Annuities are financial products designed to provide a steady income stream, often used as a retirement planning tool. They are contracts between an individual and an insurance company, where the individual pays a lump sum or periodic payments, and in return, receives regular disbursements over time. While annuities can offer financial security and tax advantages, they also come with potential drawbacks such as high fees and limited liquidity. Understanding the pros and cons of annuities is crucial for anyone considering them as part of their investment or retirement strategy.

| Pros | Cons |

|---|---|

| Guaranteed income stream | High fees and commissions |

| Tax-deferred growth | Lack of liquidity |

| Customizable options | Complexity of contracts |

| Protection against market risks (fixed annuities) | Potentially lower returns than other investments |

| Lifetime income options | Surrender charges for early withdrawal |

| Death benefit provisions | Dependence on the insurer’s financial stability |

| Inflation protection (indexed annuities) | Caps on returns for indexed annuities |

| No contribution limits (non-qualified annuities) | Limited inheritance benefits for heirs |

Advantages of Annuities

1. Guaranteed Income Stream

- Annuities provide a reliable source of income, ensuring financial stability during retirement.

- This feature is especially beneficial for retirees without access to traditional pensions.

- Fixed annuities guarantee a consistent payment amount, regardless of market fluctuations.

2. Tax-Deferred Growth

- Investments in annuities grow tax-deferred, meaning you don’t pay taxes on earnings until withdrawals begin.

- This can help maximize compounding growth over time, especially for individuals in higher tax brackets during their working years.

3. Customizable Options

- Annuities can be tailored to meet specific needs, such as choosing between fixed, variable, or indexed annuities.

- Optional riders can add features like guaranteed lifetime withdrawals or cost-of-living adjustments.

4. Protection Against Market Risks

- Fixed annuities shield your principal from market volatility, offering peace of mind for risk-averse investors.

- Indexed annuities allow participation in market gains while protecting against losses.

5. Lifetime Income Options

- Many annuities offer payouts that last as long as you live, reducing the risk of outliving your savings.

- Joint-life options ensure income continues for a spouse after the primary annuitant’s death.

6. Death Benefit Provisions

- Some annuity contracts include death benefits, allowing beneficiaries to receive payouts after the annuitant’s passing.

- This feature can provide financial security for loved ones.

7. Inflation Protection

- Indexed annuities are tied to market indices like the S&P 500, offering growth potential while mitigating inflation risks.

- Certain riders can adjust payouts annually to keep pace with rising costs.

8. No Contribution Limits

- Unlike IRAs or 401(k)s, non-qualified annuities have no annual contribution limits, making them attractive for high-income earners seeking additional tax-deferred savings.

Disadvantages of Annuities

1. High Fees and Commissions

- Annuity contracts often come with substantial fees, including administrative costs, mortality expenses, and investment management fees.

- Variable annuities are particularly notorious for high costs that can erode returns over time.

2. Lack of Liquidity

- Funds invested in an annuity are typically locked up until the contract matures or payments begin.

- Early withdrawals may incur penalties or surrender charges.

3. Complexity of Contracts

- Annuity agreements are often lengthy and filled with technical jargon, making them difficult to understand without professional guidance.

- Misunderstanding contract terms can lead to unexpected costs or limitations.

4. Potentially Lower Returns

- Fixed and indexed annuities may offer lower returns compared to other investment vehicles like mutual funds or stocks.

- Caps on indexed annuity returns limit the upside potential during strong market performance.

5. Surrender Charges

- Withdrawing funds before the end of the surrender period (often 6–10 years) can result in hefty penalties.

6. Dependence on Insurer’s Stability

- The guarantees provided by an annuity are only as strong as the issuing insurance company’s financial health.

- In rare cases of insurer insolvency, payouts could be at risk despite state-level protections.

7. Caps on Returns

- Indexed annuities often impose caps on how much you can earn from market-linked growth.

- For example, if the index gains 10%, but your cap is 5%, you’ll only receive 5% growth.

8. Limited Inheritance Benefits

- Unlike other investments that pass directly to heirs, some types of annuities may not leave significant residual value upon the owner’s death.

