The landscape of startup financing has evolved significantly over the years, with business angels emerging as a crucial source of capital for early-stage companies. Business angels, or angel investors, are typically high-net-worth individuals who provide financial backing to startups in exchange for equity ownership. They often bring more than just money to the table; their mentorship, industry experience, and networks can be invaluable for new entrepreneurs. However, while there are numerous advantages to securing funding from business angels, there are also notable disadvantages that entrepreneurs must consider. This article delves into the pros and cons of engaging with business angels, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

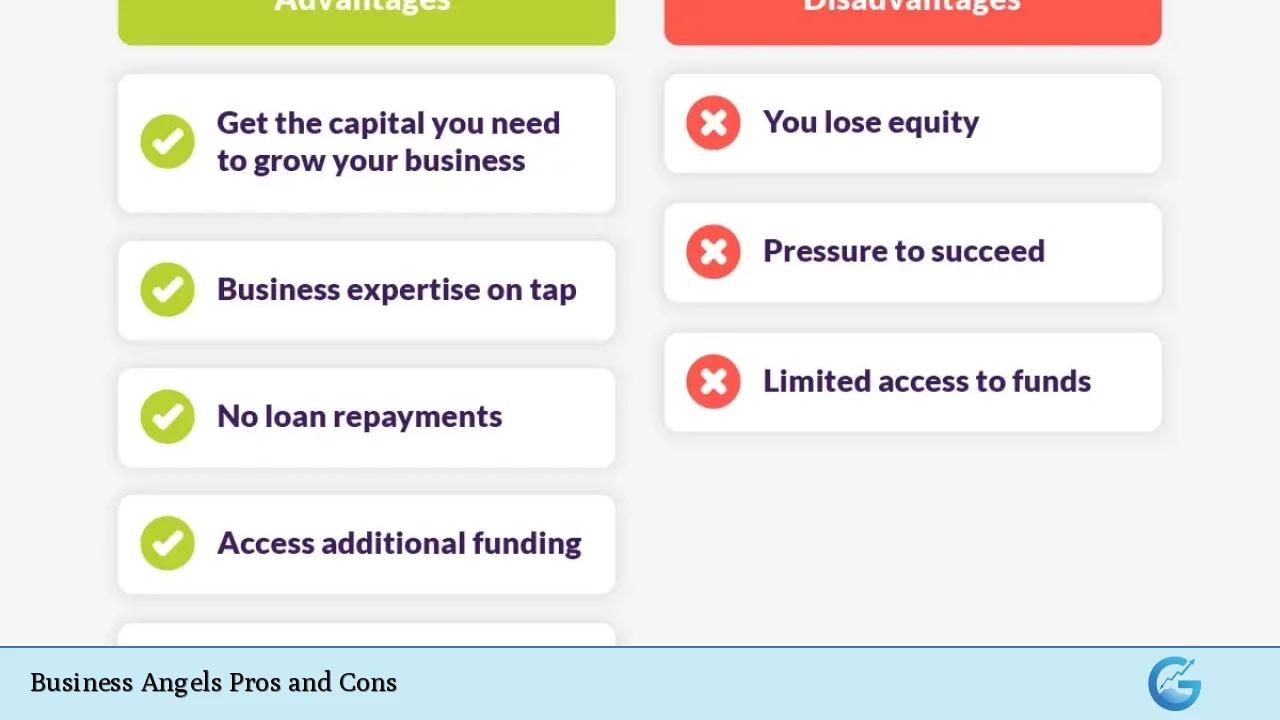

| Pros | Cons |

|---|---|

| Quick access to funding | Loss of equity and control |

| No repayment obligations | High expectations for returns |

| Access to mentorship and expertise | Potential for investor interference |

| Flexible investment terms | Lengthy search for suitable investors |

| Networking opportunities | Limited investment size |

| External accountability and discipline | Risk of misalignment of goals |

| No collateral required | Possibility of pressure to sell the business early |

Quick Access to Funding

One of the most significant advantages of working with business angels is the speed at which they can provide funding. Unlike traditional financial institutions that may take weeks or months to process loan applications, angel investors can make decisions quickly. This agility is particularly beneficial for startups that require immediate capital to seize market opportunities or address urgent operational needs.

- Fast turnaround: Angel investors can often commit funds within days or weeks.

- Less bureaucratic red tape: The informal nature of angel investing allows for quicker negotiations compared to formal bank loans.

No Repayment Obligations

Another compelling benefit of angel investment is that it typically does not involve repayment obligations like traditional loans. This means that startups do not have to worry about monthly payments or interest rates.

- Financial relief: Entrepreneurs can focus on growing their businesses without the immediate pressure of debt repayment.

- Equity-based financing: Since angel investors take an equity stake in the company, their return on investment is tied to the company’s success rather than fixed repayments.

Access to Mentorship and Expertise

Many business angels are seasoned entrepreneurs themselves who have navigated the challenges of building a successful business. Their experience can be invaluable for new founders.

- Strategic guidance: Angel investors often provide insights into market trends, operational strategies, and effective management practices.

- Avoiding common pitfalls: With their wealth of experience, they can help startups avoid mistakes that could derail their growth.

Flexible Investment Terms

Business angels typically offer more flexible terms compared to traditional lenders. They may be willing to negotiate on various aspects of the investment agreement.

- Customizable agreements: Entrepreneurs can discuss terms that align with their specific needs and growth plans.

