In the world of personal finance, choosing where to manage your money is a significant decision that can affect your financial health. Two primary options are banks and credit unions, each offering distinct advantages and disadvantages. Understanding these differences is crucial for individuals looking to optimize their financial strategies, especially those interested in finance, cryptocurrency, forex, and money markets. This article provides a comprehensive analysis of the pros and cons of banks versus credit unions, helping you make an informed choice that aligns with your financial goals.

| Pros | Cons |

|---|---|

| Lower interest rates on loans | Membership requirements for credit unions |

| Higher interest rates on savings accounts | Limited branch access compared to banks |

| Personalized customer service | Fewer financial products available |

| Community-focused initiatives | Less advanced technology and online services |

| Not-for-profit structure benefits members | Potentially slower adoption of new banking technologies |

| Insurance coverage by NCUA for credit unions and FDIC for banks | Less competitive rates with online-only banks |

Lower Interest Rates on Loans

One of the most compelling advantages of credit unions is their ability to offer lower interest rates on loans. Since credit unions operate as not-for-profit entities, they can return profits to their members in the form of reduced rates on loans. This can lead to significant savings for borrowers.

- Credit unions typically offer lower rates on personal loans, auto loans, and mortgages.

- Members benefit from lower fees associated with loan processing.

However, while banks may charge higher interest rates, they often provide a wider variety of loan products.

Higher Interest Rates on Savings Accounts

Credit unions generally offer higher interest rates on savings accounts compared to traditional banks. This is primarily due to their non-profit nature, which allows them to prioritize member benefits over shareholder profits.

- Members can enjoy better returns on savings accounts and certificates of deposit (CDs).

- Credit unions often have fewer fees associated with savings accounts.

In contrast, many banks provide lower interest rates on deposits, particularly larger national banks.

Personalized Customer Service

Credit unions are known for their personalized customer service. Being smaller and community-focused allows them to develop closer relationships with their members.

- Members often experience more attentive service and tailored financial advice.

- Credit unions frequently engage in community outreach and education programs.

On the other hand, larger banks may have less personalized service due to their size and focus on profit maximization.

Community-Focused Initiatives

Another advantage of credit unions is their commitment to community development. Many credit unions invest in local initiatives and support local businesses.

- Credit unions often provide financial literacy programs and community events.

- They may offer special loans or grants to support local projects.

While banks also engage in community efforts, they typically do so at a larger scale and may not focus as intensely on local needs.

Not-for-Profit Structure Benefits Members

The not-for-profit structure of credit unions means that any profits generated are returned to members rather than distributed to shareholders. This results in various benefits for members.

- Lower fees and better rates are common as profits are reinvested into member services.

- Members have voting rights in the governance of the credit union, allowing them a voice in decision-making processes.

Conversely, banks operate for profit, which can lead to higher fees and less favorable terms for customers.

Insurance Coverage by NCUA for Credit Unions and FDIC for Banks

Both banks and credit unions offer deposit insurance, providing peace of mind for account holders.

- Credit union deposits are insured up to $250,000 per depositor by the National Credit Union Administration (NCUA).

- Bank deposits are insured up to $250,000 per depositor by the Federal Deposit Insurance Corporation (FDIC).

This insurance protects members’ funds in case of institutional failure, making both options relatively safe choices.

Membership Requirements for Credit Unions

Despite their advantages, credit unions come with specific membership requirements that can be a barrier for some potential customers.

- To join a credit union, individuals must meet certain eligibility criteria based on employment, location, or membership in specific organizations.

- This exclusivity can limit access compared to traditional banks that welcome any customer who meets basic identification requirements.

In contrast, anyone can open an account at a bank without needing special qualifications.

