Certificates of Deposit (CDs) are a popular financial product that allows individuals to earn interest on their savings over a fixed term. They are often seen as a safe investment option, appealing to conservative savers looking for predictability and security. However, like any financial instrument, CDs come with their own set of advantages and disadvantages that potential investors should carefully consider before committing their funds. This article will delve into the pros and cons of CD accounts, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

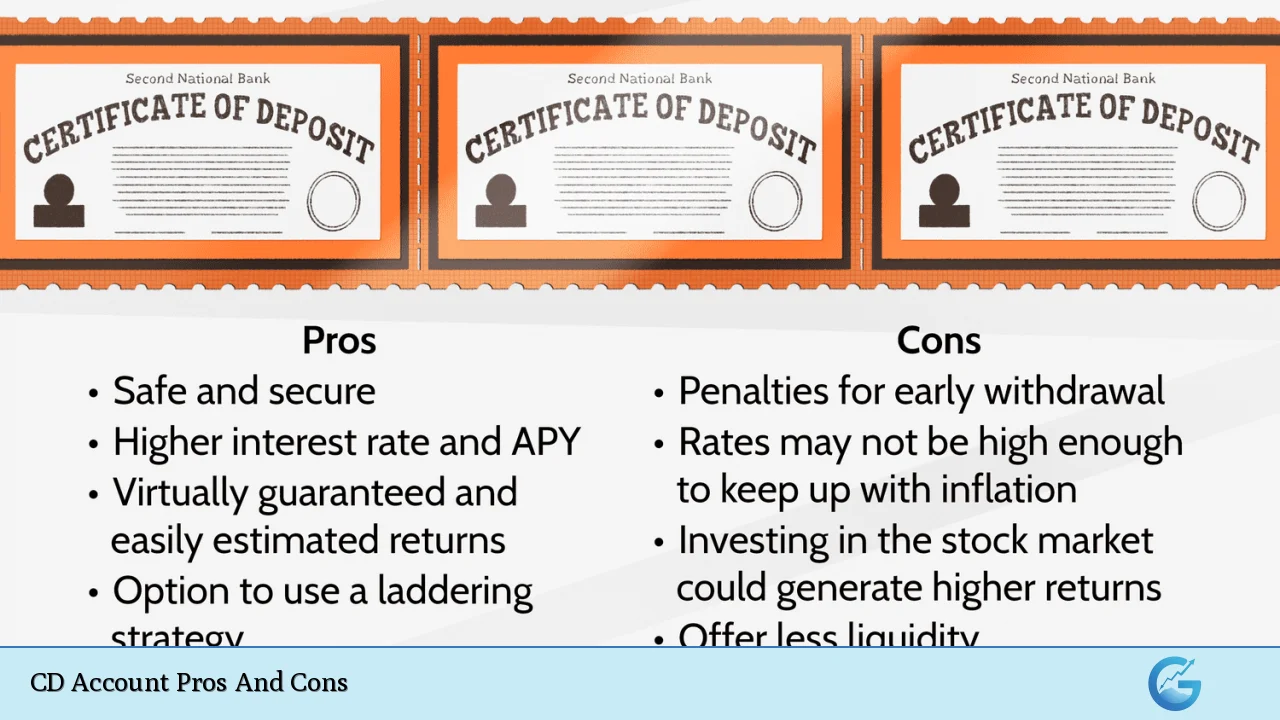

| Pros | Cons |

|---|---|

| Higher interest rates compared to traditional savings accounts | Limited liquidity; funds are locked until maturity |

| Guaranteed returns; fixed interest rates | Potential penalties for early withdrawal |

| FDIC insurance provides security for deposits | Opportunity cost if interest rates rise |

| Flexible terms available for different investment strategies | Inflation risk may erode purchasing power |

| Potential for laddering strategy to access funds periodically | Minimum deposit requirements may be higher than savings accounts |

Higher Interest Rates Compared to Traditional Savings Accounts

One of the most significant advantages of CDs is their ability to offer higher interest rates than standard savings accounts.

- Fixed Interest Rates: When you open a CD, you lock in an interest rate for the duration of the term. This means you can plan your earnings with certainty.

- Competitive Returns: Many banks provide competitive rates on CDs, especially during periods of rising interest rates. This makes them an attractive option for savers looking to maximize their returns without taking on substantial risk.

- Longer Terms Yield Higher Rates: Generally, longer-term CDs offer better rates than shorter ones, allowing investors to choose based on their financial goals.

Limited Liquidity; Funds Are Locked Until Maturity

While the fixed nature of CDs is advantageous, it also comes with a critical drawback—limited liquidity.

- Access Restrictions: Once you deposit your money into a CD, it is typically inaccessible until the maturity date. If you need cash unexpectedly, withdrawing funds early can lead to penalties.

