Cash value life insurance is a type of permanent life insurance that combines a death benefit with a savings component. Unlike term life insurance, which provides coverage for a specific period, cash value policies offer lifelong protection and the opportunity to build tax-deferred savings over time. This unique financial product has gained popularity among investors and individuals seeking both insurance protection and a potential source of supplemental income.

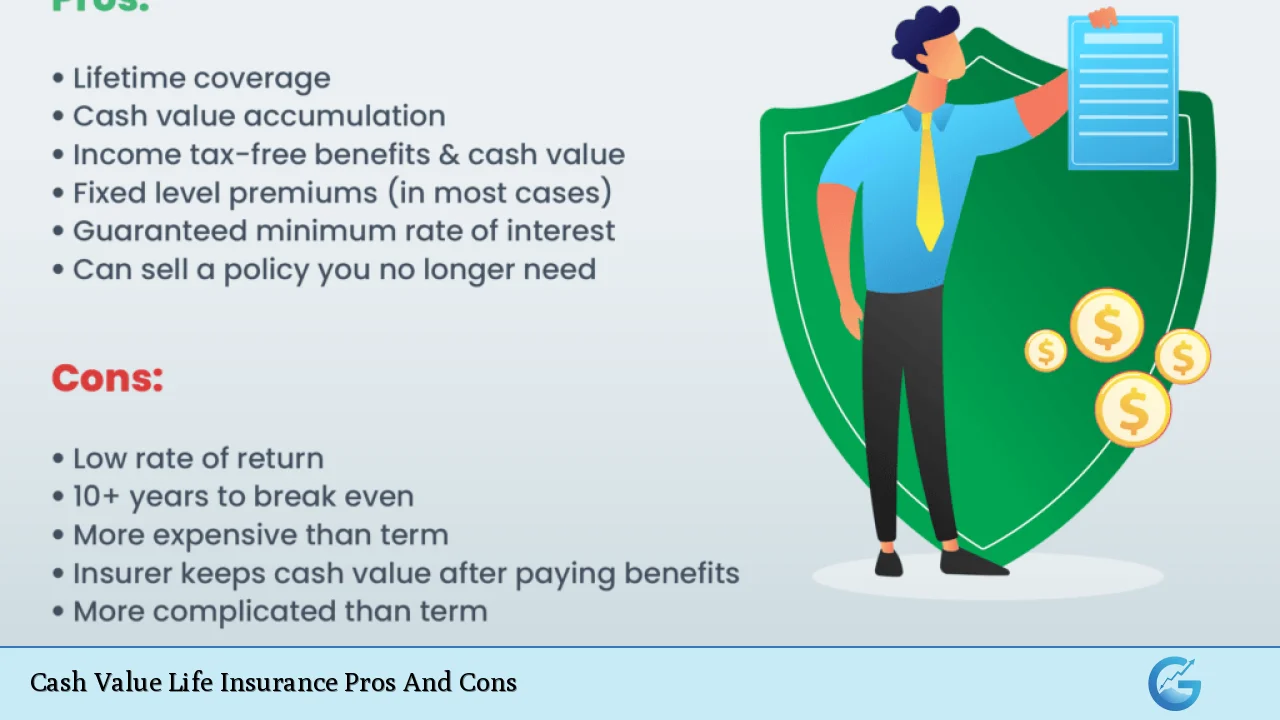

| Pros | Cons |

|---|---|

| Lifelong coverage | Higher premiums |

| Tax-deferred growth | Complex policy structures |

| Access to cash value | Lower initial death benefit |

| Potential for dividends | Slow cash value accumulation |

| Flexible premium payments | Potential for policy lapse |

| Estate planning benefits | Opportunity cost of alternative investments |

Advantages of Cash Value Life Insurance

Lifelong Coverage

Cash value life insurance provides protection that lasts for your entire lifetime, as long as premiums are paid.

This feature sets it apart from term life insurance, which expires after a set period. The lifelong coverage aspect offers several benefits:

- Peace of mind knowing your beneficiaries will receive a death benefit regardless of when you pass away

- No need to worry about qualifying for new coverage as you age or if your health deteriorates

- Potential to leave a legacy or provide for final expenses without burdening loved ones

Tax-Deferred Growth

One of the most attractive features of cash value life insurance is its tax advantages. The cash value component grows on a tax-deferred basis, meaning:

- You don’t pay taxes on the growth of your cash value while it accumulates

- Potential for compound growth over time as you’re not losing a portion to taxes each year

- Opportunity to accumulate more wealth compared to taxable investment accounts

It’s important to note that withdrawals or loans from the policy may be subject to taxes if not handled correctly.

Always consult with a tax professional before accessing your cash value.

Access to Cash Value

The ability to access the cash value of your policy provides financial flexibility that traditional term life insurance doesn’t offer. You can utilize this cash value in several ways:

- Take out loans against the cash value, often at favorable interest rates

- Make withdrawals for emergencies or planned expenses

- Use the cash value to pay premiums, potentially reducing out-of-pocket costs

This feature can be particularly valuable during retirement or in times of financial need.

However, it’s crucial to understand that loans and withdrawals will reduce the death benefit and may have tax implications.

Potential for Dividends

Some cash value life insurance policies, particularly whole life policies from mutual insurance companies, offer the potential for dividend payments. While not guaranteed, dividends can provide:

- Additional cash value growth

- Increased death benefit if used to purchase paid-up additions

- Option to receive dividends as cash, effectively reducing the cost of insurance

Dividends are typically tax-free up to the amount of premiums paid, making them an attractive feature for policyholders.

