Buffered annuities are a relatively new financial product that combines features of both variable and indexed annuities. They are designed to provide investors with a degree of downside protection against market losses while still allowing for potential market-linked growth. This unique structure has made buffered annuities an attractive option for individuals seeking to balance risk and reward in their investment portfolios. However, like any financial product, they come with their own set of advantages and disadvantages that investors should carefully consider.

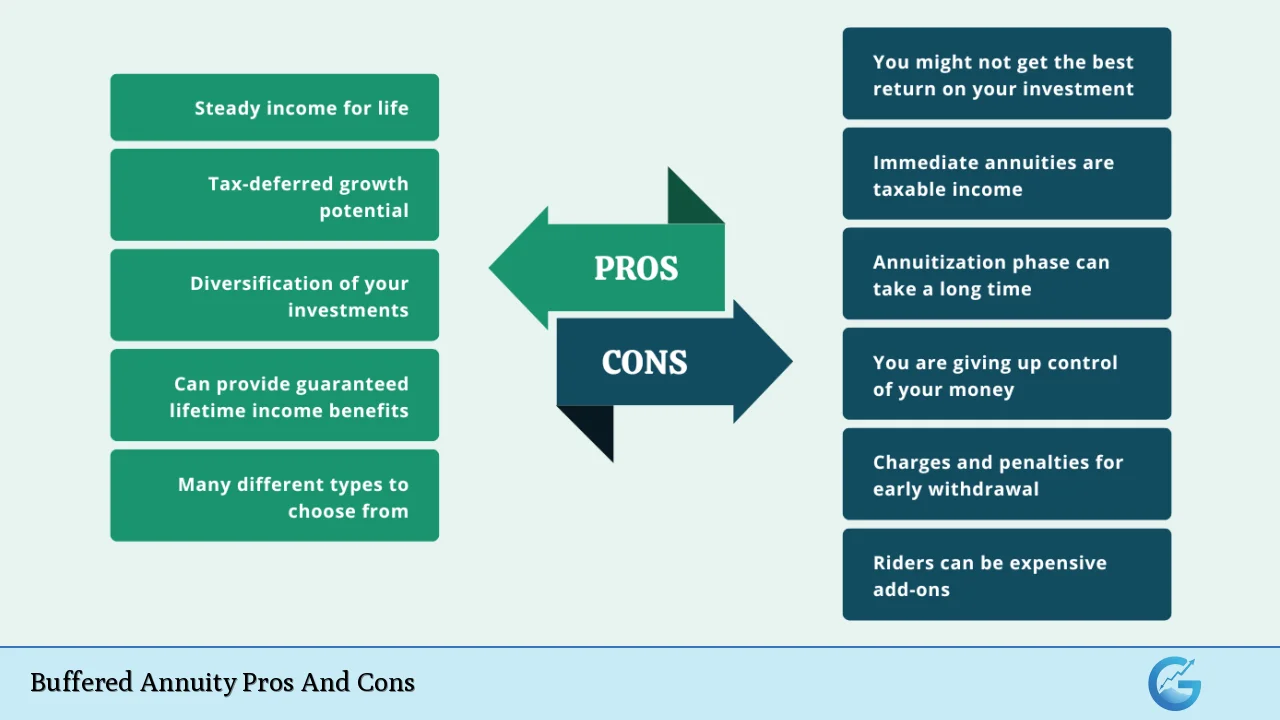

Pros and Cons Overview

| Pros | Cons |

|---|---|

| Downside protection against market losses. | Cap on potential gains limits upside growth. |

| Tax-deferred growth until withdrawal. | Complex fee structures can reduce net returns. |

| Flexibility in choosing investment segments. | Potential for loss of principal if market declines significantly. |

| Opportunity to participate in market gains. | Surrender charges may apply for early withdrawals. |

| Structured products can offer higher growth potential. | Market volatility can affect overall performance. |

Detailed Advantages of Buffered Annuities

Downside Protection Against Market Losses

Buffered annuities are designed to absorb a portion of market losses, providing investors with a safety net during downturns.

- Buffer Mechanism: Typically, these products have a buffer that protects against the first 10% to 30% of losses. For instance, if the market drops by 15% and your buffer is set at 10%, you would only experience a 5% loss.

- Risk Management: This feature allows investors to manage risk more effectively, especially during volatile market conditions.

Tax-Deferred Growth Until Withdrawal

One of the significant benefits of buffered annuities is their tax treatment.

- Tax Deferral: Like other annuities, the growth within a buffered annuity is tax-deferred. This means you won’t owe taxes on your investment gains until you withdraw funds, allowing your investment to grow more efficiently over time.

- Long-Term Planning: This characteristic makes buffered annuities appealing for retirement planning, as it can help accumulate wealth without immediate tax implications.

