Obtaining a forex broker license in Belize has become increasingly popular among financial service providers looking to establish their presence in the global market. This comprehensive guide will explore the intricacies of acquiring a Belize broker license, its benefits, requirements, and the application process.

| License Type | Capital Requirement | Annual Fee |

|---|---|---|

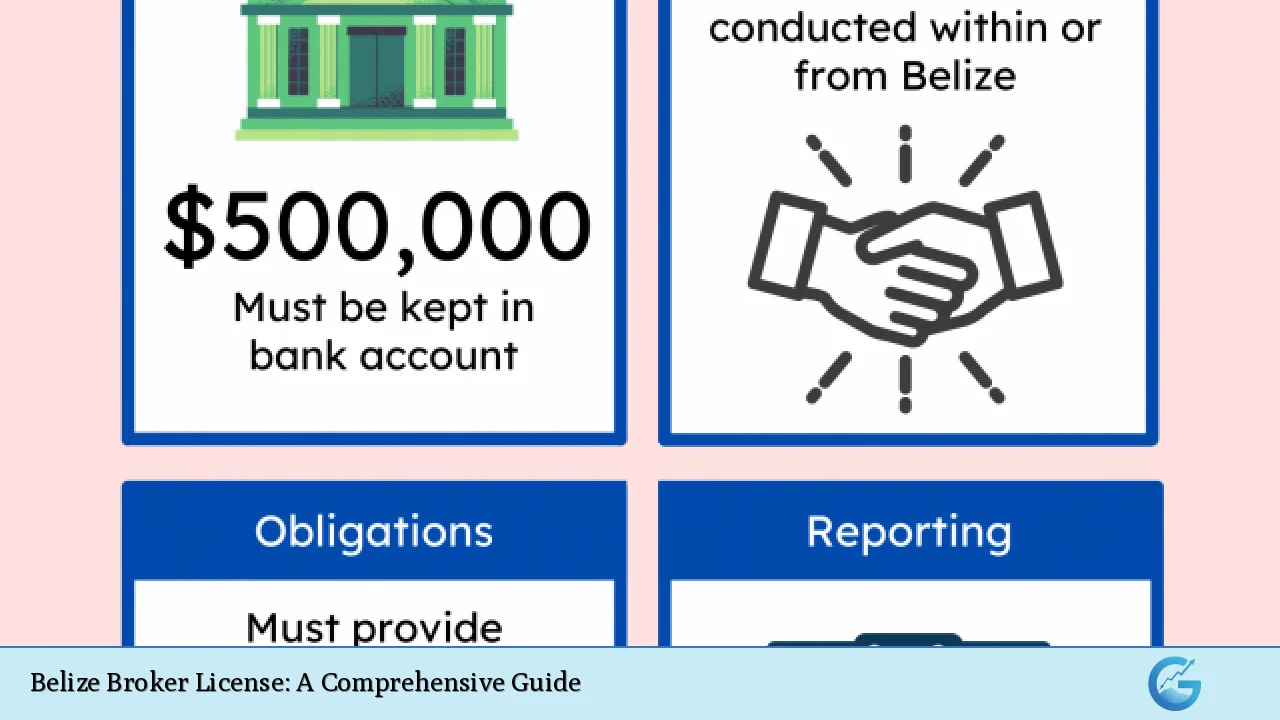

| Trading in Foreign Exchange | $500,000 | $25,000 |

| Market Maker | $500,000 | $25,000 |

| Brokerage and Consulting Services | $25,000 | $2,500 |

Understanding the Belize Broker License

The Belize broker license is a legal permission granted by the International Financial Services Commission (IFSC) of Belize, allowing entities to conduct forex and other financial trading activities. This license serves as a gateway to the world of international finance, enabling brokers to offer services such as trading securities, commodities, foreign exchange, and other investment instruments.

Key features of the Belize broker license:

- Enables companies to serve as intermediaries for clients engaging in forex trading

- Allows entities to operate as brokers and market makers

- Enhances market liquidity by quoting buy and sell prices

- Demonstrates commitment to regulatory compliance

The Belize broker license is particularly attractive due to its relatively straightforward application process and lower capital requirements compared to some other jurisdictions. However, it’s important to note that while Belize is considered an offshore jurisdiction, it still maintains a level of regulatory oversight to ensure the integrity of its financial sector.

License Requirements and Application Process

Capital Requirements

One of the primary requirements for obtaining a Belize broker license is meeting the minimum capital requirement. For a Trading in Foreign Exchange license or a Market Maker license, the minimum paid-up and unimpaired capital required is $500,000. This amount must be deposited in a bank account in Belize and maintained throughout the license period.

