The Amazon credit card options have gained popularity among consumers, particularly those who frequently shop on Amazon. With various cards tailored to different customer needs, these credit cards offer unique benefits and drawbacks. Understanding the pros and cons of Amazon credit cards can help potential users make informed decisions aligned with their shopping habits and financial goals. This article delves into the advantages and disadvantages of the Amazon credit card offerings, providing a comprehensive overview for finance enthusiasts and everyday consumers alike.

| Pros | Cons |

|---|---|

| High cashback rewards on Amazon purchases | Higher rewards require Amazon Prime membership |

| No annual fee for most cards | Limited use for closed-loop cards |

| Special financing options available | High APR for carrying a balance |

| Versatile cashback on everyday spending categories | Rewards can be less competitive compared to other cards |

| Sign-up bonuses available | Potential for overspending due to easy access to credit |

| Good option for building credit (secured card) | Rewards are not redeemable for cash directly |

High Cashback Rewards on Amazon Purchases

One of the most compelling reasons to consider an Amazon credit card is the high cashback rewards it offers for purchases made on Amazon.com and at Whole Foods.

- Up to 5% cashback: For Amazon Prime members, the Prime Visa card provides 5% back on eligible purchases.

- 3% cashback: Non-Prime members still benefit from 3% back on Amazon purchases with the standard Amazon Visa card.

This high rate of return can lead to significant savings over time, especially for frequent shoppers.

No Annual Fee for Most Cards

Another advantage is that most Amazon credit cards come with no annual fee.

- Cost-effective: This feature makes them attractive compared to many other rewards credit cards that charge annual fees.

- Accessibility: Even if you do not have a Prime membership, you can still access these credit cards without incurring extra costs.

This aspect encourages more consumers to consider an Amazon card as part of their financial toolkit.

Special Financing Options Available

Amazon credit cards also offer special financing options, which can be beneficial for larger purchases.

- 0% APR promotions: These promotions allow customers to pay off purchases over time without accruing interest, making it easier to manage cash flow during significant expenses.

- Flexible payment plans: Depending on the purchase amount, financing terms can extend up to 24 months, providing ample time for repayment without additional costs.

This feature is particularly advantageous for consumers looking to make larger purchases without immediate financial strain.

Versatile Cashback on Everyday Spending Categories

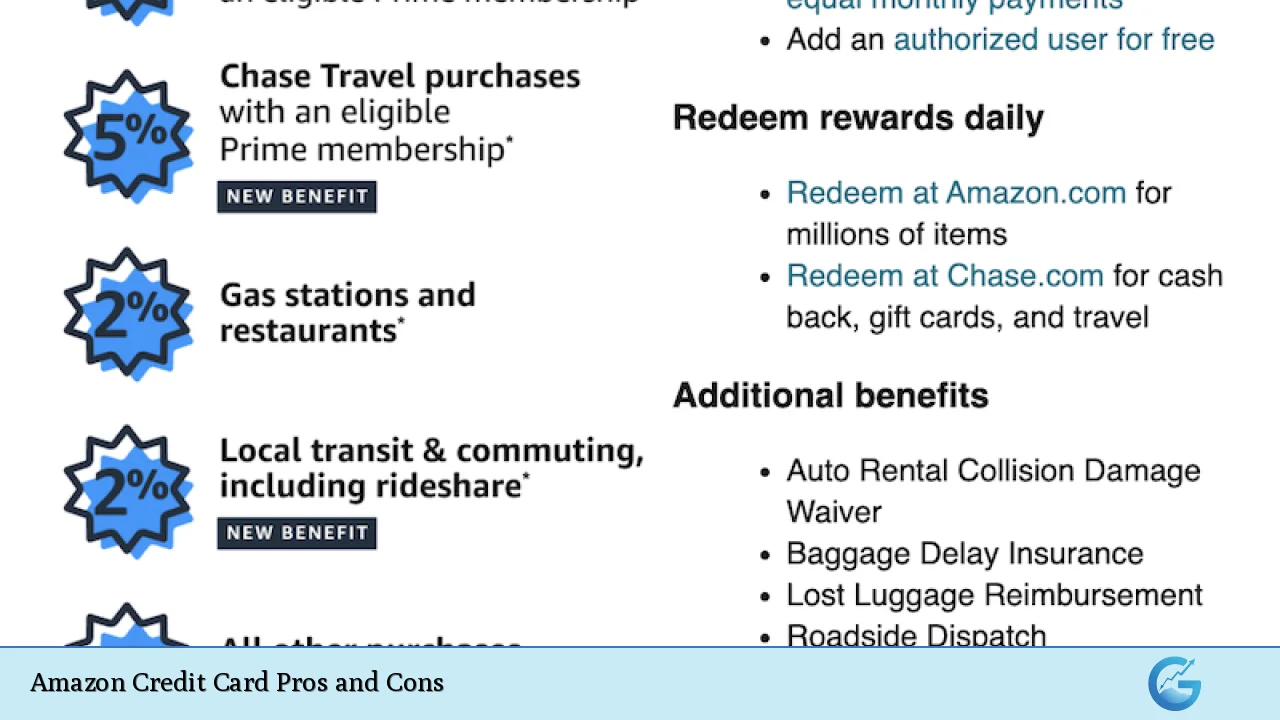

In addition to rewards on Amazon purchases, many Amazon credit cards provide cashback on other everyday spending categories.

- 2% cashback: Cardholders can earn 2% back at restaurants, gas stations, and local transit, making these cards versatile for daily expenses.

