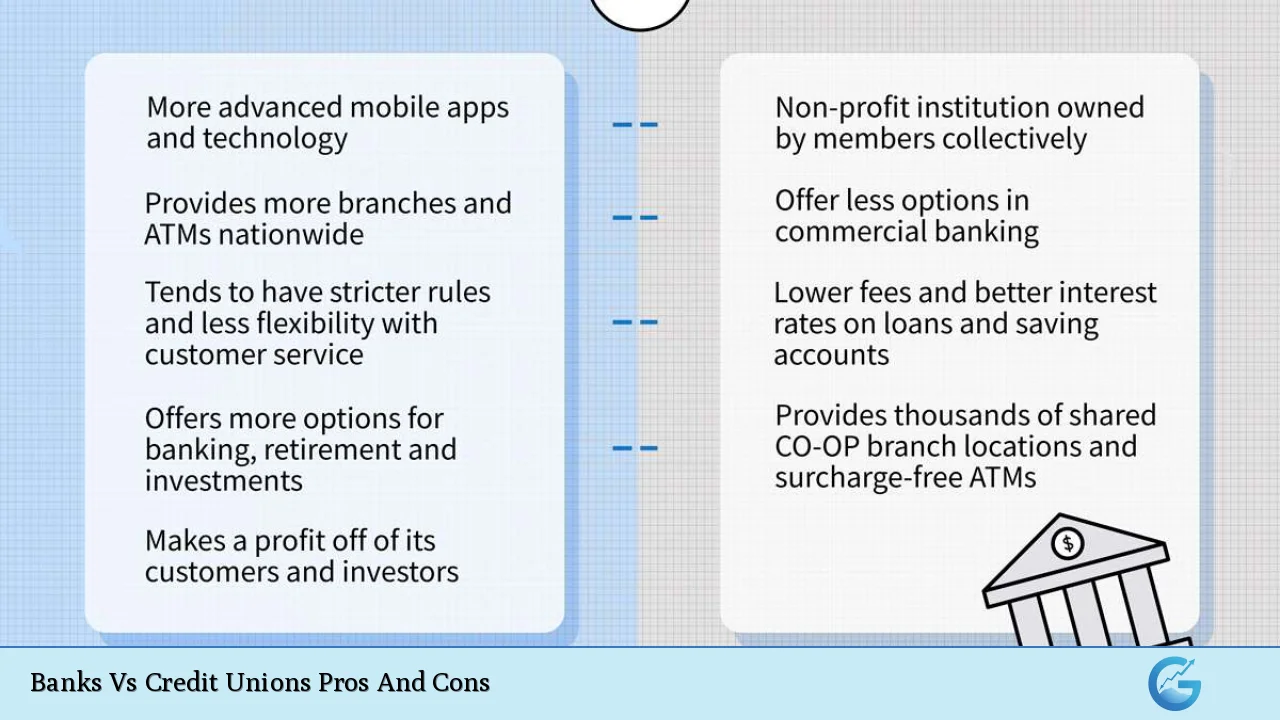

In the world of personal finance, choosing between a bank and a credit union can significantly impact your financial experience. Both institutions offer similar services, such as checking and savings accounts, loans, and credit cards, but they operate under different models. Banks are typically for-profit entities owned by shareholders, while credit unions are non-profit organizations owned by their members. This fundamental difference shapes their operations, customer service, product offerings, and fee structures. Understanding the pros and cons of each can help you make an informed decision about where to manage your finances.

| Pros | Cons |

|---|---|

| Lower interest rates on loans | Membership requirements can limit access |

| Higher interest rates on savings accounts | Fewer branches and ATMs compared to banks |

| Lower fees for services | Limited product offerings |

| Personalized customer service | Slower technology adoption |

| Community-focused approach | Potentially less convenience for frequent travelers |

| Member ownership and voting rights | Less marketing and promotional offers |

Lower Interest Rates on Loans

Credit unions typically offer lower interest rates on various loan products compared to banks. This advantage stems from their non-profit status, allowing them to return profits to their members in the form of reduced rates.

- Auto Loans: Credit unions often provide competitive rates that can be significantly lower than those offered by banks.

- Mortgages: Many credit unions offer attractive mortgage rates, making home buying more affordable.

- Personal Loans: The APRs on personal loans from credit unions are generally lower than those from traditional banks.

Higher Interest Rates on Savings Accounts

Another significant advantage of credit unions is the higher interest rates they tend to offer on savings accounts.

- Savings Accounts: Credit unions often provide better annual percentage yields (APYs) than banks, allowing members to earn more on their deposits.

- Certificates of Deposit (CDs): Credit unions frequently have more favorable terms for CDs, enhancing the return on investment for savers.

- Money Market Accounts: These accounts at credit unions typically yield higher returns compared to those at traditional banks.

Lower Fees for Services

Credit unions generally have lower fees associated with their services compared to banks.