Conclusion

Annuities can be valuable tools for securing retirement income and managing financial risks, but they are not suitable for everyone. While they offer benefits like guaranteed income and tax-deferred growth, their drawbacks—such as high fees and limited liquidity—must be carefully considered. It’s essential to evaluate your financial goals, risk tolerance, and retirement needs before investing in an annuity. Consulting with a trusted financial advisor can help determine whether an annuity aligns with your overall strategy.

Frequently Asked Questions About [keyword]

- What is an annuity?

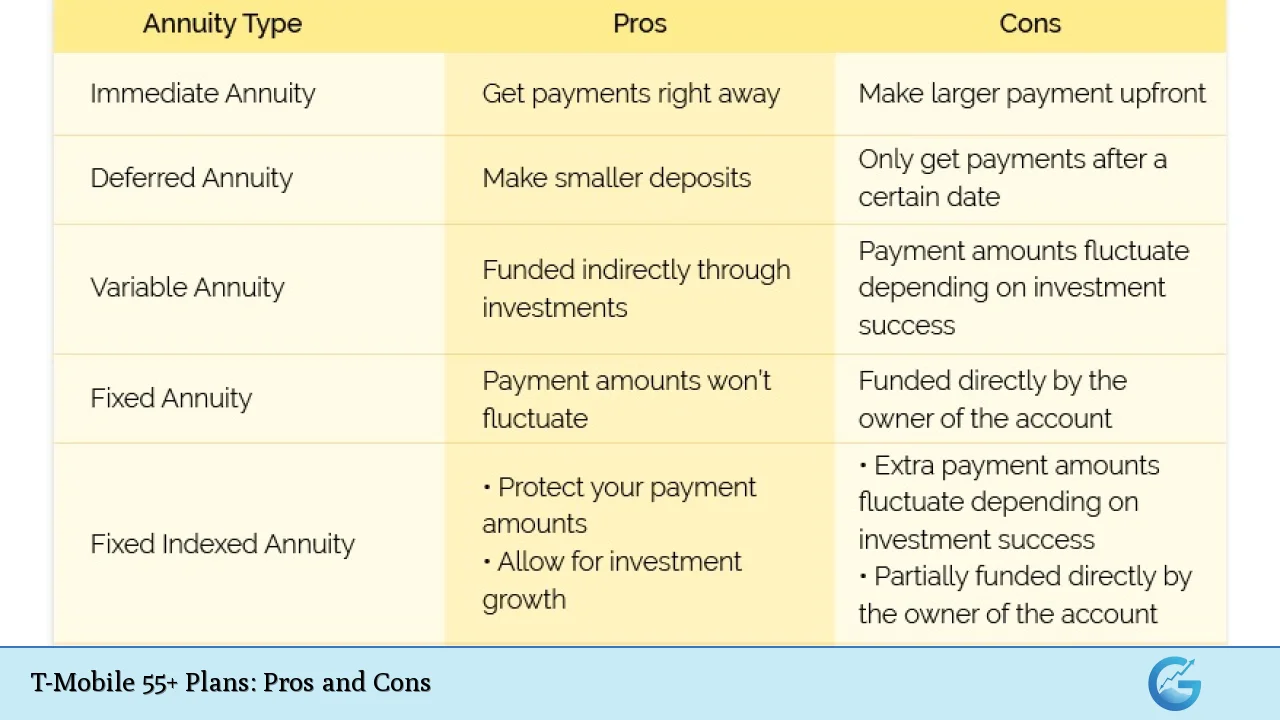

An annuity is a contract with an insurance company that provides regular payments in exchange for a lump sum or periodic contributions. - Are there different types of annuities?

Yes, common types include fixed, variable, and indexed annuities, each with unique features and risk levels. - Do annuities offer tax advantages?

Yes, earnings within an annuity grow tax-deferred until withdrawals begin. - What are surrender charges?

Surrender charges are penalties imposed for early withdrawals from an annuity before the end of its surrender period. - Can I lose money with an annuity?

You may lose money with variable or indexed annuities if investments perform poorly or due to fees; fixed annuities protect your principal. - Are there fees associated with annuities?

Yes, fees vary by type but can include administrative costs, mortality expenses, and investment management fees. - How do I know if an insurer is reliable?

You can check an insurer’s financial ratings through agencies like A.M. Best or Standard & Poor’s. - Should I consult a financial advisor before buying an annuity?

Yes, professional advice ensures that an annuity fits your financial goals and needs.