- 1% cashback: For all other purchases outside of these categories, users still earn 1% back, ensuring that every dollar spent contributes to rewards.

This versatility enhances the overall value of holding an Amazon credit card, as it integrates seamlessly into various spending habits.

Sign-Up Bonuses Available

Many Amazon credit cards come with attractive sign-up bonuses that can enhance their value further.

- Instant gift cards: New applicants might receive a bonus (e.g., a $100 gift card) upon approval, providing immediate value upon opening the account.

- Promotional offers: These bonuses can vary by promotion but often incentivize new users to apply during high shopping seasons or special events.

Such bonuses make it easier for consumers to justify applying for an Amazon credit card, especially if they plan to make significant purchases soon after approval.

Higher Rewards Require Amazon Prime Membership

While the cashback rewards are substantial, it’s important to note that the highest rates are tied to an Amazon Prime membership, which incurs an annual fee of approximately $139.

- Cost consideration: For those who do not frequently shop at Amazon or utilize Prime services (like streaming or free shipping), this cost may outweigh the benefits of having a higher rewards rate.

- Limited appeal: Consumers who are not interested in Prime may find themselves better served by general cashback or rewards cards that do not require such memberships.

This requirement may deter some potential users from fully leveraging the benefits of an Amazon credit card.

Limited Use for Closed-Loop Cards

Certain Amazon credit cards, such as the Amazon Store Credit Card and the Secured Card, are considered closed-loop cards, meaning they can only be used at Amazon and affiliated retailers.

- Lack of flexibility: This limitation restricts where you can use your card compared to traditional Visa or Mastercard options that are accepted broadly.

- Potential inconvenience: If you prefer a card that offers broader usability across various merchants and services, these closed-loop options may not meet your needs effectively.

For consumers seeking flexibility in their spending choices, this characteristic could be a significant drawback.

High APR for Carrying a Balance

Although many features are appealing, one must consider the potential downsides related to interest rates.

- APR range: The APR can range from 19.49% to 27.4%, depending on your credit score and other factors. This high rate can lead to substantial interest charges if balances are not paid in full each month.

- Financial risk: Carrying a balance on an Amazon credit card could negate any benefits gained from cashback rewards if interest accumulates significantly over time.

Consumers need to be cautious about how they manage their balances when using these cards to avoid falling into debt traps due to high-interest rates.

Rewards Can Be Less Competitive Compared to Other Cards

While the cashback rates may seem attractive, they may not always be as competitive as those offered by other general-purpose rewards cards.

- Comparison with other cards: General cashback cards often provide flat-rate rewards (e.g., 1.5% – 2%) across all categories without requiring specific merchant usage or memberships.

- Limited redemption options: The rewards earned through Amazon credit cards are primarily redeemable for future purchases at Amazon rather than cash back or versatile points systems found in other reward programs.

For users who prioritize flexibility in redeeming their rewards or who shop outside of Amazon frequently, alternative options might offer better overall value.

Potential for Overspending Due to Easy Access to Credit

The convenience of having an Amazon credit card might lead some consumers into a cycle of overspending.

- Impulse buying risk: Easy access to credit during shopping sessions could encourage unplanned purchases, leading to higher balances that may become difficult to manage over time.

- Budgeting challenges: Consumers must remain disciplined in their spending habits when using these cards; otherwise, they risk accumulating debt that exceeds their financial capabilities.

Being aware of this potential pitfall is crucial for anyone considering an Amazon credit card as part of their financial strategy.

Rewards Are Not Redeemable for Cash Directly

Lastly, it’s important to note that while users earn cashback through their purchases, these rewards typically cannot be redeemed directly as cash.

- Redemption limitations: Instead, they must be used towards future purchases on Amazon or converted into statement credits under certain conditions. This restriction may not appeal to all consumers who prefer more flexible redemption options available with other types of rewards programs.

- Focus on spending habits: Users should consider whether they will consistently shop at Amazon enough to make full use of their earned rewards since they cannot easily convert them into cash or use them elsewhere.

In conclusion, while there are numerous advantages associated with obtaining an Amazon credit card—such as high cashback rates and no annual fees—there are also notable disadvantages that potential users should carefully consider. The decision ultimately hinges on individual shopping habits and financial management practices. By weighing these pros and cons thoughtfully, consumers can determine if an Amazon credit card aligns with their overall financial goals and lifestyle choices.

Frequently Asked Questions About Amazon Credit Cards

- What benefits do I get with an Amazon credit card?

The main benefits include high cashback rates on Amazon purchases, no annual fees for most cards, special financing options for larger purchases, and versatile everyday spending rewards. - Do I need an Amazon Prime membership?

No, but having one allows you access to higher cashback rates (up to 5%) compared to non-members (3%). - Can I use my Amazon Store Credit Card anywhere?

No, it is a closed-loop card that can only be used at Amazon and select affiliated retailers. - What is the APR range for these credit cards?

The APR typically ranges from 19.49% up to 27.4%, depending on your creditworthiness. - Are there any sign-up bonuses?

Yes, many offers include sign-up bonuses like instant gift cards upon approval. - What happens if I carry a balance?

If you carry a balance, you will incur interest charges based on your APR rate, which could diminish any cashback benefits. - Can I redeem my rewards as cash?

No, rewards earned through the card must be used towards future purchases at Amazon rather than being redeemable as cash directly. - Is it good for building credit?

The secured version of the card is particularly beneficial for those looking to build or rebuild their credit score.