A 529 plan is a tax-advantaged investment vehicle designed to encourage saving for future education costs. Named after Section 529 of the Internal Revenue Code, these plans offer a unique combination of benefits and potential drawbacks for those looking to save for educational expenses. As the cost of higher education continues to rise, understanding the intricacies of 529 plans becomes increasingly important for families and individuals planning for future academic pursuits.

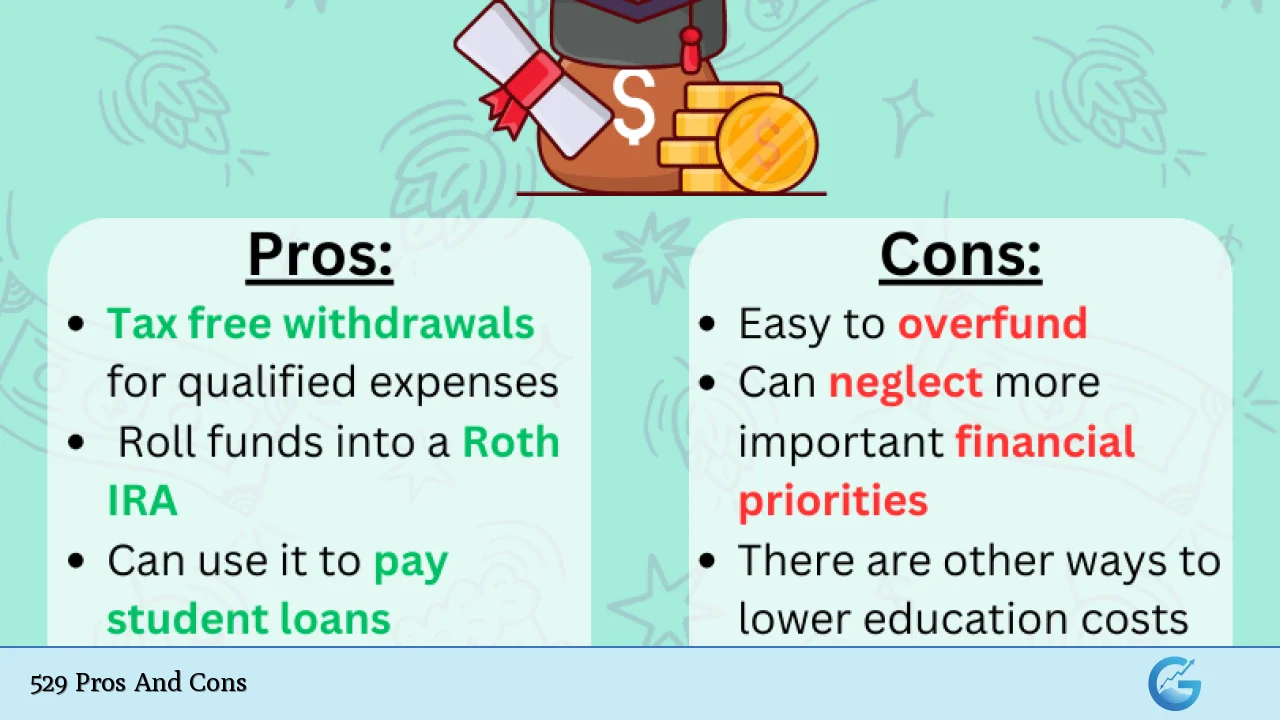

| Pros | Cons |

|---|---|

| Tax-free growth and withdrawals for qualified expenses | Limited investment options |

| High contribution limits | Potential for penalties on non-qualified withdrawals |

| State tax benefits in many states | Impact on financial aid eligibility |

| Flexibility in beneficiary changes | Market risk and potential for loss |

| Control retained by account owner | Fees associated with plan management |

| Multiple uses beyond traditional college expenses | Complexity in choosing and managing plans |

| Gift tax advantages | Limitations on investment changes |

| No income restrictions for contributors | Potential for over-saving |

Tax-Free Growth and Withdrawals

One of the most significant advantages of 529 plans is the potential for tax-free growth and withdrawals when used for qualified educational expenses. This tax benefit can result in substantial savings over time, especially for those who start investing early.

- Earnings grow federal tax-free and are not subject to capital gains taxes

- Withdrawals for qualified expenses are exempt from federal income tax

- Many states offer additional tax benefits for contributions

It’s important to note that the power of tax-free compounding can significantly boost the overall value of your educational savings over the long term.

This advantage becomes particularly pronounced when compared to taxable investment accounts, where gains are subject to annual taxation, potentially reducing the overall growth rate.

Limited Investment Options

While 529 plans offer tax advantages, they typically come with a restricted set of investment choices. This limitation can be frustrating for investors who prefer more control over their portfolio allocation.

- Most plans offer a selection of mutual funds or ETFs

- Investment options are often limited to those chosen by the plan administrator

- Some plans may have higher fees compared to similar investments outside the 529 structure

Investors accustomed to the wide array of options available in the broader financial markets may find the limited selection in 529 plans constraining.

