The Austrian Financial Market Authority (FMA) plays a crucial role in regulating and supervising the financial markets in Austria. For those interested in forex, finance, and cryptocurrency markets, understanding the FMA broker license is essential. This comprehensive guide will provide you with detailed information about the FMA license, its requirements, and its implications for brokers and investors alike.

| Aspect | Description | Importance |

|---|---|---|

| Regulatory Body | Financial Market Authority (FMA) | Ensures market integrity and consumer protection |

| License Types | Banking, Investment Services, Payment Services | Determines the scope of authorized activities |

| Requirements | Capital, Business Plan, Management Expertise | Ensures financial stability and operational competence |

Understanding the FMA and Its Role

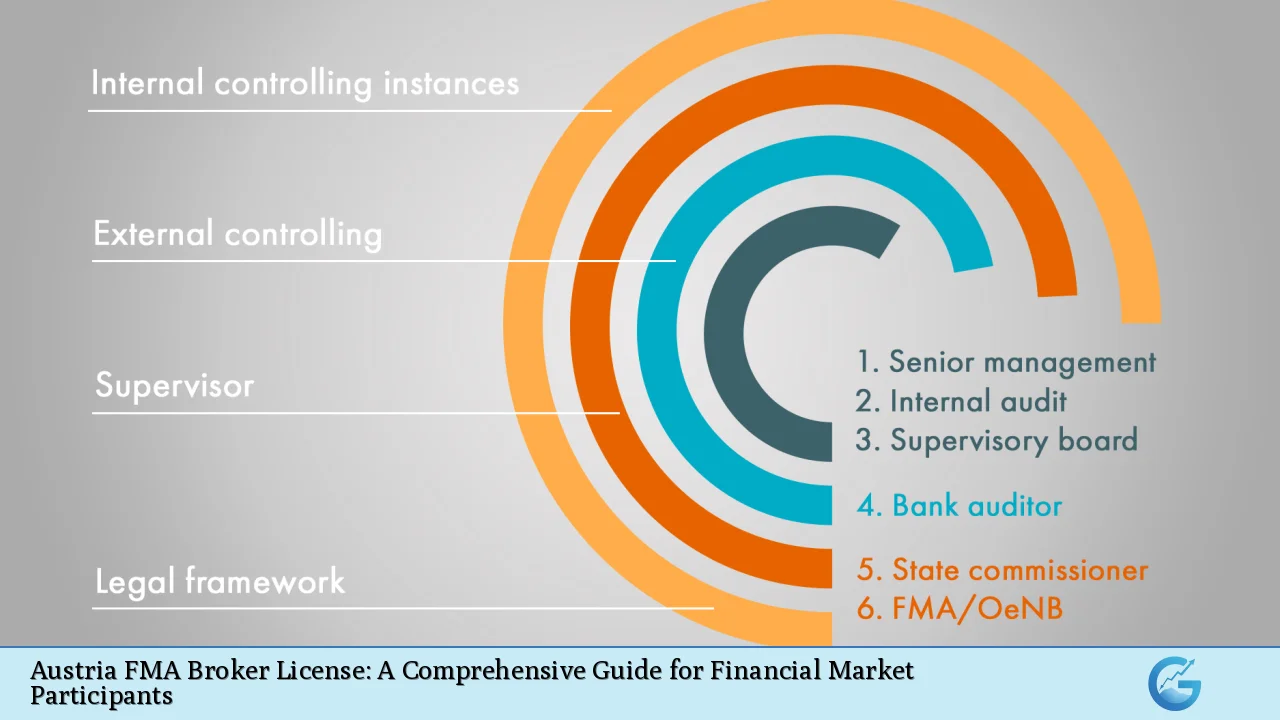

The Financial Market Authority (FMA) is Austria’s integrated supervisory authority for the financial market. Established to ensure the stability and integrity of the Austrian financial market, the FMA oversees banks, insurance companies, pension funds, and investment firms.

Key responsibilities of the FMA:

- Licensing financial institutions

- Supervising market participants

- Enforcing regulatory compliance

- Protecting consumers and investors

The FMA operates under several key legislative acts, including the Finanzmarktaufsichtsbehördengesetz, Nationalbankgesetz, and Versicherungsaufsichtsgesetz. These laws provide the framework for the FMA’s regulatory activities and empower it to maintain a stable and transparent financial environment in Austria.

Types of FMA Licenses

The FMA issues various types of licenses depending on the nature of the financial services provided. Understanding these license types is crucial for businesses looking to operate in the Austrian financial market.

Banking License

A banking license is required for entities wishing to conduct banking activities in Austria. This license is governed by the Austrian Banking Act (BWG) and allows institutions to perform a wide range of financial services.

