When it comes to real estate transactions, cash offers have gained significant traction among buyers and sellers alike. A cash offer is when a buyer proposes to purchase a property outright without relying on mortgage financing. This approach can streamline the buying and selling process, but it also comes with its own set of advantages and disadvantages. Understanding these pros and cons is essential for anyone involved in the real estate market, particularly those interested in finance, investment strategies, and market dynamics.

The appeal of cash offers lies in their potential for speed and simplicity. In a competitive housing market, cash offers can make a buyer’s proposal stand out, while sellers may appreciate the reduced risk of financing complications. However, there are also notable drawbacks that can impact both parties involved in the transaction.

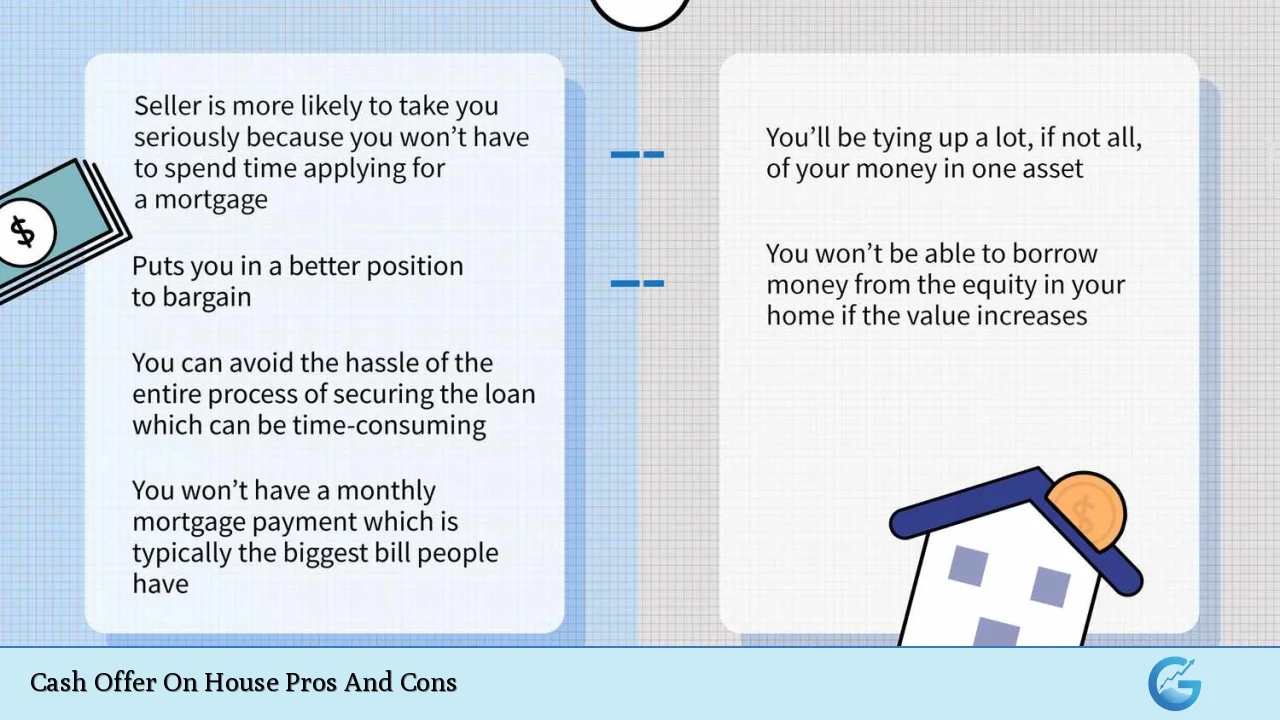

| Pros | Cons |

|---|---|

| Faster closing process | Potentially lower sale price |

| Fewer contingencies | Liquidity concerns for buyers |

| Less risk of deal falling through | Missed mortgage-related tax benefits |

| Simplified transaction process | Limited negotiation power for sellers |

| No appraisal required | Less competition in bidding wars |

| Ability to sell as-is | Possibility of hidden costs from cash buyers |

| More attractive to sellers in competitive markets | Risk of scams or fraud with unverified buyers |

| Reduced closing costs due to fewer fees | Potential for rushed decisions by sellers |

Faster Closing Process

One of the most significant advantages of accepting a cash offer is the speed at which the transaction can close.

