Adjustable-rate mortgages (ARMs) have gained popularity among homebuyers, particularly in fluctuating interest rate environments. These loans start with a lower fixed interest rate for an initial period, after which the rate adjusts based on market conditions. While ARMs can provide significant short-term savings, they also carry inherent risks that potential borrowers must consider. This article delves into the advantages and disadvantages of ARMs, helping you make an informed decision.

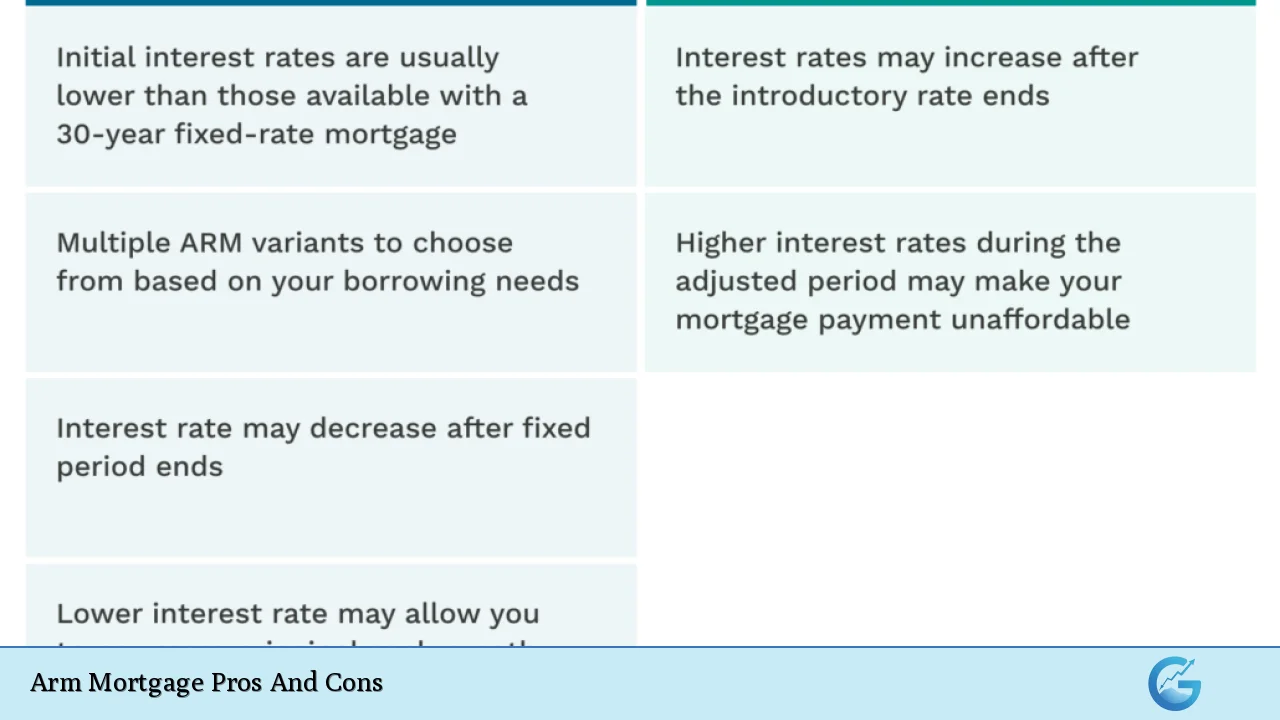

| Pros | Cons |

|---|---|

| Lower initial interest rates | Potential for increased payments |

| Ideal for short-term homeowners | Uncertainty in budgeting |

| Opportunity for lower overall costs | Complex loan structures |

| Flexibility in financial planning | Risk of negative amortization |

| Possibility of lower payments if rates drop | Difficulty in refinancing or selling |

Lower Initial Interest Rates

One of the most attractive features of ARMs is their lower initial interest rates compared to fixed-rate mortgages. This can result in significantly lower monthly payments during the initial fixed-rate period, which typically lasts from one to ten years.

- Cost Savings: Homebuyers can save hundreds of dollars each month, allowing them to allocate funds toward other financial goals.

- Increased Purchasing Power: The lower payments may enable buyers to afford a more expensive home than they could with a fixed-rate mortgage.

Potential for Increased Payments

After the initial fixed-rate period ends, the interest rate on an ARM adjusts periodically based on market conditions. This adjustment can lead to higher monthly payments.

- Payment Shock: Borrowers may experience a sudden increase in their mortgage payments when the rate adjusts, which can strain their budgets.

- Long-Term Financial Planning: Homeowners need to prepare for potential increases in their monthly payments, which can complicate long-term financial planning.

Ideal for Short-Term Homeowners

ARMs are particularly beneficial for individuals who do not plan to stay in their homes for long periods.

- Selling Before Adjustment: If a homeowner intends to sell before the adjustable period begins, they can take advantage of the low initial rates without facing the risks associated with future adjustments.

