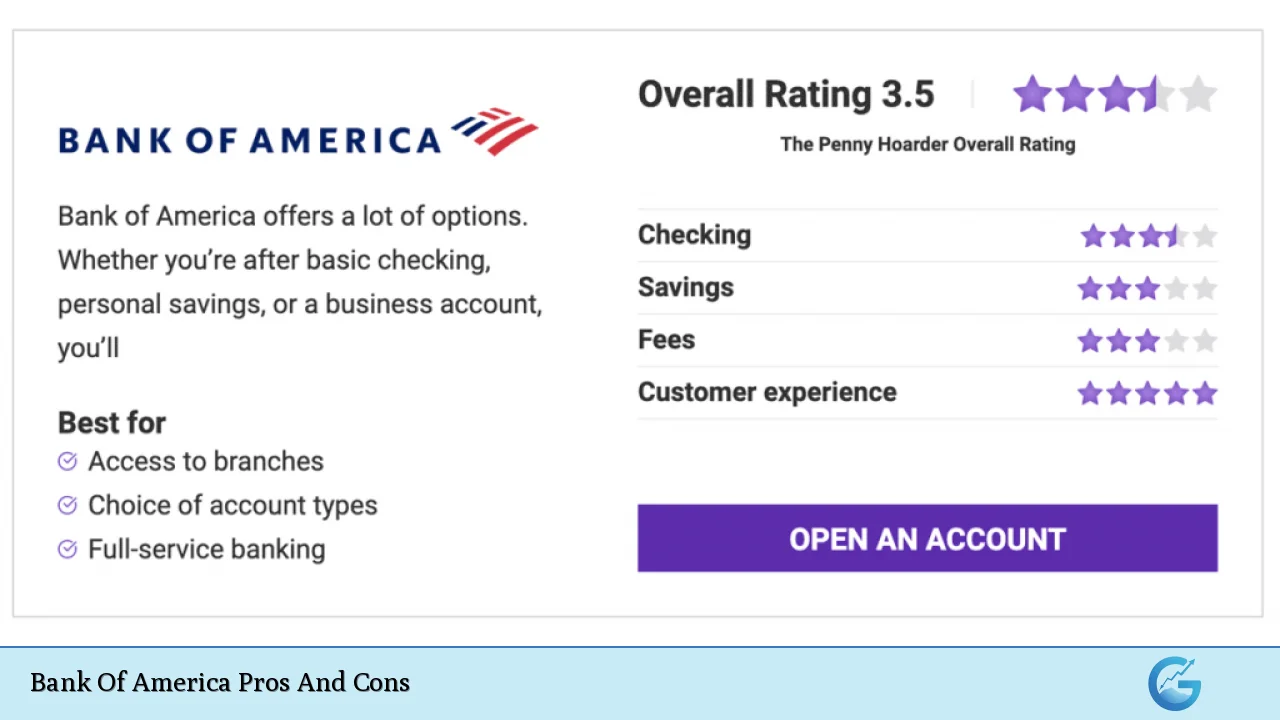

Bank of America (BofA) stands as one of the largest financial institutions in the United States, offering a wide array of banking services to millions of customers. With a significant presence across the country, BofA provides various products ranging from personal checking accounts to investment services. While it boasts numerous advantages, such as extensive branch networks and digital banking capabilities, it also faces challenges, including customer service concerns and competitive interest rates. This article will delve into the pros and cons of banking with Bank of America, providing a comprehensive overview for potential customers and investors in the finance sector.

| Pros | Cons |

|---|---|

| Extensive branch and ATM network | Low interest rates on savings accounts |

| Robust mobile banking app | Monthly service fees on accounts |

| Variety of financial products | Customer service issues reported by users |

| Strong home loan options | Legal controversies affecting reputation |

| Investment services through Merrill Edge | Dependence on U.S. market for revenue |

| Cash rewards programs available | High fees for certain transactions |

| Innovative digital tools (e.g., Erica AI assistant) | Limited international presence compared to peers |

| Flexible account options for different needs | Vulnerability to economic downturns affecting profitability |

Extensive Branch and ATM Network

One of the most significant advantages of Bank of America is its extensive network. With approximately 3,900 branches and over 15,000 ATMs nationwide, customers have easy access to banking services wherever they are.

- Convenience: The widespread availability of physical locations makes it easy for customers to perform transactions in person.

- Accessibility: The large number of ATMs allows for easy cash withdrawals without incurring fees.

Robust Mobile Banking App

Bank of America has invested heavily in its digital infrastructure, resulting in a highly rated mobile banking app.

- User-Friendly Interface: The app is designed to be intuitive, making it easy for users to navigate.

- Features: Customers can manage their accounts, transfer funds, pay bills, and even access budgeting tools through the app.

Variety of Financial Products

BofA offers a wide range of financial products, catering to various customer needs.

- Personal Banking: Options include checking and savings accounts, CDs, and credit cards.

- Loans: The bank provides competitive home loan options, making it a popular choice for mortgage seekers.

- Investment Services: Through its Merrill Edge platform, Bank of America offers investment services that appeal to both novice and experienced investors.

Strong Home Loan Options

Bank of America is known for its strong home loan offerings, which include competitive rates and various mortgage products.

- Diverse Mortgage Products: Customers can choose from fixed-rate mortgages, adjustable-rate mortgages, and FHA loans.

- Homebuyer Assistance Programs: BofA provides resources and programs aimed at first-time homebuyers, enhancing accessibility to homeownership.

