In the ever-evolving landscape of finance, understanding the advantages and disadvantages of holding cash is crucial for investors and individuals alike. As we navigate through uncertain economic times, the role of cash in investment portfolios and personal finances has become increasingly significant. This comprehensive analysis delves into the multifaceted nature of cash, exploring its benefits and drawbacks in various financial contexts.

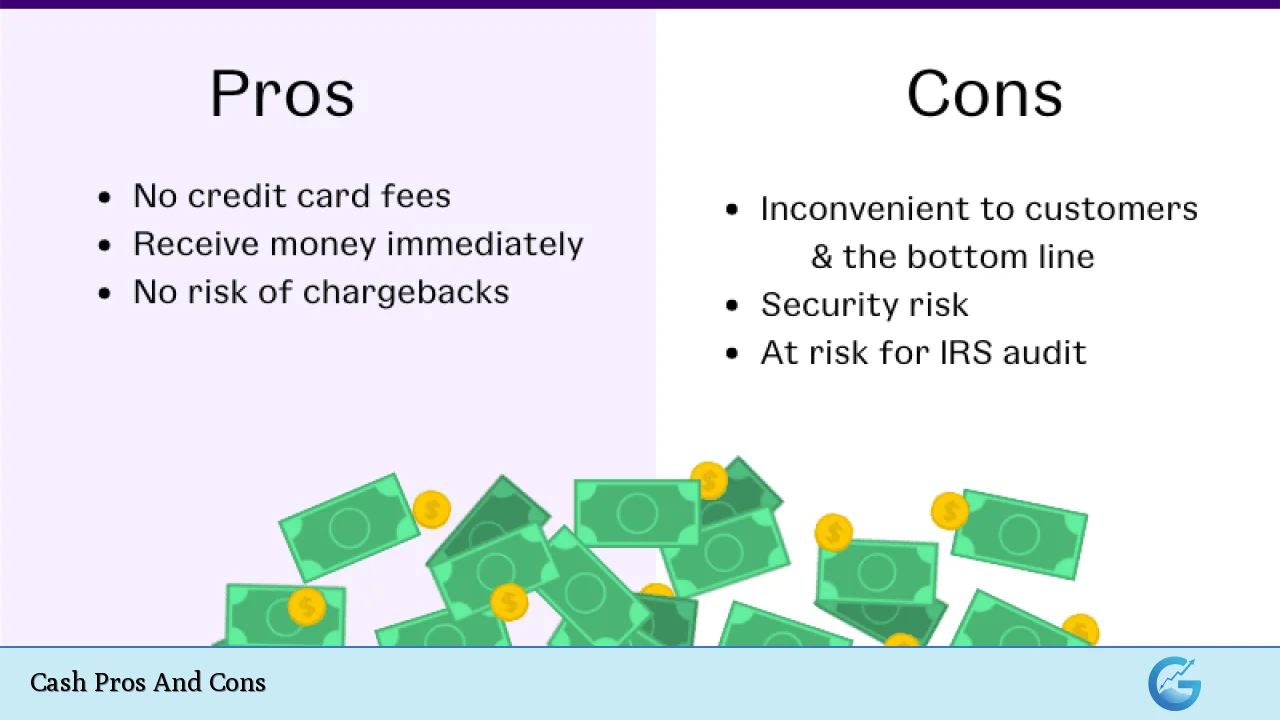

| Pros | Cons |

|---|---|

| Liquidity and Accessibility | Inflation Risk |

| Safety and Capital Preservation | Opportunity Cost |

| Flexibility for Investment Opportunities | Low Returns |

| Emergency Fund Utility | Psychological Temptation |

| Hedge Against Market Volatility | Counterparty Risk |

| Simplicity and Peace of Mind | Currency Devaluation Risk |

Advantages of Holding Cash

Liquidity and Accessibility

Cash remains the most liquid asset, providing immediate access to funds for various purposes. This characteristic is particularly valuable in today’s fast-paced financial environment, where opportunities and emergencies can arise unexpectedly. The ability to quickly deploy capital or meet financial obligations without the need for asset liquidation is a significant advantage of maintaining cash reserves.

- Instant availability for transactions and payments

- No conversion or settlement periods required

- Facilitates smooth cash flow management for businesses and individuals

Safety and Capital Preservation

In times of economic uncertainty or market turbulence, cash serves as a safe haven for capital preservation. Unlike volatile assets such as stocks or cryptocurrencies, the nominal value of cash remains stable, offering a sense of security to risk-averse investors.

- Protects principal in times of market downturns

- Provides a stable component in diversified portfolios

- Offers peace of mind during economic uncertainties

Flexibility for Investment Opportunities

Maintaining a cash position allows investors to capitalize on market dips or emerging investment opportunities swiftly. This “dry powder” strategy can be particularly advantageous in volatile markets, where timing can significantly impact returns.

- Enables quick response to market corrections

- Allows for strategic asset allocation adjustments

- Provides leverage in negotiations for large purchases or investments

Emergency Fund Utility

Financial experts consistently emphasize the importance of maintaining an emergency fund, typically recommended to cover 3-6 months of living expenses. Cash is the ideal asset for this purpose due to its immediate availability and stability.

- Provides a financial buffer against unexpected expenses or income loss

- Reduces reliance on high-interest debt in emergencies

- Enhances overall financial stability and resilience

Hedge Against Market Volatility

In periods of high market volatility or economic downturns, cash can act as a stabilizing force in investment portfolios. Its non-correlation with other asset classes helps in mitigating overall portfolio risk.

- Balances portfolio risk during market turbulence

- Offers a stable value when other assets may be declining

- Provides psychological comfort during market stress

Simplicity and Peace of Mind

The straightforward nature of cash as an asset class offers simplicity in financial management and peace of mind. Unlike complex financial instruments, cash requires no ongoing monitoring or management.

