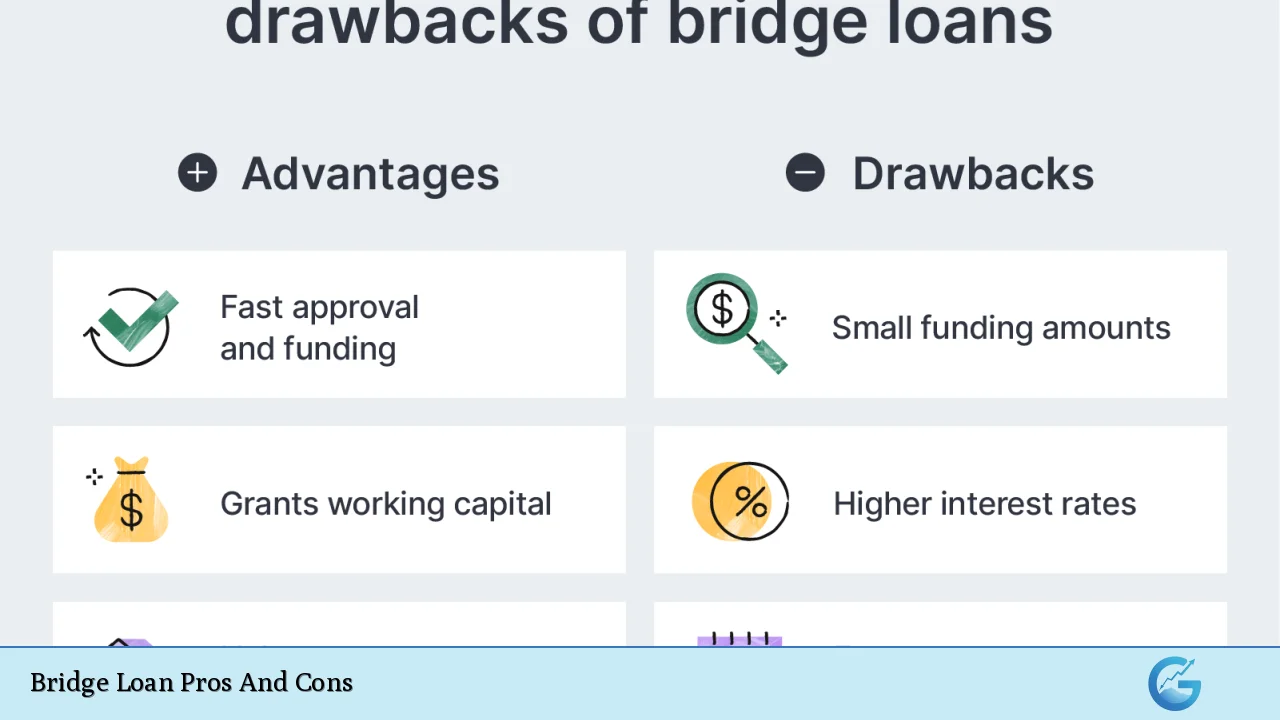

Bridge loans serve as a financial tool designed to provide temporary funding during transitional periods, particularly in real estate transactions. They enable homeowners to purchase a new property while waiting for their current home to sell. While bridge loans can be advantageous in certain situations, they also come with significant drawbacks that potential borrowers must consider. This article explores the pros and cons of bridge loans in detail, aiming to provide a comprehensive understanding for investors and individuals interested in finance, real estate, and money markets.

| Pros | Cons |

|---|---|

| Quick access to funds for time-sensitive transactions | Higher interest rates compared to traditional loans |

| Flexibility in payment options | Risk of holding multiple mortgages simultaneously |

| No need for contingencies on new home purchases | Potential for high closing costs and fees |

| Ability to leverage equity from existing property | Limited borrower protections compared to traditional loans |

| Facilitates competitive offers in a hot market | Requires significant equity in the current home |

| Short-term financing solution for urgent needs | Short repayment period can lead to financial strain if not managed properly |

Quick Access to Funds for Time-Sensitive Transactions

One of the primary advantages of bridge loans is the ability to secure quick funding. In real estate, timing can be crucial. Buyers often face situations where they need to act fast—such as when they find a desirable property that may not wait for them to sell their current home.

- Speed of funding: Many lenders can process bridge loans quickly, sometimes within just a few weeks.

- Competitive edge: This rapid access allows buyers to make non-contingent offers, increasing their chances of securing the property.

Higher Interest Rates Compared to Traditional Loans

Despite their benefits, bridge loans typically come with higher interest rates than standard mortgages.

- Cost implications: Borrowers might face rates ranging from 8% to 12%, which can significantly impact overall loan costs.

- Financial burden: This higher cost can strain finances, particularly if the borrower does not sell their existing home promptly.

