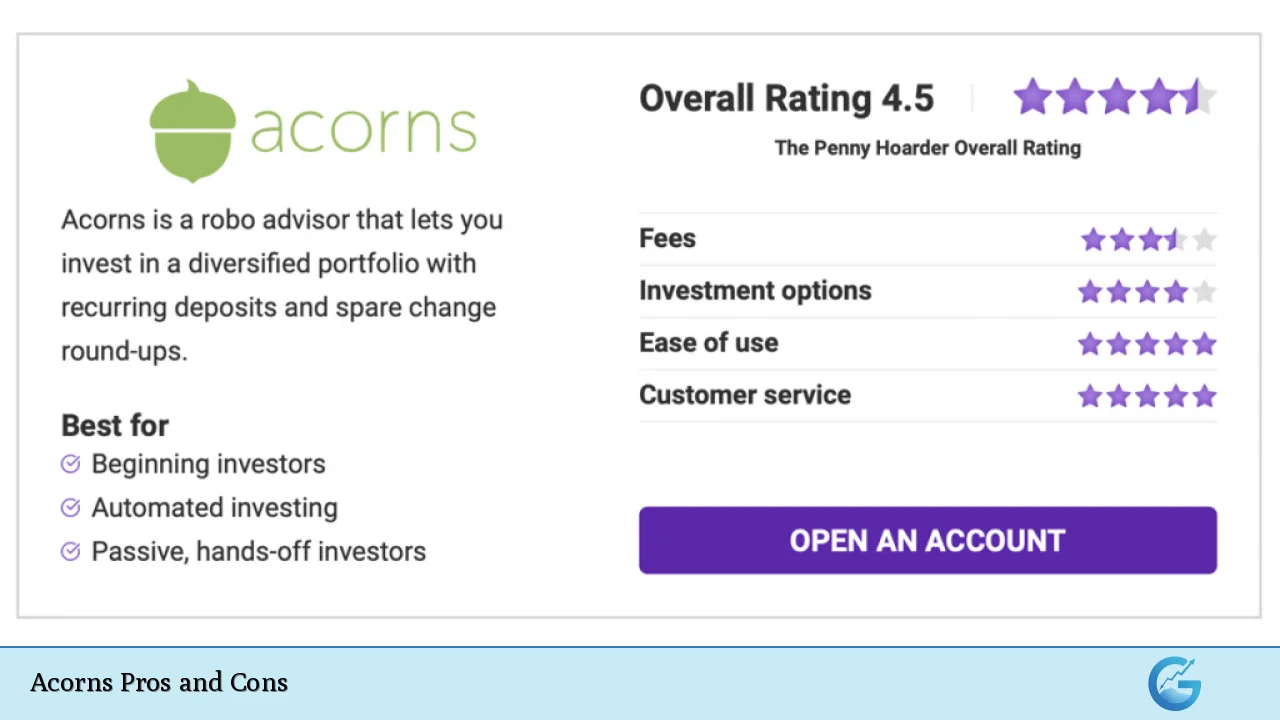

Acorns is a popular micro-investing app designed to help users save and invest their spare change effortlessly. By linking to your debit or credit card, Acorns rounds up your purchases to the nearest dollar and invests the difference into a diversified portfolio of exchange-traded funds (ETFs). This innovative approach appeals particularly to new investors and those who struggle with saving money. However, like any financial product, Acorns has its advantages and disadvantages that potential users should carefully consider before diving in.

| Pros | Cons |

|---|---|

| Automated investing through round-ups makes saving effortless. | Monthly fees can be high relative to account balance. |

| Low minimum investment required to start. | Limited investment options compared to other platforms. |

| User-friendly interface suitable for beginners. | No tax-loss harvesting feature available. |

| Offers additional features like Found Money and Acorns Later. | Customer service issues reported by users. |

| Encourages good financial habits through automatic savings. | Less control over individual investments. |

Automated Investing

One of the most significant advantages of Acorns is its automated investing feature. The app allows users to set up round-ups, which means that every time you make a purchase, Acorns will round up the total to the nearest dollar and invest the difference. This feature is particularly appealing for individuals who find it challenging to save money consistently.

- Effortless Savings: Users can save without actively thinking about it, making it easier for those who may forget to set aside money for investments.

- Incremental Growth: Over time, these small amounts can accumulate, leading to substantial savings without requiring significant lifestyle changes.

