Taking a loan from your 401(k) plan can be an attractive option for those in need of quick cash. However, while it offers certain benefits, it also comes with significant drawbacks. Understanding the pros and cons of 401(k) loans is crucial for individuals interested in finance, particularly those involved in investment strategies, retirement planning, and personal finance management. This article delves into the advantages and disadvantages of borrowing from your 401(k), providing a balanced view to help you make informed financial decisions.

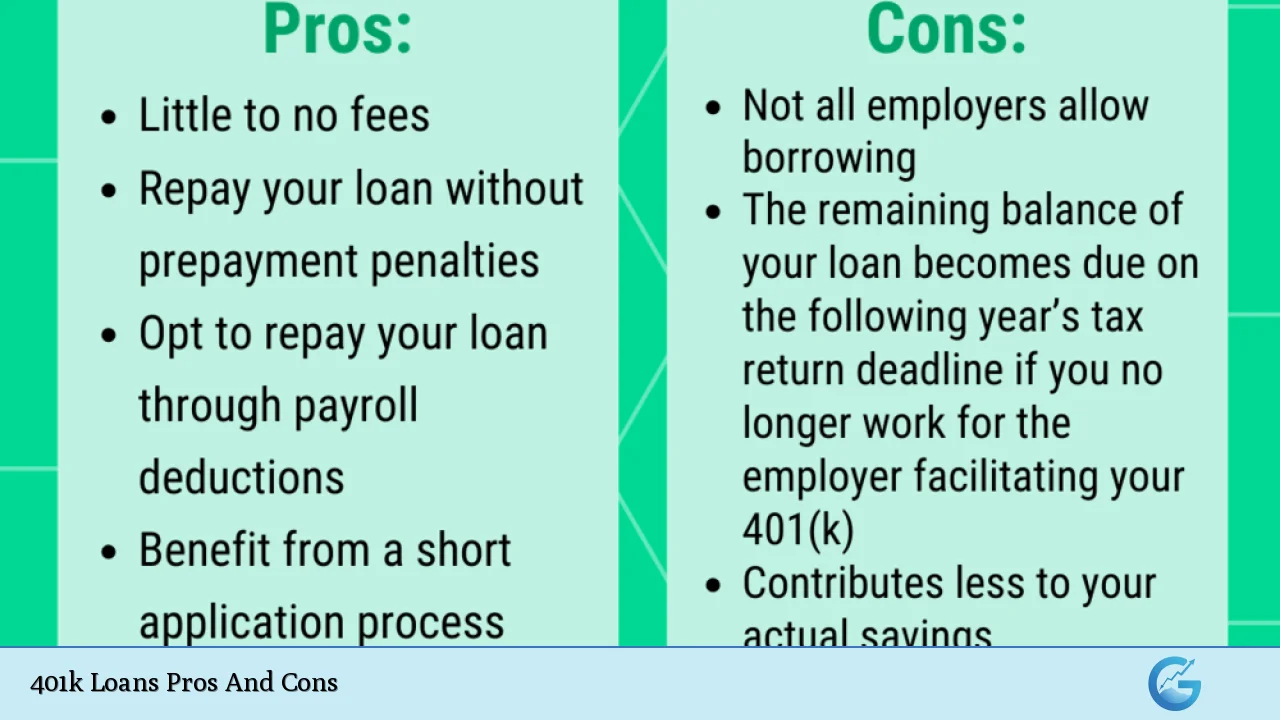

| Pros | Cons |

|---|---|

| Easy access to funds without credit checks | Potential loss of retirement savings growth |

| Interest paid goes back into your account | Risk of default if employment changes |

| No impact on credit score | Loan repayments are made with after-tax dollars |

| Flexible repayment terms | Possible fees associated with the loan |

| Avoidance of taxes and penalties if repaid on time | May discourage further contributions to retirement plans |

| Quick application process | Limited to specific borrowing amounts based on account balance |

| Can be used for various purposes like home purchases or emergencies | Potential tax implications if not repaid properly |

Easy Access to Funds Without Credit Checks

One of the primary advantages of a 401(k) loan is the ease of access to funds. Borrowers can obtain money quickly without the hassle of a credit check, making it an ideal solution for individuals facing immediate financial needs.

- No credit checks: Unlike traditional loans that require a credit assessment, 401(k) loans allow you to borrow against your retirement savings without impacting your credit score.

- Quick approval process: The application process is typically straightforward, often requiring just a few forms or an online request.

- Immediate liquidity: Funds can be accessed relatively quickly, which is beneficial in emergencies or urgent situations.

Interest Paid Goes Back Into Your Account

When you take a loan from your 401(k), the interest payments you make go directly back into your retirement account.

- Self-lending: This means you are essentially borrowing from yourself and paying yourself interest, which can help replenish your retirement savings.

- Lower interest rates: The interest rates on 401(k) loans are often lower than those offered by banks or other financial institutions, making them more affordable.

No Impact on Credit Score

Another significant advantage is that taking out a 401(k) loan does not affect your credit score.

- No hard inquiries: Since there are no credit checks involved, your score remains unaffected by the borrowing process.

