Cash App, launched in 2013 by Square, Inc., has rapidly gained popularity as a mobile payment service in the United States and the UK. It allows users to send and receive money easily, buy and sell Bitcoin, and invest in stocks—all from a single app. As digital finance continues to evolve, understanding the advantages and disadvantages of Cash App is crucial for users interested in personal finance, cryptocurrency, forex, and money markets. This article provides a comprehensive overview of Cash App’s pros and cons to help potential users make informed decisions.

| Pros | Cons |

|---|---|

| User-friendly interface and quick setup | Limited customer service options |

| No monthly fees or overdraft charges | Transaction limits for new users |

| Ability to buy and sell Bitcoin | Lack of FDIC insurance for funds |

| Instant transfers between users | Fees for instant transfers and ATM withdrawals |

| Investment options with no commission fees | Inability to retract payments once sent |

| Cash Card with cashback rewards | Limited deposit methods available |

| Convenient bill-splitting feature | Cannot be used internationally outside the US and UK |

| Round-up feature for savings and investments | Potential for scams targeting users |

User-friendly Interface and Quick Setup

One of the standout features of Cash App is its user-friendly interface, which allows even those who are not tech-savvy to navigate the app easily. The setup process is straightforward; users can create an account in just a few minutes by providing their phone number or email address.

- Ease of Use: The app’s design emphasizes simplicity, making it easy to send or request money.

- Quick Transactions: Users can complete transactions almost instantaneously, which is particularly beneficial for those who need to make last-minute payments.

No Monthly Fees or Overdraft Charges

Cash App does not charge monthly maintenance fees or overdraft fees, making it an attractive option for individuals looking to manage their finances without incurring additional costs.

- Cost-Effective: Users can enjoy various services without worrying about hidden fees that are common with traditional banking.

- Budget-Friendly: This feature is especially appealing to younger users or those on a tight budget who want to avoid unnecessary charges.

Ability to Buy and Sell Bitcoin

Cash App allows users to buy, sell, and hold Bitcoin directly within the app. This feature positions Cash App as a versatile platform for those interested in cryptocurrency.

- Low Transaction Fees: The fee structure for Bitcoin transactions is competitive compared to other platforms like Coinbase.

- Accessibility: Users can easily engage in cryptocurrency trading without needing separate accounts on different exchanges.

Instant Transfers Between Users

Cash App facilitates instant transfers between users, allowing money to be sent or received in seconds.

- Convenience: This feature is perfect for splitting bills at restaurants or sending money to friends quickly.

- Social Integration: Many users find it useful for casual transactions among friends or family members.

Investment Options with No Commission Fees

In addition to its payment features, Cash App offers investment capabilities, allowing users to buy stocks without commission fees.

- Diversification: Users can invest in fractional shares of popular companies without needing significant capital upfront.

- Simplicity: The integration of investment features within the same app streamlines financial management.

Cash Card with Cashback Rewards

Cash App provides a debit card known as the Cash Card, which offers various benefits including cashback rewards on certain purchases.

- Incentives for Spending: Users can earn rewards on everyday purchases, enhancing the overall value of using Cash App.

- Flexibility: The Cash Card can be used anywhere Visa is accepted, making it versatile for both online and offline transactions.

Convenient Bill-Splitting Feature

The bill-splitting feature simplifies group payments by allowing users to easily request money from multiple people after a shared expense.

- Social Utility: This function is particularly useful for social gatherings where expenses need to be shared among friends.

- Tracking Payments: Users can keep track of who has paid back their share through the app’s interface.

Round-up Feature for Savings and Investments

Cash App includes a round-up feature that automatically rounds up purchases made with the Cash Card to the nearest dollar, investing the difference into stocks or Bitcoin.

- Encourages Saving: This feature promotes saving habits without requiring significant effort from users.

- Automated Investing: It allows users to invest small amounts regularly without needing to think about it actively.

Limited Customer Service Options

Despite its many advantages, Cash App has been criticized for its limited customer service options.

- Lack of Immediate Support: Users often report difficulties reaching customer service representatives when issues arise.

- Reliance on In-App Support: Most support is conducted through chat within the app, which may not be ideal during urgent situations involving money transactions.

Transaction Limits for New Users

New users face transaction limits during their initial 30 days on Cash App.

- Initial Restrictions: Users can only send or receive up to $1,000 during this period.

- Frustration for Heavy Users: Those looking to conduct larger transactions may find this limitation inconvenient until they verify their identities and increase their limits.

Lack of FDIC Insurance for Funds

Funds held in Cash App are not insured by the Federal Deposit Insurance Corporation (FDIC), which poses risks for users who keep significant balances in the app.

- Risk Awareness: Without FDIC coverage, there is no guarantee that funds will be protected in case of company insolvency or technical issues.

- Caution Advised: Users should be cautious about keeping large sums of money in Cash App due to this lack of insurance.

Fees for Instant Transfers and ATM Withdrawals

While sending money between Cash App users is free, there are fees associated with instant transfers and ATM withdrawals.

- Instant Transfer Fees: If you choose an instant transfer from your Cash App balance to your bank account, a fee of 1.5% applies.

- ATM Withdrawal Fees: Using out-of-network ATMs incurs a $2.50 fee unless you have set up direct deposits totaling $300 or more each month.

Inability to Retract Payments Once Sent

One significant drawback of Cash App is that once a payment has been sent, it cannot be retracted.

- Risk of Errors: This can lead to problems if money is accidentally sent to the wrong person or if a user falls victim to scams.

