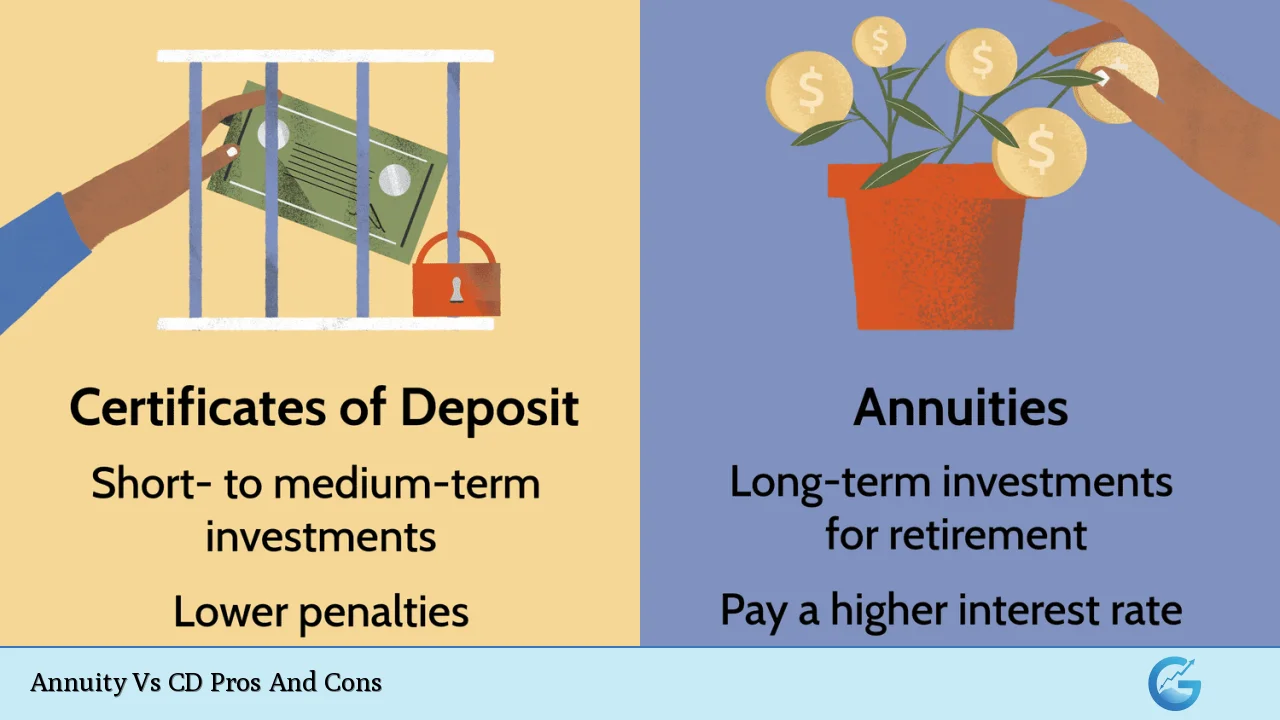

When it comes to investing for the future, individuals often find themselves weighing various options to secure their financial well-being. Among these options, annuities and certificates of deposit (CDs) stand out as popular choices for conservative investors seeking low-risk avenues for growth. Both financial products offer distinct advantages and disadvantages, making it crucial for potential investors to understand their features, risks, and benefits. This article delves into the pros and cons of annuities versus CDs, providing a comprehensive overview to help you make informed decisions about your investments.

| Pros | Cons |

|---|---|

| Tax-deferred growth on annuities | Early withdrawal penalties on both products |

| Guaranteed income streams from annuities | Less liquidity in annuities compared to CDs |

| Higher interest rates typically offered by annuities | Complexity and fees associated with annuities |

| FDIC insurance for CDs provides principal protection | Lower returns on CDs compared to annuities over time |

| Customizable features available in annuities | Limited customization options in CDs |

| Suitable for long-term retirement planning (annuities) | Shorter investment horizons may favor CDs |

| Potential for higher returns with indexed or variable annuities | Interest earned on CDs is taxable annually |

| Regular payments can be structured in various ways with annuities | Surrender charges may apply to annuities if funds are withdrawn early |

Tax-Deferred Growth on Annuities

One of the most significant advantages of investing in an annuity is the tax-deferred growth it offers. This means that any earnings generated within the annuity are not subject to taxation until they are withdrawn. This feature allows your investment to grow more rapidly over time due to the compounding effect, which can be particularly beneficial for long-term retirement savings.

- Strengths:

- Earnings accumulate without immediate tax implications.

- Potentially larger retirement nest egg due to tax deferral.

- Weaknesses:

- Withdrawals before age 59½ may incur additional penalties.

- Taxation can be significant upon withdrawal, depending on your income bracket at that time.

Guaranteed Income Streams from Annuities

Annuities are uniquely designed to provide guaranteed income streams, making them an attractive option for retirees seeking financial stability. Depending on the type of annuity chosen—immediate or deferred—you can receive regular payments for a set period or even for life.

- Strengths:

- Provides predictability in income during retirement.

- Helps mitigate the risk of outliving your savings.

- Weaknesses:

- Payments are fixed and may not keep pace with inflation.

- Once committed, it can be challenging to alter payment structures.

Higher Interest Rates Typically Offered by Annuities

Annuities often provide higher interest rates compared to CDs, especially when considering fixed and indexed options. This higher yield can significantly impact long-term savings growth.

