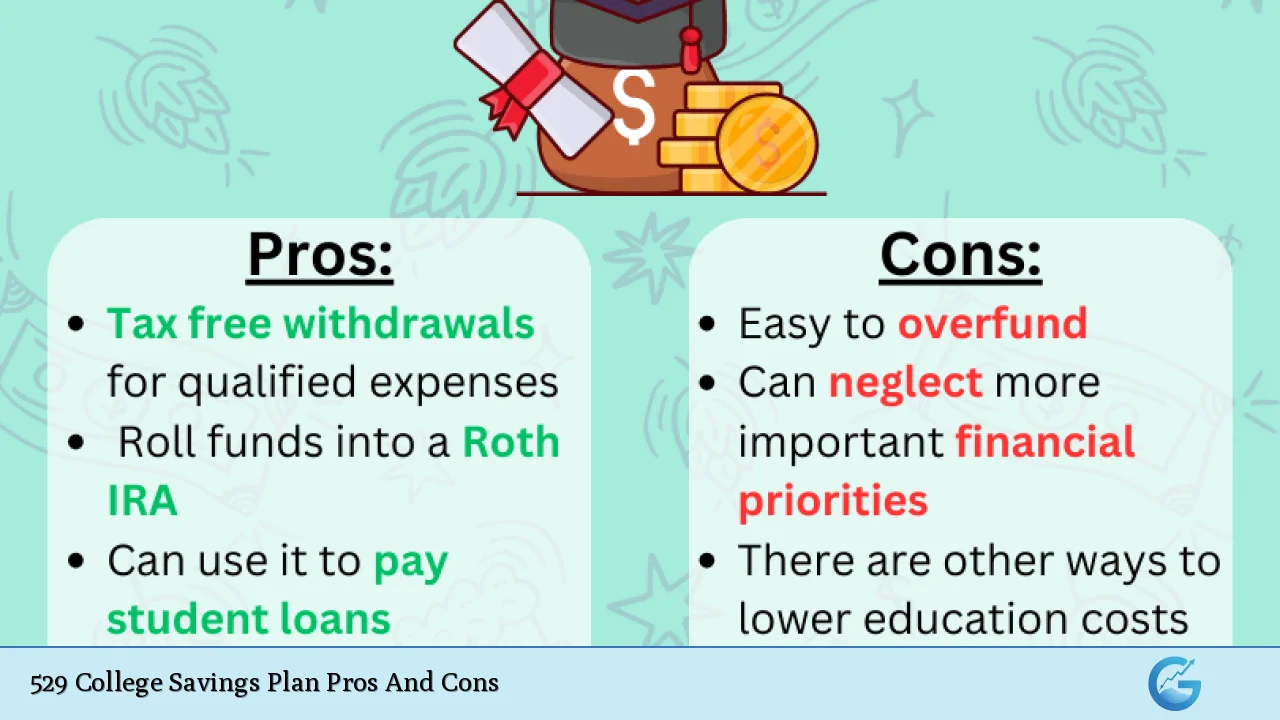

The 529 College Savings Plan is a popular financial tool designed to help families save for education expenses. Named after Section 529 of the Internal Revenue Code, these plans offer tax advantages and flexible options for funding college education. However, like any financial product, they come with their own set of benefits and drawbacks. Understanding these can help families make informed decisions about whether a 529 plan is the right choice for their educational savings needs.

| Pros | Cons |

|---|---|

| Tax-free growth and withdrawals for qualified expenses | Penalties on non-qualified withdrawals |

| High contribution limits | Limited investment options |

| No income restrictions for contributions | Impact on financial aid eligibility |

| Flexibility in use for various educational expenses | State-specific tax benefits may vary |

| Low maintenance and easy to manage | Fees can reduce overall returns |

| Ability to change beneficiaries within family members | Potential state tax recapture on rollovers |

Tax-free Growth and Withdrawals for Qualified Expenses

One of the most significant advantages of a 529 plan is the tax-free growth it offers. Contributions made to a 529 plan grow without being subject to federal income tax, and withdrawals used for qualified education expenses are also tax-free. This means that families can accumulate savings over time without worrying about taxes eroding their investments.

- Tax-free earnings: Earnings on contributions are not taxed as long as they are used for qualified expenses.

- Qualified expenses include: Tuition, fees, room and board, books, supplies, and certain K-12 expenses.

Penalties on Non-qualified Withdrawals

While the tax benefits are substantial, there are strict rules governing how funds can be used. If money is withdrawn for non-qualified expenses, it incurs penalties.

- 10% penalty: Withdrawals not used for qualified education expenses are subject to a 10% federal tax penalty on the earnings.

- Income tax: Additionally, the earnings portion of the withdrawal will be taxed at the account owner’s income tax rate.

High Contribution Limits

529 plans typically allow for high contribution limits, often exceeding $300,000 per beneficiary depending on state regulations. This allows families to save significant amounts over time without worrying about hitting contribution caps.

