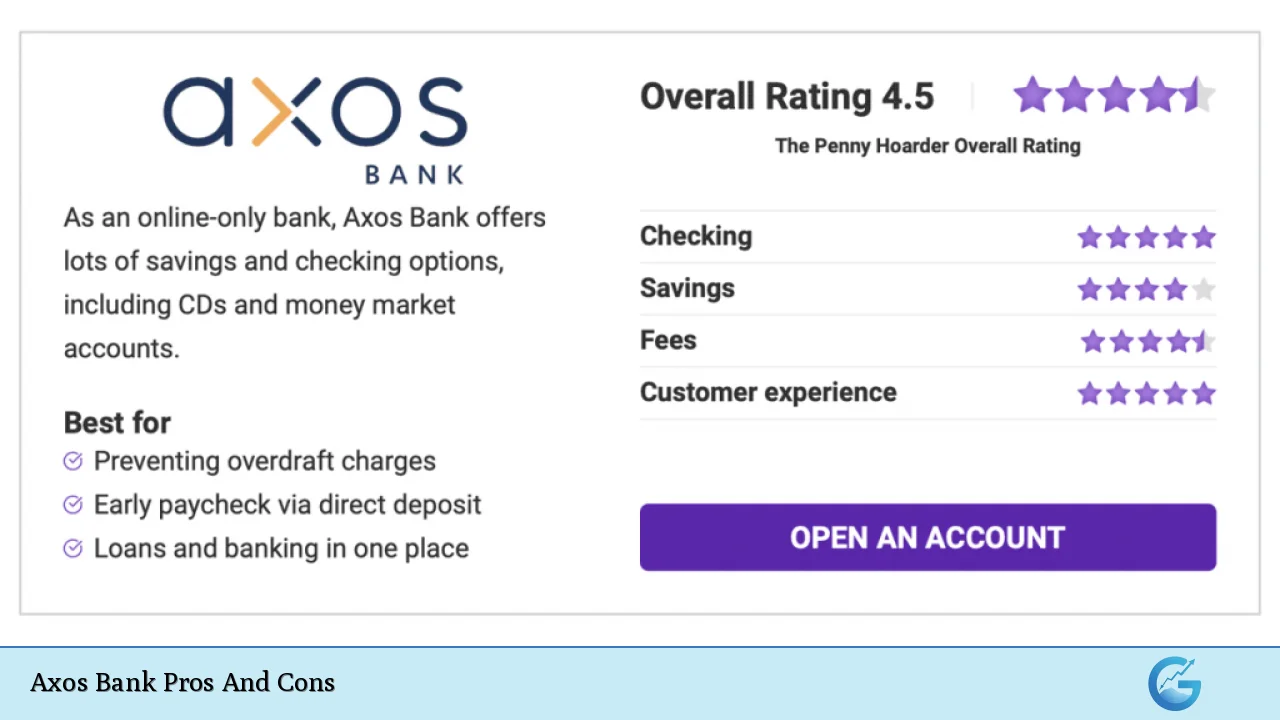

Axos Bank, originally established as Bank of Internet USA in 2000, has evolved into a prominent online banking institution. It offers a range of financial products, including checking and savings accounts, loans, and investment services. As an online-only bank, Axos caters to customers who prefer digital banking solutions without the need for physical branch access. This article explores the advantages and disadvantages of banking with Axos Bank, providing a comprehensive overview for individuals interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| High APY on savings accounts | No physical branches for in-person service |

| No monthly maintenance fees | Low rates on CDs compared to competitors |

| Large ATM network with reimbursement options | High minimum deposit for certain accounts |

| 24/7 customer support available online | Poor customer service reviews from users |

| Diverse range of financial products | Limited mobile app functionality and reviews |

| Cash deposit options at retail locations | Requirements to earn high APYs can be challenging to meet |

| Strong security features for online banking | Limited integration with third-party financial apps |

| FDIC insured deposits up to $250,000 | Potentially high penalties for early CD withdrawals |

High APY on Savings Accounts

One of the standout features of Axos Bank is its competitive annual percentage yield (APY) on savings accounts.

- High Yield: The Axos High Yield Savings Account offers rates significantly above the national average, making it an attractive option for savers looking to maximize their interest earnings.

