Building a house is a significant decision that involves various factors, including financial implications, personal preferences, and long-term goals. For those interested in finance, crypto, forex, and money markets, understanding the pros and cons of building a house is crucial. This comprehensive analysis will explore the advantages and disadvantages of constructing a home, providing insights into how these factors can influence financial decisions and investments.

| Pros | Cons |

|---|---|

| Customization and Personalization | Time-Consuming Process |

| Lower Long-Term Maintenance Costs | Potential for Project Delays |

| Energy Efficiency and Sustainability | High Initial Costs |

| Control Over Location | Complex Decision-Making |

| Stamp Duty Savings | Market Risks and Uncertainties |

| New Home Warranty Protections | Construction Risks and Liabilities |

| Possibility of Government Grants or Incentives | Emotional Stress and Commitment |

| Investment Potential in Real Estate Market | Financing Challenges for Construction Loans |

Customization and Personalization

One of the most significant advantages of building a house is the ability to customize every aspect of your new home. This includes:

- Floor Plans: You can design the layout to suit your lifestyle, whether you need extra bedrooms, an open-plan living area, or specific features like a home office.

- Materials: Choose high-quality materials that align with your aesthetic preferences and budget.

- Energy Efficiency Features: Incorporate modern energy-efficient technologies that can reduce utility bills over time.

This level of personalization ensures that the home reflects your unique taste and meets your specific needs.

Lower Long-Term Maintenance Costs

Newly built homes often require less maintenance than older properties. Key points include:

- Modern Materials: New construction typically uses durable materials that are less prone to wear and tear.

- Warranty Coverage: Many builders offer warranties on new homes, covering repairs for a specified period, which can alleviate unexpected costs.

- Energy Efficiency: New homes are designed with energy efficiency in mind, reducing long-term utility expenses.

These factors contribute to lower ongoing costs compared to purchasing an existing home that may require significant repairs or renovations.

Energy Efficiency and Sustainability

Building a house allows homeowners to prioritize energy efficiency from the outset. Benefits include:

- Sustainable Practices: Incorporating eco-friendly materials and technologies can minimize environmental impact.

- Energy Ratings: New homes often meet higher energy efficiency standards, which can lead to substantial savings on energy bills.

- Smart Home Technologies: Integrating smart technologies can enhance energy management, further reducing costs.

Investing in energy-efficient features not only benefits homeowners financially but also contributes positively to environmental sustainability.

Control Over Location

When building a house, you have greater control over where you want to live. This includes:

- Choosing the Right Neighborhood: Select a location that aligns with your lifestyle preferences, such as proximity to work, schools, or recreational areas.

- Land Selection: You can choose a plot of land that meets your criteria for size, view, and accessibility.

This control over location can significantly impact your quality of life and long-term satisfaction with your investment.

Stamp Duty Savings

In many regions, purchasing land to build a home incurs lower stamp duty costs compared to buying an existing property. This can lead to significant savings:

- Reduced Tax Burden: Since stamp duty is calculated based on the property’s value at purchase, buying land only means paying tax on the land itself rather than the combined value of land and structure.

These savings can be redirected into the construction budget or other investments.

New Home Warranty Protections

Most new homes come with warranties that protect buyers against defects in workmanship or materials. Key aspects include:

- Builder Responsibility: If issues arise within the warranty period, the builder is typically responsible for repairs at no cost to the homeowner.

- Peace of Mind: Knowing that you are protected against potential defects provides reassurance during the initial years of homeownership.

This protection can be particularly valuable for first-time homebuyers who may be unfamiliar with construction issues.

Possibility of Government Grants or Incentives

Depending on your location and circumstances, there may be government grants available for new home construction. These incentives can include:

- First-Time Homebuyer Programs: Many states offer financial assistance or tax credits for first-time builders.

- Energy Efficiency Incentives: Programs aimed at promoting sustainable building practices may provide grants or rebates for using eco-friendly materials or technologies.

These financial aids can significantly reduce overall construction costs and enhance affordability.