However, it’s worth noting that these limitations are often in place to ensure the plans remain focused on their primary goal of education savings and to simplify management for less experienced investors.

High Contribution Limits

529 plans stand out for their high contribution limits, which can be particularly attractive for high-net-worth individuals or those looking to front-load their education savings.

- Contribution limits often exceed $300,000 per beneficiary

- No annual contribution limits, unlike other tax-advantaged accounts

- Ability to make five years’ worth of contributions in a single year for gift tax purposes

The high contribution limits of 529 plans provide a unique opportunity for significant wealth transfer and estate planning, allowing families to potentially shelter large sums from estate taxes while earmarking funds for education.

This feature can be especially valuable for grandparents or other relatives looking to contribute to a child’s education while managing their own estate planning goals.

Potential for Penalties on Non-Qualified Withdrawals

One of the primary drawbacks of 529 plans is the potential for penalties if funds are not used for qualified educational expenses. This risk can create financial complications if circumstances change or if there’s an over-accumulation of funds.

- 10% federal penalty on earnings for non-qualified withdrawals

- Earnings portion of non-qualified withdrawals subject to income tax

- Potential recapture of state tax benefits in some jurisdictions

The penalty structure of 529 plans underscores the importance of careful planning and consideration of alternative scenarios when saving for education.

While the flexibility to change beneficiaries can mitigate some of this risk, investors should be aware of the potential financial implications of non-qualified withdrawals.

State Tax Benefits

Many states offer additional tax incentives for contributions to 529 plans, which can provide immediate tax savings for contributors. However, these benefits vary widely by state and may come with certain restrictions.

- State income tax deductions or credits for contributions in many states

- Some states offer tax parity for contributions to any 529 plan

- Potential for recapture of tax benefits if funds are not used as intended

The availability of state tax benefits can significantly enhance the overall value proposition of 529 plans, particularly for residents of high-tax states.

However, investors should carefully weigh these benefits against other factors such as investment performance and fees when choosing a plan, as the highest-performing plan may not always be the one offering the best tax advantages.

Impact on Financial Aid Eligibility

While 529 plans are generally considered a favorable savings vehicle, they can have an impact on financial aid eligibility. Understanding this impact is crucial for families who may be counting on need-based financial assistance.

- 529 plans owned by parents are reported as parental assets on the FAFSA

- Distributions from 529 plans can affect future year aid eligibility

- Plans owned by grandparents or other relatives may have different reporting requirements

The impact of 529 plans on financial aid is generally less severe than other savings methods, as they are treated as parental assets rather than student assets in financial aid calculations.

However, families should be aware that significant 529 plan balances could potentially reduce eligibility for need-based aid and factor this into their overall education funding strategy.

Flexibility in Beneficiary Changes

One of the key advantages of 529 plans is the ability to change beneficiaries without incurring penalties, providing flexibility as family circumstances change.

- Beneficiary can be changed to another qualifying family member

- Multiple changes allowed over the life of the account

- Ability to transfer funds between beneficiaries within the same family

The flexibility to change beneficiaries can be a powerful tool for family financial planning, allowing for the reallocation of educational funds as needs evolve over time.

This feature can be particularly valuable for families with multiple children or for those who want to preserve the option to use funds for future generations.

Market Risk and Potential for Loss

Like any investment vehicle, 529 plans are subject to market fluctuations and carry the risk of potential loss. This risk can be particularly concerning as the beneficiary approaches college age.

- Investment performance is not guaranteed

- Market downturns can significantly impact account balances

- Age-based options may not always provide adequate protection against market volatility

The potential for market losses in 529 plans highlights the importance of understanding and carefully selecting investment options that align with your risk tolerance and time horizon.

While age-based options can help mitigate some of this risk by automatically adjusting allocations over time, investors should remain vigilant and consider adjusting their strategy as needed, particularly in times of market volatility.

Control Retained by Account Owner

A significant advantage of 529 plans is that the account owner, not the beneficiary, retains control over the funds. This feature provides peace of mind and flexibility for contributors.

- Account owner can change beneficiaries or withdraw funds

- Beneficiary has no control over investment decisions

- Funds can be reclaimed by the owner if needed, subject to penalties

The control retained by the account owner in 529 plans offers a level of financial security and flexibility not found in other education savings vehicles, such as UGMA/UTMA accounts.

This feature can be particularly appealing for those who want to maintain oversight of the funds while still earmarking them for educational purposes.

Fees Associated with Plan Management

While 529 plans offer many benefits, they also come with various fees that can impact overall returns. Understanding and comparing these fees is crucial when selecting a plan.

- Account maintenance fees

- Investment management fees

- Underlying fund expenses

The fee structure of 529 plans can vary significantly between providers and states, making it essential for investors to carefully review and compare options before committing to a particular plan.

In some cases, the benefits of state tax deductions may be outweighed by higher fees, particularly for those considering out-of-state plans.