- Flexible Access: Customers can access their funds easily through online banking or ATMs, providing both liquidity and high returns.

However, it’s crucial to note that these high rates often come with specific requirements that must be met to qualify.

No Monthly Maintenance Fees

Axos Bank operates without imposing monthly maintenance fees on its checking and savings accounts.

- Cost Savings: This feature is particularly appealing for budget-conscious consumers who wish to avoid unnecessary charges that are common with traditional banks.

- Account Variety: Most account types are designed to be fee-free, which enhances the overall banking experience.

Nevertheless, some accounts may have minimum balance requirements or conditions tied to fee waivers.

Large ATM Network with Reimbursement Options

Axos provides access to a vast network of ATMs across the United States.

- Convenience: Customers can use over 90,000 ATMs without incurring fees, which is a significant advantage for those who frequently withdraw cash.

- Reimbursement Policy: Many Axos accounts also offer unlimited reimbursements for out-of-network ATM fees, further reducing costs associated with cash withdrawals.

On the downside, users should be aware that not all ATMs are eligible for reimbursement depending on their account type.

24/7 Customer Support Available Online

Axos Bank offers round-the-clock customer support through various digital channels.

- Accessibility: Customers can reach support via phone, chat, or secure messaging at any time, ensuring assistance is available when needed.

- Virtual Assistant: The bank features a virtual assistant named Evo that can help answer basic queries or direct users to live representatives.

However, despite this availability, customer satisfaction ratings indicate that many users have experienced long wait times and inadequate resolutions during support interactions.

Diverse Range of Financial Products

Axos Bank provides a comprehensive selection of financial products catering to both personal and business needs.

- Variety: From checking and savings accounts to personal loans and mortgages, Axos aims to be a one-stop shop for various banking needs.

- Specialty Accounts: It also offers unique accounts such as rewards checking and hybrid accounts that combine features of both checking and savings.

Despite this diversity, some customers may find that certain products do not meet their specific needs as effectively as those offered by specialized institutions.

Cash Deposit Options at Retail Locations

Unlike many online banks that do not allow cash deposits, Axos provides customers with the ability to deposit cash at numerous retail locations through partnerships with Green Dot.

- Ease of Use: This feature allows customers to add cash directly into their Axos accounts without needing to transfer funds from another bank.

- Accessibility: With thousands of participating retailers nationwide, customers can conveniently deposit cash when necessary.

However, there is typically a fee associated with each cash deposit transaction, which may deter some users from utilizing this service frequently.

Strong Security Features for Online Banking

Axos Bank employs robust security measures to protect customer information and funds during online transactions.

- Encryption Protocols: The bank uses advanced encryption technologies and multi-factor authentication processes to ensure secure access to accounts.

- Fraud Monitoring: Continuous monitoring helps detect suspicious activities early on, providing an additional layer of security for customers’ assets.

While these measures enhance security, customers must also remain vigilant against phishing attempts and other online threats that target digital banking users.

FDIC Insured Deposits Up to $250,000

All deposits at Axos Bank are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor.

- Peace of Mind: This insurance protects customers’ funds in the event of bank failure or insolvency, making it a safe choice for savers and investors alike.

- Joint Accounts: Joint account holders can benefit from increased coverage limits based on their combined deposits.

Despite this protection, it is essential for customers to understand the limits of FDIC insurance and consider diversifying their holdings if they exceed these limits significantly.

No Physical Branches for In-Person Service

A significant drawback of Axos Bank is its lack of physical branches.

- Digital Only: As an entirely online institution, all transactions must be conducted digitally or through customer support channels without face-to-face interaction.

- Inconvenience for Some Users: For individuals who prefer personal service or need assistance with complex transactions requiring in-person consultation, this can be a considerable disadvantage.

While many customers embrace digital banking’s convenience, others may miss the traditional banking experience offered by brick-and-mortar institutions.

Low Rates on CDs Compared to Competitors

While Axos offers various savings options with competitive rates, its certificates of deposit (CDs) tend to have lower interest rates than many other online banks.

- Limited Growth Potential: The maximum APY on CDs is often below what competitors provide, which may lead savers seeking fixed-term investments to look elsewhere.

