Capital One Financial Corporation is a prominent American bank holding company that specializes in credit cards, auto loans, banking, and savings accounts. Founded in 1994 and headquartered in Tysons, Virginia, Capital One has grown to become one of the largest banks in the United States, known for its innovative digital banking solutions and competitive financial products. This article explores the various advantages and disadvantages of banking with Capital One, offering insights for individuals interested in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Strong digital banking platform with user-friendly mobile app | Limited physical branch locations in the U.S. |

| No minimum balance requirements on accounts | Higher interest rates available at some competing online banks |

| Competitive APY on savings accounts and CDs | Customer service can be challenging to reach during peak times |

| No monthly maintenance fees on most accounts | Limited cash deposit options compared to traditional banks |

| Access to over 70,000 fee-free ATMs nationwide | Some accounts do not come with debit or ATM cards |

| Early direct deposit feature for quicker access to funds | Potential fees for out-of-network ATM usage |

| Robust fraud protection and security measures | Complex account opening process with multiple verification steps |

| Innovative features like CreditWise for credit monitoring | Limited options for certain types of accounts (e.g., money market accounts) |

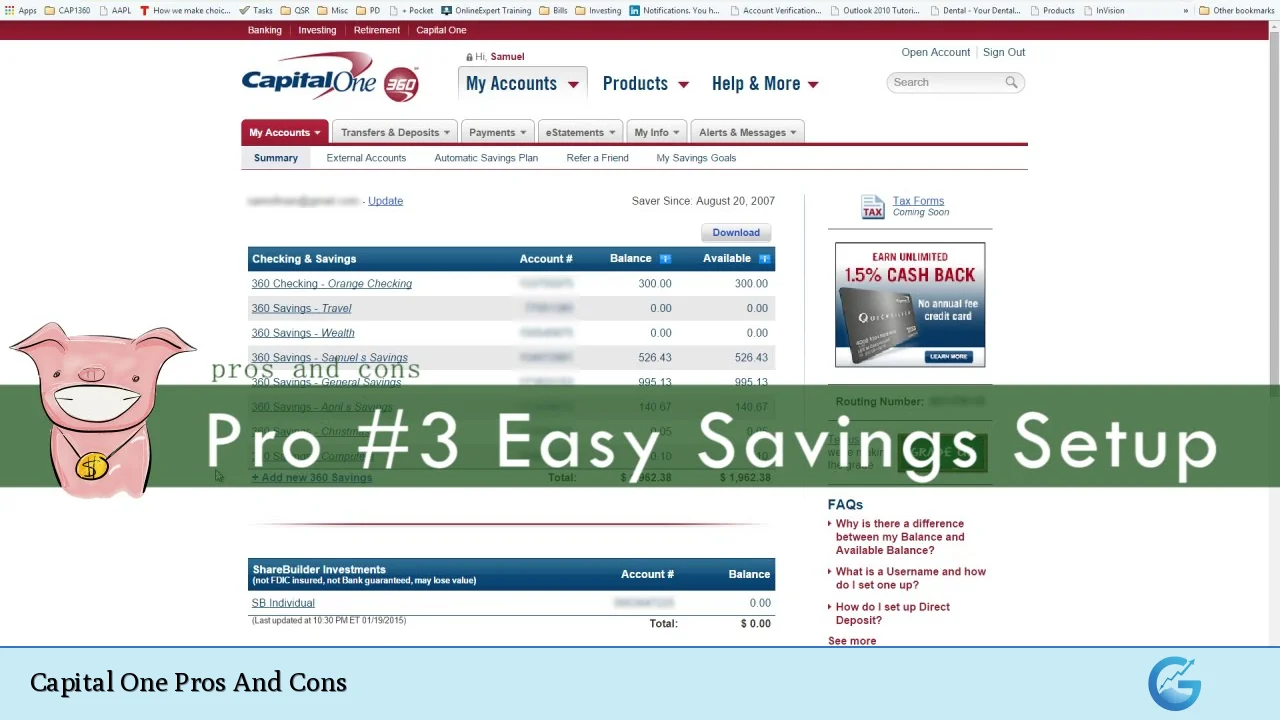

Strong Digital Banking Platform

Capital One is recognized for its strong digital banking platform, which includes a highly rated mobile app. The app allows users to manage their finances seamlessly, providing features such as:

- Mobile check deposits: Users can deposit checks directly through the app.

- Instant fund transfers: Transfers between Capital One accounts are typically instantaneous.

- Credit monitoring: With CreditWise, users can track their credit scores and receive personalized tips.

This digital-first approach caters well to tech-savvy customers who prefer managing their finances online or through mobile devices.

No Minimum Balance Requirements

One of the significant advantages of Capital One is its no minimum balance requirement policy across most of its accounts. This feature is particularly appealing to those who may not have large sums to deposit initially or who want flexibility in managing their finances without the pressure of maintaining a specific balance.

