The 83(b) election is a powerful tax strategy that allows individuals receiving restricted stock or property to potentially reduce their tax liability and gain more control over their equity compensation. This election, named after Section 83(b) of the Internal Revenue Code, gives recipients the option to pay taxes on the fair market value of their equity at the time of grant rather than waiting until the shares vest. While this approach can offer significant advantages, it also comes with potential risks and drawbacks that must be carefully considered.

| Pros | Cons |

|---|---|

| Potential tax savings | Upfront tax payment |

| Earlier start of capital gains holding period | Risk of paying taxes on forfeited shares |

| Simplified tax reporting | Potential overpayment if stock value decreases |

| Maximized capital gains treatment | Irrevocable decision |

| Flexibility in timing of income recognition | Complexity in valuation |

Advantages of the 83(b) Election

Potential Tax Savings

Making an 83(b) election can result in significant tax savings, especially if the value of the stock is expected to appreciate substantially. By paying taxes on the fair market value at the time of grant, recipients can potentially reduce their overall tax burden. This is particularly beneficial in scenarios where:

- The initial fair market value of the stock is low

- There is a high likelihood of substantial appreciation in stock value

- The recipient is in a lower tax bracket at the time of grant compared to future years

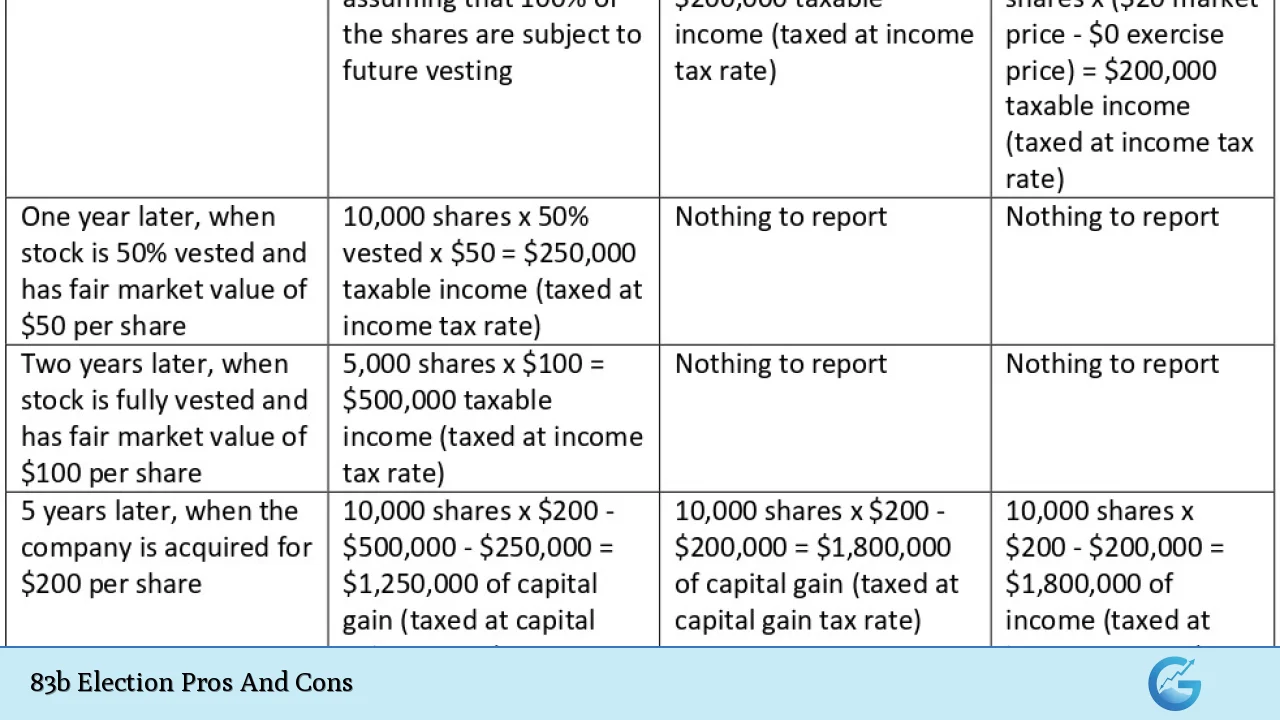

For example, consider a startup employee who receives 10,000 shares of restricted stock with a fair market value of $1 per share at the time of grant. If the employee makes an 83(b) election, they would pay taxes on $10,000 of income. Assuming a 25% tax rate, this would result in a tax liability of $2,500. If the stock value increases to $10 per share by the time it vests, the employee would have avoided paying taxes on $90,000 of additional income.

Earlier Start of Capital Gains Holding Period

Filing an 83(b) election starts the capital gains holding period at the time of grant rather than at vesting. This can be advantageous because:

- It increases the likelihood of qualifying for long-term capital gains treatment

- Long-term capital gains are typically taxed at a lower rate than short-term gains or ordinary income

For instance, if an employee receives restricted stock that vests over four years, making an 83(b) election would start the capital gains holding period immediately. Without the election, the holding period for each portion of the stock would begin only as it vests, potentially delaying the qualification for long-term capital gains treatment.

Simplified Tax Reporting

Opting for an 83(b) election can simplify tax reporting in subsequent years. Benefits include:

- Eliminating the need to report income at each vesting date

- Reducing the complexity of tracking multiple vesting events and their corresponding tax implications

- Potentially lowering the risk of errors in tax filings

This simplification can be particularly valuable for employees of startups or rapidly growing companies where stock values may fluctuate significantly, making accurate reporting at each vesting date challenging.