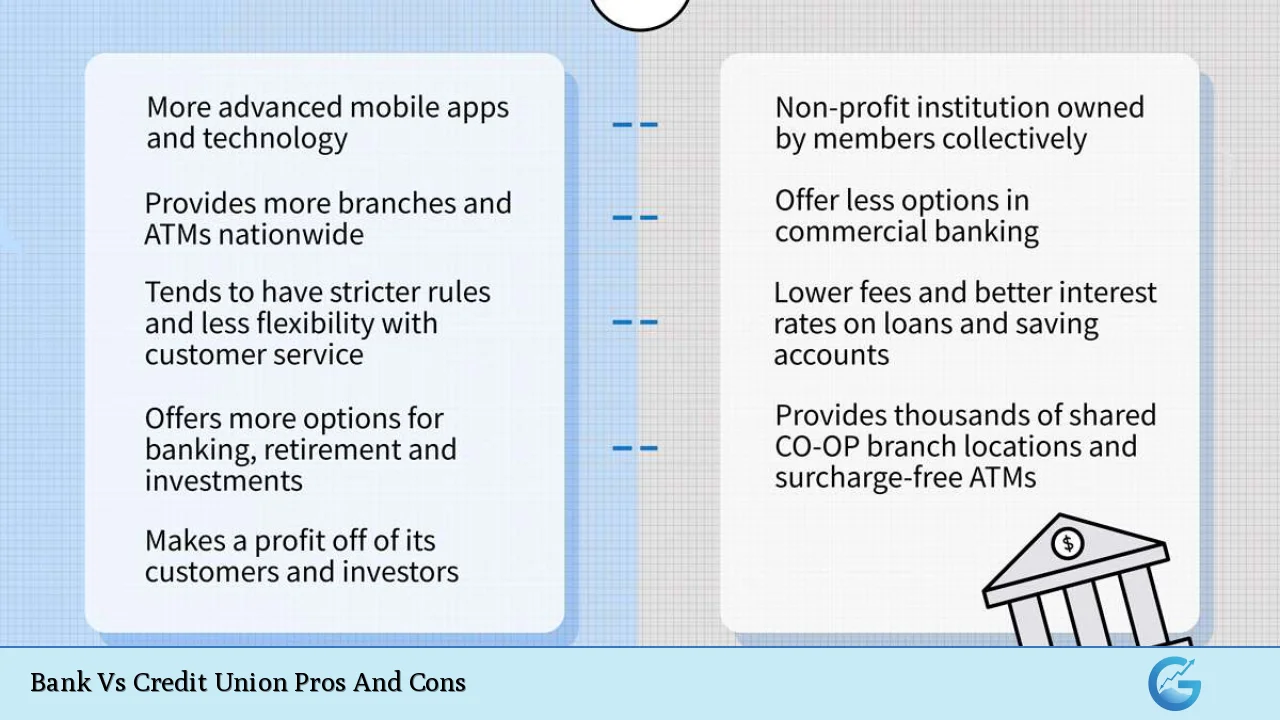

Limited Branch Access Compared to Banks

While credit unions provide valuable services, they often have fewer physical branches than larger banks.

- This can make it more challenging for members who prefer in-person banking services or need access while traveling.

- Some credit unions participate in shared branch networks but still may not match the extensive reach of national bank branches.

Banks typically offer a broader network of branches and ATMs across regions or nationwide.

Fewer Financial Products Available

Credit unions may not offer as extensive a range of financial products as larger banks do.

- Members might find fewer options regarding investment accounts or specialized loans like business loans or complex mortgage products.

- This limitation could be a drawback for those seeking diverse financial services under one roof.

Banks usually provide a more comprehensive suite of products tailored to various customer needs.

Less Advanced Technology and Online Services

Another disadvantage of credit unions is that they may lag behind banks in adopting new technologies and online banking features.

- Some smaller credit unions struggle with outdated systems that may not support modern digital banking needs effectively.

- While many larger credit unions have improved their technology offerings, they often do not match the speed at which national banks innovate their platforms.

For tech-savvy consumers who prioritize online banking capabilities, this could be a significant factor in their decision-making process.

Potentially Slower Adoption of New Banking Technologies

As mentioned earlier, the pace at which credit unions adopt new technologies can be slower than that of traditional banks.

- This can affect users’ experiences regarding mobile apps, online banking features, and overall convenience.

- Members might miss out on innovations such as advanced budgeting tools or instant payment options available through many modern banking apps.

In contrast, many large banks prioritize technological advancements to enhance customer experience continually.

Less Competitive Rates with Online-Only Banks

While credit unions generally offer better rates than traditional banks, they may still fall short compared to online-only banks that operate with lower overhead costs.

- Online-only banks often provide higher savings rates due to their minimal physical presence and reduced operating expenses.

- This competition could make it challenging for credit unions to attract members solely based on interest rate offerings.

Consumers who prioritize maximizing returns on savings may find better options through these digital-first institutions.

In conclusion, both banks and credit unions present unique advantages and disadvantages that cater to different financial needs and preferences.

Choosing between them requires careful consideration of your priorities—be it lower loan costs and personalized service from a credit union or the extensive product offerings and convenience provided by traditional banks.

Ultimately, understanding these factors will empower you to select the financial institution that best aligns with your goals in finance, crypto investments, forex trading, or money markets.

Frequently Asked Questions About Bank Vs Credit Union Pros And Cons

- What is the main difference between a bank and a credit union?

The primary difference lies in ownership; banks are for-profit institutions owned by shareholders while credit unions are non-profit cooperatives owned by their members. - Can anyone join a credit union?

No, joining a credit union typically requires meeting specific membership criteria based on employment or community affiliation. - Are deposits insured at both banks and credit unions?

Yes, deposits at both institutions are insured; banks by the FDIC and credit unions by the NCUA. - Do credit unions offer competitive loan rates?

Yes, credit unions often provide lower interest rates on loans compared to traditional banks due to their non-profit status. - What kind of services do credit unions typically lack?

Credit unions may offer fewer financial products than large banks, particularly specialized investment options. - Is customer service better at credit unions?

Many customers report more personalized service at credit unions due to their smaller size and community focus. - How does technology differ between banks and credit unions?

Banks often adopt new technologies faster than credit unions; some smaller ones may struggle with outdated systems. - Which option is better for someone who travels frequently?

Banks generally have more branches nationwide which can be beneficial for frequent travelers needing in-person services.