Borrowing from a 401(k) retirement account can be an appealing option for individuals facing financial challenges. This approach allows employees to access funds from their retirement savings without incurring early withdrawal penalties or taxes, provided they adhere to the repayment terms. However, while there are potential benefits, there are also significant drawbacks that can impact long-term financial health. In this article, we will explore the advantages and disadvantages of borrowing from a 401(k), offering a comprehensive overview for those considering this financial strategy.

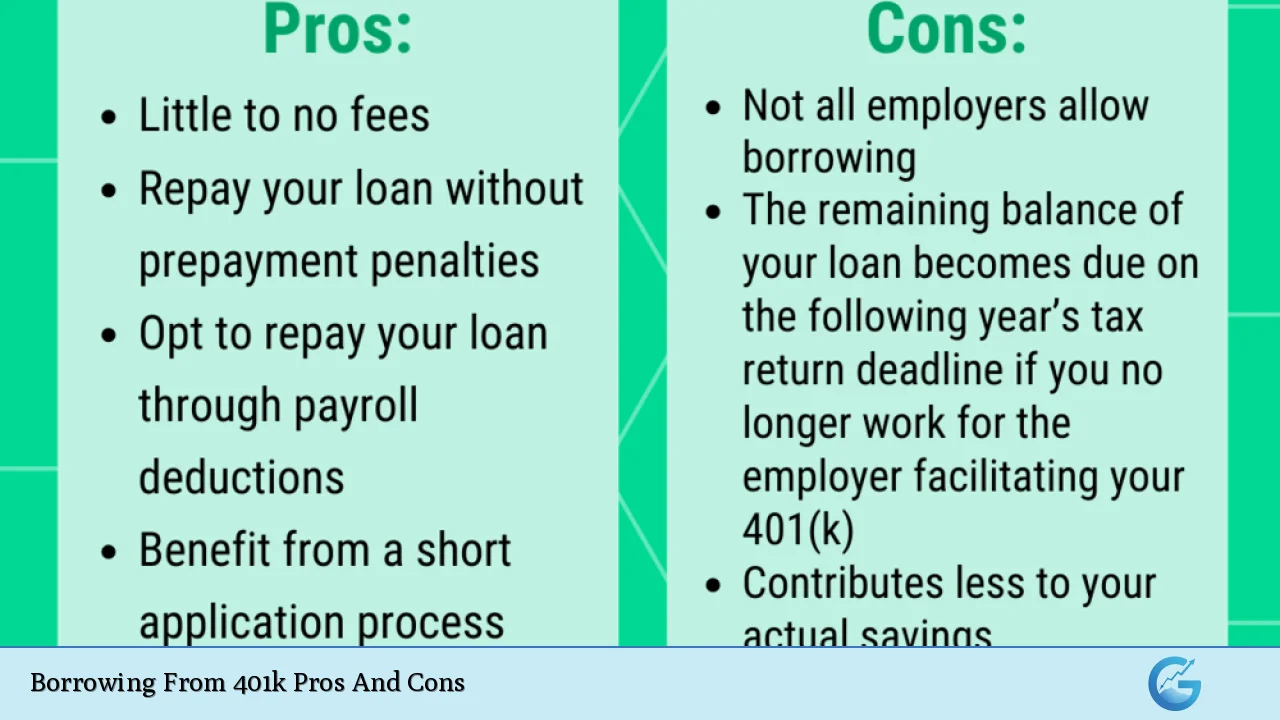

| Pros | Cons |

|---|---|

| No early withdrawal penalties or tax implications | Potential loss of investment growth |

| Interest payments go back into your account | Monthly payment obligations can strain budgets |

| No credit checks required | Risk of default and tax penalties if not repaid |

| Quick access to funds | Limits on borrowing amount and repayment terms |

| Flexible repayment options | Impact on retirement savings if not managed properly |

No Early Withdrawal Penalties or Tax Implications

One of the most significant advantages of borrowing from a 401(k) is that it allows individuals to access funds without incurring early withdrawal penalties or immediate tax liabilities. Unlike traditional withdrawals, which can trigger a 10% penalty for those under age 59½, loans do not incur such fees as long as they are repaid according to the plan’s terms.

- No penalty: Borrowers avoid the immediate financial hit that comes with early withdrawals.

- Tax deferral: Since the loan is not considered taxable income, individuals can maintain their tax-advantaged status until they withdraw funds in retirement.

Interest Payments Go Back Into Your Account

When you borrow from your 401(k), you pay interest on the loan. However, unlike traditional loans where interest goes to a bank or lender, the interest paid on a 401(k) loan is returned to your retirement account.

- Self-financing: This means you are essentially paying yourself back, which helps replenish your retirement savings over time.

- Lower interest rates: Typically, the interest rates on 401(k) loans are lower than those associated with personal loans or credit cards, making them an attractive option for short-term borrowing.