Key features of a banking license:

- Authorizes deposit-taking and lending activities

- Permits foreign exchange operations

- Allows for the issuance of electronic money

The process of obtaining a banking license is rigorous and requires substantial capital, a robust business plan, and experienced management.

Investment Services License

For firms focusing on investment services, the FMA offers licenses under the Securities Supervision Act 2018 (WAG 2018). This license is particularly relevant for forex and cryptocurrency brokers.

Activities covered by an investment services license:

- Reception and transmission of orders

- Execution of orders on behalf of clients

- Portfolio management

- Investment advice

Firms holding this license must comply with strict operational and capital requirements to ensure the protection of investor interests.

Payment Services License

The Payment Services Act 2018 (ZaDiG 2018) governs the licensing of payment service providers in Austria. This license is essential for companies offering money transfer services or operating payment platforms.

Types of payment services covered:

- Money remittance

- Payment initiation services

- Account information services

Payment service providers must demonstrate robust security measures and operational resilience to obtain and maintain this license.

FMA License Requirements

Obtaining an FMA license involves meeting stringent criteria designed to ensure the stability and integrity of the financial system. These requirements vary depending on the type of license but generally include:

Capital Requirements

The FMA imposes minimum capital requirements to ensure that licensed entities have sufficient financial resources to operate safely. For banking licenses, the minimum capital can range from €5 million to €18 million, depending on the scope of activities.

Capital requirement considerations:

- Initial capital must be fully paid up

- Ongoing capital adequacy ratios must be maintained

- Regular reporting of financial positions to the FMA

Business Plan and Corporate Structure

Applicants must submit a detailed business plan outlining their proposed activities, target market, and financial projections. The corporate structure must be transparent and demonstrate clear lines of responsibility.

Key elements of a business plan:

- Projected balance sheets and income statements

- Risk management framework

- Compliance and internal control systems

Management and Personnel

The FMA places great emphasis on the competence and integrity of key personnel. Directors and senior managers must possess relevant qualifications and experience in the financial sector.

Management requirements:

- Clean criminal records

- Proven track record in financial services

- Demonstration of good repute

Application Process for an FMA License

The process of obtaining an FMA license is comprehensive and can be time-consuming. It typically involves the following steps:

- Pre-application consultation with the FMA

- Preparation and submission of the application package

- FMA review and assessment

- Potential requests for additional information

- Final decision by the FMA

Applicants should be prepared for a thorough examination of their business model, financial resources, and operational capabilities. The FMA may conduct on-site inspections and interviews with key personnel as part of the assessment process.

Compliance and Ongoing Obligations

Obtaining an FMA license is just the beginning. Licensed entities must maintain ongoing compliance with regulatory requirements and submit to regular supervision by the FMA.

Key compliance areas:

- Anti-money laundering (AML) and counter-terrorist financing (CTF) measures

- Client asset protection

- Risk management and internal controls

- Regular reporting and disclosure

The FMA has the power to conduct audits, impose fines, and revoke licenses for non-compliance. It’s crucial for licensed entities to stay up-to-date with regulatory changes and maintain robust compliance programs.

Implications for Forex and Cryptocurrency Markets

The FMA’s regulatory framework has significant implications for forex and cryptocurrency brokers operating in Austria. With the implementation of MiFID II and the upcoming MiCA regulation, the landscape for these markets is evolving.

Key considerations for forex and crypto brokers:

- Enhanced customer due diligence requirements

- Stricter rules on leverage and marketing practices

- Increased transparency in pricing and execution

Brokers must adapt to these regulatory changes to maintain their licenses and operate legally in the Austrian market.

Conclusion

The Austria FMA broker license represents a high standard of regulatory compliance and investor protection. For businesses looking to enter the Austrian financial market, obtaining an FMA license is a crucial step that demonstrates credibility and commitment to regulatory standards. While the process can be complex and demanding, it ultimately contributes to a more stable and trustworthy financial ecosystem in Austria.

FAQs

- How long does it take to obtain an FMA license?

The process typically takes at least one year, depending on the complexity of the application and the type of license sought. - Can foreign companies apply for an FMA license?

Yes, foreign companies can apply, but they must establish a physical presence in Austria and meet all regulatory requirements. - What are the costs associated with obtaining an FMA license?

Costs vary depending on the license type but include application fees, capital requirements, and ongoing compliance expenses. - Is an FMA license recognized in other EU countries?

Yes, under the EU passporting regime, FMA-licensed firms can operate in other EU/EEA countries with minimal additional requirements. - How often does the FMA conduct supervisory reviews of licensed entities?

The FMA conducts regular reviews, typically annually, but may perform more frequent inspections based on risk assessments.