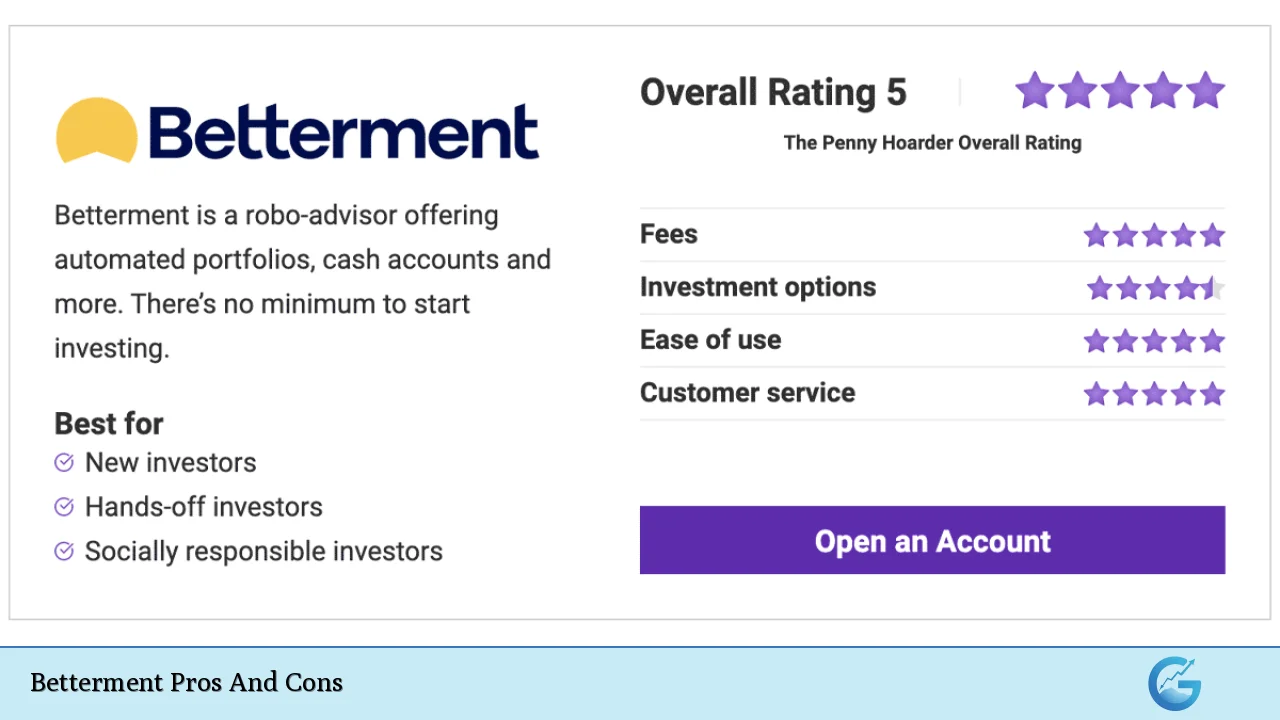

Betterment is a popular robo-advisor that offers automated investment management services to individuals seeking a hands-off approach to investing. Founded in 2008, Betterment has grown to become one of the largest independent robo-advisors in the United States, managing over $45 billion in assets for more than 850,000 customers. The platform aims to simplify investing by using advanced algorithms and modern portfolio theory to create and manage diversified portfolios tailored to each investor’s goals and risk tolerance.

| Pros | Cons |

|---|---|

| Low fees and no minimum balance requirement | Limited investment options compared to traditional brokerages |

| Automated portfolio management and rebalancing | Lack of direct control over individual investments |

| Tax-loss harvesting for all account sizes | Higher fees for premium services and human advisor access |

| Goal-based investing approach | No direct real estate investment trust (REIT) exposure |

| Access to human financial advisors (premium plan) | Limited customization options for advanced investors |

| Socially responsible investing (SRI) options | No margin trading capabilities |

| High-yield cash management account | Potential for tax implications in taxable accounts |

| User-friendly interface and mobile app | No weekend customer support |

Advantages of Betterment

Low Fees and No Minimum Balance Requirement

Betterment’s fee structure is highly competitive in the robo-advisor market, making it an attractive option for investors of all sizes. The platform offers two primary service tiers:

- Digital Plan: 0.25% annual fee

- Premium Plan: 0.40% annual fee (requires a $100,000 minimum balance)

For the Digital Plan, there is no minimum balance requirement to open an account, allowing investors to start with any amount they’re comfortable with. This low barrier to entry makes Betterment accessible to beginners and those with limited funds to invest.

