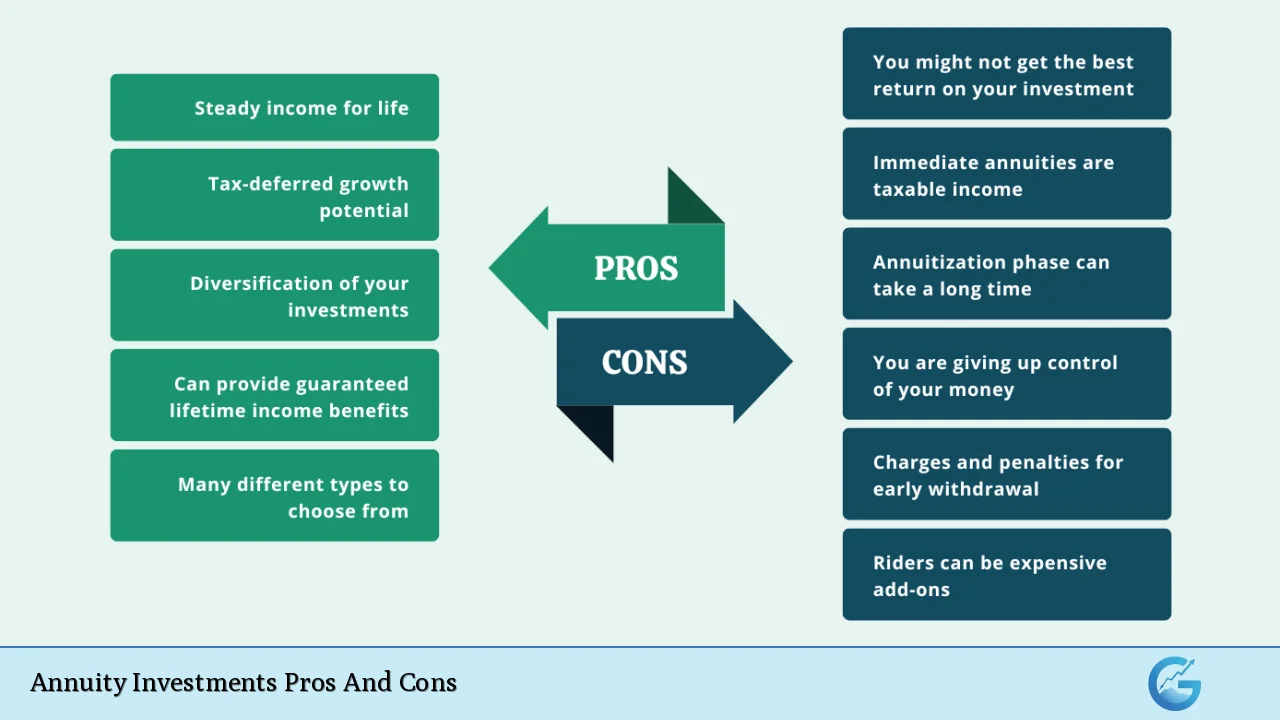

Annuities are financial products that offer a unique blend of investment and insurance features, designed to provide individuals with a steady income stream, particularly during retirement. As with any financial instrument, annuities come with their own set of advantages and disadvantages that potential investors should carefully consider before making a decision.

| Pros | Cons |

|---|---|

| Guaranteed Income Stream | High Fees and Expenses |

| Tax-Deferred Growth | Limited Liquidity |

| Principal Protection | Complexity |

| Customization Options | Opportunity Cost |

| Death Benefits | Inflation Risk |

| Diversification Tool | Credit Risk |

Advantages of Annuity Investments

Guaranteed Income Stream

One of the most significant benefits of annuities is the promise of a guaranteed income stream, which can last for a specified period or even for life. This feature is particularly attractive for retirees who want to ensure they don’t outlive their savings.

- Provides financial security and peace of mind

- Helps in budgeting and financial planning

- Can supplement other retirement income sources like Social Security

It’s important to note that the guarantee is only as strong as the financial stability of the insurance company issuing the annuity. Therefore, it’s crucial to choose a reputable and financially sound insurer.

Tax-Deferred Growth

Annuities offer tax-deferred growth, which means you don’t pay taxes on the earnings until you start withdrawing funds. This feature can be particularly beneficial for high-income earners or those in higher tax brackets.

- Allows your investment to compound over time without the drag of annual taxation

- Provides flexibility in managing your tax liability in retirement

- Can be especially advantageous if you expect to be in a lower tax bracket during retirement

However, it’s essential to understand that withdrawals from annuities are taxed as ordinary income, not at the potentially lower capital gains rates that apply to many other investments.

Principal Protection

Many types of annuities, particularly fixed and indexed annuities, offer principal protection. This means that regardless of market performance, your initial investment is guaranteed not to lose value.

- Provides a safety net for risk-averse investors

- Can be crucial for those nearing retirement who can’t afford significant losses

- Offers peace of mind during market volatility

While principal protection is a valuable feature, it’s important to consider that it may come at the cost of potentially higher returns offered by other, riskier investments.

Customization Options

Annuities offer a wide range of customization options, allowing investors to tailor the product to their specific needs and financial goals.