Flexible Premium Payments

Certain types of cash value life insurance, such as universal life policies, offer flexibility in premium payments. This can be advantageous for individuals with fluctuating incomes or changing financial circumstances. Benefits include:

- Ability to adjust premium payments within certain limits

- Option to use cash value to cover premium costs during lean times

- Potential to overfund the policy in good years to build cash value faster

It’s essential to monitor the policy closely and ensure sufficient premiums are paid to keep the policy in force.

Estate Planning Benefits

Cash value life insurance can play a significant role in estate planning strategies. Some advantages in this area include:

- Providing liquidity to pay estate taxes without forcing the sale of other assets

- Ability to equalize inheritances among heirs

- Option to establish an irrevocable life insurance trust (ILIT) for potential estate tax savings

For high-net-worth individuals, these benefits can be crucial in preserving wealth for future generations.

Disadvantages of Cash Value Life Insurance

Higher Premiums

The most significant drawback of cash value life insurance is its higher cost compared to term life insurance.

The reasons for these higher premiums include:

- Part of the premium goes towards building cash value

- Lifelong coverage is more expensive to provide than term coverage

- Additional fees and charges associated with policy administration

For many individuals, especially younger adults with limited budgets, the higher cost can be prohibitive and may lead to underinsurance if a sufficient death benefit cannot be afforded.

Complex Policy Structures

Cash value life insurance policies are often more complex than term life insurance, which can lead to several issues:

- Difficulty in understanding all policy features and how they interact

- Challenges in comparing different policies and insurers

- Potential for misunderstanding the risks and limitations of the policy

This complexity necessitates careful study of policy documents and often requires guidance from a financial professional to make informed decisions.

Lower Initial Death Benefit

For the same premium amount, cash value life insurance typically provides a lower initial death benefit compared to term life insurance. This can result in:

- Inadequate coverage for immediate life insurance needs

- Necessity to purchase additional term insurance to meet coverage requirements

- Potential for being underinsured in the early years of the policy

It’s crucial to ensure that your total life insurance coverage meets your family’s needs, which may involve combining cash value and term policies.

Slow Cash Value Accumulation

In the early years of a cash value policy, the accumulation of cash value can be slow due to:

- High initial costs and fees associated with policy setup

- A larger portion of premiums going towards the cost of insurance

- Time needed for compound growth to become significant

This slow growth can be frustrating for policyholders expecting to see substantial cash value in the short term and may impact the policy’s effectiveness as a savings vehicle in the early years.

Potential for Policy Lapse

If not managed properly, cash value life insurance policies can lapse, resulting in a loss of coverage and potential tax consequences. Risks include:

- Insufficient premium payments, especially if relying on cash value to cover premiums

- Poor policy performance in the case of variable or indexed universal life policies

- Taking excessive loans or withdrawals that deplete the cash value

Regular policy reviews and careful management are essential to prevent unintended policy lapses.

Opportunity Cost of Alternative Investments

While cash value life insurance offers tax advantages and a death benefit, it may not provide the best returns compared to other investment options. Considerations include:

- Potentially higher returns from direct investments in stocks, bonds, or mutual funds

- Limited investment options within the policy, particularly for whole life insurance

- Fees and charges that can eat into overall returns

Investors must weigh the combined benefits of life insurance protection and tax-advantaged savings against the potential for higher returns elsewhere.

Closing Thoughts

Cash value life insurance offers a unique combination of lifelong protection and tax-advantaged savings that can be attractive for certain individuals and financial situations. Its benefits in estate planning, financial flexibility, and guaranteed coverage make it a valuable tool for many. However, the higher costs, complexity, and potential drawbacks require careful consideration.

Before purchasing a cash value life insurance policy, it’s essential to thoroughly assess your financial goals, insurance needs, and long-term objectives.

Consulting with a qualified financial advisor or insurance professional can help you determine if cash value life insurance aligns with your overall financial strategy and whether the pros outweigh the cons for your specific circumstances.

Remember that life insurance should primarily serve as protection for your loved ones, and any cash value accumulation should be viewed as a secondary benefit. By understanding both the advantages and disadvantages of cash value life insurance, you can make an informed decision that best serves your financial future and provides peace of mind for you and your family.

Frequently Asked Questions About Cash Value Life Insurance Pros And Cons

- How long does it take for cash value to build up in a life insurance policy?

Cash value typically takes 10-15 years to accumulate significantly. The growth rate depends on the policy type, premiums paid, and policy performance. - Can I lose money in a cash value life insurance policy?

Yes, it’s possible to lose money if you surrender the policy early, take excessive loans, or if the policy performs poorly. Always review your policy regularly and consult with a financial advisor. - Is cash value life insurance a good investment vehicle?

It can be, but it depends on your financial goals and situation. Cash value life insurance offers tax advantages and guaranteed returns, but may have lower potential returns compared to other investments. - What happens to the cash value when I die?

In most cases, the cash value is retained by the insurance company upon death. Only the death benefit is paid to beneficiaries, unless specific riders are added to the policy. - Can I withdraw all the cash value from my life insurance policy?

Yes, but it may have significant consequences. Full withdrawal can reduce your death benefit, potentially cause the policy to lapse, and may result in tax liabilities. - How does cash value life insurance compare to investing in the stock market?

Cash value life insurance offers more stability and guaranteed returns, while the stock market potentially offers higher returns with greater risk. Your risk tolerance and financial goals should guide this decision. - Are premiums for cash value life insurance tax-deductible?

Generally, premiums for personal life insurance are not tax-deductible. However, there may be exceptions for business-owned policies or certain estate planning situations. - Can I convert my term life insurance to a cash value policy?

Many term policies offer a conversion option to permanent life insurance. Check your policy details or consult with your insurance provider for specific conversion terms and deadlines.