Competitive APY on Savings Accounts

Capital One offers competitive annual percentage yields (APY) on its savings accounts and certificates of deposit (CDs). As of late 2024, the 360 Performance Savings account boasts an APY significantly higher than the national average. This makes it an attractive option for savers looking to grow their money without incurring fees or penalties.

No Monthly Maintenance Fees

Most Capital One accounts come with no monthly maintenance fees, which is a considerable advantage over traditional banks that often charge monthly fees that can eat into savings. This policy allows customers to keep more of their money working for them rather than paying it out in fees.

Access to Over 70,000 Fee-Free ATMs

Capital One provides access to a vast network of over 70,000 fee-free ATMs across the United States. This extensive network ensures that customers can easily access their funds without incurring additional charges, enhancing convenience for those who frequently withdraw cash.

Early Direct Deposit Feature

The early direct deposit feature allows customers to receive their paychecks up to two days earlier than traditional banks. This capability can significantly improve cash flow management for individuals who rely on timely access to their funds.

Robust Fraud Protection and Security Measures

Capital One employs robust fraud protection measures, including encryption technology and multi-factor authentication. These security features help protect customer information and funds from unauthorized access, providing peace of mind when banking online.

Innovative Features Like CreditWise

Capital One’s CreditWise tool offers users free access to their credit score and personalized insights on improving it. This feature not only helps users monitor their credit health but also educates them on financial literacy, making it a valuable resource for anyone looking to enhance their financial standing.

Limited Physical Branch Locations

Despite its many advantages, one notable disadvantage of Capital One is its limited physical branch locations. While it operates around 750 branches primarily in select states, customers outside these areas may find it challenging to access in-person services. This limitation may deter individuals who prefer face-to-face interactions when managing their finances.

Higher Interest Rates Available at Competing Online Banks

Although Capital One offers competitive rates on its savings products, some online banks provide even higher interest rates. Customers seeking the absolute best returns on their savings might find better options elsewhere. It’s essential for potential customers to compare rates before committing to an account.

Customer Service Challenges

While Capital One generally receives positive feedback regarding its customer service, some users report challenges in reaching representatives during peak times. Long wait times or difficulty navigating automated systems can lead to frustration when assistance is needed urgently.

Limited Cash Deposit Options

Capital One’s online banking model poses challenges for customers who frequently deal with cash deposits. While there are options for depositing cash at select ATMs or retail partners like CVS and Walgreens, these methods may not be as convenient as traditional bank branches that offer direct cash deposits.

Some Accounts Lack Debit or ATM Cards

Certain Capital One accounts do not come with debit or ATM cards, which could inconvenience customers accustomed to having easy access to their funds via physical cards. This limitation may require users to adapt to alternative withdrawal methods.

Potential Fees for Out-of-Network ATM Usage

Although Capital One provides access to a vast network of fee-free ATMs, using out-of-network ATMs can incur fees. Customers should be aware of these potential charges when withdrawing cash outside the Capital One network.

Complex Account Opening Process

Some users have reported that the account opening process at Capital One can be complex and time-consuming due to multiple verification steps. While these measures are essential for security, they may deter potential customers looking for a quick and straightforward setup experience.

Limited Options for Certain Types of Accounts

Capital One has phased out some account types, such as money market accounts for new customers. Individuals seeking specific account features may need to explore other financial institutions that offer a broader range of products tailored to their needs.

In conclusion, Capital One presents a compelling choice for many consumers seeking modern banking solutions with competitive rates and robust digital tools. However, like any financial institution, it has its drawbacks that potential customers should consider before opening an account. By weighing these pros and cons carefully, individuals can make informed decisions about whether Capital One aligns with their financial goals.

Frequently Asked Questions About Capital One Pros And Cons

- What are the main advantages of using Capital One?

The main advantages include a strong digital banking platform, no minimum balance requirements, competitive APY on savings accounts, no monthly maintenance fees, and access to numerous fee-free ATMs. - What are some disadvantages associated with Capital One?

Disadvantages include limited physical branch locations, potential higher interest rates available at competing online banks, customer service challenges during peak times, and limited cash deposit options. - How does Capital One’s APY compare with other banks?

While Capital One offers competitive APYs on its savings products, some online banks provide even higher rates; thus it’s important to compare before deciding. - Can I deposit cash at Capital One?

You can deposit cash at select ATMs or retail partners like CVS and Walgreens; however, this may not be as convenient as traditional bank branches. - Is there a fee for using out-of-network ATMs?

Yes, using out-of-network ATMs may incur fees; it’s advisable to use Capital One’s network of fee-free ATMs whenever possible. - What security measures does Capital One implement?

Capital One employs robust security measures including encryption technology and multi-factor authentication to protect customer information. - Does Capital One offer any tools for credit monitoring?

Yes, Capital One provides CreditWise which allows users free access to their credit score along with personalized insights. - Are there any monthly maintenance fees with Capital One accounts?

No, most Capital One accounts do not have monthly maintenance fees which is beneficial for consumers looking to avoid unnecessary charges.