranty. This article delves into the pros and cons of 2-10 home warranties, providing a comprehensive overview for potential buyers.

| Pros | Cons |

|---|---|

| Peace of Mind | Limited Coverage |

| Cost Savings on Repairs | Service Call Fees |

| Convenience in Finding Service Providers | Exclusions and Limitations |

| Predictable Annual Costs | Potential for Low-Quality Repairs |

| Increased Home Value | Claims Process Can Be Lengthy |

| Coverage for Older Appliances | May Not Cover Pre-existing Conditions |

| Multiple Coverage Plans Available | Bait and Switch Pricing Practices |

| Annual Maintenance Perks | Less Control Over Repair Process |

Peace of Mind

One of the most significant advantages of a 2-10 home warranty is the peace of mind it provides. Homeowners can rest easy knowing that unexpected repairs will not lead to financial strain.

- Financial Security: Knowing that a major appliance failure won’t result in exorbitant out-of-pocket expenses can help homeowners budget more effectively.

- Emotional Relief: The stress associated with potential repairs is alleviated, allowing homeowners to focus on other aspects of homeownership.

Cost Savings on Repairs

Home warranties can lead to substantial savings on repair costs.

- Flat Fees for Repairs: Instead of paying full retail prices for repairs that could run into hundreds or thousands of dollars, homeowners often pay a service fee (typically between $50 and $100) per service call.

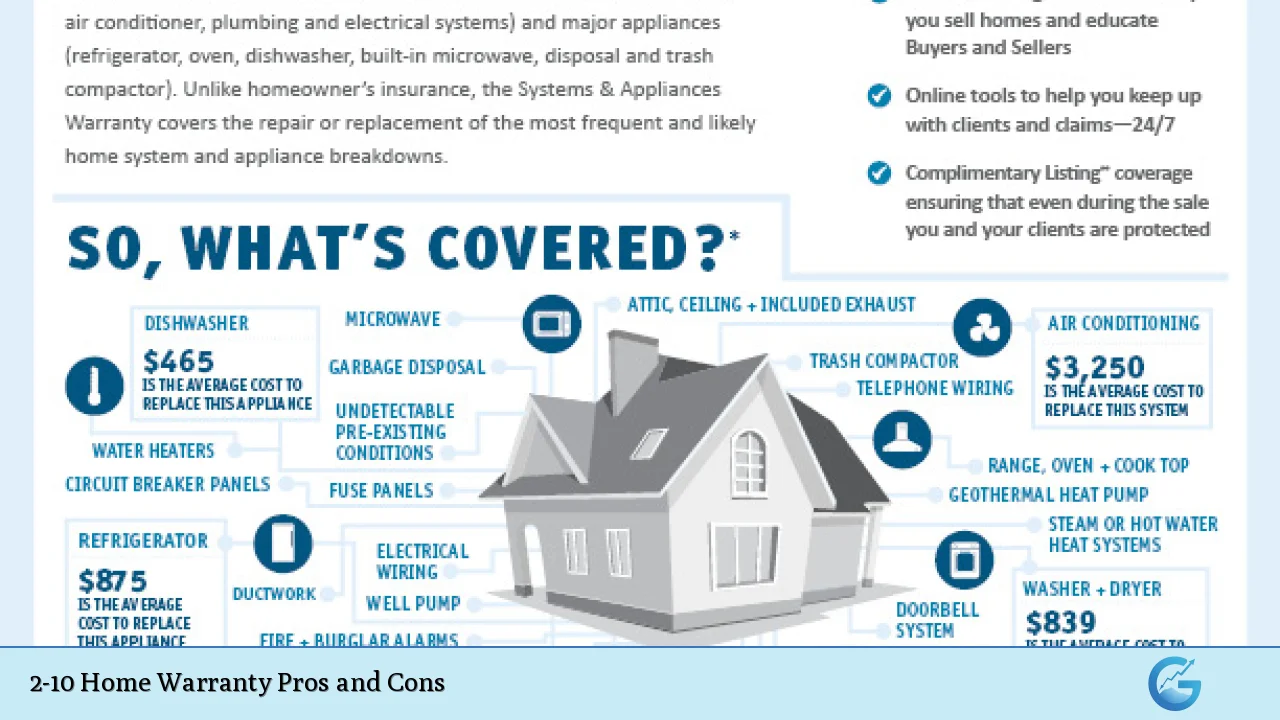

- Coverage for Major Systems: Many warranties cover expensive systems such as HVAC units, which can cost thousands to replace.

Convenience in Finding Service Providers

Homeowners often find it challenging to locate reliable contractors for repairs.

- Pre-screened Contractors: Home warranty companies typically have networks of vetted professionals, saving homeowners time and effort in finding trustworthy service providers.

- Simplified Process: Homeowners can simply call their warranty provider rather than searching for contractors themselves.

Predictable Annual Costs

Having a home warranty allows homeowners to budget more effectively.

- Fixed Annual Premiums: Home warranties usually come with predictable annual premiums, which helps homeowners plan their finances without worrying about sudden repair costs.

- No Surprises: Knowing the annual cost helps in financial planning, especially for those on fixed incomes or strict budgets.

Increased Home Value

A home warranty can be an appealing selling point when listing a property.

- Attracts Buyers: Potential buyers may feel more secure knowing they have coverage for major repairs during the first year after purchase.

- Negotiation Tool: A warranty can be used as leverage during negotiations, potentially increasing the sale price or making the home more attractive compared to others without warranties.

Coverage for Older Appliances

Older appliances are more prone to breakdowns, making coverage essential.

