When it comes to retirement savings, two of the most popular options are the 401(k) and the Individual Retirement Account (IRA). Both have distinct advantages and disadvantages that can significantly impact your financial future. Understanding these differences is crucial for making informed decisions about your retirement strategy. This article will explore the pros and cons of both 401(k) plans and IRAs, helping you determine which option may be best for your financial situation.

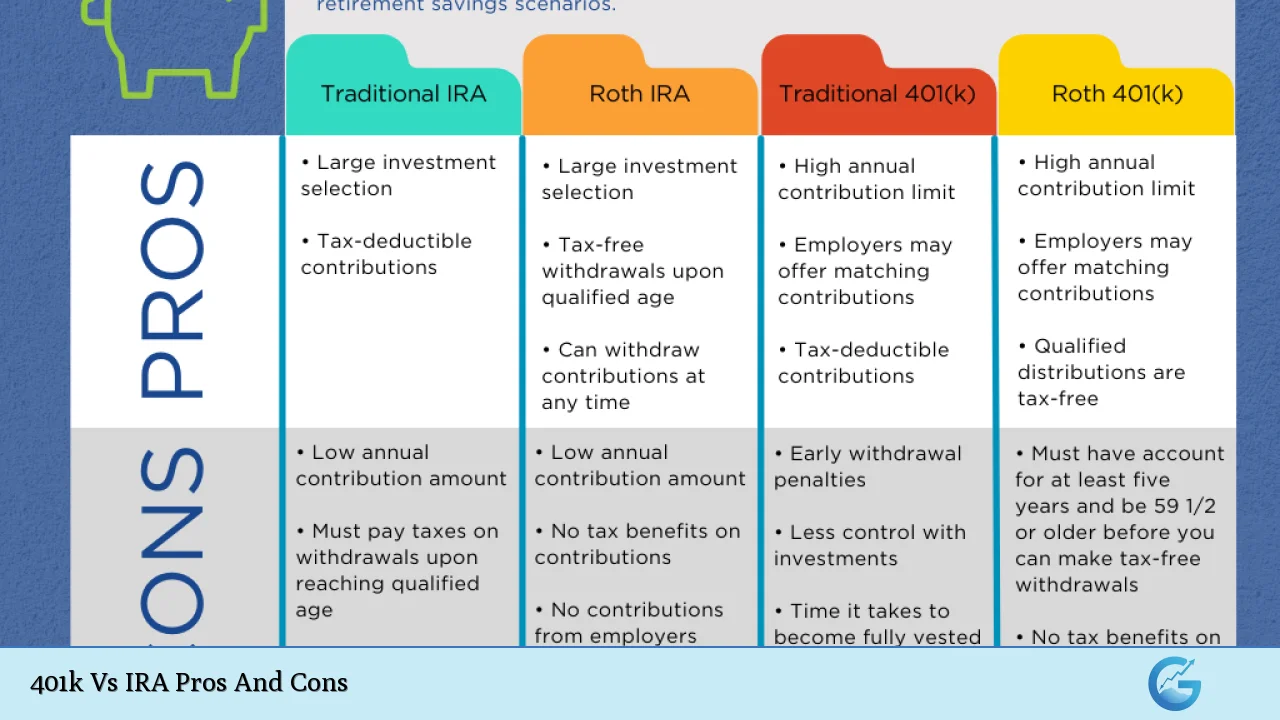

| Pros | Cons |

|---|---|

| Higher contribution limits for 401(k)s | IRAs have lower contribution limits |

| Employer matching contributions available in 401(k)s | Limited investment options in 401(k)s |

| Tax-deferred growth in both accounts | Penalties for early withdrawals apply to both |

| Automatic payroll deductions for 401(k)s | Complex rules regarding withdrawals and taxes |

| Potential for loans against 401(k) balances | Required minimum distributions (RMDs) apply to both |

| Flexibility in investment choices with IRAs | Income limits may restrict IRA contributions |

| No income restrictions for contributing to a 401(k) | Employer control over 401(k) plan features and fees |

| Ability to consolidate retirement accounts into an IRA | Less creditor protection compared to 401(k)s in some cases |

Higher Contribution Limits for 401(k)s

One of the most significant advantages of a 401(k) is its higher contribution limits compared to IRAs. For the tax year 2024, employees can contribute up to $23,000 to a 401(k), with an additional catch-up contribution of $7,500 if they are aged 50 or older. In contrast, the contribution limit for IRAs is capped at $7,000, with a $1,000 catch-up contribution for those over 50. This difference allows individuals to save significantly more in a tax-advantaged account through a 401(k).

Employer Matching Contributions Available in 401(k)s

Many employers offer matching contributions as part of their 401(k) plans. This means that employers will match a portion of the employee’s contributions, effectively providing “free money” towards retirement savings. This can significantly enhance the growth of retirement funds over time, making it a compelling reason to participate in an employer-sponsored plan.

Tax-Deferred Growth in Both Accounts

Both 401(k)s and IRAs allow for tax-deferred growth on investments. This means that any earnings on investments within these accounts are not taxed until withdrawals are made during retirement. This tax advantage can lead to substantial growth over time, as the money can compound without the drag of annual taxes.

Automatic Payroll Deductions for 401(k)s

Contributing to a 401(k) is often more straightforward due to automatic payroll deductions. Employees can elect to have a percentage of their paycheck automatically deposited into their retirement account, making saving effortless and consistent. This feature can help ensure that individuals regularly contribute towards their retirement without needing to take additional steps.