- Reduces cognitive load in financial decision-making

- Simplifies financial planning and budgeting

- Offers clarity in assessing one’s financial position

Disadvantages of Holding Cash

Inflation Risk

Perhaps the most significant drawback of holding cash is its vulnerability to inflation. Over time, the purchasing power of cash erodes as the general price level of goods and services increases. This silent wealth destroyer can significantly impact long-term financial goals.

- Reduces real value of savings over time

- Can lead to negative real returns in low-interest environments

- Particularly impactful in periods of high inflation

Opportunity Cost

By holding substantial amounts of cash, investors may miss out on potential returns from other asset classes. This opportunity cost can be substantial over long periods, especially when considering the power of compound interest.

- Foregone potential returns from stocks, bonds, or real estate

- Impact amplified in bull markets or periods of economic growth

- Can hinder long-term wealth accumulation goals

Low Returns

In the current low-interest-rate environment, cash and cash equivalents typically offer meager returns. Even high-yield savings accounts or money market funds often struggle to keep pace with inflation.

- Minimal interest earned on savings accounts and CDs

- Returns often below the rate of inflation

- Particularly problematic for retirees relying on interest income

Psychological Temptation

The high liquidity of cash can sometimes lead to impulsive spending or poor financial decisions. The ease of access may tempt individuals to use funds earmarked for long-term goals for short-term gratification.

- Can lead to overspending or unnecessary purchases

- May reduce discipline in adhering to financial plans

- Potentially undermines long-term savings goals

Counterparty Risk

While generally considered safe, cash held in banks or financial institutions is not entirely risk-free. Bank failures, though rare, can expose depositors to potential losses beyond the limits of deposit insurance.

- Risk of bank failures or financial institution insolvency

- Limited protection by deposit insurance schemes

- Potential for temporary inaccessibility during financial crises

Currency Devaluation Risk

For those holding significant amounts of cash in a single currency, there’s a risk of currency devaluation. This is particularly relevant in an increasingly globalized economy where exchange rates can fluctuate rapidly.

- Vulnerability to monetary policy decisions

- Impact of geopolitical events on currency values

- Potential for significant loss in purchasing power against other currencies

Strategic Considerations for Cash Management

Balancing the pros and cons of holding cash requires a nuanced approach tailored to individual financial situations and market conditions. Here are some strategic considerations for effective cash management:

- Diversification: While cash plays a crucial role, it should be part of a diversified portfolio that includes other asset classes to balance risk and return.

- Asset Allocation: Regularly review and adjust the proportion of cash in your portfolio based on market conditions, personal risk tolerance, and financial goals.

- Tiered Cash Strategy: Implement a tiered approach to cash holdings, with separate allocations for immediate needs, short-term goals, and long-term investment opportunities.

- Yield Optimization: Explore higher-yielding cash equivalents like high-yield savings accounts, money market funds, or short-term bond funds to mitigate the impact of inflation.

- Currency Diversification: Consider holding cash in multiple currencies to hedge against currency devaluation risks, especially for international investors or those with global financial interests.

- Regular Rebalancing: Periodically rebalance your portfolio to maintain your target cash allocation, selling other assets when they outperform and buying when cash levels are high.

- Tax Considerations: Be mindful of the tax implications of cash holdings, particularly for large amounts generating interest income.

- Inflation Protection: Explore inflation-protected securities or assets that can provide a hedge against inflation for longer-term cash holdings.

In conclusion, while cash offers unparalleled liquidity, safety, and flexibility, it’s crucial to balance these benefits against the risks of inflation and opportunity costs. A well-thought-out cash management strategy, integrated into a broader financial plan, can help individuals and investors navigate the complexities of modern finance while maintaining financial stability and pursuing long-term growth.

Frequently Asked Questions About Cash Pros And Cons

- How much cash should I keep in my investment portfolio?

The ideal cash allocation varies based on individual circumstances, risk tolerance, and market conditions. Generally, financial advisors recommend keeping 5-10% of an investment portfolio in cash, with higher allocations for more conservative investors or during uncertain market periods. - Are there any alternatives to traditional cash holdings that offer better returns?

Yes, alternatives include high-yield savings accounts, money market funds, short-term bond funds, and certificates of deposit (CDs). These options often provide higher yields than traditional savings accounts while maintaining relatively high liquidity. - How does inflation impact the value of cash holdings?

Inflation erodes the purchasing power of cash over time. If the inflation rate exceeds the interest rate earned on cash holdings, the real value of the cash decreases, potentially leading to a loss in purchasing power. - Is it wise to hold cash during a market downturn?

Holding some cash during market downturns can be advantageous, providing a buffer against volatility and the opportunity to invest at lower prices. However, timing the market is challenging, and excessive cash holdings may lead to missed opportunities for recovery. - How can I protect my cash holdings from currency devaluation?

Strategies to protect against currency devaluation include diversifying into multiple currencies, investing in assets denominated in stable currencies, or using currency hedging instruments like forward contracts or currency ETFs. - What are the tax implications of holding large amounts of cash?

Interest earned on cash holdings is typically taxable as ordinary income. For large cash holdings, this can result in a significant tax burden, especially in high-yield accounts. It’s important to consider after-tax returns when evaluating cash management strategies. - How does holding cash affect my overall investment strategy?

Cash acts as a stabilizing force in a portfolio, reducing overall volatility. However, excessive cash holdings can drag down long-term returns. Balancing cash with growth-oriented assets is crucial for achieving long-term financial goals. - Are there risks associated with holding too little cash?

Yes, holding insufficient cash can lead to liquidity problems, forcing the sale of assets at inopportune times to meet unexpected expenses or investment opportunities. It can also increase vulnerability to financial shocks or emergencies.