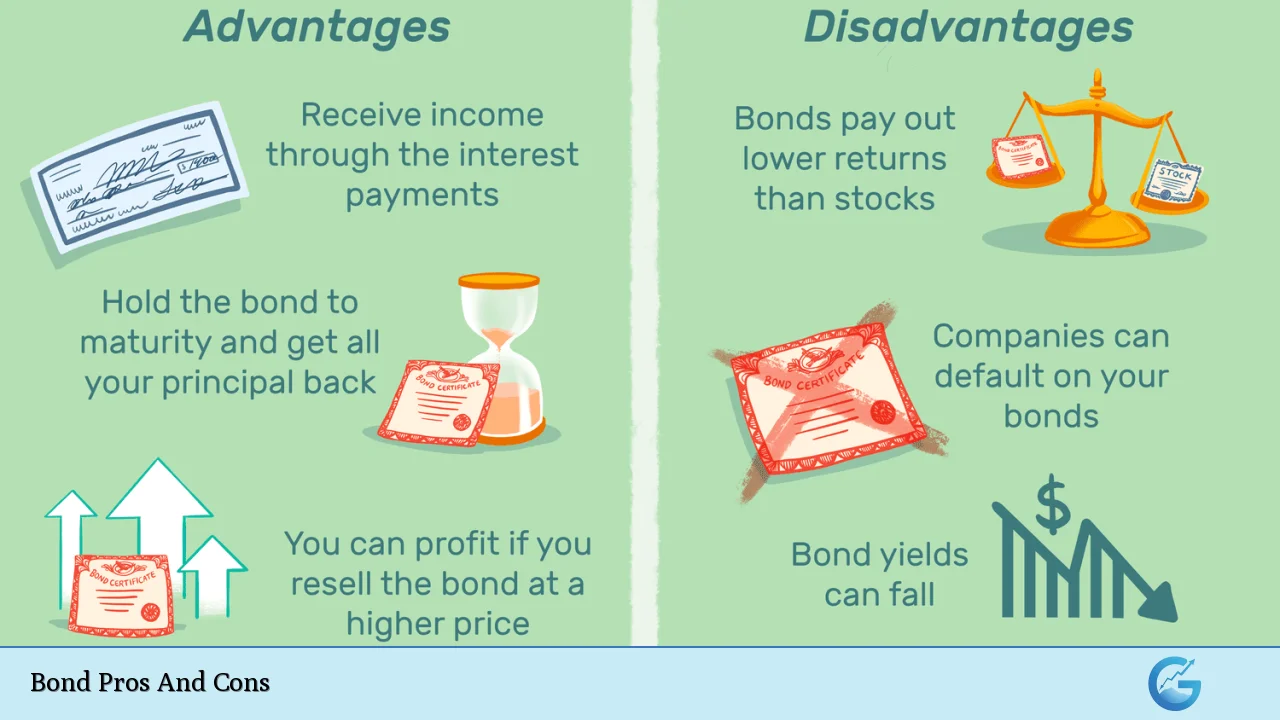

Investing in bonds is a fundamental strategy for many individuals and institutions looking to diversify their portfolios and secure a steady income stream. Bonds are essentially loans made by investors to borrowers, typically governments or corporations, which promise to pay back the principal amount along with interest over a specified period. This financial instrument offers various advantages and disadvantages that potential investors should carefully consider. In this article, we will explore the pros and cons of bonds, helping you make informed decisions in your investment journey.

| Pros | Cons |

|---|---|

| Reliable income stream from interest payments | Interest rate risk can affect bond prices |

| Lower volatility compared to stocks | Potential for lower returns over the long term |

| Diversification benefits for investment portfolios | Credit risk associated with bond issuers |

| Tax advantages with certain bonds (e.g., municipal bonds) | Liquidity risk in certain bond markets |

| Predictable cash flow and maturity value | Inflation risk may erode purchasing power |

| Variety of bond types to suit different investment strategies | Complexity in understanding different bond features |

| Potential for capital gains if sold before maturity at a premium | Callable bonds may be redeemed early by issuers, affecting returns |

Reliable Income Stream from Interest Payments

One of the most significant advantages of investing in bonds is the reliable income they provide. Bonds typically pay interest at regular intervals (usually semiannually), allowing investors to receive a consistent cash flow. This feature is particularly appealing for retirees or individuals seeking a stable income source without the volatility associated with stocks.

