Reverse mortgages have become an increasingly popular financial tool for seniors looking to tap into their home equity during retirement. The American Association of Retired Persons (AARP) has been at the forefront of educating older Americans about this complex financial product. While AARP doesn’t offer reverse mortgages directly, it provides valuable information and advocates for consumer protections. Let’s delve into the advantages and disadvantages of reverse mortgages, with a focus on AARP’s perspective and guidance.

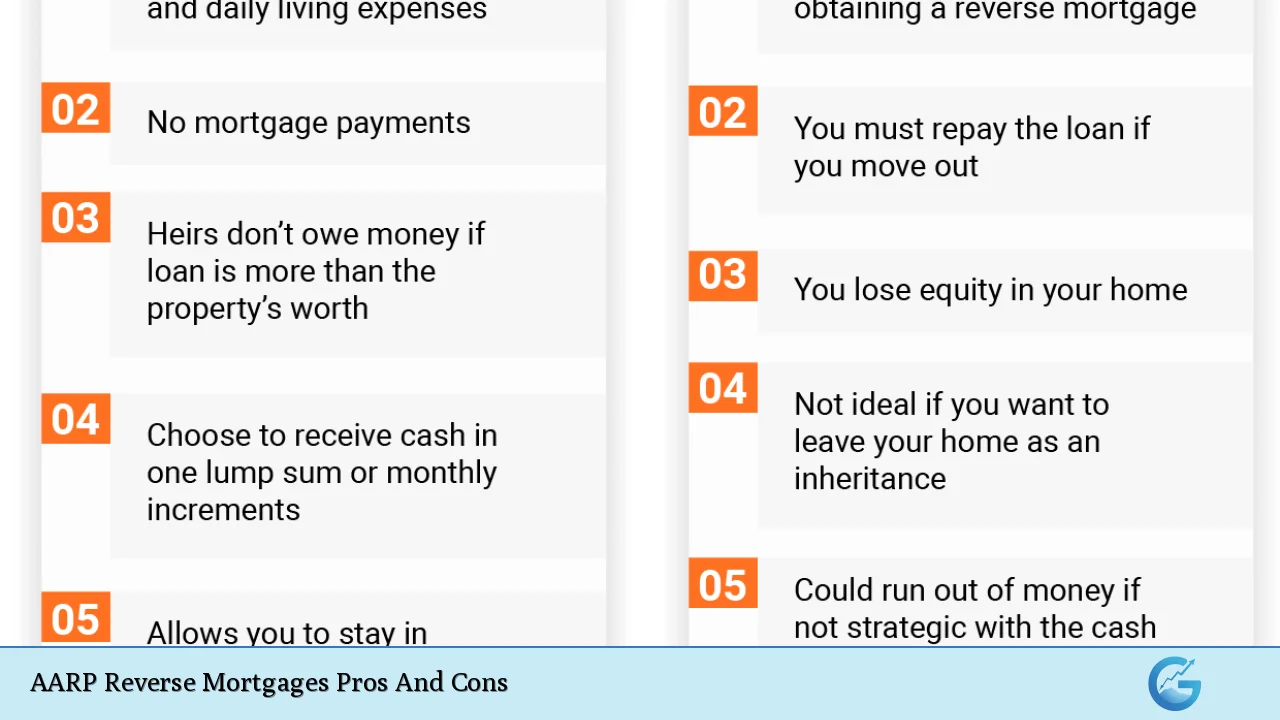

| Pros | Cons |

|---|---|

| Supplemental Income | Increasing Debt |

| No Monthly Payments | Reduced Inheritance |

| Stay in Your Home | High Costs and Fees |

| Non-Recourse Loan | Potential for Foreclosure |

| Tax-Free Proceeds | Impact on Government Benefits |

| Flexible Disbursement Options | Complexity and Confusion |

Advantages of AARP-Endorsed Reverse Mortgages

Supplemental Income

Reverse mortgages can provide a crucial financial lifeline for seniors struggling with limited retirement income. This additional cash flow can help cover daily expenses, medical costs, or even fund home improvements. AARP recognizes that for many older Americans, their home is their most valuable asset, and a reverse mortgage allows them to access this wealth without selling the property.

Benefits include:

- Regular monthly payments or a lump sum

- Line of credit that grows over time

- Combination of payment options to suit individual needs

No Monthly Payments

One of the most attractive features of reverse mortgages is that borrowers are not required to make monthly mortgage payments. This can significantly reduce financial stress for retirees on fixed incomes. As long as the borrower lives in the home and meets the loan obligations, such as paying property taxes and insurance, no repayment is required.

Stay in Your Home

AARP emphasizes the importance of aging in place for many seniors. Reverse mortgages allow homeowners to:

- Remain in their familiar surroundings

- Maintain community connections

- Avoid the costs and stress of moving

Non-Recourse Loan

AARP-endorsed reverse mortgages come with a valuable protection: they are non-recourse loans. This means that even if the loan balance exceeds the home’s value when it’s time to repay, neither the borrower nor their heirs will be responsible for the difference. The lender can only recoup the amount from the sale of the home, providing peace of mind to borrowers concerned about leaving debt to their families.