- Choice between immediate or deferred annuities

- Options for fixed, variable, or indexed returns

- Riders for additional benefits like long-term care coverage or enhanced death benefits

This flexibility can be particularly useful for investors with unique financial situations or specific retirement goals. However, it’s important to note that additional features and riders often come with increased costs.

Death Benefits

Many annuities include death benefit provisions, which can provide a financial legacy for your beneficiaries.

- Guarantees that your beneficiaries will receive at least your initial investment

- Some annuities offer enhanced death benefits for an additional cost

- Can bypass probate, allowing for quicker distribution to heirs

It’s crucial to carefully review the terms of the death benefit, as they can vary significantly between different annuity contracts.

Diversification Tool

Annuities can serve as a valuable diversification tool within a broader investment portfolio.

- Provides exposure to different asset classes and investment strategies

- Can help balance overall portfolio risk

- Offers a fixed income component to complement equity investments

By including annuities in a diversified portfolio, investors can potentially reduce overall investment risk and enhance long-term returns.

Disadvantages of Annuity Investments

High Fees and Expenses

One of the most significant drawbacks of annuities is their often high fee structure. These fees can significantly impact the overall return on your investment.

- Mortality and expense risk charges

- Administrative fees

- Investment management fees (for variable annuities)

- Surrender charges for early withdrawals

It’s crucial to carefully review and understand all fees associated with an annuity before investing, as they can substantially erode your returns over time.

Limited Liquidity

Annuities are generally designed as long-term investments, and accessing your funds before the agreed-upon time can be costly.

- Surrender charges for early withdrawals, often lasting 6-8 years or more

- IRS penalties for withdrawals before age 59½

- Potential loss of benefits or guarantees if funds are withdrawn early

This lack of liquidity can be problematic if you face unexpected financial needs or if better investment opportunities arise.

Complexity

Annuities, particularly variable and indexed annuities, can be extremely complex financial products. This complexity can make it challenging for the average investor to fully understand what they’re buying.

- Complicated fee structures

- Complex crediting methods for indexed annuities

- Numerous riders and options that can be difficult to evaluate

The complexity of annuities underscores the importance of working with a trusted financial advisor who can explain all aspects of the product and help determine if it’s suitable for your financial situation.

Opportunity Cost

While annuities offer certain guarantees, they may provide lower returns compared to other investment options, especially during bull markets.

- Fixed annuities may offer lower interest rates than other fixed-income investments

- Caps and participation rates on indexed annuities can limit upside potential

- Even variable annuities may underperform due to high fees

Investors need to carefully consider whether the security offered by annuities outweighs the potential for higher returns from other investment vehicles.

Inflation Risk

For fixed annuities in particular, there’s a risk that inflation will erode the purchasing power of your annuity payments over time.

- Fixed payments may not keep pace with rising costs of living

- The real value of your income stream can decrease significantly over a long retirement

- Inflation-adjusted annuities are available but typically start with lower initial payments

It’s important to factor in the potential impact of inflation when considering an annuity, especially for long-term income planning.

Credit Risk

The guarantees provided by an annuity are only as strong as the financial health of the insurance company issuing the contract.

- If the insurer becomes insolvent, your annuity could be at risk

- State guaranty associations provide some protection, but coverage limits vary by state

- Large annuity investments may exceed state guaranty limits

To mitigate this risk, it’s crucial to choose a highly-rated insurance company and potentially spread large investments across multiple insurers.

In conclusion, annuities can be a valuable tool for retirement planning and income generation, offering unique benefits such as guaranteed income and tax-deferred growth. However, they also come with significant drawbacks, including high fees, complexity, and limited liquidity. As with any major financial decision, it’s essential to carefully weigh the pros and cons of annuities in the context of your overall financial situation and goals. Consulting with a qualified financial advisor can help you determine whether an annuity is an appropriate investment for your portfolio.

Frequently Asked Questions About Annuity Investments Pros And Cons

- What types of annuities are available?

The main types of annuities are fixed, variable, and indexed annuities. Each type offers different features in terms of potential returns, risk, and guarantees. - How are annuity payments taxed?

For non-qualified annuities, only the earnings portion of withdrawals is taxed as ordinary income. For qualified annuities, the entire withdrawal is typically taxable. - Can I withdraw money from my annuity early?

Yes, but early withdrawals often incur surrender charges from the insurer and may be subject to a 10% IRS penalty if you’re under 59½. - Are annuities FDIC insured?

No, annuities are not FDIC insured. They are backed by the financial strength of the issuing insurance company and may have some protection from state guaranty associations. - How do annuities compare to other retirement savings options?

Annuities offer guaranteed income and tax-deferred growth but often have higher fees than other options like 401(k)s or IRAs. They can be complementary to other retirement savings vehicles. - What happens to my annuity if I die?

It depends on the type of annuity and any death benefit provisions. Some annuities cease upon death, while others provide a death benefit to beneficiaries. - Can I customize my annuity?

Yes, many annuities offer customization options through various riders, such as guaranteed minimum withdrawal benefits or long-term care provisions. - How do market fluctuations affect annuities?

The impact of market fluctuations varies by annuity type. Fixed annuities are not affected, indexed annuities have limited exposure, while variable annuities are directly impacted by market performance.