Cash value life insurance is a unique financial product that combines a death benefit with a savings component. Unlike term life insurance, which offers coverage for a specific period, cash value policies remain in effect for the lifetime of the insured, as long as premiums are paid. This type of insurance can accumulate cash value over time, allowing policyholders to access funds during their lifetime for various needs. However, it comes with its own set of advantages and disadvantages that potential buyers should carefully consider.

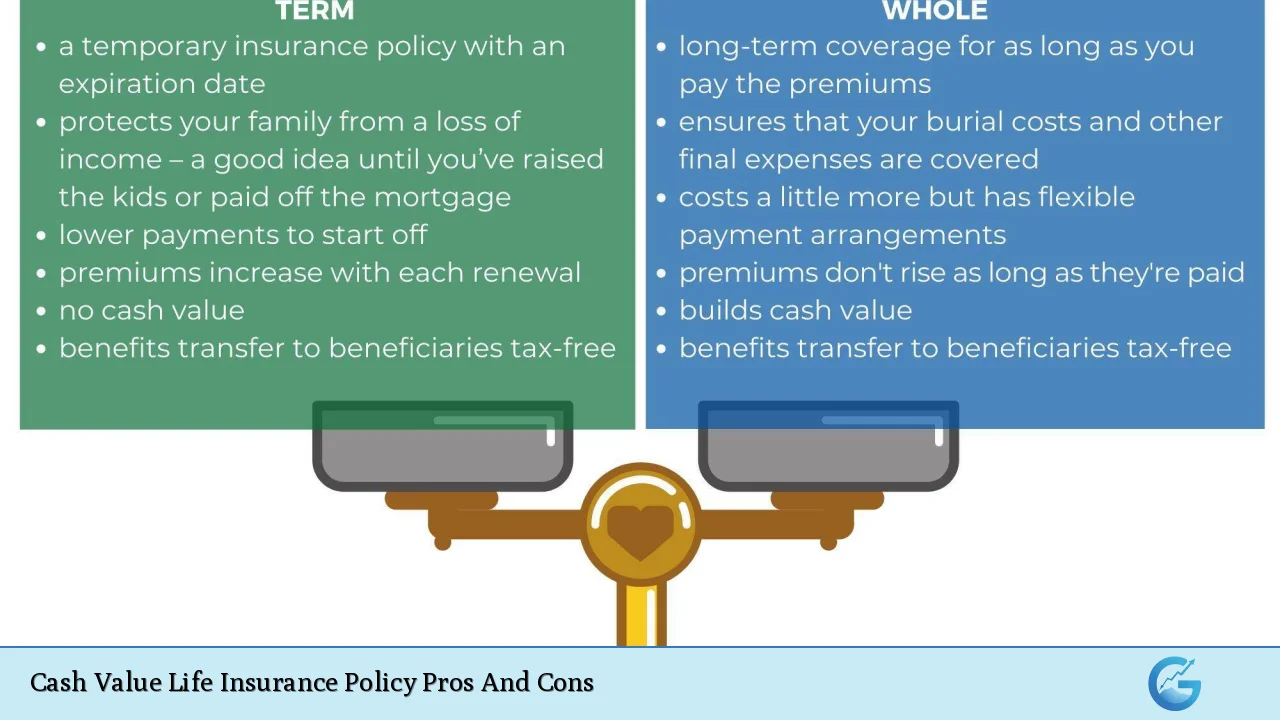

The following table summarizes the main pros and cons of cash value life insurance policies:

| Pros | Cons |

|---|---|

| Provides lifelong coverage regardless of health changes | Higher premiums compared to term life insurance |

| Cash value accumulates over time and can be accessed | Slow accumulation of cash value in the early years |

| Tax-deferred growth on cash value | Loans against cash value reduce death benefit |

| Potential for fixed or variable returns based on policy type | Complex policies requiring careful management |

| Can serve as collateral for loans or funding emergencies | Fees and charges can reduce overall cash value growth |

| Flexible premium payments in some policies | Surrender penalties if the policy is canceled early |

| Can be used as part of a comprehensive financial strategy | Not ideal for short-term insurance needs |

Lifelong Coverage

Cash value life insurance offers lifelong coverage, ensuring that beneficiaries receive a death benefit regardless of when the insured passes away. This aspect is particularly beneficial for individuals who may face health issues later in life, which could make obtaining new insurance difficult or impossible.

