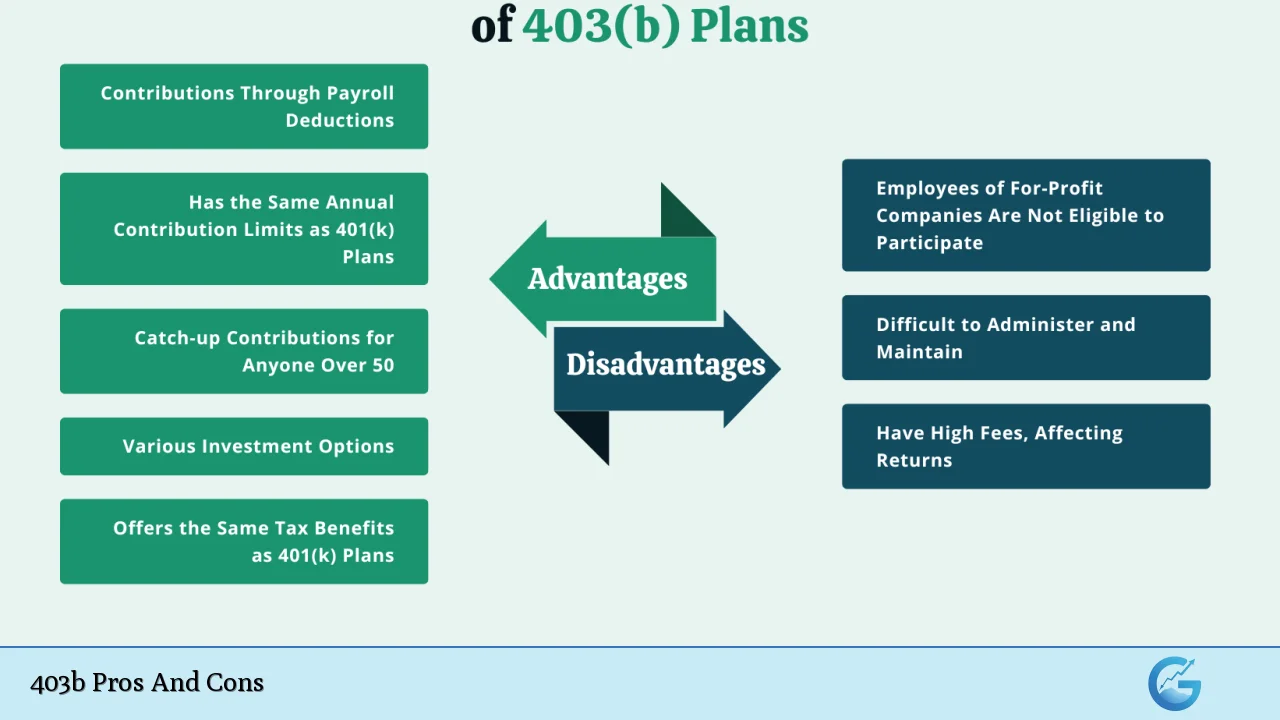

The 403(b) plan is a retirement savings vehicle primarily designed for employees of public schools, certain non-profit organizations, and some government entities. Similar to the more widely known 401(k) plans, 403(b)s allow participants to save for retirement on a tax-advantaged basis. Contributions are made pre-tax, which lowers taxable income, and investment growth is tax-deferred until withdrawal. However, while 403(b) plans offer significant benefits, they also come with various drawbacks that potential investors should consider carefully. This article delves into the pros and cons of 403(b) plans, providing a comprehensive overview for those interested in finance, investing, and retirement planning.

| Pros | Cons |

|---|---|

| Tax-deferred growth on contributions | Limited investment options compared to other plans |

| Higher contribution limits than some other retirement accounts | Potentially high fees associated with annuities |

| Catch-up contributions for long-term employees | Early withdrawal penalties apply |

| Immediate vesting of contributions | Lack of ERISA protections for many plans |

| Lower administrative costs in some cases | Employer matching is not guaranteed |

| Flexibility in withdrawal options under certain conditions | May not be suitable for those expecting higher income in retirement |

| Special catch-up provisions for long-term employees | Complex fee structures can obscure true costs |

| Potential for tax-free withdrawals with Roth options | Limited access to funds before retirement age |

Tax-deferred Growth on Contributions

One of the most significant advantages of a 403(b) plan is the ability to grow your investments without immediate tax implications. Contributions are made before taxes are deducted from your paycheck, which reduces your taxable income in the year you contribute. This means that you can invest more money upfront, allowing your savings to grow faster over time due to the compounding effect.

- Benefit: The tax-deferred growth can lead to substantial savings over the long term.

- Example: If you invest $5,000 annually in a 403(b) and achieve an average annual return of 7%, after 30 years, your investment could grow to over $300,000 without paying taxes on the earnings until withdrawal.

Higher Contribution Limits

For 2024, the contribution limit for 403(b) plans is set at $23,000 for individuals under 50 years old. Those aged 50 or older can contribute an additional $7,500 as a catch-up contribution. Furthermore, long-term employees may be eligible for an additional catch-up option that allows them to contribute even more under specific conditions.

- Benefit: These higher limits enable individuals to save significantly more for retirement compared to traditional IRAs.

- Example: A participant who has been with their employer for over 15 years may contribute an additional $3,000 annually if their average contributions have been less than $5,000 per year.

Catch-up Contributions for Long-term Employees

The unique provisions available to long-serving employees can significantly enhance retirement savings opportunities. The “15-year rule” allows eligible participants to make additional contributions beyond standard limits if they have worked for their employer for at least 15 years.