Flexibility in Payment Options

Bridge loans often provide flexible payment options that can suit various financial situations.

- Deferred payments: Some bridge loans allow borrowers to defer payments until their current home sells.

- Interest-only payments: Others may offer interest-only payment structures during the loan term, which can ease immediate cash flow concerns.

Risk of Holding Multiple Mortgages Simultaneously

A significant downside of bridge loans is the risk associated with potentially holding multiple mortgages at once.

- Financial strain: If the existing home does not sell within the loan term (typically 6 to 12 months), borrowers may find themselves managing three separate mortgages—each requiring monthly payments.

- Increased financial risk: This situation can lead to severe financial stress and even foreclosure if payments cannot be maintained.

No Need for Contingencies on New Home Purchases

Bridge loans eliminate the need for contingencies when making an offer on a new property.

- Simplified transactions: Buyers can purchase a new home without waiting for their current one to sell, making the buying process more straightforward.

- Market advantage: This flexibility is particularly advantageous in competitive markets where sellers prefer non-contingent offers.

Potential for High Closing Costs and Fees

While bridge loans offer quick access and flexibility, they often come with substantial closing costs and fees.

- Cost breakdown: Borrowers may incur costs ranging from 1.5% to 3% of the loan amount in closing fees, along with other administrative charges.

- Overall expense: These additional costs can make bridge loans more expensive than other financing options, impacting overall affordability.

Ability to Leverage Equity from Existing Property

Borrowers can utilize the equity built up in their current home as collateral for a bridge loan.

- Accessing funds: This allows individuals to tap into their home’s value without needing to sell it first, providing necessary liquidity for purchasing another property.

- Investment opportunities: This leverage can facilitate investments or purchases that might otherwise be out of reach due to cash flow limitations.

Limited Borrower Protections Compared to Traditional Loans

Unlike traditional mortgage products, bridge loans often lack robust borrower protections.

- Risk exposure: Borrowers may not have the same legal protections if their existing home does not sell as planned.

- Foreclosure risks: In extreme cases, lenders could initiate foreclosure proceedings on the existing property if payments are missed or if the loan term expires without resolution.

Facilitates Competitive Offers in a Hot Market

In today’s fast-paced real estate market, having the ability to make swift offers is invaluable.

- Market dynamics: Bridge loans empower buyers by allowing them to act quickly without being contingent on selling their current homes first.

- Seller appeal: Sellers are often more inclined to accept offers from buyers who are financially prepared without contingencies related to selling another property.

Requires Significant Equity in the Current Home

Most lenders require borrowers to have substantial equity in their existing properties before approving a bridge loan.

- Equity thresholds: Typically, lenders look for at least 20% equity; however, many prefer 30% or more depending on market conditions and borrower profiles.

- Barrier for some borrowers: This requirement can exclude potential borrowers who do not have sufficient equity built up in their homes.

Short Repayment Period Can Lead to Financial Strain if Not Managed Properly

The short-term nature of bridge loans necessitates careful planning and management by borrowers.

- Repayment timeline: With repayment terms usually ranging from six months up to one year, borrowers must ensure they have a solid exit strategy—whether through selling their existing home or refinancing into a longer-term loan.

- Financial planning necessity: Failing to manage this effectively could result in significant financial strain or even default on the loan obligations.

In conclusion, while bridge loans offer several advantages such as quick access to funds and flexibility during real estate transitions, they also present notable risks including high costs and potential financial burdens. It is essential for potential borrowers to weigh these pros and cons carefully against their individual circumstances and financial capabilities before proceeding with this type of financing. Understanding both sides will empower investors and homeowners alike in making informed decisions that align with their financial goals and market conditions.

Frequently Asked Questions About Bridge Loans

- What is a bridge loan?

A bridge loan is a short-term financing option that helps cover costs during transitional periods, typically between buying a new property and selling an existing one. - How long do bridge loans last?

Bridge loans usually have terms ranging from six months up to one year. - What are typical interest rates for bridge loans?

Interest rates for bridge loans typically range between 8% and 12%, which is higher than standard mortgage rates. - What happens if my old home doesn’t sell before the bridge loan term ends?

If your old home doesn’t sell within the term, you may end up paying multiple mortgages simultaneously or facing foreclosure risks. - Do I need equity in my current home for a bridge loan?

Yes, most lenders require at least 20% equity in your current home before approving a bridge loan. - Are there any fees associated with bridge loans?

Yes, borrowers can expect closing costs ranging from 1.5% to 3% of the loan amount along with other administrative fees. - Can I use a bridge loan for purposes other than buying a new home?

Yes, while commonly used for real estate purchases, bridge loans can also be utilized for renovations or other urgent financial needs. - What should I consider before taking out a bridge loan?

You should consider your ability to repay the loan within its short term and whether you have a solid plan for selling your existing property.