Investment Potential in Real Estate Market

Building a house can be seen as an investment opportunity. Considerations include:

- Market Value Appreciation: A well-built home in a desirable location is likely to appreciate over time, providing potential returns on investment.

- Rental Income Potential: If you choose to rent out part of your property or build multiple units, this can create additional income streams.

Investing in real estate through building offers both immediate benefits and long-term financial growth opportunities.

Time-Consuming Process

While building offers many advantages, it is essential to recognize the time commitment involved. Key points include:

- Extended Timeline: The construction process typically takes several months to complete—often 9 to 12 months or longer—depending on various factors such as design complexity and weather conditions.

- Involvement Required: Homeowners must be prepared to make numerous decisions throughout the process, from selecting materials to overseeing construction progress.

This time investment can be challenging for individuals with demanding schedules or those seeking a quick move-in solution.

Potential for Project Delays

Delays are common in construction projects due to various factors including:

- Weather Conditions: Rain or snow can halt progress on-site, extending timelines unexpectedly.

- Material Shortages: Supply chain disruptions may lead to delays in obtaining necessary materials, impacting overall completion dates.

These uncertainties require homeowners to remain flexible throughout the building process while planning for potential setbacks.

High Initial Costs

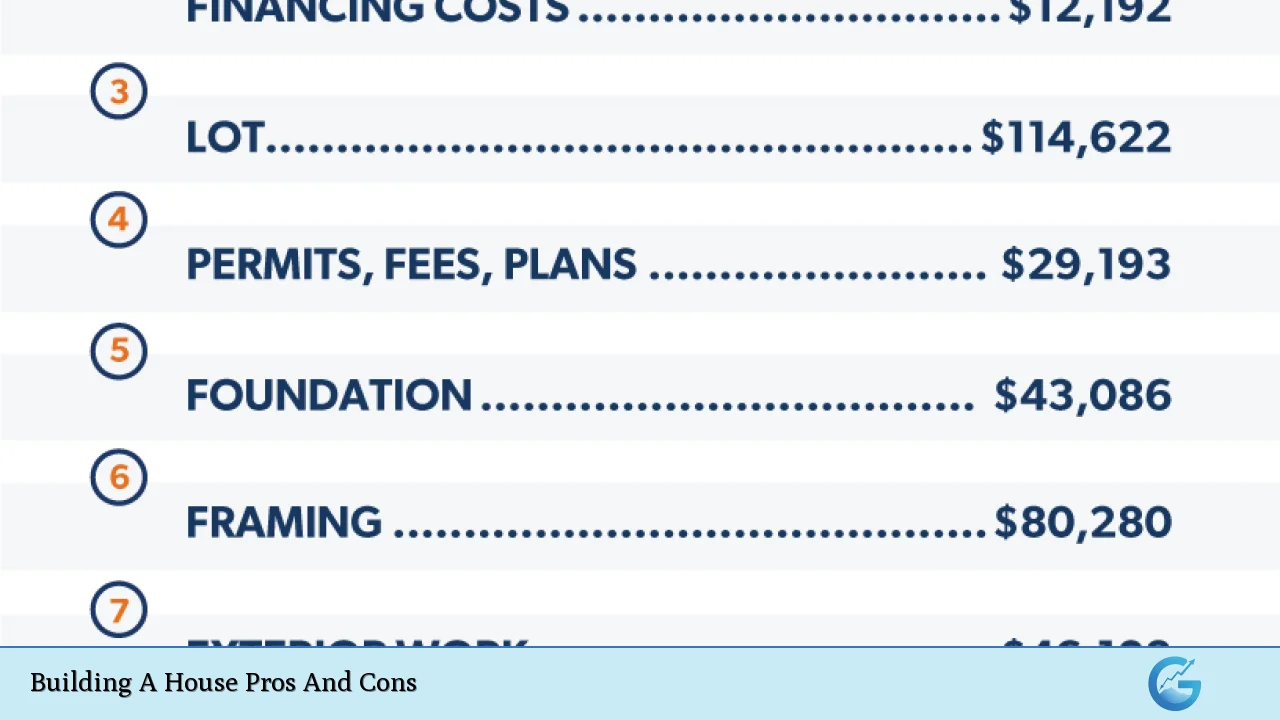

Building a house often comes with high upfront costs that must be carefully considered:

- Construction Expenses: The average cost of constructing a new home varies widely depending on location but typically ranges from $100 to $200 per square foot plus land costs.