Investment Services Through Merrill Edge

The integration with Merrill Edge allows Bank of America customers to access comprehensive investment services.

- Brokerage Services: Customers can trade stocks, bonds, ETFs, and mutual funds easily through the platform.

- Financial Advisory: Merrill offers personalized financial advice tailored to individual goals.

Cash Rewards Programs Available

Bank of America features several cash rewards programs that incentivize customer spending.

- Cash Back Rewards: Customers can earn cash back on purchases made with eligible credit cards.

- BankAmeriDeals® Program: This program allows users to earn additional cash back at participating retailers.

Innovative Digital Tools (e.g., Erica AI Assistant)

BofA has embraced technology with innovative tools like its AI-driven virtual assistant named Erica.

- Expense Tracking: Erica helps users track their spending habits and manage budgets more effectively.

- Personalized Insights: The assistant provides tailored recommendations based on user behavior.

Flexible Account Options for Different Needs

Bank of America offers various account types tailored to different customer requirements.

- Student Accounts: Special accounts designed for students often come with waived fees.

- Senior Accounts: Options are available that cater specifically to seniors with lower fees and special features.

Low Interest Rates on Savings Accounts

Despite its many strengths, one significant disadvantage is the low interest rates offered on savings accounts.

- Competitive Disadvantage: Compared to online banks or credit unions that offer higher APYs, BofA’s rates can be unappealing.

- Impact on Savings Growth: Customers looking to grow their savings may find better options elsewhere.

Monthly Service Fees on Accounts

Bank of America charges monthly service fees on most accounts unless specific criteria are met.

- Fee Avoidance Requirements: While these fees can often be waived by maintaining a minimum balance or setting up direct deposits, not all customers may meet these requirements.

- Customer Frustration: Many users express dissatisfaction over these fees which can accumulate significantly over time.

Customer Service Issues Reported by Users

Customer service at Bank of America has received mixed reviews from users.

- Long Wait Times: Customers often report lengthy wait times when contacting support.

- Inconsistent Service Quality: Experiences can vary widely depending on the representative’s knowledge and expertise.

Legal Controversies Affecting Reputation

Bank of America has faced several legal challenges that have impacted its public perception.

- Past Settlements: The bank has been involved in settlements related to overdraft fees and other practices that have drawn scrutiny.

- Reputation Risks: Ongoing legal issues may deter potential customers concerned about ethical banking practices.

Dependence on U.S. Market for Revenue

A significant portion of Bank of America’s revenue comes from the U.S. market.

- Market Sensitivity: This dependence makes BofA vulnerable to economic fluctuations within the United States.

- Limited Global Diversification: Compared to some competitors with a more balanced international presence, BofA’s reliance on domestic operations could pose risks during economic downturns.

High Fees for Certain Transactions

Certain transactions at Bank of America can incur high fees that may surprise customers.

- Transaction Fees: Fees for wire transfers, stop payments, or using out-of-network ATMs can add up quickly.

- Impact on Budgeting: These unexpected costs can affect overall budgeting strategies for customers trying to manage their finances effectively.

Limited International Presence Compared to Peers

While Bank of America operates internationally, its presence is not as extensive as some competitors.

- Global Reach Limitations: This limitation may affect customers who travel frequently or conduct business overseas.

- Service Availability Issues: Users might find fewer options or support when dealing with international transactions or investments compared to banks with a larger global footprint.

Vulnerability to Economic Downturns Affecting Profitability

Like all major banks, Bank of America’s profitability is susceptible to economic downturns.

- Risk Management Challenges: Economic crises can lead to increased loan defaults and reduced consumer spending.

- Profitability Pressures: During recessions or periods of low interest rates, BofA may struggle more than competitors with diversified revenue streams.

In conclusion, Bank of America presents a mix of advantages and disadvantages that potential customers must weigh carefully. Its extensive branch network and robust digital offerings make it an attractive option for many consumers. However, low interest rates on savings accounts and ongoing customer service issues could deter others. As with any financial institution, understanding both sides is crucial when deciding whether Bank of America aligns with your banking needs and financial goals.

Frequently Asked Questions About Bank Of America

- What are the main advantages of banking with Bank of America?

The main advantages include an extensive branch network, robust mobile banking capabilities, a variety of financial products including strong home loan options, and innovative digital tools like the Erica AI assistant. - What are the primary disadvantages associated with Bank of America?

The primary disadvantages consist of low interest rates on savings accounts, monthly service fees that may apply unless certain conditions are met, customer service issues reported by users, and legal controversies affecting its reputation. - Does Bank of America offer competitive mortgage rates?

Yes, Bank of America is known for providing competitive mortgage rates along with various mortgage products suitable for different borrower needs. - Are there ways to avoid monthly service fees at Bank of America?

Yes, monthly service fees can often be waived by maintaining a minimum balance or setting up direct deposits into your account. - How does Bank of America’s mobile app compare to other banks?

The mobile app is highly rated for its user-friendly interface and features such as expense tracking and bill payments; however, user experiences may vary. - Is customer service at Bank of America satisfactory?

Customer satisfaction varies; while some report positive experiences, others mention long wait times and inconsistent service quality. - What types of investment services does Bank of America provide?

BofA offers investment services through Merrill Edge which includes brokerage services for trading stocks and bonds along with personalized financial advice. - How does Bank of America’s international presence compare to other banks?

BofA has a limited international presence compared to some competitors which may affect services available for customers traveling abroad.