- Protection Beyond Manufacturer’s Warranty: A home warranty often covers appliances beyond their original manufacturer’s warranty period, which is beneficial for older homes.

- Financial Relief for Aging Systems: Homeowners with aging systems can avoid the financial burden associated with frequent repairs or replacements.

Multiple Coverage Plans Available

Homeowners have options when it comes to selecting a plan that fits their needs.

- Tailored Coverage: Various plans allow homeowners to choose coverage that aligns with their specific needs and budget constraints.

- Add-on Options: Many providers offer additional coverage options for items not included in standard plans, such as pools or spas.

Annual Maintenance Perks

Some home warranties include maintenance services that can prevent future issues.

- Regular Check-ups: Annual inspections or tune-ups included in some plans can help identify potential issues before they become costly problems.

- Efficiency Improvements: Regular maintenance can lead to improved efficiency of systems like HVAC units, potentially lowering utility bills over time.

Limited Coverage

Despite their benefits, 2-10 home warranties come with significant limitations that homeowners should be aware of.

- Specific Exclusions: Many warranties do not cover items such as pre-existing conditions, cosmetic damage, or maintenance-related issues. Understanding what is excluded from coverage is crucial before purchasing a warranty.

- Caps on Coverage: Warranties often impose dollar limits on how much they will pay per repair or replacement, which may leave homeowners responsible for substantial out-of-pocket expenses if costs exceed these limits.

Service Call Fees

While service call fees are generally lower than full repair costs, they can add up over time.

- Cumulative Costs: Frequent repairs may lead to multiple service fees throughout the year, which could negate some savings provided by the warranty itself.

- Budgeting Challenges: Homeowners should consider these additional costs when evaluating the overall value of a home warranty.

Exclusions and Limitations

Understanding exclusions is critical when considering a home warranty.

- Varied Coverage Terms: Different companies have different definitions of what constitutes normal wear and tear versus damage covered by the warranty. This variability can lead to misunderstandings about what is covered when claims are made.

- Potentially Costly Gaps: If homeowners do not read their contracts thoroughly, they may find themselves facing unexpected expenses due to uncovered items or conditions deemed pre-existing by the warranty provider.

Potential for Low-Quality Repairs

The quality of service provided by contractors under home warranties can vary significantly.

- Cost-Cutting Measures: Warranty companies may prioritize cost savings over quality, leading to subpar repairs that do not fully resolve issues or require repeated visits.

- Limited Choice of Contractors: Homeowners often cannot choose their own contractors; instead, they must rely on those selected by the warranty company. This lack of control can lead to dissatisfaction with repair work done on their homes.

Claims Process Can Be Lengthy

The process of filing claims and receiving service can be frustratingly slow at times.

- Wait Times for Service: Depending on the company and local contractor availability, homeowners may experience delays in getting repairs completed after filing a claim.

- Bureaucratic Hurdles: The claims process often involves multiple steps that require patience from homeowners who need urgent repairs completed quickly.

May Not Cover Pre-existing Conditions

Home warranties typically exclude coverage for pre-existing conditions or issues known at the time of purchase.

- Risk of Denial: If an appliance or system has known issues before purchasing the warranty, claims related to those problems will likely be denied.

- Misleading Assumptions: Homeowners might mistakenly believe they are covered for all issues once they purchase a warranty without understanding these limitations fully.

Bait and Switch Pricing Practices

Some companies lure customers with low initial rates that increase significantly upon renewal.

- Initial Discounts vs. Long-term Costs: While many companies offer attractive introductory rates, subsequent years may see steep increases that make maintaining coverage expensive over time.

- Lack of Transparency: Homeowners must scrutinize contracts carefully to avoid surprises when renewal time comes around.

Less Control Over Repair Process

Home warranties often dictate how repairs are handled, which may not suit all homeowners’ preferences.

- Limited Involvement in Repairs: For those who prefer being hands-on with home repairs or have specific preferences regarding contractors or parts used, this lack of control could be frustrating.

- Scheduling Conflicts: Warranty companies typically schedule service calls based on their availability rather than the homeowner’s convenience, which could lead to delays in getting necessary work done.

In conclusion, while a 2-10 home warranty offers numerous advantages such as peace of mind, cost savings on repairs, and convenience in finding service providers, it also comes with notable disadvantages including limited coverage options and potential frustrations with claims processes. Homeowners must weigh these pros and cons carefully against their specific needs and circumstances before deciding whether a home warranty is a worthwhile investment. Understanding both sides will empower them to make informed decisions about protecting their homes and finances effectively.

Frequently Asked Questions About 2-10 Home Warranty Pros And Cons

- What is a 2-10 home warranty?

A 2-10 home warranty is a service contract that covers repair or replacement costs for major systems and appliances in homes. - What are common exclusions in home warranties?

Common exclusions include pre-existing conditions, cosmetic damage, and certain types of damage caused by neglect or improper installation. - How much does a 2-10 home warranty typically cost?

The average cost ranges from $300 to $600 annually but may vary based on coverage levels and additional options. - Can I choose my own contractors?

No; most home warranties require you to use their network of pre-approved contractors. - What happens if my claim is denied?

If your claim is denied, you will be responsible for covering any repair costs out-of-pocket. - Are there limits on how much I can claim?

Yes; many warranties impose caps on individual claims as well as annual limits. - How long does it take to get service after filing a claim?

The timeline varies but could take several days depending on contractor availability. - Is it worth getting a 2-10 home warranty?

This depends on individual circumstances; those with older appliances may find them beneficial while others might prefer saving money instead.