Chapter 13 bankruptcy, often referred to as a “wage earner’s plan,” is a legal process that allows individuals with regular income to create a repayment plan to settle their debts over a period of three to five years. This option is particularly appealing for those who wish to retain their assets while working through financial difficulties. However, like any financial decision, it comes with its own set of advantages and disadvantages. Understanding these can help individuals make informed choices about their financial futures.

| Pros | Cons |

|---|---|

| Allows retention of valuable assets. | Long repayment period (3-5 years). |

| Automatic stay on collections. | Affects credit score negatively. |

| Flexible repayment plans tailored to income. | Non-dischargeable debts remain. |

| Protection from foreclosure and repossession. | Requires regular income and adherence to the plan. |

| Discharge of remaining eligible debts after completion. | Potential loss of disposable income during repayment. |

| Possibility of modifying secured debts. | Complex legal process requiring professional assistance. |

| Less severe impact on credit than missed payments. | Certain debts, like student loans, are not discharged. |

| Opportunity for financial restructuring and recovery. | Court oversight can be intrusive and demanding. |

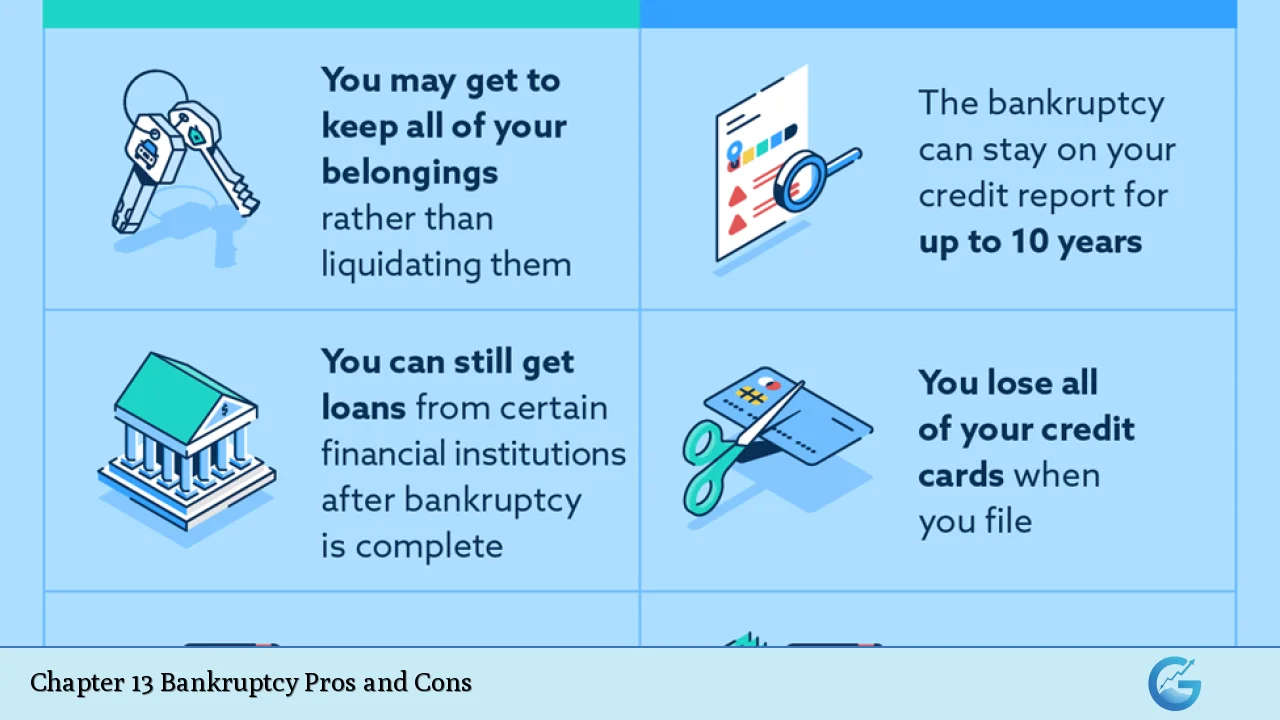

Allows Retention of Valuable Assets

One of the most significant advantages of Chapter 13 bankruptcy is the ability to keep essential assets such as homes and vehicles. Unlike Chapter 7 bankruptcy, which often requires liquidation of assets, Chapter 13 allows individuals to retain their property as long as they adhere to the repayment plan.

- Asset Protection: Individuals can avoid foreclosure on their homes and repossession of vehicles by making regular payments according to the court-approved plan.

- Catch-Up Payments: The plan allows for missed mortgage or car payments to be made up over time, providing a structured way to regain financial stability.

Automatic Stay on Collections

Filing for Chapter 13 initiates an automatic stay that halts all collection activities from creditors. This immediate relief can be crucial for individuals facing aggressive collection practices.