Maximized Capital Gains Treatment

An 83(b) election allows recipients to maximize the portion of their gains that qualify for capital gains treatment. This strategy is beneficial because:

- Capital gains are often taxed at lower rates than ordinary income

- It can result in substantial tax savings on large appreciations in stock value

For example, if an employee receives restricted stock valued at $100,000 at grant and makes an 83(b) election, any appreciation above $100,000 would be treated as capital gains upon sale. Without the election, the appreciation between grant and vesting would be taxed as ordinary income, potentially at higher rates.

Flexibility in Timing of Income Recognition

The 83(b) election provides recipients with more control over when they recognize income for tax purposes. This flexibility can be advantageous in various situations:

- Aligning income recognition with personal financial planning goals

- Taking advantage of current tax rates if increases are anticipated in the future

- Managing overall taxable income to avoid pushing into higher tax brackets

For instance, an employee might choose to make an 83(b) election in a year when their other income is lower, minimizing the impact of the additional taxable income from the stock grant.

Disadvantages of the 83(b) Election

Upfront Tax Payment

One of the primary drawbacks of the 83(b) election is the requirement to pay taxes on the fair market value of the stock at the time of grant. This can be problematic because:

- It requires immediate out-of-pocket expenses

- The stock is not yet vested and cannot be sold to cover the tax liability

- It may create cash flow issues for some recipients

For example, if an employee receives restricted stock valued at $50,000 and is in the 30% tax bracket, they would need to pay $15,000 in taxes upon making the 83(b) election, without the ability to sell the stock to cover this cost.

Risk of Paying Taxes on Forfeited Shares

Making an 83(b) election carries the risk of paying taxes on shares that may never fully vest. This risk is particularly significant because:

- If employment is terminated before vesting, the shares are typically forfeited

- The IRS does not allow for a refund of taxes paid on forfeited shares

- It can result in a substantial financial loss with no corresponding benefit

Consider a scenario where an employee makes an 83(b) election on restricted stock worth $100,000, paying $30,000 in taxes. If they leave the company before the shares vest, they would forfeit the shares but would not be able to recover the $30,000 in taxes paid.

Potential Overpayment if Stock Value Decreases

If the value of the stock decreases after making an 83(b) election, the recipient may end up paying more in taxes than necessary. This disadvantage is notable because:

- Stock values, especially in startups and volatile industries, can fluctuate significantly

- There is no mechanism to recover overpaid taxes if the stock value declines

- It can result in a higher effective tax rate on the actual value received

For instance, if an employee makes an 83(b) election on stock valued at $50 per share, but the value drops to $10 per share by the time it vests, they would have paid taxes on $40 per share more than necessary.

Irrevocable Decision

Once made, an 83(b) election cannot be revoked without IRS consent, which is rarely granted. This irrevocability is problematic because:

- It locks the recipient into the tax consequences of their decision

- Changes in personal financial situations or company prospects cannot be factored in later

- It may lead to regret if circumstances change unfavorably

For example, if an employee makes an 83(b) election and then the company’s prospects deteriorate significantly, they cannot undo their election to avoid the tax liability on potentially worthless stock.

Complexity in Valuation

Determining the fair market value of stock, especially for private companies, can be challenging and may lead to disputes with the IRS. This complexity is concerning because:

- Inaccurate valuations can result in under- or overpayment of taxes

- The IRS may challenge valuations, leading to potential audits or additional tax liabilities

- Professional valuation services may be required, adding to the cost of making the election

For instance, a startup employee might make an 83(b) election based on a $1 per share valuation, only to have the IRS later argue that the fair market value was actually $5 per share, resulting in additional tax liability and potential penalties.

In conclusion, the decision to make an 83(b) election requires careful consideration of individual circumstances, company prospects, and overall financial planning goals. While it can offer significant tax advantages and simplify equity compensation management, it also carries risks that must be weighed against the potential benefits. Consulting with a qualified tax professional or financial advisor is crucial before making this important and irrevocable decision.

Frequently Asked Questions About 83b Election Pros And Cons

- What is the deadline for making an 83(b) election?

The 83(b) election must be filed with the IRS within 30 days of receiving the restricted stock or property. This deadline is strict and non-negotiable. - Can I make an 83(b) election for stock options?

Generally, 83(b) elections are not applicable to standard stock options. However, they can be used for early exercise stock options where you can purchase unvested shares. - How does an 83(b) election affect my company’s tax situation?

When an employee makes an 83(b) election, the company can typically take a corresponding tax deduction at the time of grant. This can be advantageous for cash flow and financial reporting purposes. - What happens if I forget to file the 83(b) election within 30 days?

If you miss the 30-day deadline, you cannot make the 83(b) election. You’ll be taxed on the value of the stock as it vests, potentially resulting in higher taxes if the stock appreciates. - Can I revoke an 83(b) election if I change my mind?

An 83(b) election is generally irrevocable without IRS consent, which is rarely granted. It’s crucial to carefully consider the decision before filing. - How does an 83(b) election interact with alternative minimum tax (AMT)?

For incentive stock options (ISOs), an 83(b) election can trigger AMT liability. The spread between the exercise price and fair market value at grant is included in AMT calculations. - Is an 83(b) election advisable for founders of a startup?

Founders often benefit from 83(b) elections due to the typically low initial valuation of their shares. However, each situation should be evaluated individually, considering factors like cash availability for taxes and growth projections. - How does the 83(b) election affect my cost basis for capital gains purposes?

The cost basis for shares subject to an 83(b) election is typically the amount paid for the shares plus any amount included in income as a result of the election. This can impact future capital gains calculations upon sale of the shares.