- Advantage: Provides peace of mind knowing that your loved ones will be financially protected.

- Disadvantage: The higher premiums associated with lifelong coverage can strain budgets, especially if the policyholder’s financial situation changes.

Cash Value Accumulation

One of the most attractive features of cash value life insurance is its ability to accumulate cash value over time. A portion of each premium payment goes into a savings component, which grows tax-deferred.

- Advantage: This accumulated cash can be accessed through loans or withdrawals for emergencies, college funding, or retirement planning.

- Disadvantage: It often takes several years before significant cash value accumulates, making it less appealing for those seeking immediate financial benefits.

Tax Advantages

The cash value in these policies grows tax-deferred, meaning policyholders do not pay taxes on the growth until they withdraw funds. This feature can enhance long-term savings strategies.

- Advantage: Allows for potentially greater wealth accumulation over time without annual tax burdens.

- Disadvantage: Taxes may apply when withdrawing funds, especially if the amount exceeds the total premiums paid into the policy.

Investment Potential

Depending on the type of cash value policy—such as whole life or variable universal life—policyholders may enjoy fixed returns or returns linked to market performance.

- Advantage: The potential for higher returns can make these policies attractive as part of a diversified investment strategy.

- Disadvantage: Market-linked policies carry risks and may not perform as expected, leading to lower-than-anticipated cash values.

Financial Flexibility

Cash value life insurance provides flexibility in managing finances. Policyholders can borrow against their cash value, use it to pay premiums, or withdraw funds as needed.

- Advantage: This flexibility can be crucial during financial emergencies or unexpected expenses.

- Disadvantage: Borrowing against the policy reduces the death benefit payable to beneficiaries and must be repaid with interest.

Complexity and Management

These policies are generally more complex than term life insurance. Understanding how various components work together requires ongoing management and attention.

- Advantage: Offers unique features that can be tailored to individual financial goals.

- Disadvantage: Complexity can lead to misunderstandings about how much coverage is truly available or how to effectively utilize the cash value.

Fees and Charges

Cash value life insurance often comes with additional fees and charges that can impact overall growth. These may include administrative fees, surrender charges, and costs associated with managing investments within variable policies.

- Advantage: Some fees contribute to valuable services provided by the insurer.

- Disadvantage: High fees can significantly diminish the growth potential of your cash value over time.

Surrender Penalties

If you decide to cancel your policy before a certain period (often 10 years), you may face surrender penalties that reduce your accumulated cash value significantly.

- Advantage: Provides a structured way to ensure long-term commitment from policyholders.

- Disadvantage: Penalties can deter individuals from accessing their funds when they need them most.

Long-Term Financial Strategy

For many individuals, particularly those with complex financial needs or high-net-worth individuals, cash value life insurance can play an integral role in a broader financial strategy.

- Advantage: Can complement retirement planning by providing both a death benefit and a savings component.

- Disadvantage: It might not be suitable for everyone; those needing short-term coverage may find better options with term life insurance.

In conclusion, while cash value life insurance offers numerous benefits such as lifelong coverage and tax-deferred growth, it also presents challenges like higher premiums and complexity. Individuals considering this type of policy should thoroughly evaluate their financial goals, risk tolerance, and need for flexibility before making a decision.

Frequently Asked Questions About Cash Value Life Insurance Policy Pros And Cons

- What is cash value life insurance?

Cash value life insurance is a type of permanent life insurance that includes both a death benefit and a savings component that accumulates cash over time. - How does cash value accumulate?

A portion of each premium payment goes into a savings account within the policy that grows tax-deferred. - Can I access my cash value?

Yes, you can borrow against your cash value or withdraw funds; however, this may reduce your death benefit. - Are there tax implications?

The growth of cash value is tax-deferred until withdrawn; excess amounts over premiums paid may incur taxes. - What types of policies have cash values?

Main types include whole life, universal life, indexed universal life, and variable universal life policies. - Is it better than term life insurance?

This depends on individual needs; term provides lower-cost coverage while cash value offers lifelong protection and savings. - What are surrender charges?

Surrender charges are fees incurred if you cancel your policy before a specified period, reducing your available cash value. - Who should consider this type of insurance?

This may suit individuals seeking lifelong coverage combined with savings benefits or those with complex financial planning needs.

In summary, understanding both the advantages and disadvantages of cash value life insurance is essential for anyone considering this option as part of their financial portfolio.