- Flexible contributions: There are no annual contribution limits, although contributions may be subject to gift tax rules.

- Generational wealth-building: This feature makes 529 plans an attractive option for families looking to build wealth across generations.

Limited Investment Options

Despite their advantages, 529 plans often come with limited investment choices. Most plans offer a selection of mutual funds or target-date funds managed by financial institutions.

- Lack of control: Investors cannot select individual stocks or bonds; they must choose from pre-defined portfolios.

- Potentially lower returns: Limited investment options may lead to lower returns compared to other investment vehicles that allow more flexibility.

No Income Restrictions for Contributions

Another benefit of 529 plans is that there are no income restrictions on who can contribute. This means that anyone can open and fund a 529 account regardless of their income level.

- Inclusivity: Families from all financial backgrounds can participate in saving for education.

- Multiple contributors allowed: Parents, grandparents, relatives, and friends can all contribute to the same account.

Impact on Financial Aid Eligibility

A notable disadvantage of 529 plans is their impact on financial aid eligibility. The assets in a 529 plan are considered parental assets when calculating Expected Family Contribution (EFC).

- EFC calculation: Up to 5.64% of the value of a parent-owned 529 plan counts against financial aid eligibility.

- Potential reduction in aid: This could reduce the amount of need-based financial aid available to students.

Flexibility in Use for Various Educational Expenses

529 plans provide flexibility in how funds can be utilized. They can cover a wide range of educational expenses beyond just college tuition.

- Qualified uses include: Room and board, textbooks, and even certain K-12 tuition costs.

- Use for apprenticeships: Funds can also be used for apprenticeship programs that meet IRS criteria.

State-specific Tax Benefits May Vary

While many states offer tax deductions or credits for contributions made to their own state’s 529 plan, these benefits are not universal.

- State residency matters: Some states provide significant tax breaks only if you invest in your home state’s plan.

- Limited benefits elsewhere: If you choose a different state’s plan, you may miss out on potential tax advantages.

Low Maintenance and Easy to Manage

Managing a 529 plan is generally straightforward. Once set up, these accounts require minimal maintenance compared to other investment accounts.

- Automatic contributions: Many plans allow automatic contributions, making it easy to grow savings over time.

- Simple administration: Most plans provide online access to account information and performance tracking.

Fees Can Reduce Overall Returns

Despite their advantages, many 529 plans come with fees that can eat into investment returns. These fees vary by plan and can include management fees and administrative costs.

- Expense ratios: Some plans may have high expense ratios compared to other investment vehicles.

- Impact on growth: Over time, high fees can significantly reduce the overall growth potential of your investment.

Ability to Change Beneficiaries Within Family Members

One unique feature of 529 plans is the ability to change beneficiaries without incurring penalties. This allows families flexibility if the original beneficiary does not need all the funds saved.

- Family transfers allowed: You can transfer unused funds to another family member’s account.

- Wide range of eligible beneficiaries: Family members include siblings, cousins, and even parents or grandparents.

Potential State Tax Recapture on Rollovers

If you decide to roll over your 529 plan into another state’s plan or change investments within your current plan, you may face state tax recapture issues.

- Recapture penalties: Some states will require you to pay back any state tax deductions previously taken if you roll over funds.

- Complexity in planning: This adds an additional layer of complexity when considering changing plans or investments.

In conclusion, while the 529 College Savings Plan offers numerous advantages such as tax-free growth and high contribution limits, it also has drawbacks including penalties on non-qualified withdrawals and limited investment options. Families must carefully weigh these pros and cons based on their specific financial situations and educational goals before deciding if a 529 plan is right for them.

Frequently Asked Questions About 529 College Savings Plans

- What are the main benefits of a 529 plan?

The main benefits include tax-free growth on investments and withdrawals for qualified education expenses, high contribution limits, and no income restrictions. - Can I use 529 funds for K-12 education?

Yes, up to $10,000 per year can be used for K-12 tuition at private schools. - What happens if my child doesn’t go to college?

If your child does not attend college, you can change the beneficiary or withdraw funds; however, non-qualified withdrawals incur penalties. - Are there any fees associated with 529 plans?

Yes, many 529 plans charge management fees that can reduce overall returns. - How does a 529 plan affect financial aid?

A parent-owned 529 plan counts as an asset in financial aid calculations but has minimal impact compared to student-owned assets. - Can I change my investment options within a 529 plan?

You can change your investment options once per year or when changing beneficiaries. - Do contributions to a 529 plan qualify for federal tax deductions?

No, contributions are not federally tax-deductible; however, some states offer deductions. - What types of educational expenses are covered by a 529 plan?

A wide range of expenses including tuition, room and board, books, supplies, and certain K-12 costs qualify.

This comprehensive overview aims to equip potential investors with the necessary knowledge about the strengths and weaknesses associated with using a 529 College Savings Plan as part of their educational funding strategy.