- Early Withdrawal Penalties: Additionally, penalties for early withdrawals can be steep depending on the term length chosen by the customer.

This aspect makes CDs less attractive for those prioritizing higher returns on fixed investments over time.

High Minimum Deposit for Certain Accounts

Some account types at Axos require relatively high minimum opening deposits compared to other banks.

- Barrier to Entry: For instance, the Golden Checking account necessitates a $250 initial deposit. This requirement may limit accessibility for potential customers who prefer low-barrier entry points.

- Account Maintenance Costs: While many accounts do not charge monthly fees once established, the initial deposit could deter some individuals from opening an account altogether.

Customers should carefully consider their financial situation before committing to accounts with higher minimum deposit requirements.

Poor Customer Service Reviews from Users

Despite offering 24/7 support options, Axos has received mixed reviews regarding its customer service quality.

- Long Wait Times: Many users report extended hold times when seeking assistance via phone or chat services.

- Dissatisfaction with Resolutions: Additionally, some customers express frustration over unresolved issues or inadequate responses from support representatives.

This feedback highlights a critical area where Axos could improve its overall customer experience by enhancing training and resources available to support staff.

Limited Mobile App Functionality and Reviews

The mobile app offered by Axos has garnered mixed reviews regarding its usability and functionality.

- User Experience Issues: Some users have reported bugs or limitations within the app that hinder smooth navigation or transaction processing.

- Lack of Features Compared to Competitors: While it includes essential banking functions like balance checks and fund transfers, it may lack advanced features found in apps from other leading banks.

Customers considering Axos should evaluate whether its mobile app meets their expectations before fully committing to the bank’s services.

Limited Integration with Third-party Financial Apps

Another downside is that Axos Bank does not integrate well with many third-party financial applications commonly used by consumers today.

- Inconvenience for Users: This limitation can make it challenging for users who rely on budgeting tools or investment platforms that require seamless connectivity between their bank accounts and external applications.

- Potentially Reduced Financial Management Efficiency: Without easy integration options available through APIs or partnerships with popular fintech services, managing finances holistically might become cumbersome for some users.

Individuals interested in using third-party services should consider how this limitation might affect their overall banking experience before choosing Axos as their primary institution.

Potentially High Penalties for Early CD Withdrawals

While CDs can provide guaranteed returns over time when held until maturity, withdrawing funds early from an Axos CD could result in significant penalties.

- Withdrawal Penalties Vary by Term Length: Depending on how long you commit your funds—ranging from three months up to five years—the penalty could amount to several months’ worth of interest lost if you need access before maturity dates arrive.

- Consideration Before Investment: Savers should carefully assess their liquidity needs before investing in CDs with potentially high penalties associated with early withdrawal scenarios.

In conclusion, while Axos Bank presents numerous advantages such as competitive interest rates on savings accounts and no monthly maintenance fees alongside robust security measures; it also comes with notable disadvantages including limited physical presence and mixed reviews regarding customer service quality. Potential customers should weigh these pros and cons carefully based on their individual preferences within modern digital finance landscapes before deciding whether this online bank aligns well with their unique banking needs.

Frequently Asked Questions About Axos Bank Pros And Cons

- What are the main advantages of using Axos Bank?

Axos Bank offers high APYs on savings accounts, no monthly maintenance fees across most accounts, a large ATM network with reimbursement options for out-of-network fees. - Are there any significant drawbacks?

The main drawbacks include no physical branches for in-person service and lower CD rates compared to many competitors. - Is customer service reliable at Axos Bank?

Customer service reviews are mixed; while 24/7 support is available online, many users report long wait times and dissatisfaction with resolution quality. - Can I deposit cash into my Axos account?

Yes! You can deposit cash at numerous retail locations through partnerships with Green Dot. - What security measures does Axos Bank have?

Axos employs strong encryption protocols and multi-factor authentication processes along with continuous fraud monitoring. - Are my deposits safe at Axos Bank?

Yes! All deposits are FDIC insured up to $250,000 per depositor. - Does Axos offer any unique banking products?

Yes! They provide specialty accounts like rewards checking and hybrid checking/savings accounts. - What should I consider before opening an account?

You should evaluate your need for physical branch access versus digital convenience along with understanding any minimum deposit requirements or potential penalties related to specific account types.