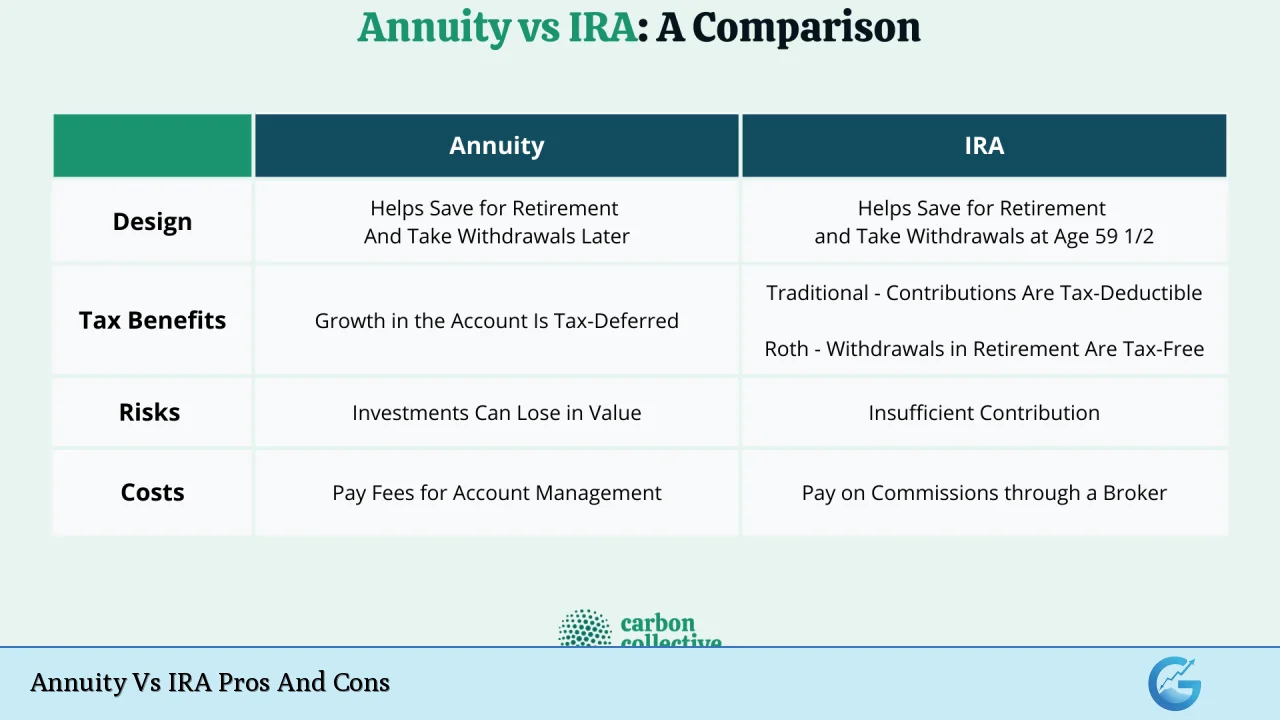

When planning for retirement, individuals often face a crucial decision: whether to invest in an annuity or an Individual Retirement Account (IRA). Both options offer unique advantages and disadvantages that can significantly impact your financial future. Understanding these pros and cons is essential for making informed investment choices that align with your retirement goals. This article delves into the strengths and weaknesses of annuities and IRAs, providing a comprehensive overview to help you navigate this important financial decision.

| Pros | Cons |

|---|---|

| Guaranteed income stream for life | High fees and commissions |

| Tax-deferred growth on earnings | Limited liquidity and access to funds |

| No contribution limits | Potential for lower returns compared to other investments |

| Protection from market volatility (for fixed annuities) | Complexity and lack of transparency in contracts |

| Diverse investment options available (in IRAs) | Required minimum distributions (RMDs) for traditional IRAs |

| Flexibility in withdrawal strategies (for IRAs) | Tax implications on withdrawals from both products |

Guaranteed Income Stream for Life

One of the most significant advantages of annuities is the guaranteed income stream they provide.

- Lifetime Payments: Annuities can be structured to pay out a fixed amount for the rest of your life, ensuring that you do not outlive your savings.

- Financial Security: This feature is particularly appealing for retirees who are concerned about maintaining their standard of living without relying solely on investment performance.

However, this benefit comes with trade-offs:

- Cost: The guarantee of lifetime income often comes at a high price, with fees that can significantly reduce the overall return on investment.