No Credit Checks Required

Another advantage of borrowing from a 401(k) is that it does not require a credit check. This can be particularly beneficial for individuals with poor credit histories or those who may struggle to secure loans through traditional financial institutions.

- Accessibility: The absence of credit checks makes it easier for employees to obtain funds quickly when needed.

- No impact on credit score: Since these loans do not appear on credit reports, taking out a loan from a 401(k) will not affect your credit score.

Quick Access to Funds

Borrowing from a 401(k) can provide quick access to cash in times of need. The process is often straightforward and can be completed without extensive paperwork or lengthy approval processes.

- Speedy transactions: Many plans allow participants to request loans online and receive funds in just a few days.

- Privacy: The process is typically private, allowing individuals to manage their finances without scrutiny.

Flexible Repayment Options

Most 401(k) loans come with flexible repayment terms. While regulations generally require repayment within five years, many plans allow for early repayment without penalties.

- Payroll deductions: Repayments can often be made through automatic payroll deductions, simplifying the process for borrowers.

- Prepayment flexibility: Borrowers have the option to pay off their loans early without incurring additional fees, allowing for greater financial control.

Potential Loss of Investment Growth

Despite the advantages, one significant disadvantage of borrowing from a 401(k) is the potential loss of investment growth. When funds are withdrawn from the account, they cease to participate in market gains.

- Reduced compounding: The money taken out does not benefit from compound interest during the loan period, potentially leading to lower overall retirement savings.

- Market risks: If the market performs well during the loan term, borrowers may miss out on significant gains that could have been accrued had the money remained invested.

Monthly Payment Obligations Can Strain Budgets

Taking out a loan against your 401(k) creates an obligation to repay that loan over time. This can strain monthly budgets, especially if borrowers are already facing financial difficulties.

- Budgeting challenges: Monthly payments must be factored into personal budgets, which could lead to further financial stress if unexpected expenses arise.

- After-tax payments: Repayments are made with after-tax dollars, meaning borrowers will effectively pay taxes twice on those funds—once when they repay the loan and again when they withdraw them in retirement.

Risk of Default and Tax Penalties if Not Repaid

If borrowers fail to repay their loans according to schedule, they face significant consequences. Unpaid loans may be treated as distributions by the IRS, leading to tax liabilities and penalties.

- Tax implications: Defaulting on a loan can result in owing income taxes on the amount borrowed plus an additional 10% penalty if under age 59½.

- Retirement savings impact: A default can severely impact retirement savings and future financial security.

Limits on Borrowing Amount and Repayment Terms

There are strict limits regarding how much one can borrow from a 401(k). Generally, individuals can borrow up to $50,000 or half of their vested balance—whichever is less.

- Loan caps: These limits may restrict access to sufficient funds during emergencies or significant expenses.

- Repayment timeframe: While most loans must be repaid within five years (longer if used for purchasing a home), this timeframe may not align with individual financial situations.

Impact on Retirement Savings if Not Managed Properly

Ultimately, borrowing from a 401(k) can jeopardize long-term retirement planning if not managed correctly.

- Reduced future contributions: Some plans may restrict contributions while loans are outstanding, further hindering growth potential in retirement accounts.

- Long-term consequences: The overall impact on retirement savings could be detrimental if borrowers do not have a clear plan for repayment and future contributions post-loan.

In conclusion, while borrowing from a 401(k) offers several advantages—such as avoiding early withdrawal penalties and providing quick access to funds—it also carries substantial risks that could affect long-term financial health. Individuals should carefully weigh these pros and cons before deciding whether this option aligns with their financial goals and circumstances.

Frequently Asked Questions About Borrowing From 401k Pros And Cons

- What is the maximum amount I can borrow from my 401(k)?

The maximum amount you can borrow is typically limited to $50,000 or half of your vested balance, whichever is less. - Are there any penalties for borrowing from my 401(k)?

No penalties apply as long as you repay the loan according to your plan’s terms; otherwise, it may be treated as a taxable distribution. - How long do I have to repay a 401(k) loan?

You generally have five years to repay the loan unless it is used for purchasing a primary residence. - Will taking out a loan affect my credit score?

No; borrowing from your 401(k) does not require a credit check and does not appear on your credit report. - Can I take multiple loans from my 401(k)?

Most plans allow only one outstanding loan at a time unless specified otherwise. - What happens if I leave my job with an outstanding loan?

If you leave your job with an unpaid loan, you may need to repay it in full within a short period or face tax consequences. - Can I pay off my 401(k) loan early?

Yes; most plans allow early repayment without penalties. - Is borrowing from my 401(k) better than taking out personal loans?

In many cases, yes; borrowing from your 401(k) typically has lower interest rates and avoids credit checks.

By understanding both sides of borrowing from a 401(k), individuals can make informed decisions that align with their financial needs while safeguarding their future retirement savings.