- Less stringent requirements: Unlike banks that may require extensive documentation and collateral, angel investors often have more relaxed criteria.

Networking Opportunities

Angel investors often come with extensive networks that can be leveraged by startups. These connections can open doors to potential customers, partners, and additional funding sources.

- Access to valuable contacts: Business angels can introduce entrepreneurs to key industry players who may be instrumental in scaling their businesses.

- Potential follow-on funding: A well-connected angel investor may facilitate introductions to venture capitalists or other investors for future rounds of funding.

External Accountability and Discipline

Engaging with a business angel introduces an element of external scrutiny that can foster better discipline within the startup.

- Improved governance: The presence of an investor can lead to more structured decision-making processes.

- Enhanced performance tracking: Regular updates and accountability measures may help keep the business on track toward its goals.

No Collateral Required

Unlike traditional loans that often require personal assets as collateral, funding from business angels typically does not involve such risks.

- Reduced personal risk: Entrepreneurs do not have to jeopardize their personal assets when seeking investment from angels.

- Greater financial flexibility: This allows startups to allocate resources more freely without the fear of losing personal property if they fail to meet loan obligations.

Loss of Equity and Control

While there are many advantages to securing investment from business angels, one significant drawback is the potential loss of equity in the company.

- Dilution of ownership: Entrepreneurs may have to give up a substantial portion of their company (typically 10% to 50%) in exchange for capital.

- Impact on decision-making power: With decreased ownership stakes, founders might find themselves having less influence over critical business decisions.

High Expectations for Returns

Business angels are typically looking for significant returns on their investments. This expectation can create pressure on entrepreneurs to achieve rapid growth.

- Pressure for performance: Angels often expect returns equivalent to 10 times their initial investment within five to seven years, which may not align with a startup’s natural growth trajectory.

- Focus on short-term gains: This pressure can lead entrepreneurs to prioritize immediate profits over long-term sustainability.

Potential for Investor Interference

While mentorship is valuable, it can also lead to conflicts if an investor becomes overly involved in day-to-day operations or strategic decisions.

- Loss of autonomy: Founders may find themselves needing to justify decisions or strategies to their investors, which could conflict with their vision for the company.

- Conflict resolution challenges: Differing opinions between founders and investors can lead to tension and hinder decision-making processes.

Lengthy Search for Suitable Investors

Finding the right angel investor can be a time-consuming process. Entrepreneurs must invest effort into identifying potential backers who align with their vision and values.

- Building relationships takes time: Establishing trust and rapport with potential investors is essential but can prolong the fundraising process.

- Not all angels are a good fit: Entrepreneurs must carefully vet potential investors to ensure compatibility in terms of goals and expectations.

Limited Investment Size

Business angels typically invest smaller amounts compared to venture capitalists. This limitation may pose challenges for startups seeking larger sums of capital.

- Investment range constraints: Many angel investments range from €25,000 up to €500,000; startups requiring more substantial funding might need additional sources.

- Multiple rounds needed: Startups may need to engage multiple angel investors or seek venture capital after initial funding rounds from angels.

Risk of Misalignment of Goals

The objectives of entrepreneurs and business angels may not always align perfectly.

- Different timelines for exit strategies: While entrepreneurs might be focused on long-term growth, investors may prioritize quicker exits for returns on their investments.

- Potential conflicts over strategy: Misalignment in vision could lead to disagreements regarding the direction and management style of the company.

Possibility of Pressure to Sell Early

Angel investors often look for an exit strategy that allows them to realize returns on their investments within a specific timeframe.

- Encouragement towards premature exits: Investors might push founders toward selling the business before they feel ready or before maximizing its potential value.

- Impact on long-term strategy: This pressure could divert focus away from sustainable growth strategies in favor of short-term sale opportunities.

In conclusion, while engaging with business angels offers numerous advantages such as quick access to funding, mentorship opportunities, and no repayment obligations, it also comes with significant drawbacks including loss of control over one’s company and high expectations for returns. Entrepreneurs must weigh these pros and cons carefully when considering whether angel investment aligns with their long-term goals. Understanding both sides will enable them to make informed decisions about financing options that best suit their unique circumstances in today’s dynamic financial landscape.

Frequently Asked Questions About Business Angels Pros And Cons

- What is a business angel?

A business angel is a high-net-worth individual who invests personal funds into startups in exchange for equity ownership. - What are the main advantages of working with business angels?

The main advantages include quick access to funding, no repayment obligations, access to mentorship and expertise, flexible terms, networking opportunities, external accountability, and no collateral requirements. - What are some disadvantages associated with angel investment?

Disadvantages include loss of equity and control, high expectations for returns from investors, potential interference in operations, lengthy searches for suitable investors, limited investment sizes, misalignment of goals between founders and investors, and pressure to sell early. - How much equity do I typically need to give up?

Entrepreneurs usually give up between 10% and 50% equity when securing funding from business angels. - Can I expect mentorship from my angel investor?

Yes! Many business angels provide valuable mentorship based on their own experiences as successful entrepreneurs. - How do I find a suitable business angel?

You can find suitable business angels through networking events, online platforms dedicated to connecting startups with investors, or through referrals from your professional network. - What should I consider before seeking angel investment?

You should consider your willingness to give up equity and control over your company as well as your ability to meet investor expectations regarding growth. - Is it common for angels to push for an early exit?

Yes, many angel investors seek quick returns on their investments which may lead them to encourage founders toward selling before they feel ready.