Flexibility in Choosing Investment Segments

Buffered annuities offer investors the ability to choose from various investment options.

- Market Index Selection: Investors can select indices such as the S&P 500 or Russell 2000, allowing them to tailor their investments according to their risk tolerance and market outlook.

- Segment Duration: Investors can also choose the duration of their investment segments, typically ranging from one to six years, which adds another layer of customization.

Opportunity to Participate in Market Gains

Buffered annuities provide a unique opportunity for investors to benefit from market growth.

- Higher Caps: Compared to traditional indexed annuities, buffered annuities often offer higher caps on potential gains (usually around 8% to 9%). This allows investors to capture more upside when markets perform well.

- Structured Products: The use of structured products within these annuities can enhance growth potential while still providing downside protection.

Structured Products Can Offer Higher Growth Potential

Buffered annuities often utilize complex structured products that can lead to higher returns compared to traditional investments.

- Investment Strategy: By investing in options contracts or other sophisticated financial instruments, these annuities can provide exposure to various asset classes and potentially higher returns.

- Attractive for Growth-Oriented Investors: This aspect makes buffered annuities appealing for investors looking for growth without fully exposing themselves to market risks.

Detailed Disadvantages of Buffered Annuities

Cap on Potential Gains Limits Upside Growth

While buffered annuities provide some protection against losses, they also impose limits on how much investors can gain.

- Growth Caps: The caps on credited interest mean that even if the market performs exceptionally well, your returns will be capped. For example, if the market gains 10% but your cap is set at 6%, you will only receive the capped amount.

- Opportunity Cost: This limitation may lead to missed opportunities for higher returns compared to direct investments in the stock market.

Complex Fee Structures Can Reduce Net Returns

Buffered annuities often come with intricate fee structures that can eat into returns.

- Surrender Charges: Most buffered annuities have surrender charges that penalize early withdrawals. These charges typically decrease over time but can be significant in the initial years.

- Management Fees: Additionally, fees associated with managing structured products may further reduce overall returns, making it essential for investors to understand all costs involved before committing.

Potential for Loss of Principal If Market Declines Significantly

Despite offering some downside protection, buffered annuities do not eliminate the risk of loss entirely.

- Exceeding Buffer Limits: If market losses exceed the buffer limit (e.g., a 10% buffer during a 20% decline), investors will incur losses beyond the protected amount.

- Market Volatility Impact: This exposure means that while some risk is mitigated, there is still potential for significant losses during extreme market conditions.

Surrender Charges May Apply for Early Withdrawals

Investors should be aware of the penalties associated with withdrawing funds from buffered annuities before maturity.

- Withdrawal Penalties: Surrender charges can be particularly high in the early years of the contract, which may discourage liquidity and flexibility in managing investments.

- Limited Access to Funds: This restriction could pose challenges for individuals who may need access to their capital during emergencies or unexpected expenses.

Market Volatility Can Affect Overall Performance

Buffered annuities are not immune to the effects of market fluctuations.

- Performance Dependence on Market Conditions: The performance of these products is tied closely to market indices. Therefore, significant volatility can impact both gains and losses associated with the investment.

- Investor Sentiment and Behavior: Market sentiment can also influence how these products perform over time, making it crucial for investors to remain informed about broader economic conditions.

Closing Paragraph

In conclusion, buffered annuities present a unique blend of benefits and drawbacks that make them suitable for certain types of investors. They provide an appealing option for those seeking downside protection while still wanting exposure to potential market gains. However, it is essential for investors to fully understand both the advantages and disadvantages before making a commitment. As always, consulting with a financial advisor can help tailor investment strategies that align with individual goals and risk tolerance levels.

Frequently Asked Questions About Buffered Annuity

- What is a buffered annuity?

A buffered annuity is a type of structured product that offers partial protection against market losses while allowing for potential gains linked to specific indices. - How does downside protection work?

The buffer absorbs a set percentage of losses (e.g., 10%), meaning you only incur losses beyond this threshold if the market declines significantly. - What are the tax implications?

Buffered annuities offer tax-deferred growth until withdrawals are made, at which point earnings are taxed as ordinary income. - Can I access my funds easily?

No; early withdrawals may incur surrender charges that decrease over time, potentially limiting liquidity. - What happens if my investment loses value?

If losses exceed the buffer limit, you will incur additional losses; thus it’s important to assess your risk tolerance before investing. - Are there caps on my earnings?

Yes; buffered annuities typically have caps on potential gains (around 8%–9%), which limits how much you can earn even if markets perform well. - Who should consider investing in buffered annuities?

Investors looking for moderate growth potential with some level of loss protection may find buffered annuities appealing; however, those seeking guaranteed income should evaluate other options. - How do they compare with traditional indexed annuities?

Buffered annuities generally offer higher caps but less downside protection compared to traditional indexed annuities which protect against all principal loss.