- Quick Transactions: Cash deals can close in as little as one week, compared to the typical 30-60 days required for financed transactions.

- Less Waiting: Without the need for mortgage approvals or underwriting processes, both parties can expedite their plans.

This rapid closing process is particularly beneficial for sellers looking to relocate quickly or those facing financial pressures.

Fewer Contingencies

Cash offers generally come with fewer contingencies compared to financed purchases.

- Reduced Risk: Sellers don’t have to worry about financing falling through due to loan denials or appraisal issues.

- Simplified Process: With fewer conditions attached, the transaction becomes more straightforward and less stressful.

This reduction in contingencies makes cash offers appealing to sellers who want certainty in their sale.

Less Risk of Deal Falling Through

The reliability of cash offers significantly reduces the risk that a deal will fall apart.

- Immediate Funds: Buyers with cash can demonstrate their financial capability upfront, ensuring that they can complete the purchase without delays.

- Peace of Mind: For sellers, this means a higher likelihood that the sale will go through as planned.

This assurance is particularly valuable in fluctuating markets where financing issues could derail a sale at any moment.

Simplified Transaction Process

Cash transactions tend to be less complicated than those involving financing.

- Minimal Paperwork: With no lender involved, there’s less paperwork to manage, making the process smoother.

- Streamlined Communication: Fewer parties mean simpler communication, reducing potential misunderstandings or delays.

This simplicity can be especially appealing for first-time home sellers who may find traditional sales daunting.

No Appraisal Required

In many cases, cash buyers do not require an appraisal before purchasing a home.

- Avoiding Delays: This eliminates one of the most common bottlenecks in real estate transactions—waiting for an appraisal to confirm property value.

- Direct Transactions: Sellers can often bypass lengthy negotiations over appraised values, leading to faster agreements.

However, skipping the appraisal might mean that sellers risk undervaluing their property if they are not careful.

Ability to Sell As-Is

Cash buyers often purchase properties “as-is,” which means sellers do not need to invest time or money into repairs before selling.

- Cost Savings: This can save sellers significant expenses related to renovations or staging.

- Convenience: Sellers looking for quick sales can avoid the hassle of preparing their home for traditional showings.

This aspect is particularly attractive for homeowners looking to sell distressed properties or those who wish to avoid extensive renovations.

More Attractive to Sellers in Competitive Markets

In hot real estate markets, cash offers often stand out among multiple bids.

- Bidding Advantage: Sellers may prioritize cash offers over financed ones due to their reliability and speed.

- Negotiation Leverage: Cash buyers may have more negotiating power because they present less risk to sellers.

Being able to present an all-cash offer can be a decisive factor in winning a competitive bidding situation.

Potentially Lower Sale Price

Despite their advantages, cash offers often come with trade-offs, one being potentially lower sale prices than financed offers.

- Discount Expectations: Cash buyers may expect discounts due to the convenience they provide.

- Investor Offers: Many cash buyers are investors looking for profitable deals and may offer significantly below market value.

Sellers must weigh the benefits of a quick sale against potentially receiving less money than they would from traditional buyers.

Liquidity Concerns for Buyers

For buyers making cash offers, there are liquidity concerns associated with tying up large sums of money in real estate.

- Limited Funds Available: Buyers may find themselves with limited liquid assets after purchasing a home outright.

- Emergency Preparedness: In case of unforeseen expenses or emergencies, having substantial funds tied up in property could pose risks.

Buyers should carefully consider their financial situation before making large cash investments in real estate.

Missed Mortgage-related Tax Benefits

By opting for a cash purchase, buyers miss out on certain tax benefits associated with mortgage financing.