- Predictable payments: Investors can plan their finances better knowing when they will receive interest payments.

- Steady income: Bonds can serve as a dependable source of income, especially during economic downturns when stock dividends may be cut.

Lower Volatility Compared to Stocks

Bonds generally exhibit lower price volatility than stocks, making them a safer investment option during turbulent market conditions. This characteristic helps stabilize an investor’s portfolio, especially when equities are experiencing significant fluctuations.

- Reduced risk: The lower volatility means that bond prices are less likely to experience dramatic swings, providing peace of mind for conservative investors.

- Portfolio stability: Including bonds in an investment portfolio can help mitigate risks associated with stock market downturns.

Diversification Benefits for Investment Portfolios

Bonds play a crucial role in portfolio diversification. By including different asset classes, such as stocks and bonds, investors can reduce overall portfolio risk while potentially enhancing returns.

- Risk reduction: Bonds often behave differently than stocks; when stock prices fall, bond prices may remain stable or even increase.

- Asset allocation: A well-diversified portfolio typically includes a mix of asset types, which can help achieve better long-term financial goals.

Tax Advantages with Certain Bonds

Certain types of bonds offer tax benefits that can enhance their appeal. For instance, municipal bonds are often exempt from federal taxes and sometimes state taxes as well, making them attractive options for high-income earners.

- Tax-free income: Investors can benefit from tax-free interest payments, which can significantly improve their after-tax returns.

- Strategic tax planning: Tax-exempt bonds can be integrated into an investor’s overall tax strategy to minimize tax liabilities.

Predictable Cash Flow and Maturity Value

Bonds come with a set maturity date when the principal amount is returned to the investor. This predictability allows investors to plan their finances more effectively.

- Fixed maturity: Knowing when the investment will mature helps in financial planning for future expenses or investments.

- Capital preservation: If held to maturity, bonds return the principal amount, assuming no default occurs.

Variety of Bond Types to Suit Different Investment Strategies

The bond market offers a wide range of instruments catering to various investment strategies and risk tolerances. From government bonds to corporate bonds and high-yield options, investors can choose based on their individual needs.

- Customization: Investors can select bonds that align closely with their financial goals and risk appetite.

- Access to different sectors: Bonds from various sectors (government, corporate, municipal) allow investors to diversify further within fixed-income investments.

Potential for Capital Gains if Sold Before Maturity at a Premium

Investors have the opportunity to sell their bonds before maturity at a premium if interest rates decline after purchase. This potential for capital gains adds another layer of attractiveness to bond investments.

- Market opportunities: Investors can capitalize on favorable market conditions by selling bonds at higher prices than what they paid.

- Flexibility: Selling before maturity provides liquidity and flexibility in managing investment portfolios.

Interest Rate Risk Can Affect Bond Prices

Despite their advantages, bonds are not without risks. One major concern is interest rate risk. When interest rates rise, existing bond prices tend to fall as newer issues offer higher yields.

- Price fluctuations: Investors holding long-term bonds may see significant declines in market value if rates increase sharply.

- Reinvestment challenges: If an investor needs to reinvest interest payments or principal into new bonds during high-rate environments, they may face lower yields than expected.

Potential for Lower Returns Over the Long Term

Historically, bonds have provided lower returns compared to equities over extended periods. This characteristic may deter growth-oriented investors seeking substantial capital appreciation.

- Growth limitations: While providing stability and income, bonds may not deliver the aggressive growth potential that stocks offer.

- Long-term planning: Investors must balance their portfolios according to their growth objectives and time horizons while considering the trade-offs between risk and return.

Credit Risk Associated with Bond Issuers

Investing in bonds carries credit risk—the possibility that the issuer may default on its obligations. Corporate bonds tend to have higher credit risks than government securities due to varying financial health among companies.

- Default concerns: Investors must assess the creditworthiness of issuers before investing; lower-rated bonds carry higher risks but may offer higher yields.