Automated Portfolio Management and Rebalancing

One of Betterment’s core strengths is its automated portfolio management system. The platform uses sophisticated algorithms to:

- Create diversified portfolios based on modern portfolio theory

- Automatically rebalance portfolios to maintain target asset allocations

- Reinvest dividends efficiently

- Implement tax-efficient investment strategies

This hands-off approach saves investors time and helps maintain a disciplined investment strategy, regardless of market conditions.

Tax-Loss Harvesting for All Account Sizes

Betterment offers tax-loss harvesting to all taxable accounts, regardless of balance, which is a significant advantage over some competitors that restrict this feature to higher-balance accounts. Tax-loss harvesting involves selling investments that have experienced losses to offset capital gains, potentially reducing an investor’s tax liability.

Betterment’s tax-loss harvesting algorithm operates daily, seeking opportunities to harvest losses and improve after-tax returns. This feature can be particularly valuable for high-income investors or those with substantial taxable investment accounts.

Goal-Based Investing Approach

Betterment’s platform is designed around a goal-based investing approach, which helps investors align their portfolios with specific financial objectives. Users can set up multiple goals, such as:

- Retirement savings

- Major purchases (e.g., home down payment, car)

- Education funding

- Emergency fund building

For each goal, Betterment recommends an appropriate asset allocation and investment timeline, adjusting the strategy as the investor progresses toward their target.

Access to Human Financial Advisors (Premium Plan)

While Betterment is primarily a robo-advisor, it offers access to human financial advisors for those who desire additional guidance. Premium Plan members ($100,000+ balance) receive unlimited access to Certified Financial Planner™ professionals who can provide personalized advice on various financial topics, including:

- Investment strategy

- Retirement planning

- Tax optimization

- Estate planning

This hybrid model combines the efficiency of automated investing with the expertise of human advisors, offering a comprehensive wealth management solution.

Socially Responsible Investing (SRI) Options

Betterment caters to investors who want to align their portfolios with their values by offering socially responsible investing options. The platform provides three SRI portfolio strategies:

- Broad Impact: Focuses on overall ESG (Environmental, Social, and Governance) factors

- Climate Impact: Emphasizes companies with lower carbon emissions and fossil fuel exposure

- Social Impact: Targets companies with strong diversity and inclusion practices

These SRI portfolios allow investors to support companies that prioritize sustainability and social responsibility without sacrificing potential returns.

High-Yield Cash Management Account

Betterment offers a cash management account called Betterment Cash Reserve, which provides:

- A competitive high-yield interest rate

- FDIC insurance up to $2 million through partner banks

- No fees or minimum balance requirements

- Easy transfers between investment accounts and cash reserve

This feature allows users to manage their cash alongside their investments, potentially earning higher returns on their idle cash compared to traditional savings accounts.

User-Friendly Interface and Mobile App

Betterment’s platform is known for its intuitive design and ease of use, making it accessible to investors of all experience levels. The web interface and mobile app offer:

- Clear visualizations of portfolio performance and progress toward goals

- Easy account management and fund transfers

- Educational resources and financial planning tools

- Seamless integration between investment accounts and cash management features

The user-friendly nature of Betterment’s platform helps investors stay engaged with their financial goals and make informed decisions about their investments.

Disadvantages of Betterment

Limited Investment Options Compared to Traditional Brokerages

While Betterment’s simplified approach is beneficial for many investors, it may be restrictive for those seeking more control over their portfolios. The platform primarily invests in a selection of low-cost ETFs, which means users cannot:

- Invest in individual stocks or bonds

- Trade options or other derivatives

- Access certain asset classes like commodities or cryptocurrencies directly

This limitation may frustrate more experienced investors who want to implement specific investment strategies or have exposure to a broader range of assets.

Lack of Direct Control Over Individual Investments

Betterment’s automated approach means that investors cannot choose specific ETFs or adjust the weightings of individual securities within their portfolios. While this hands-off approach is ideal for many, it may not suit investors who:

- Have strong convictions about particular sectors or companies

- Want to implement tactical asset allocation strategies

- Prefer to actively manage a portion of their portfolio

The lack of granular control may be a significant drawback for those who want to be more involved in their investment decisions.