Tax-Free Proceeds

The funds received from a reverse mortgage are considered loan advances, not income. As a result, they are not taxable. This tax-free status can be particularly beneficial for seniors looking to manage their overall tax liability in retirement. However, AARP advises consulting with a tax professional to understand the full implications.

Flexible Disbursement Options

Reverse mortgages offer various ways to receive funds:

- Lump sum

- Fixed monthly payments

- Line of credit

- Combination of these options

This flexibility allows borrowers to tailor the loan to their specific financial needs and goals. AARP recommends carefully considering which option or combination best suits your long-term financial plan.

Disadvantages of AARP-Endorsed Reverse Mortgages

Increasing Debt

While the absence of monthly payments is a benefit, it’s important to understand that interest and fees continue to accrue over time. This means the loan balance grows larger, potentially at a faster rate than home appreciation, which can erode home equity. AARP cautions borrowers to consider how this increasing debt might impact their long-term financial plans and estate goals.

Factors contributing to increasing debt:

- Compounding interest

- Ongoing mortgage insurance premiums

- Servicing fees

Reduced Inheritance

As the loan balance increases, it reduces the equity available to leave to heirs. AARP advises having open discussions with family members about the impact of a reverse mortgage on inheritance plans. While heirs can still inherit the home, they would need to repay the loan balance to keep the property, which may require selling the home if they can’t refinance or pay off the debt.

High Costs and Fees

Reverse mortgages often come with significant upfront costs:

- Origination fees

- Mortgage insurance premiums

- Closing costs

- Ongoing servicing fees

AARP warns that these expenses can quickly add up, potentially making reverse mortgages an expensive way to access home equity, especially for those who may not remain in the home for many years.

Potential for Foreclosure

While reverse mortgages don’t require monthly payments, borrowers must still meet certain obligations:

- Paying property taxes

- Maintaining homeowner’s insurance

- Keeping the home in good repair

Failure to meet these requirements can result in loan default and potential foreclosure. AARP stresses the importance of understanding and planning for these ongoing responsibilities.

Impact on Government Benefits

Reverse mortgage proceeds can affect eligibility for need-based government programs such as Medicaid and Supplemental Security Income (SSI). AARP recommends consulting with a benefits specialist before taking out a reverse mortgage to understand how it might impact your specific situation.

Complexity and Confusion

Reverse mortgages are complex financial products with many rules and requirements. AARP has found that many seniors and their families struggle to fully understand the terms and implications of these loans. This complexity can lead to misunderstandings and potentially poor financial decisions.

Key areas of confusion include:

- Repayment terms

- Impact on estate planning

- Borrower obligations

AARP’s Role and Recommendations

AARP plays a crucial role in educating seniors about reverse mortgages and advocating for consumer protections. While the organization doesn’t explicitly recommend for or against reverse mortgages, it emphasizes the importance of thorough research and consideration before making a decision.

AARP recommends:

- Attending HUD-approved counseling sessions

- Exploring alternative options (e.g., downsizing, home equity loans)

- Involving family members in the decision-making process

- Carefully reviewing and understanding all loan documents

AARP also advocates for policy changes to improve consumer protections in the reverse mortgage market, such as clearer disclosures and stronger safeguards against predatory lending practices.

In conclusion, reverse mortgages can be a valuable financial tool for some seniors, but they come with significant risks and considerations. AARP’s guidance emphasizes the importance of thorough education, careful planning, and consideration of individual circumstances when deciding whether a reverse mortgage is the right choice.

Frequently Asked Questions About AARP Reverse Mortgages Pros And Cons

- Does AARP offer reverse mortgages?

No, AARP does not offer reverse mortgages directly. They provide education and advocacy related to reverse mortgages for seniors. - What is the minimum age to qualify for a reverse mortgage?

The minimum age for a Home Equity Conversion Mortgage (HECM), the most common type of reverse mortgage, is 62 years old. - Can I lose my home with a reverse mortgage?

Yes, you can lose your home if you fail to meet the loan obligations, such as paying property taxes and insurance, or if you move out of the home for more than 12 months. - How does AARP help with reverse mortgage decisions?

AARP provides educational resources, policy research, and advocacy to help seniors make informed decisions about reverse mortgages and protect their interests. - Are reverse mortgage proceeds taxable?

No, reverse mortgage proceeds are generally not taxable as they are considered loan advances, not income. However, it’s advisable to consult a tax professional for individual circumstances. - What happens to a reverse mortgage when the borrower dies?

When the last borrower dies, the loan becomes due. Heirs can choose to repay the loan and keep the house, sell the house to repay the loan, or turn the house over to the lender. - Can I get a reverse mortgage if I still owe money on my existing mortgage?

Yes, but the reverse mortgage must first be used to pay off the existing mortgage balance. Any remaining funds can then be used as you choose. - What alternatives to reverse mortgages does AARP suggest?

AARP suggests considering alternatives such as downsizing, home equity loans, refinancing, state and local programs for seniors, or seeking assistance from family members before deciding on a reverse mortgage.