- Financing Requirements: Securing financing for construction may involve different processes than traditional mortgages, such as obtaining a construction loan that often requires higher interest rates or down payments.

These initial financial commitments necessitate thorough budgeting and planning before embarking on a building project.

Complex Decision-Making

The decision-making process involved in building a house can be overwhelming:

- Numerous Choices: From floor plans to finishes, each choice impacts both aesthetics and budget. This complexity may lead some individuals to feel stressed about making decisions quickly during construction phases.

- Contractor Selection Risks: Choosing a reliable contractor is critical; poor choices can lead to costly mistakes or delays in project completion.

Navigating these challenges requires careful consideration and research to ensure informed decisions are made throughout the process.

Market Risks and Uncertainties

Building a house comes with inherent market risks that should not be overlooked:

- Economic Factors: Fluctuations in interest rates or changes in local real estate markets may affect property values after construction is completed.

- Resale Challenges: Should circumstances change (e.g., job relocation), selling a newly built home may not yield expected returns if market conditions are unfavorable at that time.

Understanding these risks is essential for anyone considering building as an investment strategy within real estate markets.

Construction Risks and Liabilities

Homebuilders face various risks during the construction process:

- Accidents on Site: Injuries or damages occurring during construction could lead to liability claims against homeowners if proper insurance coverage isn’t secured beforehand.

- Supply Chain Issues: Disruptions in material availability could result in increased costs or delays that impact project timelines significantly.

It’s crucial for homeowners planning new construction projects to have adequate insurance coverage and contingency plans in place before breaking ground on their new homes.

Emotional Stress and Commitment

The journey of building a house can also take an emotional toll on individuals involved:

- Investment of Time & Resources: The commitment required—from financial investments down through emotional involvement—can lead some homeowners feeling overwhelmed by their responsibilities during this lengthy process.

- Uncertainty About Outcomes: Concerns about whether final results will meet expectations may create anxiety leading up until completion day arrives.

Recognizing these emotional aspects helps prepare individuals mentally before undertaking such significant life changes as constructing one’s dream home.

Frequently Asked Questions About Building A House Pros And Cons

- What are the main advantages of building a house?

The primary advantages include customization options, lower long-term maintenance costs, energy efficiency benefits, control over location choices, potential stamp duty savings, warranty protections from builders, access to government grants, and investment potential. - What are common disadvantages associated with building?

The main disadvantages encompass time-consuming processes, potential project delays due to external factors like weather conditions or material shortages, high initial costs compared with buying existing homes, complex decision-making requirements throughout construction phases, market risks affecting resale value later down the line. - How long does it typically take to build a house?

The average timeline ranges from 9 months up until 12+ months depending upon various factors including design complexity & availability of materials. - Are there financial incentives available when constructing?

Certain government programs offer grants/financial assistance specifically aimed at first-time builders which could help offset overall expenses. - What should I consider before deciding between buying vs. building?

You should evaluate personal preferences regarding customization versus convenience along with assessing local market conditions impacting future resale values. - Can I finance my new build differently than purchasing an existing property?

Yes! Financing options differ; typically requiring specialized construction loans rather than traditional mortgages. - What risks do builders face during construction?

Common risks include accidents occurring onsite leading liability claims against homeowners & supply chain disruptions affecting material availability resulting increased costs/delays. - Is emotional stress common when going through this process?

Yes! Building involves significant investments both financially/emotionally which may create anxiety surrounding outcomes until completion day arrives.

In conclusion, building a house presents both significant advantages and notable disadvantages. The decision requires careful consideration of personal preferences regarding customization versus convenience alongside evaluating local market conditions impacting future resale values. By understanding these factors thoroughly—alongside potential financial implications—individuals interested in real estate investments will be better equipped to make informed choices about their housing journey.