- Account Maintenance Fees: Many credit unions offer free checking accounts without monthly fees or minimum balance requirements.

- Transaction Fees: Overdraft fees and ATM withdrawal fees at credit unions are often lower than those charged by banks.

- Loan Origination Fees: Credit unions may charge fewer or lower fees when processing loans.

Personalized Customer Service

One of the hallmark features of credit unions is their emphasis on personalized customer service.

- Member Relationships: Credit unions often foster closer relationships with their members due to their smaller size.

- Tailored Services: Members may receive customized financial advice based on individual circumstances.

- Community Engagement: Many credit unions actively participate in local community events, enhancing member loyalty and satisfaction.

Community-Focused Approach

Credit unions prioritize community involvement and member welfare over profit maximization.

- Local Investment: They often invest in local projects and initiatives that benefit their communities.

- Financial Education: Many credit unions provide resources and workshops aimed at improving financial literacy among members.

- Support for Local Businesses: Credit unions frequently support small businesses within their communities through loans and financial services.

Member Ownership and Voting Rights

As member-owned entities, credit unions give their members a voice in governance.

- Voting Rights: Members have the right to vote on key issues and elect board members, fostering a sense of ownership.

- Profit Distribution: Any profits made by the credit union are returned to members in the form of better rates or lower fees rather than being distributed to shareholders.

Membership Requirements Can Limit Access

Despite their advantages, credit unions come with certain limitations that can affect potential members.

- Eligibility Criteria: Many credit unions require individuals to meet specific membership criteria based on location, employment, or affiliation with certain organizations.

- Limited Accessibility: Those who do not qualify may find it challenging to access the benefits offered by credit unions.

Fewer Branches and ATMs Compared to Banks

Credit unions often have a smaller network of branches and ATMs compared to larger banks.

- Limited Locations: Members may need to travel further or rely on shared branch networks for in-person banking services.

- ATM Access: While many credit unions participate in surcharge-free ATM networks, they still may not match the extensive reach of national bank chains.

Limited Product Offerings

Credit unions may not provide as wide a variety of financial products as traditional banks.

- Specialized Products: Some unique financial products or investment options might be unavailable at credit unions.

- Technology Services: Advanced digital banking features such as robo-advisors or comprehensive wealth management services may be lacking.

Slower Technology Adoption

In terms of technology, credit unions often lag behind larger banks in adopting new digital tools.

- Mobile Banking Apps: While many credit unions offer mobile banking options, they may not have as robust features as those provided by larger banks.

- Online Services: The pace at which new online services are introduced can be slower at credit unions due to limited resources.

Potentially Less Convenience for Frequent Travelers

For individuals who travel frequently or live in multiple locations, using a bank might be more convenient than a local credit union.

- Branch Availability: National banks typically have branches across various states or regions, making it easier for travelers to access services.

- ATM Networks: Larger banks usually provide extensive ATM networks that allow for easy cash withdrawals without incurring fees.

Less Marketing and Promotional Offers

Credit unions may not engage in aggressive marketing strategies like traditional banks do.

- Promotional Rates: While they offer competitive rates, they may not have frequent promotional offers that attract new customers.

- Incentives for New Members: Banks often provide sign-up bonuses or special offers that might not be available at credit unions.

In conclusion, both banks and credit unions have distinct advantages and disadvantages that cater to different financial needs. Credit unions excel in providing lower loan rates, higher savings yields, personalized service, and community focus. However, they also face limitations such as membership restrictions, fewer branches, limited product offerings, slower technology adoption, and potentially less convenience for frequent travelers.

When deciding between a bank and a credit union, consider your personal financial goals and priorities. If you value community engagement and personalized service over extensive product offerings or branch accessibility, a credit union might be the right choice for you. Conversely, if you prioritize convenience and a broader range of financial products, a traditional bank could better serve your needs.

Frequently Asked Questions About Banks Vs Credit Unions Pros And Cons

- What is the primary difference between a bank and a credit union?

The main difference lies in ownership; banks are for-profit institutions owned by shareholders while credit unions are non-profit organizations owned by their members. - Are interest rates generally higher at credit unions?

Yes, credit unions typically offer higher interest rates on savings accounts compared to traditional banks. - Can anyone join a credit union?

No, membership is usually restricted based on specific eligibility criteria related to location or affiliation. - Do banks offer better technology than credit unions?

Generally speaking, banks tend to adopt new technologies faster than credit unions. - Are fees lower at credit unions?

Yes, many credit unions charge lower fees for services compared to traditional banks. - What type of customer service can I expect from a credit union?

Credit unions often provide more personalized customer service due to their smaller size. - Do both institutions offer federally insured deposits?

Yes, deposits at both banks (FDIC) and credit unions (NCUA) are federally insured up to $250,000. - Which option is better for someone who travels frequently?

Banks might be more suitable due to their extensive branch networks and ATM availability across regions.