Opening a bank account is a fundamental step in managing your finances, whether you’re interested in forex trading, cryptocurrency investments, or general financial planning. This comprehensive guide will walk you through the process, requirements, and considerations for opening a bank account, tailored for those engaged in the dynamic world of finance, forex, and cryptocurrency markets.

| Account Type | Key Features | Best For |

|---|---|---|

| Checking Account | – Daily transactions – Debit card access – Online banking | Regular expenses and payments |

| Savings Account | – Higher interest rates – Limited withdrawals – Goal-oriented saving | Building emergency funds or saving for specific goals |

| Investment Account | – Access to stocks, bonds, ETFs – Potential for higher returns – More risk involved | Long-term wealth building and diversification |

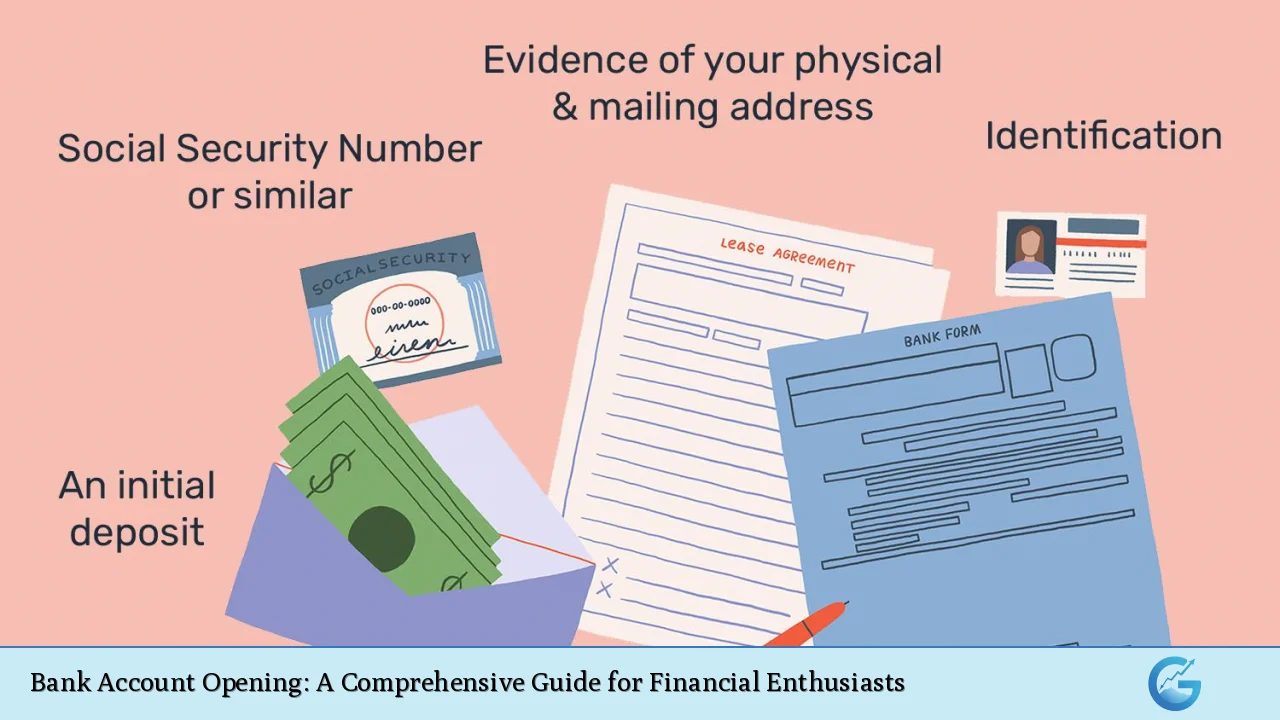

Essential Documents for Opening a Bank Account

When opening a bank account, you’ll need to provide specific documentation to verify your identity and address. This process is crucial for compliance with anti-money laundering (AML) regulations, which are particularly important for those involved in forex and cryptocurrency trading.

