A 529 savings account, also known as a 529 plan, is a tax-advantaged investment vehicle designed to help families save for future education expenses. Named after Section 529 of the Internal Revenue Code, these plans offer unique benefits that can significantly ease the financial burden of educational costs. As education expenses continue to rise, understanding the advantages and disadvantages of 529 plans is crucial for families considering this savings option. This article will delve into the pros and cons of 529 savings accounts, providing a comprehensive overview for those interested in finance and investment strategies.

| Pros | Cons |

|---|---|

| Tax advantages for qualified withdrawals | Penalties for non-qualified withdrawals |

| High contribution limits | Limited investment options |

| Flexibility in changing beneficiaries | Potential state tax recapture on rollovers |

| No expiration on funds | Fees can vary significantly by state and plan |

| Favorable financial aid treatment | Account owner retains control, limiting beneficiary autonomy |

| Ability to use funds for K-12 education and student loans | State-specific rules can complicate usage |

| Automatic investment options available | Contributions must be made in cash only |

| No income restrictions on contributors | Complexity of understanding state-specific benefits and drawbacks |

Tax Advantages for Qualified Withdrawals

One of the most significant advantages of a 529 savings account is the tax benefits it provides. Contributions are made with after-tax dollars, but earnings grow federal and often state tax-free. When funds are withdrawn for qualified education expenses—such as tuition, fees, books, and room and board—these withdrawals are exempt from federal income taxes. This tax-free growth can substantially increase the amount available for educational expenses over time.

- Tax-free growth: Earnings accumulate without being taxed annually.

- Tax-free withdrawals: Funds used for qualified education expenses do not incur federal taxes.

Penalties for Non-Qualified Withdrawals

While 529 plans offer substantial tax benefits, they come with strict regulations regarding withdrawals. If funds are withdrawn for purposes other than qualified education expenses, the account holder will face taxation on the earnings portion of the withdrawal plus a 10% penalty.

- Tax implications: Earnings withdrawn for non-qualified uses are subject to income tax.

- Penalty fees: The additional penalty can significantly diminish the value of non-qualified withdrawals.

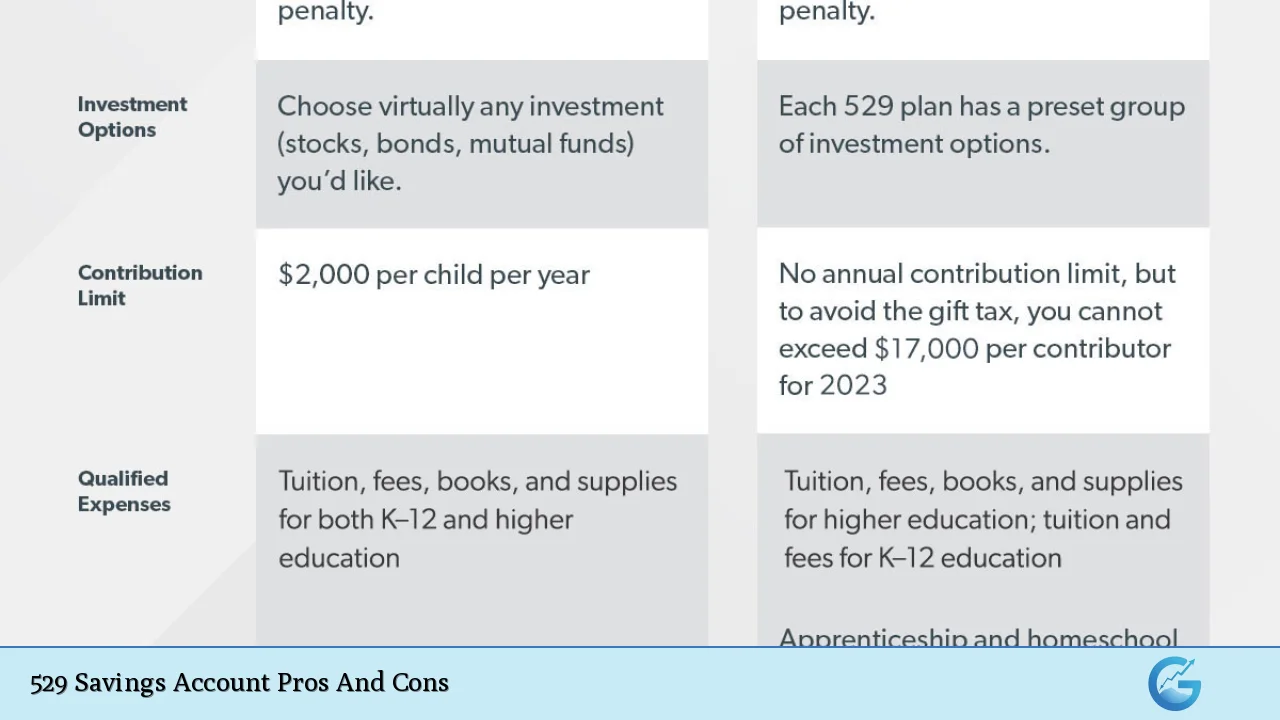

High Contribution Limits

Another major benefit of 529 plans is their high contribution limits. Most states allow contributions up to $400,000 or more per beneficiary. This flexibility enables families to save adequately for college or other educational pursuits without worrying about hitting contribution caps too soon.

- Generous limits: Many plans allow contributions that reflect several years’ worth of tuition at expensive institutions.