- User Responsibility: It places a heavy responsibility on users to double-check recipient details before completing transactions.

Limited Deposit Methods Available

Users have reported challenges when trying to deposit funds into their Cash App accounts.

- Restrictions on Deposits: Some have experienced difficulties even when using personal debit cards linked under their names.

- Inconvenience Factor: This limitation can hinder quick access to funds when needed most.

Cannot Be Used Internationally Outside the US and UK

Cash App’s functionality is limited geographically; it cannot be used outside of the United States and the United Kingdom.

- Travel Limitations: For frequent travelers or expatriates, this restriction can pose significant challenges when trying to manage finances abroad.

- Alternative Solutions Needed: Users may need to rely on other payment apps that offer international services when traveling outside these regions.

Potential for Scams Targeting Users

As with many financial applications, there is a risk of scams targeting Cash App users.

- Scam Awareness Required: Users must remain vigilant against phishing attempts and fraudulent requests.

- Education on Security Practices Needed: Understanding how to recognize potential scams is essential for safe usage of the app.

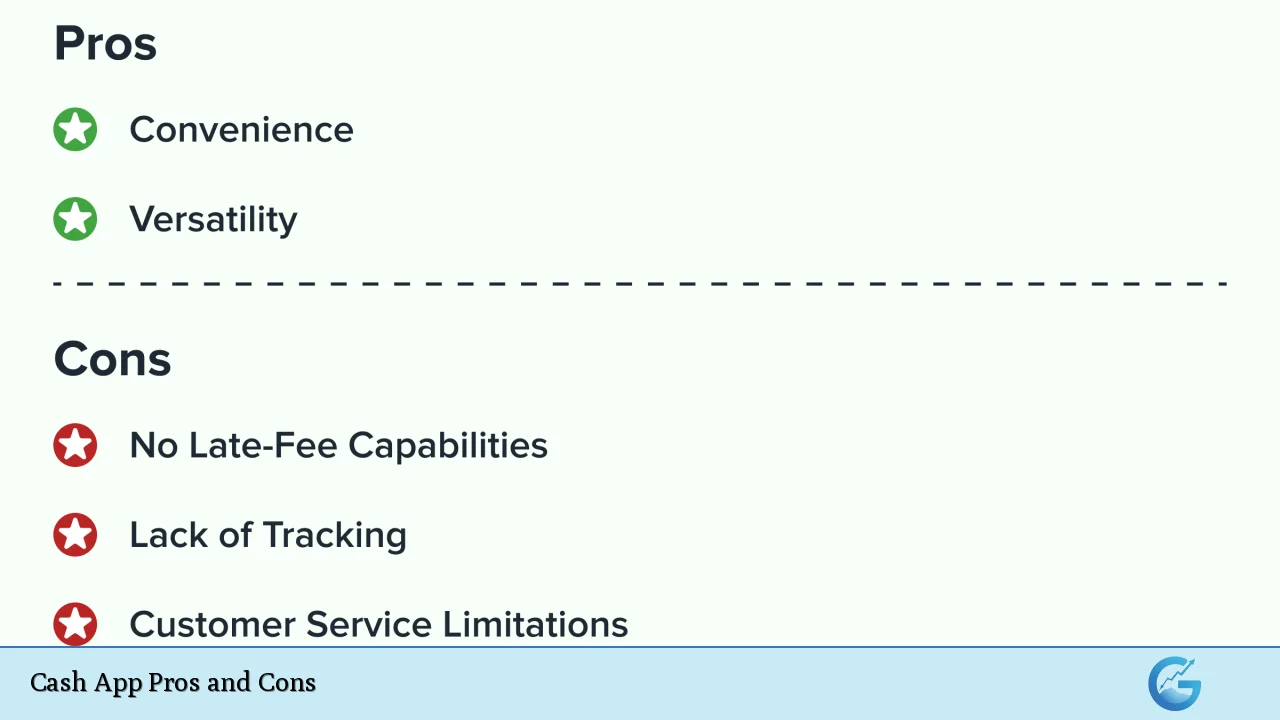

In conclusion, while Cash App offers numerous advantages such as ease of use, no monthly fees, investment options, and innovative features like bill-splitting and round-ups, it also presents several disadvantages including limited customer service options, transaction limits for new users, lack of FDIC insurance, and potential risks associated with scams. Therefore, it’s essential for potential users—especially those involved in finance, crypto trading, forex markets, or general money management—to weigh these pros and cons carefully before deciding whether Cash App meets their financial needs effectively.

Frequently Asked Questions About Cash App

- What are the main features of Cash App?

The main features include peer-to-peer payments, Bitcoin trading, stock investments without commissions, a debit card with cashback rewards, and bill-splitting functionalities. - Is my money safe with Cash App?

Funds held in Cash App are not insured by FDIC; therefore, it’s advisable not to keep large amounts in your account. - Can I use Cash App internationally?

No, Cash App is only available in the United States and the United Kingdom. - What happens if I send money by mistake?

Once sent through Cash App, payments cannot be retracted; it’s crucial to double-check recipient details before confirming transactions. - Are there any fees associated with using Cash App?

While sending money between users is free, there are fees for instant transfers (1.5%) and out-of-network ATM withdrawals ($2.50). - How do I increase my transaction limits on Cash App?

You can increase your limits by verifying your identity through the app settings. - What should I do if I encounter a scam?

If you suspect you have been scammed on Cash App, report it immediately through their support channels. - Can I invest using Cash App?

Yes! You can buy stocks with no commission fees directly through the app.