Multiple Uses Beyond Traditional College Expenses

Recent legislative changes have expanded the potential uses of 529 plan funds, increasing their versatility as a savings tool.

- Up to $10,000 per year can be used for K-12 tuition

- Funds can be used for apprenticeship programs

- Up to $10,000 lifetime can be used to repay student loans

The expanded use cases for 529 plans have significantly increased their utility as a comprehensive education savings vehicle, providing families with more options for utilizing accumulated funds.

However, it’s important to note that state tax treatment of these expanded uses may vary, and investors should consult with a tax professional to understand the implications in their specific situation.

Complexity in Choosing and Managing Plans

The wide array of 529 plan options and the nuances of their features can make choosing and managing a plan complex, particularly for less experienced investors.

- Differences in state tax benefits and investment options

- Varying fee structures and performance histories

- Complexity in understanding and optimizing asset allocations

The complexity involved in selecting and managing a 529 plan underscores the importance of thorough research and potentially seeking professional advice to ensure optimal alignment with individual financial goals and circumstances.

While this complexity can be daunting, it also reflects the flexibility and customization options available within the 529 plan structure.

Gift Tax Advantages

529 plans offer unique gift tax advantages that can be particularly appealing for estate planning purposes.

- Ability to front-load five years of gift tax exclusions in a single year

- Contributions reduce the donor’s taxable estate

- Multiple donors can contribute to a single beneficiary’s account

The gift tax advantages of 529 plans provide a powerful tool for wealth transfer and estate planning, allowing for significant contributions while potentially reducing estate tax liability.

This feature can be especially valuable for grandparents or other relatives looking to contribute to a child’s education while managing their own estate planning goals.

Limitations on Investment Changes

While 529 plans offer some flexibility, there are restrictions on how often investment allocations can be changed, which may be frustrating for more active investors.

- Investment allocations can typically only be changed twice per calendar year

- Limitations on reacting to market conditions or changing financial goals

- Restrictions may vary between plans and states

The limitations on investment changes in 529 plans emphasize the importance of careful initial allocation and long-term planning, as frequent adjustments to react to short-term market movements are not permitted.

While this restriction can be seen as a drawback for some investors, it also encourages a disciplined, long-term approach to education savings.

In conclusion, 529 plans offer a powerful combination of tax advantages, flexibility, and high contribution limits that make them an attractive option for education savings. However, they also come with potential drawbacks such as limited investment options, the risk of penalties for non-qualified withdrawals, and potential impacts on financial aid eligibility. As with any financial decision, it’s crucial to carefully weigh these pros and cons in the context of your individual financial situation and goals. Consulting with a financial advisor can help ensure that a 529 plan aligns with your overall financial strategy and provides the best possible foundation for future educational expenses.

Frequently Asked Questions About 529 Pros And Cons

- Can I use 529 funds for any educational institution?

529 funds can be used at any eligible educational institution, which includes most accredited colleges and universities in the U.S. and many foreign institutions. Additionally, funds can now be used for certain apprenticeship programs and K-12 tuition, subject to specific limits. - What happens if my child doesn’t need all the money in the 529 plan?

If there are unused funds, you have several options: change the beneficiary to another qualifying family member, use the funds for your own education, or withdraw the money and pay income tax plus a 10% penalty on the earnings portion. Some states also allow 529 funds to be rolled over into ABLE accounts for individuals with disabilities. - Are there income limits for contributing to a 529 plan?

There are no income limits for contributing to a 529 plan, making them accessible to high-income earners who may be phased out of other tax-advantaged savings options. However, individual plans may have maximum aggregate contribution limits, which vary by state. - How do 529 plans compare to other education savings options like Coverdell ESAs?

529 plans generally offer higher contribution limits and more flexible beneficiary options compared to Coverdell ESAs. However, Coverdell ESAs may offer more investment flexibility and broader qualified expense definitions for K-12 education. The choice depends on individual circumstances and savings goals. - Can I have multiple 529 plans for the same beneficiary?

Yes, you can open multiple 529 plans for the same beneficiary, even in different states. This strategy can be used to maximize state tax benefits or access different investment options. However, be aware of aggregate contribution limits across all plans for a single beneficiary. - How do market fluctuations affect 529 plan investments?

Like any investment, 529 plans are subject to market fluctuations. Many plans offer age-based options that automatically shift to more conservative investments as the beneficiary approaches college age. However, there’s still a risk of loss, especially in more aggressive investment options or during market downturns. - Are there professional management options for 529 plans?

Some 529 plans offer professionally managed investment options or advisor-sold plans that provide guidance on investment choices. These options may come with higher fees but can be beneficial for those who prefer professional management or lack investment experience. - How do 529 plans affect financial aid eligibility for grandparent-owned accounts?

Grandparent-owned 529 plans are not reported as assets on the FAFSA. However, distributions from these accounts have historically been treated as student income, potentially impacting aid eligibility. Recent FAFSA changes aim to eliminate this issue, making grandparent-owned 529 plans more attractive for financial aid purposes.