- Financial flexibility: This allows individuals with less-than-perfect credit histories to access funds without worrying about additional penalties or impacts on their creditworthiness.

Flexible Repayment Terms

Repayment terms for 401(k) loans are generally flexible compared to traditional loans.

- Typical repayment period: Most plans allow borrowers up to five years to repay the loan, which can be extended if the funds are used for purchasing a primary residence.

- No prepayment penalties: Borrowers can pay off their loans early without incurring additional fees, allowing for greater financial flexibility.

Avoidance of Taxes and Penalties If Repaid on Time

If you adhere to the repayment schedule, you can avoid taxes and penalties that typically accompany early withdrawals from retirement accounts.

- Tax benefits: Unlike traditional withdrawals that incur income tax and potential penalties (especially for those under age 59½), 401(k) loans do not have these same restrictions as long as they are repaid according to plan rules.

Quick Application Process

The application process for a 401(k) loan is generally fast and efficient.

- Minimal documentation required: Most plans require limited paperwork compared to conventional loans.

- Immediate access: Once approved, funds can often be disbursed quickly, providing immediate relief for financial needs.

Potential Loss of Retirement Savings Growth

Despite the benefits, one major disadvantage is that borrowing from your 401(k) can hinder your retirement savings growth.

- Missed investment opportunities: The money borrowed is no longer invested in the market, which means you could miss out on potential gains during that period.

- Compounding effects: Over time, this loss can significantly impact the total value of your retirement savings due to the power of compounding interest.

Risk of Default If Employment Changes

Another critical downside is the risk associated with job changes while having an outstanding loan.

- Accelerated repayment requirements: If you leave your job (voluntarily or involuntarily), many plans require you to repay the remaining loan balance within a short timeframe—often just 60 days.

- Tax consequences upon default: Failure to repay may result in the outstanding balance being treated as a taxable distribution, leading to income taxes and potential penalties.

Loan Repayments Are Made With After-Tax Dollars

Unlike traditional loans where interest payments may be tax-deductible, repayments on 401(k) loans must be made with after-tax dollars.

- Double taxation risk: You will pay taxes on the money before it goes into your account and again when you withdraw it during retirement.

Possible Fees Associated With the Loan

Borrowing from a 401(k) may incur certain fees that could diminish its attractiveness.

- Origination and maintenance fees: Some plans charge fees for processing loans or maintaining them throughout their duration.

- Impact on overall returns: These fees can add up over time and reduce the overall effectiveness of using a 401(k) loan as a financial strategy.

May Discourage Further Contributions to Retirement Plans

Taking out a loan against your retirement savings might lead some individuals to reduce or stop their contributions altogether.

- Psychological factors: Borrowers may feel that their loan repayments substitute for regular contributions, leading them further behind in their retirement savings goals.

- Long-term implications: This behavior could significantly impact future retirement readiness and overall financial health.

Limited To Specific Borrowing Amounts Based On Account Balance

The amount you can borrow from your 401(k) is limited by specific regulations.

- Borrowing limits: Generally, you can borrow up to 50% of your vested balance or $50,000—whichever is less. For smaller balances (under $10,000), borrowing limits are even more restrictive.

- Plan-specific rules: Each employer’s plan may have unique stipulations regarding how much one can borrow and how often loans can be taken out.

Potential Tax Implications If Not Repaid Properly

Failure to adhere to repayment schedules can lead to significant tax consequences.

- Taxable distributions: If you default on a loan or fail to repay within required timelines due to job changes or other reasons, the IRS treats the unpaid balance as taxable income.

- Early withdrawal penalties: For individuals under age 59½, this could also trigger an additional 10% early withdrawal penalty.

In conclusion, while taking a loan from your 401(k) offers immediate access to cash and certain benefits like self-lending interest payments and no credit checks, it also poses serious risks including potential loss of retirement savings growth and tax implications upon default. Individuals must carefully weigh these factors against their current financial needs and long-term retirement goals before deciding whether this option aligns with their overall financial strategy.

Frequently Asked Questions About 401k Loans

- What is a 401(k) loan?

A 401(k) loan allows participants in an employer-sponsored retirement plan to borrow against their own account balance without incurring taxes or penalties if repaid according to plan rules. - How much can I borrow from my 401(k)?

You can typically borrow up to 50% of your vested account balance or $50,000—whichever is less. - Do I need good credit for a 401(k) loan?

No credit checks are required for a 401(k) loan; therefore, borrowers do not need good credit scores. - What happens if I can’t repay my 401(k) loan?

If you cannot repay your loan according to schedule, it may be considered a taxable distribution subject to income tax and possibly early withdrawal penalties. - Can I take multiple loans from my 401(k)?

This depends on your employer’s plan rules; many plans allow only one outstanding loan at any given time. - Are there any fees associated with taking out a 401(k) loan?

Some plans charge origination or maintenance fees when processing loans. - How long do I have to repay my 401(k) loan?

The standard repayment period is five years unless used for purchasing a primary residence. - Will taking out a loan affect my retirement savings?

Yes, borrowing reduces the amount invested in your account during the term of the loan, potentially impacting growth due to missed investment opportunities.