Limited pay life insurance, often referred to as 20 pay life insurance, is a type of whole life insurance that allows policyholders to pay premiums for a limited period—typically 20 years—after which the policy is considered “paid up.” This means that the insured will have lifelong coverage without needing to make further premium payments. This insurance product can be appealing for those who want to secure a death benefit while avoiding lifelong financial commitments. However, like any financial product, it comes with its own set of advantages and disadvantages.

This article will explore the pros and cons of 20 pay life insurance in detail, providing insights that can help individuals make informed decisions about their financial planning.

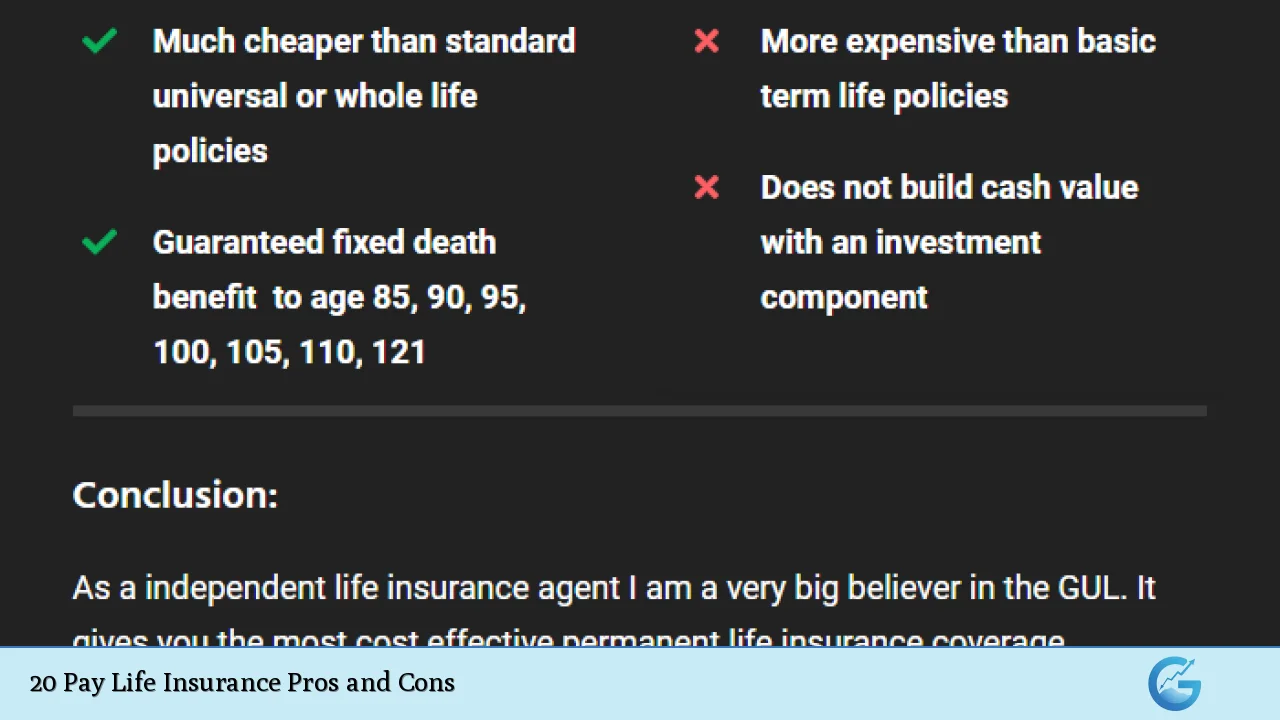

| Pros | Cons |

|---|---|

| Limited payment period | Higher premiums compared to traditional whole life insurance |

| Faster cash value accumulation | Opportunity cost of investing higher premiums elsewhere |

| Permanent coverage for life | Risk of becoming a Modified Endowment Contract (MEC) |

| Predictable costs with clear end date | Potentially less flexibility in premium payments |

| No premiums after the payment period ends | Higher total costs if death occurs early in the policy term |

| Potential for dividends and additional benefits | Complexity compared to term life insurance policies |

| Tax-deferred cash value growth | Less liquidity compared to other investment options |

| Can serve as a wealth-building tool | May not be suitable for all financial situations or goals |

| Good for individuals expecting lower income later in life | Limited access to cash value until certain conditions are met |

| Provides peace of mind with lifelong coverage | May require careful management to avoid tax implications on cash value withdrawals or loans |

Limited Payment Period

One of the most significant advantages of 20 pay life insurance is the limited payment period. Policyholders only need to make premium payments for 20 years, after which they no longer owe anything but still maintain coverage for life. This structure can be particularly appealing for individuals who want to ensure their beneficiaries are protected without the burden of lifelong premium payments.

- Advantage: The shorter payment window allows individuals to plan their finances better, knowing that they will not have ongoing obligations in their retirement years.

- Disadvantage: However, this structure means that premiums must be higher during the payment period compared to policies where payments are spread over a lifetime.