Required Documents:

- Government-issued photo ID (driver’s license, passport, or state ID)

- Proof of address (utility bill, lease agreement, or official mail)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Initial deposit (amount varies by bank and account type)

For forex traders and cryptocurrency enthusiasts, it’s essential to choose a bank that is familiar with and accommodating to these activities. Some banks may have stricter policies regarding transactions related to cryptocurrency exchanges or international wire transfers common in forex trading.

Choosing the Right Bank for Your Financial Needs

Selecting the appropriate bank is crucial, especially for those active in forex and cryptocurrency markets. Consider the following factors:

- International Transaction Capabilities: Look for banks with robust international wire transfer services and favorable exchange rates.

- Cryptocurrency-Friendly Policies: Some banks are more accepting of cryptocurrency-related transactions than others. Research their policies to avoid potential account freezes or closures.

- Online and Mobile Banking Features: Advanced digital banking tools are essential for managing your finances efficiently, especially when dealing with fast-paced markets.

- Fee Structure: Compare account maintenance fees, transaction fees, and international transfer costs.

- Integration with Trading Platforms: Check if the bank easily integrates with your preferred forex or cryptocurrency trading platforms.

The Account Opening Process

- Research and Compare: Evaluate different banks based on your specific needs as a forex or crypto trader.

- Apply Online or In-Person: Many banks offer online applications, which can be more convenient for busy traders.

- Provide Required Documentation: Submit all necessary documents as discussed earlier.

- Fund Your Account: Make the initial deposit to activate your account.

- Set Up Online Banking: Configure your online and mobile banking services for easy access to your funds.

- Verify Account Details: Ensure all your information is correct and your account is properly set up for your trading activities.

Special Considerations for Forex and Crypto Traders

- Disclosure of Trading Activities: Be transparent about your forex or crypto trading activities when opening the account to avoid future complications.

- Multiple Account Strategy: Consider opening separate accounts for trading and personal use to simplify record-keeping and tax reporting.

- Currency Conversion Services: If you frequently deal with multiple currencies, inquire about the bank’s foreign exchange services and rates.

- Reporting Requirements: Familiarize yourself with the bank’s policies on reporting large transactions, especially relevant for high-volume traders.

- Security Features: Opt for banks with advanced security measures to protect your funds, given the high-risk nature of forex and crypto trading.

Maintaining Your Bank Account as a Trader

Once your account is open, proper maintenance is crucial:

- Regular Monitoring: Frequently check your account for any unusual activities or errors.

- Accurate Record-Keeping: Maintain detailed records of all transactions, especially those related to trading activities.

- Compliance with Bank Policies: Stay informed about and adhere to your bank’s policies regarding forex and crypto-related transactions.

- Timely Communication: Promptly respond to any inquiries from your bank about your account activities.

- Regular Updates: Keep your personal information and contact details up to date with the bank.

By following these guidelines and choosing the right bank account, you can create a solid financial foundation that supports your forex and cryptocurrency trading activities while ensuring compliance with banking regulations.

FAQs

- Can I open a bank account specifically for forex trading?

Yes, many banks offer specialized accounts for forex traders with features like multi-currency holdings and favorable exchange rates. - Do I need to disclose my cryptocurrency investments when opening a bank account?

It’s advisable to be transparent about significant crypto activities to ensure compliance and avoid potential account issues. - Are online-only banks suitable for forex and crypto traders?

Online banks can be excellent choices, often offering lower fees and advanced digital tools suitable for traders. - How quickly can I start using my new bank account for trading activities?

Most accounts are operational within 1-2 business days, but it may take longer to set up all features needed for trading. - What should I do if my bank freezes my account due to trading activities?

Contact your bank immediately, provide necessary documentation of your trading activities, and consider switching to a more trader-friendly bank if issues persist.