Low Minimum Investment

Acorns has a very low barrier to entry for new investors. Unlike many traditional investment platforms that require a minimum investment amount, Acorns allows users to start investing with as little as $5.

- Accessibility: This low minimum makes it an attractive option for young investors or those with limited funds who want to begin their investment journey.

- Encouragement for Beginners: The ability to start small can motivate individuals who might otherwise feel intimidated by investing.

User-Friendly Interface

The Acorns app is designed with simplicity in mind, making it accessible even for those who are not financially savvy.

- Intuitive Design: Users can easily navigate through the app, track their investments, and understand their financial progress.

- Educational Resources: Acorns provides educational content aimed at helping users learn more about investing and personal finance.

Additional Features

Acorns offers several additional features that enhance its value proposition:

- Found Money: This feature allows users to earn cash back from select brands when they shop, which is automatically invested into their Acorns account.

- Acorns Later: This feature enables users to invest in retirement accounts such as IRAs, providing a pathway for long-term savings and investment growth.

Customer Service Issues

Despite its many benefits, some users report challenges with customer service.

- Response Times: There have been complaints about slow response times from customer support, which can be frustrating for users needing assistance.

- Account Access Problems: Some users have experienced difficulties accessing their accounts or resolving issues related to account management.

Monthly Fees

While Acorns offers valuable services, its fee structure can be a disadvantage for some users.

- Flat Monthly Fees: Acorns charges a monthly fee ranging from $3 to $12 depending on the plan selected. For users with smaller account balances, these fees can represent a significant percentage of their total investment.

- Cost-Benefit Analysis: Users must evaluate whether the benefits they receive justify the monthly fees, especially if they are only investing small amounts.

Limited Investment Options

Another notable drawback of Acorns is its limited investment choices compared to other platforms.

- Predefined Portfolios: Users cannot select individual stocks or assets; instead, they must choose from predefined portfolios based on their risk tolerance.

- Lack of Advanced Features: More experienced investors may find Acorns lacking in advanced trading features or customization options available on other platforms.

No Tax-Loss Harvesting

Unlike many robo-advisors that offer tax-loss harvesting—an important strategy for reducing tax liabilities—Acorns does not provide this feature.

- Tax Implications: Without tax-loss harvesting, investors may miss out on potential tax savings that could enhance overall returns.

- Long-Term Strategy Considerations: For those looking at long-term wealth accumulation strategies, this absence could be a significant drawback.

Less Control Over Investments

Acorns operates primarily as a passive investing platform.

- Minimal Control: Users have limited ability to influence which specific investments are made within their portfolios. This might not appeal to individuals who prefer more hands-on management of their investments.

- Risk Management Concerns: Passive investing may not suit everyone’s risk tolerance or investment strategy preferences.

Closing Thoughts

In conclusion, Acorns presents a unique approach to investing that simplifies the process for new and inexperienced investors. Its automated features encourage saving and investing without requiring significant effort from users. However, potential investors should weigh these benefits against the drawbacks of fees, limited investment options, and customer service challenges.

Ultimately, whether Acorns is the right choice depends on individual financial goals and preferences. It may be an excellent starting point for those looking to dip their toes into investing but may not suit seasoned investors seeking more control over their portfolios or advanced features typically found in traditional brokerage accounts.

Frequently Asked Questions About Acorns

- What is Acorns?

Acorns is a micro-investing app that rounds up purchases made with linked debit or credit cards and invests the spare change into diversified portfolios. - How does the round-up feature work?

The round-up feature automatically rounds each purchase to the nearest dollar and invests the difference into your Acorns account. - What fees does Acorns charge?

Acorns charges a monthly fee ranging from $3 to $12 based on the plan chosen by the user. - Can I customize my investment portfolio?

No, Acorns offers predefined portfolios based on risk tolerance but does not allow customization of individual investments. - Is there a minimum investment requirement?

No minimum investment is required; you can start investing with as little as $5. - Does Acorns offer retirement accounts?

Yes, through its “Acorns Later” feature, users can invest in individual retirement accounts (IRAs). - What types of investments does Acorns use?

Acorns primarily invests in exchange-traded funds (ETFs) that are diversified across various sectors. - Can I withdraw my funds at any time?

Yes, you can withdraw your funds from your Acorns account at any time without penalties.