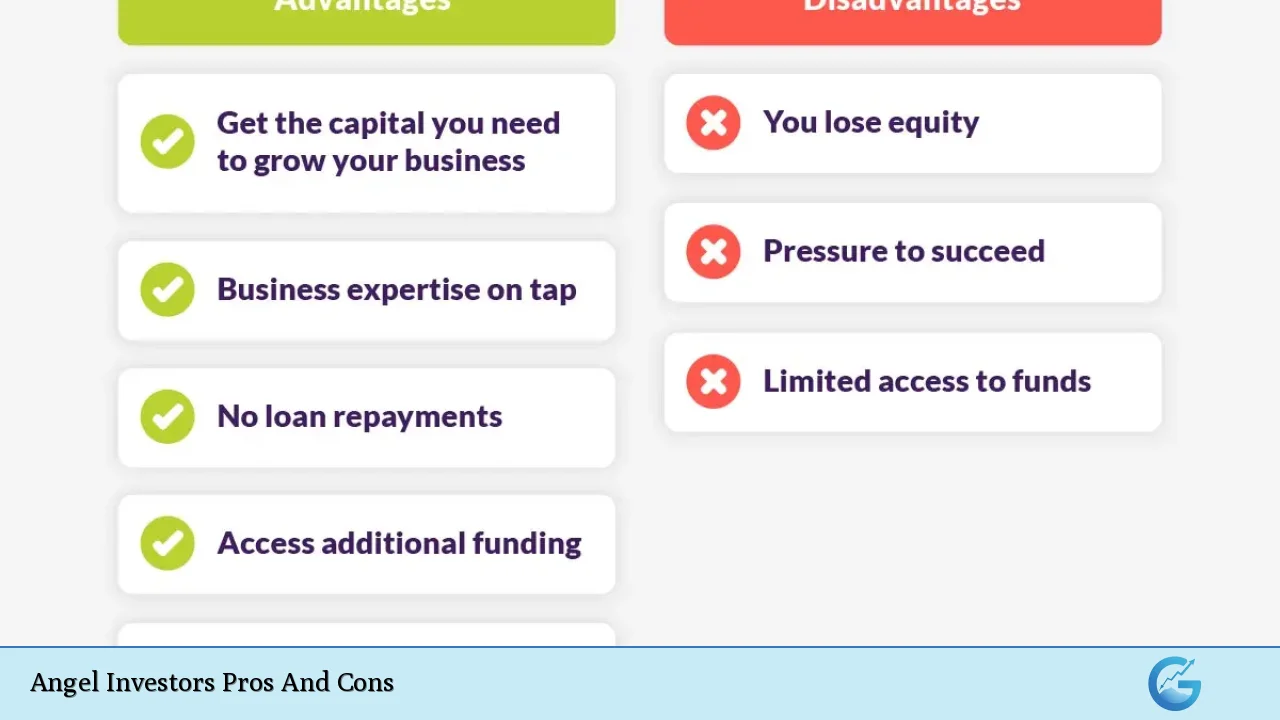

Angel investors play a crucial role in the startup ecosystem by providing essential funding and mentorship to early-stage companies. These high-net-worth individuals invest their personal capital in exchange for equity, helping entrepreneurs turn their innovative ideas into viable businesses. However, while angel investing offers numerous advantages, it also comes with notable drawbacks that entrepreneurs must carefully consider. This article explores the pros and cons of angel investors, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Willingness to take risks on unproven ventures | Higher expectations and pressure for rapid growth |

| No repayment obligations like traditional loans | Potential loss of equity and control over the business |

| Access to valuable mentorship and industry connections | Investment terms may come with strings attached |

| Faster access to capital compared to banks | Risk of misalignment between investor and founder goals |

| Flexibility in funding arrangements | Possibility of investor interference in business decisions |

Willingness to Take Risks on Unproven Ventures

One of the primary advantages of angel investors is their willingness to invest in startups that may not have a proven track record. Unlike traditional lenders, who often require extensive documentation and established revenue streams, angel investors are more open to taking risks on innovative ideas with high growth potential. This risk tolerance can be a game-changer for entrepreneurs seeking financial backing when conventional funding sources are unavailable.

- Angel investors often have firsthand experience as entrepreneurs themselves, allowing them to identify promising opportunities that others might overlook.

- Their investment can provide the necessary capital to launch or scale a business that might otherwise struggle to secure funding.

No Repayment Obligations Like Traditional Loans

Angel investments do not require repayment like a conventional loan. Instead, these investments are made in exchange for equity in the company. This arrangement can significantly alleviate financial pressure on startups, especially during their early stages when cash flow is often limited.

- Entrepreneurs can focus on growing their business without the burden of monthly loan payments.