Company Formation

Before applying for a license, applicants must establish a legal entity in Belize. This can be done by incorporating a domestic company, which involves:

- Appointing directors and shareholders

- Paying all necessary fees

- Ensuring directors and shareholders have no criminal record and are of good standing

Physical Presence

The IFSC requires licensed companies to maintain a physical office in Belize. This demonstrates the company’s commitment to operating within the jurisdiction and helps ensure proper oversight.

Local Director

At least one director of the company must be a Belize resident. This requirement helps maintain a local connection and ensures that there’s always a point of contact within the country.

Application Documents

The application process requires submitting various documents, including:

- Completed application form

- Business plan

- Due diligence information on shareholders and directors

- Police conduct certificates

- Professional reference letters

- Articles of association and company charter

All documents must be properly filled out, signed, and notarized by a Belize notary. Non-English documents should be translated and certified locally.

Application Process

- Select a licensed service provider listed by the IFSC to handle your application.

- Compile necessary documentation and complete the application form.

- Submit the application along with the required fees.

- The IFSC will review the application, typically responding within two business days to confirm its completeness.

- The IFSC conducts due diligence on the company and key personnel.

- If approved, the IFSC issues a formal approval letter and an invoice for license fees.

Regulatory Compliance and Ongoing Obligations

Obtaining a Belize broker license is just the beginning. License holders must maintain ongoing compliance with IFSC regulations to ensure continued operation.

Anti-Money Laundering (AML) Compliance

Licensed brokers must comply with the Money Laundering and Terrorism (Prevention) Act. This involves implementing robust AML policies and procedures, including:

- Customer due diligence

- Transaction monitoring

- Suspicious activity reporting

Client Fund Protection

Brokers must segregate client funds into separate accounts and maintain physical possession or control of fully paid and excess margin securities carried for customers. This ensures the safety of client assets and helps maintain trust in the brokerage.

Reporting Requirements

License holders must submit regular reports to the IFSC, including:

- Annual audited financial statements

- Monthly operational reports

- Any significant changes in business operations or ownership structure

Renewal Process

Licenses are typically issued for one year, with an option to extend up to three years. Renewal requires proof of ongoing regulatory compliance, submission of current documents, and payment of renewal fees to the IFSC.

Benefits and Considerations of a Belize Broker License

Advantages

- Lower capital requirements: Compared to many other jurisdictions, Belize offers relatively low capital requirements for obtaining a forex broker license.

- Faster processing time: The application process in Belize is generally quicker than in many other financial centers.

- Tax benefits: Belize offers attractive tax incentives for offshore companies, which can significantly reduce operational costs.

- Regulatory framework: While considered an offshore jurisdiction, Belize maintains a regulatory framework that provides a balance between flexibility and oversight.

Considerations

- Reputation: While Belize is a legitimate jurisdiction for forex brokers, some clients may perceive offshore licenses as less prestigious than those from major financial centers.

- Limited passporting rights: A Belize license may not provide passporting rights to operate in certain other jurisdictions, particularly in the European Union.

- Ongoing compliance: Maintaining compliance with IFSC regulations requires ongoing effort and resources.

- Banking relationships: Some international banks may be hesitant to work with offshore-licensed brokers, which could impact payment processing capabilities.

Conclusion

Obtaining a Belize broker license can be an attractive option for many forex and financial trading businesses, offering a balance of regulatory oversight and operational flexibility. While the process involves several steps and ongoing obligations, the relatively low capital requirements and efficient application process make it a popular choice for many brokers entering the market or expanding their global presence.

As with any significant business decision, it’s crucial to thoroughly research and consider all aspects of obtaining a Belize broker license. Consulting with legal and financial experts familiar with the Belize regulatory environment can help ensure a smooth application process and successful ongoing operations.

FAQs

- How long does it take to obtain a Belize broker license?

The process typically takes 2-3 months from application to approval. However, preparation time before application submission can vary. - Can non-Belize residents apply for a broker license?

Yes, non-residents can apply, but the company must have at least one Belize resident director. - Is it possible to operate globally with a Belize broker license?

While possible, operators should be aware of regulatory requirements in other jurisdictions where they wish to offer services. - What are the ongoing costs associated with maintaining a Belize broker license?

Ongoing costs include annual license fees, compliance expenses, and maintaining the required capital. - Can cryptocurrency trading be included in a Belize forex broker license?

Yes, the IFSC allows for cryptocurrency trading under certain conditions, but specific approval may be required.