Potential for Loans Against 401(k) Balances

Some 401(k) plans allow participants to borrow against their account balances. This can provide access to funds in emergencies without incurring taxes or penalties, as long as the loan is repaid according to the plan’s terms. However, it’s essential to approach this option cautiously, as failing to repay the loan can result in it being treated as a taxable distribution.

Flexibility in Investment Choices with IRAs

One of the primary advantages of IRAs is the flexibility they offer regarding investment choices. While many 401(k) plans have limited investment options (often just mutual funds), IRAs allow investors to select from a broader array of investments, including individual stocks, bonds, ETFs, and even alternative assets like real estate or cryptocurrencies. This flexibility enables individuals to tailor their investment strategies according to their risk tolerance and financial goals.

No Income Restrictions for Contributing to a 401(k)

Unlike IRAs, which have income limits that may restrict high earners from contributing directly (especially for Roth IRAs), anyone can contribute to a 401(k) as long as they are employed by an employer that offers such a plan. This makes it easier for individuals with higher incomes to maximize their retirement savings without worrying about eligibility restrictions.

Lower Contribution Limits for IRAs

While IRAs provide valuable tax advantages, they come with lower contribution limits compared to 401(k) plans. For many individuals looking to save aggressively for retirement, this limitation can be a significant drawback. The lower caps may require those who want to save more aggressively to rely primarily on their employer-sponsored plans.

Limited Investment Options in 401(k)s

The investment options available within many employer-sponsored 401(k) plans can be quite limited compared to what is available through an IRA. Employees typically have access only to specific mutual funds chosen by their employer or plan administrator. This lack of variety may hinder investors from diversifying their portfolios effectively or pursuing specific investment strategies.

Penalties for Early Withdrawals Apply to Both

Both account types impose penalties for early withdrawals before age 59½. Withdrawing funds early from either account typically incurs a penalty of 10% on top of any regular income taxes owed on the distribution. This rule emphasizes the importance of treating these accounts as long-term savings vehicles rather than sources of short-term cash.

Complex Rules Regarding Withdrawals and Taxes

The rules governing withdrawals from both accounts can be complex and vary based on several factors, including account type (traditional vs. Roth), age at withdrawal, and employment status at retirement. Understanding these rules is crucial for effective planning and avoiding unexpected tax liabilities or penalties.

Required Minimum Distributions (RMDs) Apply to Both

Both traditional IRAs and traditional 401(k)s require account holders to start taking minimum distributions by age 73 (as per current regulations). Failing to take RMDs can result in severe penalties—up to 50% of the amount that should have been withdrawn—making it essential for retirees to plan accordingly.

Income Limits May Restrict IRA Contributions

IRAs come with income limits that may restrict high earners from contributing directly or deducting contributions on their taxes. For example, if you earn above certain thresholds (e.g., $161,000 for single filers in tax year 2024), you may not be able to contribute directly to a Roth IRA or deduct contributions made to a traditional IRA if you also participate in an employer-sponsored plan.

Employer Control Over 401(k) Plan Features and Fees

Since 401(k) plans are sponsored by employers, they have significant control over plan features, including fees associated with managing the account and available investment options. Some employers may offer high-fee plans that eat into returns over time, which could be detrimental compared to potentially lower-cost IRA options managed independently by individuals.

Less Creditor Protection Compared to 401(k)s in Some Cases

While both accounts offer some level of protection from creditors under federal law, ERISA governs many aspects of employer-sponsored plans like the 401(k), providing stronger protections against bankruptcy claims than those typically available with IRAs. In certain legal situations or states, this difference could impact how much protection your retirement savings receive.

In conclusion, both 401(k) plans and IRAs offer valuable benefits and drawbacks that cater differently depending on individual financial situations and goals. A well-rounded approach might involve utilizing both types of accounts—taking advantage of employer matches through a 401(k) while also investing in an IRA for greater flexibility and control over investments.

Frequently Asked Questions About 401k Vs IRA Pros And Cons

- Can I contribute to both a 401(k) and an IRA?

You can contribute to both accounts simultaneously; however, be mindful of each account’s contribution limits. - What is the primary difference between traditional and Roth accounts?

A traditional account allows pre-tax contributions with taxable withdrawals during retirement; Roth accounts use after-tax dollars allowing tax-free withdrawals later. - Are there penalties for withdrawing funds early from either account?

Yes, early withdrawals before age 59½ typically incur a penalty of 10% plus applicable income taxes. - What happens if I don’t take my required minimum distributions?

If you fail to take RMDs from your traditional accounts after age 73, you may face hefty penalties up to half of what should have been withdrawn. - How do employer matches work in a 401(k)?

Employers may match employee contributions up to a certain percentage; this effectively increases your retirement savings without additional cost. - What are catch-up contributions?

If you’re aged 50 or older, you can make additional contributions beyond standard limits—$7,500 extra for **401(k)**s and $1,000 extra for **IRAs**. - Can I roll my **401(k)** into an IRA?

You can roll over your **401(k)** into an **IRA** upon leaving your job or retiring; this often provides more investment options. - Which account should I prioritize saving into?

If your employer offers matching contributions on your **401(k)**, it’s generally wise first to contribute enough to get that match before funding an **IRA**.

Understanding the intricacies between 401(k)s and IRAs allows individuals not only better planning but also maximizes potential growth through strategic contributions tailored according to personal financial circumstances.