Tax-Deferred Growth on Earnings

Both annuities and IRAs offer tax-deferred growth, which means you won’t pay taxes on your investment gains until you withdraw funds.

- Compounding Benefits: This allows your investments to grow more quickly than they would in a taxable account, as all earnings can be reinvested without immediate tax consequences.

Despite this advantage, there are important considerations:

- Taxation Upon Withdrawal: When you withdraw funds from an annuity or traditional IRA, those withdrawals are taxed as ordinary income, which could affect your tax bracket in retirement.

No Contribution Limits

Annuities do not have annual contribution limits like IRAs do.

- Investment Flexibility: This allows investors to contribute as much as they wish, which can be particularly beneficial for high earners looking to maximize their retirement savings.

However, the absence of limits can lead to:

- Potential Overspending: Without limits, there’s a risk of overcommitting funds to an annuity at the expense of other investment opportunities that may provide better returns.

Protection from Market Volatility

Fixed annuities provide a safeguard against market fluctuations.

- Stable Returns: Investors seeking stability may find fixed annuities appealing since they offer guaranteed returns regardless of market performance.

On the downside:

- Inflation Risk: Fixed payments may not keep pace with inflation over time, potentially eroding purchasing power.

Diverse Investment Options Available (in IRAs)

IRAs typically offer a broader range of investment options compared to annuities.

- Investment Control: Investors can choose from stocks, bonds, mutual funds, ETFs, and more within an IRA, allowing for tailored investment strategies based on individual risk tolerance and goals.

However:

- Market Risk: The performance of an IRA heavily depends on market conditions and the investor’s choices, which can lead to significant fluctuations in account value.

Limited Liquidity and Access to Funds

Annuities often come with restrictions on accessing funds.

- Surrender Charges: If you withdraw money from an annuity before a specified period, you may incur hefty surrender charges that diminish your returns.

Conversely:

- More Flexible Access with IRAs: While IRAs also impose penalties for early withdrawals (before age 59½), they generally offer more liquidity than annuities.

Complexity and Lack of Transparency in Contracts

Annuity contracts can be complex and difficult to understand fully.

- Understanding Terms: Many investors struggle with the intricacies of fees, surrender periods, and payout structures associated with annuities.

This complexity can lead to:

- Poor Decision-Making: Misunderstanding the terms may result in unfavorable choices that impact long-term financial health.

Required Minimum Distributions (RMDs) for Traditional IRAs

Traditional IRAs require account holders to start taking distributions at age 73.

- Mandatory Withdrawals: This can create a tax burden if not planned properly since RMDs are taxed as ordinary income.

In contrast:

- No RMDs on Annuities Until Death: Annuities do not require distributions during the owner’s lifetime unless specified in the contract, providing more control over when to access funds.

Tax Implications on Withdrawals from Both Products

Both annuities and IRAs have tax implications upon withdrawal.

- Ordinary Income Tax Rates Apply: Withdrawals from both products are subject to ordinary income tax rates, which can be higher than capital gains rates applicable to other investments.

This aspect necessitates careful planning:

- Strategic Withdrawals Needed: Understanding how withdrawals will impact your overall tax situation is crucial for effective retirement planning.

In conclusion, both annuities and IRAs have their unique advantages and disadvantages. Choosing between them—or deciding how best to use both—depends largely on individual financial situations, retirement goals, and risk tolerance.

Frequently Asked Questions About Annuity Vs IRA Pros And Cons

- What is the primary benefit of an annuity?

Annuities provide guaranteed income for life, offering financial security during retirement. - Are there contribution limits for IRAs?

Yes, IRAs have annual contribution limits ($7,000 or $8,000 if you’re 50 or older in 2024). - Can I access my money easily in an annuity?

No, accessing funds in an annuity may incur surrender charges and penalties. - Do both products offer tax benefits?

Yes, both allow for tax-deferred growth until withdrawals begin. - What happens if I withdraw from my IRA before age 59½?

You will incur a 10% early withdrawal penalty unless certain exceptions apply. - Can I hold an annuity inside an IRA?

Yes, you can purchase an annuity within an IRA structure. - Which option has better liquidity?

IRAs generally offer better liquidity compared to annuities. - What is one major disadvantage of annuities?

Annuities often come with high fees that can reduce overall returns.

Understanding these factors will empower you to make informed decisions about your retirement savings strategy. Always consider consulting with a financial advisor to tailor your approach based on personal circumstances.