Higher Fees for Premium Services and Human Advisor Access

While Betterment’s base fee of 0.25% is competitive, accessing additional features and human advice comes at a higher cost:

- Premium Plan: 0.40% annual fee (requires $100,000 minimum balance)

- One-time advisor consultations: $299 to $399 per session

These fees can add up, especially for larger account balances, and may be higher than what some traditional financial advisors charge for comprehensive wealth management services.

No Direct Real Estate Investment Trust (REIT) Exposure

Betterment’s core portfolios do not include direct exposure to real estate investment trusts (REITs), which are a popular asset class for diversification and income generation. While some of the broad-market ETFs may include REITs, investors seeking significant real estate exposure may find Betterment’s offerings lacking in this area.

Limited Customization Options for Advanced Investors

Betterment’s one-size-fits-most approach may not satisfy advanced investors who desire more control over their portfolio construction. The platform offers limited options to customize asset allocations or include specific ETFs, which can be frustrating for those who:

- Have unique tax situations requiring specific investment strategies

- Want to implement factor-based investing approaches

- Seek to incorporate alternative investment strategies

While Betterment does offer some flexibility, such as adjusting stock-to-bond ratios, the overall level of customization is limited compared to some competitors or self-directed investing platforms.

No Margin Trading Capabilities

Betterment does not offer margin trading, which may be a drawback for investors who want to use leverage to potentially enhance returns or implement more sophisticated trading strategies. This limitation also means that investors cannot use their Betterment account as collateral for loans, a feature offered by some traditional brokerages.

Potential for Tax Implications in Taxable Accounts

While Betterment employs tax-efficient strategies, the automated nature of the platform can sometimes lead to unexpected tax consequences, particularly in taxable accounts. For example:

- Frequent rebalancing may trigger short-term capital gains

- Tax-loss harvesting could create wash sales if not coordinated with other investment accounts

- Dividend reinvestment may create taxable events

Investors with complex tax situations or those who prioritize tax minimization may find these automated processes less than ideal for their specific needs.

No Weekend Customer Support

Betterment’s customer support is available only on weekdays, which can be inconvenient for investors who need assistance outside of regular business hours. Given that financial markets operate globally and news can break at any time, the lack of weekend support may be a significant drawback for some users.

In conclusion, Betterment offers a robust, user-friendly platform for automated investing that caters well to beginners and hands-off investors. Its low fees, goal-based approach, and tax-efficient features make it an attractive option for many. However, more advanced investors or those seeking greater control over their portfolios may find the platform’s limitations frustrating. As with any investment decision, it’s crucial to weigh these pros and cons against your personal financial goals and investing style before committing to Betterment or any robo-advisor.

Frequently Asked Questions About Betterment Pros And Cons

- Is Betterment suitable for experienced investors?

While Betterment can be useful for experienced investors seeking a hands-off approach, those desiring more control over individual investments may find it limiting. The platform is best suited for investors comfortable with a passive, ETF-based strategy. - How does Betterment’s tax-loss harvesting compare to other robo-advisors?

Betterment offers tax-loss harvesting to all taxable accounts regardless of balance, which is more inclusive than some competitors. The daily harvesting algorithm is sophisticated, but its effectiveness can vary based on individual tax situations. - Can I transfer my existing investments to Betterment?

Yes, you can transfer existing investments to Betterment. However, be aware that this may trigger taxable events if transferring from taxable accounts, and Betterment will likely sell and reinvest according to its own portfolio strategies. - What are the main differences between Betterment’s Digital and Premium plans?

The main differences are the fee (0.25% vs. 0.40%), minimum balance requirement ($0 vs. $100,000), and access to human advisors. Premium offers unlimited calls with CFP® professionals, while Digital users can purchase one-time consultations. - How does Betterment handle market volatility?

Betterment’s algorithms automatically rebalance portfolios during market fluctuations to maintain target allocations. The platform also encourages long-term investing and provides educational resources to help investors stay the course during volatile periods. - Can I choose my own ETFs with Betterment?

No, Betterment does not allow users to select individual ETFs. The platform chooses from a pre-selected list of ETFs based on your risk profile and goals, which may be a drawback for investors wanting more control. - Is Betterment’s socially responsible investing (SRI) option effective?

Betterment offers three SRI portfolio options that align with different ESG priorities. While these portfolios do emphasize socially responsible companies, they may not be as targeted or comprehensive as some dedicated SRI funds or custom portfolios. - How secure is my money with Betterment?

Betterment uses bank-level security measures and is a member of SIPC, which protects securities customers of its members up to $500,000. Cash Reserve accounts are FDIC-insured up to $2 million through partner banks, making it a secure option for both investing and cash management.