- Emergency Fund Considerations: For those who might need quick access to cash for emergencies or unplanned expenses, a CD may not be the best choice due to its illiquid nature.

Guaranteed Returns; Fixed Interest Rates

CDs provide a level of security that is appealing to many investors.

- Predictable Earnings: Unlike stocks or bonds, where returns can fluctuate significantly, CDs offer guaranteed returns. You know exactly how much interest you will earn by the end of the term.

- No Market Risk: The fixed interest rate means that your investment is not subject to market volatility. This makes CDs a safe haven during uncertain economic times.

Potential Penalties for Early Withdrawal

A notable disadvantage of CDs is the penalties associated with early withdrawals.

- Withdrawal Fees: If you withdraw your funds before the maturity date, you will likely incur an early withdrawal penalty. This penalty can vary significantly between institutions and may involve forfeiting several months’ worth of interest.

- Impact on Returns: Early withdrawal penalties can diminish the overall return on your investment, making it crucial to ensure that you won’t need access to your funds before maturity.

FDIC Insurance Provides Security for Deposits

Another advantage of CDs is their insurance protection.

- Federal Insurance: Most CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor per bank. This insurance protects your investment in case the bank fails.

- Peace of Mind: Knowing that your funds are protected gives many investors peace of mind, especially in turbulent economic climates.

Opportunity Cost If Interest Rates Rise

While CDs are generally safe investments, they come with an opportunity cost if market conditions change.

- Fixed Rates vs. Rising Rates: If interest rates rise after you open a CD, your locked-in rate may become less attractive compared to new offerings in the market. This could lead to missed opportunities for higher earnings elsewhere.

- Laddering Strategy: To mitigate this risk, some investors employ a laddering strategy—investing in multiple CDs with staggered maturity dates—to take advantage of rising rates while still having access to some funds periodically.

Flexible Terms Available for Different Investment Strategies

CDs offer various terms that cater to different financial strategies and goals.

- Diverse Options: Investors can choose from terms ranging from as short as three months to as long as ten years. This flexibility allows individuals to align their investments with their financial timelines and objectives.

- Customizable Investment Plans: Depending on individual needs—whether saving for a short-term goal or planning long-term investments—CDs can be tailored accordingly.

Inflation Risk May Erode Purchasing Power

Despite their advantages, one significant drawback is inflation risk associated with fixed-rate investments like CDs.

- Purchasing Power Erosion: If inflation rises above the interest rate earned on a CD, the real value of your returns diminishes over time. For instance, if your CD earns 2% but inflation is at 3%, you’re effectively losing purchasing power each year.

- Strategic Timing: To combat this risk, consider opening CDs during periods when rates are high relative to inflation or opting for longer-term CDs that typically offer better rates.

Minimum Deposit Requirements May Be Higher Than Savings Accounts

Many CDs require higher minimum deposits compared to traditional savings accounts.

- Accessibility Issues: Some banks may require minimum deposits ranging from $500 to $10,000 or more. This can make it challenging for individuals with limited savings to take advantage of CD offerings.

- Investment Planning: It’s essential for potential investors to assess their financial situation and ensure they can meet these minimum requirements without compromising other financial goals or needs.

Closing Paragraph

In conclusion, Certificates of Deposit (CDs) present both compelling advantages and notable disadvantages for those interested in safe and predictable investment options. While they offer higher interest rates than traditional savings accounts and guaranteed returns backed by FDIC insurance, they also impose restrictions on liquidity and present risks associated with inflation and early withdrawal penalties. Understanding these pros and cons is crucial for making informed decisions about whether a CD aligns with your financial goals and investment strategy. As always, it’s advisable to carefully evaluate your personal circumstances and consider consulting with a financial advisor before committing funds into any investment vehicle.

Frequently Asked Questions About CD Accounts

- What is a Certificate of Deposit (CD)?

A Certificate of Deposit (CD) is a type of savings account that offers a fixed interest rate over a specified term. - How do I withdraw money from my CD?

You can withdraw money from your CD at maturity without penalty; however, withdrawing early usually incurs fees. - Are CDs insured?

Yes, most CDs are insured by the FDIC up to $250,000 per depositor per bank. - What happens if I need my money before the CD matures?

If you withdraw funds early from a CD, you will likely face penalties that could reduce your earnings. - Can I add more money to my CD after opening it?

No, most standard CDs do not allow additional deposits once opened; however, some banks offer add-on CDs. - How do I choose the right term length for my CD?

The right term length depends on your financial goals; shorter terms provide more liquidity while longer terms often yield higher rates. - What is a CD ladder?

A CD ladder is an investment strategy where multiple CDs with staggered maturity dates are purchased to provide regular access to cash. - Are there risks associated with investing in CDs?

Yes, risks include early withdrawal penalties and potential loss of purchasing power due to inflation.