- Due diligence required: Researching issuer ratings and financial stability is crucial in mitigating credit risk exposure.

Liquidity Risk in Certain Bond Markets

Liquidity risk refers to the difficulty investors may face when trying to buy or sell bonds without causing significant price changes. Some bond markets are less liquid than others, particularly for corporate or municipal issues.

- Market access issues: In illiquid markets, investors might struggle to find buyers or sellers at desired prices, impacting overall returns.

- Investment strategy implications: Understanding liquidity levels is essential when selecting specific bond investments within a portfolio strategy.

Inflation Risk May Erode Purchasing Power

Inflation poses a significant threat to fixed-income investments like bonds. If inflation rises significantly, it can erode the purchasing power of interest payments received by bondholders over time.

- Real return considerations: Investors need to account for inflation when assessing the real return on their bond investments; nominal returns may appear attractive but could be misleading after adjusting for inflation effects.

- Inflation-linked options available: Some investors opt for inflation-indexed securities (like TIPS) designed specifically to combat this issue by adjusting principal values based on inflation rates.

Complexity in Understanding Different Bond Features

The bond market’s complexity can be overwhelming for novice investors. Various types of bonds come with unique features (e.g., callable vs. non-callable) that require careful consideration before investing.

- Educational requirements: Investors must invest time in learning about different bond types and their characteristics before making informed decisions.

- Professional advice recommended: Seeking guidance from financial advisors familiar with fixed-income investments can help navigate this complexity effectively.

Callable Bonds May Be Redeemed Early by Issuers

Callable bonds allow issuers to redeem them before maturity under certain conditions. While this feature benefits issuers during declining interest rates, it poses risks for investors who may lose out on expected interest payments if their bonds are called early.

- Uncertainty regarding cash flow: Investors cannot predict with certainty how long they will hold callable bonds or what yield they will ultimately receive if called early.

- Yield compensation needed: Callable bonds typically offer higher yields than non-callable options as compensation for this added risk; however, investors must weigh these trade-offs carefully.

In conclusion, investing in bonds presents both advantages and disadvantages that should be thoroughly understood before committing funds. On one hand, they offer reliable income streams, lower volatility compared to stocks, diversification benefits, tax advantages, predictable cash flows, and various types suited for different strategies. On the other hand, potential risks include interest rate fluctuations impacting prices, lower long-term returns compared to equities, credit risks associated with issuers, liquidity concerns in certain markets, inflation eroding purchasing power, complexity in understanding features like call provisions, and uncertainty regarding cash flow from callable securities.

Investors should carefully assess these factors based on their individual financial goals and risk tolerance levels while considering how best to incorporate bonds into their overall investment strategy.

Frequently Asked Questions About Bond Pros And Cons

- What are the main benefits of investing in bonds?

Bonds provide reliable income through interest payments, lower volatility compared to stocks, diversification benefits in portfolios, tax advantages (especially municipal bonds), predictable cash flows at maturity, and various options tailored for different investment strategies. - What risks should I consider when investing in bonds?

The primary risks include interest rate risk (which affects bond prices), credit risk (the possibility of issuer default), liquidity risk (difficulty buying/selling without affecting price), inflation risk (eroding purchasing power), and complexity related to understanding different bond features. - How do interest rates affect bond investments?

When interest rates rise, existing bond prices typically fall because newer issues offer higher yields; this inverse relationship impacts market value significantly. - Are there tax advantages associated with certain types of bonds?

Yes! Municipal bonds often provide tax-free interest income at federal levels and sometimes state levels too—making them attractive options for high-income earners. - What is credit risk in relation to bonds?

Credit risk refers specifically to the likelihood that an issuer will default on its obligations—investors should assess issuer ratings before investing. - How does inflation impact my bond investments?

If inflation rises significantly over time—it erodes purchasing power—thus reducing real returns from fixed-interest payments received by bondholders. - What types of investors benefit most from holding bonds?

Bonds tend towards conservative investors seeking stable income streams—such as retirees—who prioritize capital preservation over aggressive growth strategies. - Can I lose money investing in bonds?

While generally considered safer than stocks—investors can still incur losses through defaults or unfavorable market conditions affecting pricing; hence due diligence remains crucial.