- Tax Deductions: Homeowners with mortgages can deduct interest payments and other related costs on their taxes.

- Long-term Financial Planning: Buyers should consider how foregoing these benefits impacts their overall financial strategy.

This aspect might deter some from making all-cash offers if they are focused on maximizing tax efficiency over time.

Limited Negotiation Power for Sellers

While cash offers provide certainty, they can also limit negotiation power for sellers regarding price and terms.

- Take-it-or-leave-it Offers: Cash buyers might present fixed prices that leave little room for negotiation.

- Pressure on Sellers: The urgency that comes with some cash offers may pressure sellers into accepting terms they wouldn’t otherwise consider if given more time or options.

Sellers should approach cash offers with an understanding of their negotiating position and potential limitations.

Less Competition in Bidding Wars

Accepting a cash offer might mean losing out on potential bidding wars that could drive up sale prices.

- Single Offers: Cash buyers often provide single offers without competing bids that could increase overall sale value.

- Market Dynamics: In slower markets, this lack of competition could lead sellers to miss out on higher-priced opportunities from traditional buyers willing to finance their purchase.

Sellers should evaluate whether accepting a cash offer aligns with their financial goals and market conditions before proceeding.

Possibility of Hidden Costs from Cash Buyers

Some cash buyers may incorporate hidden costs into their offers that could affect net proceeds from the sale.

- Service Fees: Investors or companies buying homes for cash might charge substantial service fees that reduce overall profits from the sale.

- Transparency Issues: It’s crucial for sellers to understand all terms associated with a cash offer before agreeing to ensure they aren’t blindsided by unexpected costs later on.

Sellers should conduct thorough due diligence when evaluating any offer, especially from institutional investors or companies specializing in quick home purchases.

Risk of Scams or Fraud with Unverified Buyers

The rise in popularity of cash offers has also led to an increase in fraudulent schemes targeting unsuspecting sellers.

- Verification Importance: Sellers must ensure they verify proof of funds and perform background checks on potential buyers.

- Legal Protections: Engaging professionals such as real estate agents or attorneys can help mitigate risks associated with scams during transactions involving significant amounts of money.

Being vigilant about buyer legitimacy is essential when considering accepting a cash offer.

Potentially Rushed Decisions by Sellers

The speed associated with cash transactions might lead some sellers to make hasty decisions regarding their property sales.

- Pressure Factors: Sellers under time constraints might feel pressured into accepting an offer without fully considering alternatives.

- Long-term Implications: Rushed decisions could lead to regrets if better opportunities arise shortly after selling at less than optimal terms.

Sellers should take care not to compromise on critical aspects simply due to the allure of quick sales without adequate consideration.

In conclusion, while cash offers present numerous advantages such as faster closing times and fewer contingencies, they also come with significant drawbacks including potentially lower sale prices and liquidity concerns. Both buyers and sellers must carefully evaluate these factors based on individual circumstances and market conditions before proceeding with any transaction involving cash offers. Understanding these dynamics is crucial for anyone involved in real estate transactions today.

Frequently Asked Questions About Cash Offer On House

- What is a cash offer?

A cash offer is when a buyer proposes to purchase a property outright without needing mortgage financing. - Are cash offers typically lower than financed offers?

Yes, many times they are lower because buyers expect discounts for providing quick payments. - What are the benefits of making a cash offer?

The main benefits include faster closing times, fewer contingencies, and less risk of deal fall-through. - What are common risks associated with accepting a cash offer?

The primary risks include potentially receiving lower prices and missing out on mortgage-related tax benefits. - How quickly can a cash transaction close?

A cash transaction can close as quickly as one week compared to 30–60 days for financed deals. - Can I negotiate a cash offer?

Yes, but it may be limited depending on how competitive the market is and how motivated the buyer is. - What should I verify when considering a cash offer?

Sellers should verify proof of funds and ensure that all terms are clear before proceeding. - Are there any hidden costs associated with cash sales?

Yes, some investors may include hidden fees that could affect your net proceeds from the sale.