- Strengths:

- Higher potential returns can lead to greater wealth accumulation.

- Fixed indexed annuities can offer returns linked to market performance while protecting principal.

- Weaknesses:

- Higher returns often come with increased complexity and risk.

- Variable annuities expose investors to market fluctuations.

FDIC Insurance for CDs Provides Principal Protection

Certificates of deposit (CDs) are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per bank. This insurance provides a safety net that ensures your principal investment is protected in case of bank failure.

- Strengths:

- Provides peace of mind knowing your investment is secure.

- Ideal for conservative investors prioritizing capital preservation.

- Weaknesses:

- Limited coverage means larger investments may not be fully insured.

- Interest rates can be lower than those offered by other investment vehicles.

Customizable Features Available in Annuities

Annuities can come with various customizable features, known as riders, which allow investors to tailor their contracts according to their specific financial goals. These may include options for inflation protection or enhanced death benefits.

- Strengths:

- Flexibility in structuring payments and benefits according to personal needs.

- Additional features can enhance overall value and security.

- Weaknesses:

- Customization often involves higher fees.

- Complexity can lead to confusion regarding terms and conditions.

Suitable for Long-Term Retirement Planning (Annuities)

Annuities are generally designed as long-term investments aimed at providing income during retirement. They serve as a strategic tool for individuals looking to secure their financial future over several decades.

- Strengths:

- Encourages disciplined saving and investment over time.

- Aligns well with retirement planning strategies.

- Weaknesses:

- Not suitable for short-term financial goals due to liquidity constraints.

- Early withdrawal penalties can deter access to funds when needed most.

Potential for Higher Returns with Indexed or Variable Annuities

Indexed and variable annuities offer the potential for higher returns linked directly to stock market performance or other indices. This feature appeals to investors seeking growth beyond traditional fixed-rate products.

- Strengths:

- Opportunity for substantial gains during bullish market conditions.

- Diversification through exposure to various markets without direct stock investment risks.

- Weaknesses:

- Market volatility can lead to losses; returns are not guaranteed.

- Complexity in understanding how returns are calculated and applied.

Less Liquidity in Annuities Compared to CDs

One major disadvantage of annuities is their lack of liquidity. Once you invest in an annuity, accessing those funds before maturity often incurs significant penalties. In contrast, CDs typically allow earlier withdrawals with less severe consequences.

- Strengths:

- Encourages long-term savings discipline without easy access.

- Weaknesses:

- Limited access can be problematic during emergencies or unexpected expenses.

Early Withdrawal Penalties on Both Products

Both annuities and CDs impose penalties for early withdrawals. For CDs, this usually means losing some or all of the interest earned if funds are accessed before maturity. Annuity contracts often come with surrender charges that decrease over time but can still significantly reduce your investment’s value if accessed prematurely.

- Strengths:

- Discourages impulsive withdrawals, promoting saving behavior.

- Weaknesses:

- Financial emergencies may necessitate accessing funds at a loss.

Lower Returns on CDs Compared to Annuities Over Time

While CDs provide safety and guaranteed interest rates, they typically offer lower returns than annuities over extended periods. The difference in yield can significantly affect overall wealth accumulation, especially when considering inflation impacts.

- Strengths:

- Predictable returns make budgeting easier.

- Weaknesses:

- Inflation risk erodes purchasing power over time due to lower interest rates compared to other investments.

Limited Customization Options in CDs

CDs generally lack the customization features available with annuities. Investors cannot modify terms or payment structures once they commit funds into a CD; they must adhere strictly to the initial agreement regarding interest rates and maturity dates.

- Strengths:

- Simplicity makes them easy to understand and manage.

- Weaknesses:

- Lack of flexibility may not meet changing financial needs over time.

Closing Thoughts

Choosing between an annuity and a CD ultimately depends on individual financial goals, risk tolerance, and investment horizon. Annuities offer unique advantages such as tax-deferred growth, guaranteed income streams, and higher potential returns but come with complexities and liquidity constraints. Conversely, CDs provide safety through FDIC insurance and predictable returns but typically yield lower interest rates over time.

Investors should carefully assess their financial situation and consider consulting with a financial advisor before making decisions regarding these investment vehicles. Understanding the strengths and weaknesses of each option will empower you to create a balanced portfolio that aligns with your long-term objectives.

Frequently Asked Questions About Annuity Vs CD Pros And Cons

- What is an annuity?

An annuity is a contract with an insurance company where you pay a lump sum or series of payments in exchange for regular income payments over time. - What is a certificate of deposit (CD)?

A CD is a savings product offered by banks that provides a fixed interest rate over a specified term. - Are both options safe investments?

Yes, both annuities (backed by insurance companies) and CDs (insured by the FDIC) are considered low-risk investments. - Which option offers better returns?

Annuities generally offer higher potential returns compared to CDs due to longer investment terms. - Can I withdraw money early from either option?

Yes, but both impose penalties; early withdrawals from CDs usually result in lost interest while annuities may incur surrender charges. - What are the tax implications of each?

Annuity earnings grow tax-deferred until withdrawal; CD interest is taxed annually unless held in tax-advantaged accounts. - Which option is better for short-term savings?

CDs are typically better suited for short-term savings due to their flexibility compared to the long-term nature of most annuities. - How do I choose between an annuity and a CD?

Your choice should depend on your investment goals—annuities are better for long-term income planning while CDs suit short-term savings needs.