- Benefit: This feature can be especially beneficial for those who may have started saving later in their careers or who have had lower average contributions.

- Example: An employee who meets these criteria could potentially contribute up to $21,000 in a single year if they are also over age 50.

Immediate Vesting of Contributions

In many cases, contributions made by employees to their 403(b) plans are immediately vested. This means that any money contributed by the employee is fully owned by them without waiting periods that are often seen in other retirement plans like 401(k)s.

- Benefit: Immediate vesting provides security and peace of mind as participants know their contributions are theirs from day one.

Lower Administrative Costs

Some studies indicate that 403(b) plans may have lower administrative costs compared to other employer-sponsored plans like 401(k)s. This can lead to more money being invested rather than spent on fees.

- Benefit: Lower fees mean that more of your money is working for you rather than being eaten up by administrative costs.

Flexibility in Withdrawal Options

While many retirement accounts impose strict rules regarding withdrawals before retirement age, some features of the 403(b) plan allow for greater flexibility under certain circumstances. For example, participants may be able to withdraw funds without penalties under specific conditions such as financial hardship or disability.

- Benefit: This flexibility can provide crucial access to funds when needed most.

Special Catch-up Provisions

The special catch-up provisions available within the 403(b) framework can be advantageous for those looking to boost their retirement savings as they approach retirement age.

- Benefit: These provisions allow seasoned employees to maximize their contributions significantly.

Potential Downsides of a 403(b)

Despite the numerous advantages associated with 403(b) plans, there are several notable drawbacks that participants should consider before enrolling.

Limited Investment Options

One of the primary criticisms of 403(b) plans is their limited range of investment options. Many plans focus heavily on annuities or insurance products rather than offering a broad selection of mutual funds or exchange-traded funds (ETFs).

- Concern: This lack of diversity can restrict participants’ ability to tailor their investment strategies according to their risk tolerance and financial goals.

Potentially High Fees

While some 403(b) plans may boast low administrative costs, others—especially those heavily reliant on annuities—can carry high fees that significantly reduce overall returns. These fees may include management fees, surrender charges, and other hidden costs.

- Concern: High fees can erode savings over time; even a seemingly small percentage difference in fees can lead to substantial losses over decades.

Early Withdrawal Penalties

Like most retirement accounts, withdrawing funds from a 403(b) plan before reaching age 59½ typically incurs a penalty of 10% in addition to regular income taxes.

- Concern: This penalty discourages early withdrawals but can pose challenges if unexpected financial needs arise.

Lack of ERISA Protections

Many 403(b) plans are not subject to the Employee Retirement Income Security Act (ERISA), which governs most employer-sponsored retirement plans and provides important protections for participants.

- Concern: Without ERISA protections, there may be fewer safeguards against mismanagement or high fees imposed by plan providers.

Employer Matching Not Guaranteed

While some employers offer matching contributions similar to those found in traditional employer-sponsored plans like 401(k)s, this is not universally available in all 403(b) plans.

- Concern: Participants may miss out on potential “free money” if their employer does not provide matching contributions.

May Not Suit Higher Income Expectations

Individuals anticipating higher income levels during retirement might find that contributing pre-tax dollars into a 403(b) plan could lead them into a higher tax bracket when they withdraw funds later.

- Concern: If retirees find themselves in a higher tax bracket upon withdrawal than when they contributed, they could end up paying more in taxes overall.

Complex Fee Structures

The fee structures associated with many 403(b) plans can be complex and difficult for participants to navigate.

- Concern: Participants may struggle to understand how much they are actually paying and how it affects their overall returns.

Limited Access Before Retirement Age

Participants generally face restrictions on accessing their funds before reaching retirement age unless specific conditions apply.

- Concern: This limitation can hinder financial flexibility during times of need.

In conclusion, while the 403(b) plan offers several compelling advantages such as tax-deferred growth and higher contribution limits tailored specifically for employees within non-profit sectors and educational institutions, it also presents notable disadvantages including limited investment options and potential high fees. Individuals considering this retirement savings vehicle should weigh these pros and cons carefully against their personal financial situations and long-term goals.

Frequently Asked Questions About 403b Pros And Cons

- What is a 403(b) plan?

A 403(b) plan is a tax-advantaged retirement savings plan designed primarily for employees of public schools and non-profit organizations. - What are the main benefits of a 403(b)?

The main benefits include tax-deferred growth on contributions, higher contribution limits compared to IRAs, immediate vesting of employee contributions, and potential catch-up contributions for long-term employees. - Are there any drawbacks associated with a 403(b)?

Yes, drawbacks include limited investment options compared to other plans like IRAs or 401(k)s and potentially high fees associated with annuity products. - Can I withdraw money from my 403(b) before retirement?

You can withdraw money before retirement age but will typically face penalties unless specific exceptions apply. - Is employer matching common in 403(b) plans?

No, while some employers do offer matching contributions, it is not guaranteed across all plans. - What happens if I leave my job?

If you leave your job, you typically have several options including rolling over your account into another qualified plan or cashing out (which may incur penalties). - How do I know if my fees are too high?

You should review your plan’s fee disclosures carefully; generally speaking, lower expense ratios (below about 0.50%) indicate better value. - What should I consider when choosing between a 401(k) and a 403(b)?

Consider factors such as investment options available within each plan type, fee structures involved, employer matching policies offered by your employer.

This comprehensive overview highlights both the strengths and weaknesses inherent in utilizing a 403(b) plan as part of one’s overall financial strategy. Understanding these factors will empower individuals making informed decisions about their future retirements.