- Gift tax exclusion: Individuals can contribute up to five years’ worth of gifts without triggering gift taxes through front-loading strategies.

Limited Investment Options

Despite their many advantages, 529 plans often have limited investment choices compared to other investment vehicles like IRAs or taxable brokerage accounts. Most plans offer a selection of mutual funds and target-date funds but do not allow direct investments in individual stocks or bonds.

- Restricted choices: Investors may find themselves limited to a few fund options that may not align with their investment strategy.

- Potentially higher fees: Some state plans may only offer high-cost funds, which can erode returns over time.

Flexibility in Changing Beneficiaries

A notable feature of 529 plans is the ability to change beneficiaries without incurring taxes or penalties. This flexibility allows families to reallocate funds among siblings or other family members if one beneficiary does not need the funds due to scholarships or changes in educational plans.

- Ease of transfer: Changing beneficiaries is straightforward and can be done with minimal paperwork.

- Family-oriented: Funds can be used across family members, making it a versatile savings tool.

Potential State Tax Recapture on Rollovers

If an account owner decides to roll over funds from one state’s plan to another, they may face state tax recapture on any deductions or credits previously claimed. This means that while federal rules allow rollovers without penalty, state-specific rules may impose additional taxes.

- State-specific risks: Each state’s rules regarding rollovers can differ significantly, impacting overall savings strategies.

No Expiration on Funds

Unlike some educational savings accounts that require funds to be used within a certain timeframe, 529 plans have no expiration date on their funds. This allows families to take their time deciding when to use the money, whether it be for undergraduate education or advanced degrees later on.

- Long-term savings potential: Funds can remain invested until needed without pressure to withdraw them prematurely.

- Flexibility in timing: Families can wait until they are sure about their educational needs before using the funds.

Fees Can Vary Significantly by State and Plan

While many states offer low-cost options within their 529 plans, others may have high fees that can eat into investment returns. It’s essential for investors to compare different plans and understand all associated costs before committing to a particular plan.

- Cost awareness: Investors should be vigilant about management fees and expense ratios associated with their chosen plan.

- Impact on returns: Higher fees can significantly reduce overall returns over time, making it crucial to choose wisely.

Favorable Financial Aid Treatment

Funds in a 529 plan are treated favorably when calculating financial aid eligibility. Generally, only a small percentage of these assets are considered when determining financial aid packages, making them an advantageous choice for families concerned about future educational funding needs.

- Lower impact on aid calculations: Compared to other assets like savings accounts or investments held in the student’s name, 529 accounts have minimal effects on financial aid assessments.

Account Owner Retains Control

While having control over the account is beneficial in many ways—such as being able to change beneficiaries or investment options—it also means that beneficiaries have limited autonomy over their own educational savings. The account owner retains full control until the funds are withdrawn.

- Control dynamics: The account owner decides how and when funds are used, which may not align with the beneficiary’s preferences.

Ability to Use Funds for K-12 Education and Student Loans

Recent changes in legislation have expanded the use of 529 plan funds beyond just college expenses. Now, account holders can use up to $10,000 per year for K-12 tuition at private schools and even apply some funds toward student loan repayments.

- Broader applicability: This flexibility allows families to utilize their savings more effectively based on their educational needs.

Contributions Must Be Made in Cash Only

Another limitation of 529 plans is that contributions must be made in cash; investors cannot transfer stocks or other assets directly into a 529 account. This requirement may deter some investors who prefer more diversified approaches to funding their education savings.

- Liquidation required: Investors must sell any assets they wish to contribute before funding their 529 accounts.

Complexity of Understanding State-Specific Benefits and Drawbacks

With each state offering different rules regarding contributions, tax benefits, and withdrawal penalties, navigating the landscape of 529 plans can be complex. Families need to thoroughly research their state’s specific offerings before committing resources.

- Research necessity: Understanding local regulations is crucial for maximizing benefits while minimizing penalties or taxes associated with withdrawals or rollovers.

In conclusion, while 529 savings accounts present numerous advantages such as tax benefits, high contribution limits, and flexibility regarding beneficiaries and usage of funds, they also come with notable disadvantages including penalties for non-qualified withdrawals and limited investment options. Families considering opening a 529 plan should weigh these factors carefully against their specific financial goals and educational needs.

Frequently Asked Questions About 529 Savings Accounts

- What is a 529 plan?

A 529 plan is a tax-advantaged savings account designed specifically for educational expenses. - Are contributions to a 529 plan tax-deductible?

No, contributions are not federally tax-deductible; however, some states offer deductions or credits. - What happens if I withdraw money from my 529 plan for non-qualified expenses?

You will incur income taxes on earnings plus an additional 10% penalty. - Can I change the beneficiary on my 529 plan?

Yes, you can change beneficiaries without incurring taxes as long as the new beneficiary is a family member. - What types of expenses can I pay with a 529 plan?

You can use it for qualified higher education expenses as well as K-12 tuition up to $10,000 per year. - Is there an age limit for using funds from a 529 plan?

No, there is no expiration date; you can use the funds whenever needed. - How do I choose which state’s 529 plan to invest in?

You should consider factors like fees, investment options, and any available state tax benefits. - Can I use my 529 plan funds if my child receives a scholarship?

Yes! You can still use your funds; however, you may want to adjust your withdrawals accordingly.

This comprehensive analysis aims to equip individuals interested in finance with essential knowledge about the pros and cons of investing in a 529 savings account. Understanding these factors will help families make informed decisions about saving for future educational endeavors.