Faster Cash Value Accumulation

Another strong point in favor of 20 pay life insurance is its ability to facilitate faster cash value accumulation. Because premiums are paid over a shorter time frame, more money is directed toward building cash value earlier in the policy’s life.

- Advantage: This quicker accumulation can provide policyholders with more substantial cash value that they can borrow against or withdraw if needed.

- Disadvantage: On the flip side, this means that if funds are needed early on, the higher premiums may not leave enough liquidity for other investments or expenses.

Permanent Coverage for Life

Once the premium payments are completed, 20 pay life insurance provides permanent coverage for life. This means that beneficiaries will receive a death benefit regardless of when the insured passes away, as long as premiums were paid during the specified term.

- Advantage: This feature offers peace of mind and financial security for families, ensuring that loved ones are taken care of financially.

- Disadvantage: However, some might find this unnecessary if their financial situation changes and they no longer require such extensive coverage.

Predictable Costs with Clear End Date

The structure of limited pay life insurance allows for predictable costs with a clear end date. Policyholders know exactly how much they will pay and when those payments will cease.

- Advantage: This predictability can aid in long-term financial planning and budgeting.

- Disadvantage: Nonetheless, this predictability can come at a cost; if circumstances change (like job loss), managing these higher premium payments can become challenging.

No Premiums After Payment Period Ends

Once the payment period concludes, policyholders enjoy the benefit of having no further premiums, while still retaining their coverage.

- Advantage: This feature makes it easier for individuals who anticipate lower income later in life, as they won’t have to worry about ongoing costs during retirement.

- Disadvantage: However, if an individual dies shortly after completing their payments, they may end up paying significantly more in total premiums than if they had opted for a traditional whole life policy with lower ongoing payments.

Potential for Dividends and Additional Benefits

Many limited pay policies offer the potential for dividends based on the insurer’s performance. These dividends can be used to purchase additional paid-up insurance or reduce future premiums.

- Advantage: This can enhance both the death benefit and cash value growth over time.

- Disadvantage: However, relying on dividends can introduce uncertainty; they are not guaranteed and depend on company performance.

Tax-Deferred Cash Value Growth

The cash value component of 20 pay life insurance grows on a tax-deferred basis. This means that policyholders do not have to pay taxes on any gains as long as they remain within the policy.

- Advantage: This feature allows individuals to accumulate wealth without immediate tax implications.

- Disadvantage: Conversely, accessing this cash value through loans or withdrawals may result in tax liabilities if not managed properly.

Can Serve as a Wealth-Building Tool

For some individuals, 20 pay life insurance can act as an effective wealth-building tool due to its combination of permanent coverage and cash value growth potential.

- Advantage: It provides an avenue for savings alongside protection, appealing especially to those looking for dual benefits from their investments.

- Disadvantage: However, it may not yield returns comparable to other investment vehicles like stocks or mutual funds, leading some to question its effectiveness as an investment strategy.

Good for Individuals Expecting Lower Income Later in Life

This type of policy is particularly beneficial for those who expect their income to decrease later in life.

- Advantage: By paying higher premiums now while earning more money, individuals can secure lifelong coverage without future financial strain.

- Disadvantage: Yet, this approach may not suit everyone; those with stable or increasing incomes might prefer different types of policies that offer lower initial costs.

Provides Peace of Mind with Lifelong Coverage

Ultimately, one of the strongest selling points of 20 pay life insurance is the peace of mind it provides through lifelong coverage.

- Advantage: Knowing that your loved ones will receive financial support after your passing can alleviate stress and anxiety related to future uncertainties.

- Disadvantage: On the downside, this peace of mind comes at a high cost; individuals must weigh whether such assurance is worth the financial commitment involved.

In conclusion, while 20 pay life insurance offers several compelling advantages such as limited payment periods and permanent coverage, it also presents significant disadvantages including higher premiums and opportunity costs. Individuals considering this type of policy should carefully assess their financial situation and long-term goals before making a decision.

Frequently Asked Questions About 20 Pay Life Insurance

- What is 20 pay life insurance?

It is a type of whole life insurance where you make premium payments over a fixed period (typically 20 years) after which you no longer need to make payments but maintain lifelong coverage. - What are the main benefits?

The primary benefits include limited payment periods, faster cash value accumulation, permanent coverage, and predictable costs. - Are there any downsides?

The downsides include higher premiums compared to traditional policies and opportunity costs associated with investing those funds elsewhere. - How does it compare with term life insurance?

Unlike term insurance which provides coverage only for a specified term without cash value accumulation, 20 pay life insurance offers lifelong protection and builds cash value. - Can I access my cash value?

You can borrow against your cash value or withdraw it; however, doing so may incur taxes if not managed properly. - What happens if I die before completing my payments?

If you pass away before completing your payments, your beneficiaries will still receive the full death benefit. - Is it suitable for everyone?

No, it may not be ideal for everyone; individuals should evaluate their financial situation and goals before choosing this type of policy. - Can I convert my policy later?

This depends on your insurer’s terms; some policies may allow conversion options while others do not.

By understanding both sides—pros and cons—individuals can make informed decisions about whether 20 pay life insurance aligns with their financial strategies and needs.