- Investment Opportunities: Investors looking to flip properties can benefit from the lower costs associated with ARMs during their ownership period.

Uncertainty in Budgeting

The variability of ARMs introduces uncertainty that can complicate budgeting and financial planning.

- Fluctuating Payments: Homeowners must be prepared for potential increases in their monthly payments, making it challenging to maintain a stable budget.

- Market Dependency: The performance of ARMs is tied to market interest rates, which can be unpredictable and influenced by various economic factors.

Opportunity for Lower Overall Costs

If managed correctly, ARMs can lead to lower overall costs over the life of the loan compared to fixed-rate mortgages.

- Initial Savings: Borrowers benefit from lower payments during the initial fixed-rate phase, allowing them to save or invest the difference.

- Potential Rate Decreases: If market rates decrease after the adjustment period begins, homeowners may enjoy even lower payments than anticipated.

Complex Loan Structures

ARMs often come with complex terms and conditions that borrowers must understand fully before committing.

- Understanding Terms: Key features such as rate caps, margins, and indexes dictate how much and how often interest rates will adjust. Borrowers must be diligent in understanding these aspects to avoid unexpected costs.

- Risk of Misunderstanding: Many borrowers may not fully grasp the complexities of ARMs, leading to potential financial pitfalls if rates rise unexpectedly.

Flexibility in Financial Planning

ARMs offer flexibility that can be advantageous for certain financial strategies.

- Lower Initial Payments Allow Investment: With lower initial payments, homeowners might choose to invest extra funds elsewhere, potentially yielding higher returns than paying down a mortgage faster would.

- Adapting to Market Conditions: Borrowers may find it easier to adapt their financial strategies based on changing market conditions due to the adjustable nature of their mortgage.

Risk of Negative Amortization

One significant risk associated with ARMs is negative amortization, where monthly payments do not cover the full amount of interest due.

- Increasing Debt Burden: If payments are insufficient to cover interest costs, borrowers may see their loan balance increase over time rather than decrease, leading to greater long-term debt burdens.

- Financial Instability: This situation can create significant financial instability if borrowers are unaware or unprepared for it, potentially leading to foreclosure if they cannot make higher future payments.

Possibility of Lower Payments if Rates Drop

In addition to potential increases, there is also a chance that interest rates may decrease after an adjustment period begins.

- Lower Payments During Rate Drops: If market conditions lead to lower benchmark rates, homeowners could benefit from reduced monthly payments even after the initial period ends.

- Strategic Timing: Homeowners who anticipate favorable market conditions may strategically choose ARMs over fixed-rate options for this reason.

Difficulty in Refinancing or Selling

While ARMs can offer short-term benefits, they also pose challenges when it comes time to refinance or sell a property.

- Market Conditions Impacting Sales: If homeowners need to sell during a downturn or when rates are high, they may struggle to find buyers willing to take on an ARM with rising payments.

- Refinancing Challenges: Borrowers may find it difficult or costly to refinance into a more stable fixed-rate mortgage if their creditworthiness has changed or if market conditions are unfavorable at the time they wish to refinance.

In conclusion, adjustable-rate mortgages present both opportunities and risks that potential homebuyers must carefully consider. While they offer enticing advantages such as lower initial rates and flexibility for short-term homeowners or investors, they also carry significant risks related to payment fluctuations and complex loan structures.

Ultimately, understanding these pros and cons is crucial for making an informed decision about whether an ARM aligns with your financial goals and risk tolerance. Engaging with a financial advisor or mortgage professional can further aid in navigating these complexities and ensuring that your choice supports your long-term financial health.

Frequently Asked Questions About Arm Mortgage Pros And Cons

- What is an adjustable-rate mortgage (ARM)?

An ARM is a type of mortgage where the interest rate is initially fixed for a specific period before adjusting periodically based on market conditions. - What are the main advantages of ARMs?

The primary advantages include lower initial interest rates, cost savings during the initial period, and flexibility for short-term homeowners. - What are some disadvantages of ARMs?

The main disadvantages include potential payment increases after the fixed period ends and complexities associated with understanding loan terms. - Who should consider getting an ARM?

Individuals who plan on moving or refinancing within a few years may benefit most from an ARM due to its lower initial rates. - How does negative amortization occur with ARMs?

Negative amortization occurs when monthly payments do not cover accrued interest costs, resulting in an increasing loan balance. - Can ARMs be refinanced easily?

Refinancing an ARM can be challenging depending on market conditions and changes in borrower creditworthiness at the time of refinancing. - What should I look out for when considering an ARM?

You should understand rate caps, how often your rate will adjust, and what happens if you cannot make higher payments after adjustments. - Are there any risks associated with ARMs?

Yes, risks include fluctuating monthly payments leading to budgeting challenges and potential foreclosure if payment increases become unaffordable.