- If the startup fails, the angel investor does not expect repayment, which reduces financial risk for the founders.

Access to Valuable Mentorship and Industry Connections

In addition to financial support, angel investors often bring a wealth of experience and industry knowledge. Many angel investors are seasoned entrepreneurs or professionals who can provide invaluable mentorship and guidance.

- They can help navigate challenges and avoid common pitfalls that startups face.

- Angel investors typically have extensive networks that can open doors to potential clients, partners, and additional funding sources.

Faster Access to Capital Compared to Banks

The approval process for angel investments is generally much quicker than that of traditional bank loans. With fewer bureaucratic hurdles, entrepreneurs can secure funding more rapidly, allowing them to capitalize on market opportunities without delay.

- This speed can be crucial for startups needing immediate capital to launch products or services.

- The ability to access funds quickly can give startups a competitive edge over slower-moving competitors.

Flexibility in Funding Arrangements

Angel investors often offer flexible terms compared to traditional financing options. They may be more willing to negotiate terms that align with the startup’s needs, which can lead to more favorable arrangements.

- This flexibility allows founders to structure deals that best suit their business model and growth trajectory.

- Entrepreneurs can often negotiate aspects such as ownership percentage and exit strategies directly with their angel investors.

Higher Expectations and Pressure for Rapid Growth

While angel investors provide significant benefits, they also come with high expectations. Many angels seek substantial returns on their investments within a relatively short timeframe (typically 5-7 years).

- This pressure can lead founders to prioritize rapid growth over sustainable business practices.

- The intense scrutiny from investors may create stress for entrepreneurs who must consistently meet performance benchmarks.

Potential Loss of Equity and Control Over the Business

In exchange for their investment, angel investors typically require an ownership stake in the company. This means that founders may have to give up a portion of their equity, which can impact their decision-making authority.

- Entrepreneurs must carefully consider how much equity they are willing to part with before accepting an investment.

- The dilution of ownership can lead to conflicts if founders feel they no longer have control over their vision for the company.

Investment Terms May Come With Strings Attached

Angel investments often involve negotiations around various terms such as voting rights, exit strategies, and ownership percentages. While these terms align interests between investors and founders, they may also impose restrictions that limit operational flexibility.

- Founders may find themselves constrained by conditions set forth by angel investors.

- It is crucial for entrepreneurs to fully understand these terms before entering into agreements.

Risk of Misalignment Between Investor and Founder Goals

Another disadvantage is the potential misalignment between the goals of angel investors and those of the founders. Investors typically seek high returns within a specific timeframe, while entrepreneurs may prioritize long-term sustainability or other objectives.

- This divergence in priorities can lead to tension between parties.

- Founders must ensure that they select angel investors whose vision aligns with their own.

Possibility of Investor Interference in Business Decisions

With shared ownership comes shared decision-making. While many angel investors adopt a hands-off approach, some may wish to be involved in strategic decisions or operational matters.

- This involvement can lead to conflicts if there are differing opinions on how the business should be run.

- Founders should establish clear boundaries regarding the level of involvement expected from their investors.

In conclusion, partnering with an angel investor presents both opportunities and challenges for entrepreneurs. While these investors provide critical funding, mentorship, and networking opportunities that can significantly enhance a startup’s chances of success, they also come with expectations that may pressure founders into rapid growth trajectories at the expense of long-term sustainability.

Entrepreneurs must weigh these pros and cons carefully before seeking angel investment. Understanding one’s own business goals and aligning them with the right investor is crucial for fostering a productive partnership that benefits both parties over time.

Frequently Asked Questions About Angel Investors Pros And Cons

- What is an angel investor?

An angel investor is an affluent individual who provides capital for startups in exchange for equity ownership. - What are the main advantages of working with an angel investor?

The main advantages include access to capital without repayment obligations, valuable mentorship, industry connections, and faster approval processes. - What are some disadvantages of accepting angel investment?

Disadvantages include potential loss of equity and control over the business, high expectations for performance, and possible investor interference in decision-making. - How do I find an angel investor?

You can find angel investors through networking events, online platforms dedicated to connecting startups with investors, or local business incubators. - What should I consider before approaching an angel investor?

You should evaluate your business model, determine how much equity you are willing to give up, and ensure your goals align with potential investors. - Can I negotiate terms with an angel investor?

Yes, many angel investors are open to negotiating terms that suit both parties’ interests. - What type of businesses do angel investors typically fund?

Angel investors usually fund early-stage companies across various industries but prefer those with high growth potential. - Is it common for startups backed by angels to succeed?

Startups backed by angel investors tend to have higher success rates due to additional resources and mentorship provided by these experienced individuals.