- Cease Collection Efforts: Creditors cannot pursue lawsuits, garnish wages, or initiate foreclosure proceedings while the bankruptcy case is active.

- Peace of Mind: This protection provides a much-needed respite from the stress associated with debt collection efforts.

Flexible Repayment Plans Tailored to Income

Chapter 13 offers flexibility in creating a repayment plan that aligns with an individual’s income and financial situation. This can make managing debt more feasible.

- Customizable Payments: The repayment amount is based on disposable income, allowing for adjustments based on changing financial circumstances.

- Longer Timeframe: Individuals have three to five years to repay their debts, which can lower monthly payment amounts compared to other debt relief options.

Protection from Foreclosure and Repossession

This type of bankruptcy is particularly beneficial for those at risk of losing their homes or vehicles due to missed payments.

- Home Retention: Homeowners can catch up on overdue mortgage payments while keeping their homes intact during the repayment period.

- Vehicle Protection: Similarly, individuals can maintain ownership of their vehicles by adhering to the terms set forth in the repayment plan.

Discharge of Remaining Eligible Debts After Completion

Upon successful completion of the Chapter 13 repayment plan, any remaining eligible debts may be discharged, providing a fresh start.

- Debt Relief: This discharge allows individuals to move forward without the burden of certain debts that were included in the plan.

- Financial Rebuilding: After discharge, individuals can begin rebuilding their credit and financial health without lingering debt obligations.

Possibility of Modifying Secured Debts

Chapter 13 provides opportunities for modifying secured debts, which can lead to more manageable payment terms.

- Restructuring Loans: Individuals may negotiate lower interest rates or extended payment terms on secured loans during the bankruptcy process.

- Debt Consolidation: This restructuring can simplify finances by consolidating multiple debts into one manageable payment.

Less Severe Impact on Credit Than Missed Payments

While filing for bankruptcy does affect credit scores, Chapter 13 may have a less damaging impact compared to ongoing missed payments or defaults.

- Credit Reporting Duration: A Chapter 13 bankruptcy remains on your credit report for up to seven years, while missed payments can have lasting effects that are often harder to recover from.

- Pathway to Recovery: Successfully completing a Chapter 13 plan can demonstrate responsible financial behavior, aiding in future credit applications.

Long Repayment Period (3-5 Years)

Despite its advantages, one significant drawback is the lengthy commitment required under Chapter 13.

- Extended Financial Burden: The repayment plan typically spans three to five years, which can feel overwhelming for some individuals as they must adhere strictly to budget constraints during this time.

- Inflexibility During Repayment: Any changes in income or unexpected expenses must still be managed within the confines of the established repayment schedule.

Affects Credit Score Negatively

Filing for Chapter 13 bankruptcy will negatively impact an individual’s credit score.

- Immediate Impact: The filing itself will lower your credit score initially, making it more challenging to obtain new credit during the repayment period.

- Long-Term Effects: Although it may be less damaging than ongoing defaults or collections, it still poses challenges when applying for loans or credit cards in the future.

Non-Dischargeable Debts Remain

Certain types of debts cannot be discharged through Chapter 13 bankruptcy.

- Student Loans and Taxes: Obligations such as student loans and certain tax debts typically remain even after completing a Chapter 13 plan.

- Ongoing Responsibility: Individuals must continue managing these non-dischargeable debts alongside their repayment obligations under Chapter 13.

Requires Regular Income and Adherence to the Plan

To qualify for Chapter 13 bankruptcy, individuals must demonstrate a regular income sufficient to fund their repayment plan.

- Income Stability Required: Those with inconsistent earnings may find it difficult or impossible to meet the requirements necessary for filing under this chapter.

- Strict Compliance Needed: Adhering strictly to the payment schedule is crucial; failure to do so can result in dismissal from bankruptcy protection and potential loss of assets.

Potential Loss of Disposable Income During Repayment

During the repayment period, all disposable income must be directed toward debt repayment.

- Limited Financial Flexibility: This requirement means that individuals may have little room in their budgets for unexpected expenses or savings during this time.

- Impact on Quality of Life: Living on a restricted budget can affect overall quality of life and financial well-being during the lengthy repayment period.

Complex Legal Process Requiring Professional Assistance

Navigating Chapter 13 bankruptcy involves a complex legal process that typically requires professional assistance from an attorney.

- Legal Fees Incurred: Hiring an attorney incurs costs that may add additional financial strain during an already challenging time.

- Understanding Requirements: Individuals must understand various legal documents and requirements necessary for filing successfully; professional guidance is often essential in this regard.

Closing Thoughts

Chapter 13 bankruptcy offers a structured approach for individuals seeking relief from overwhelming debt while retaining essential assets. However, it also requires significant commitment over several years and comes with its own set of challenges. It is crucial for anyone considering this option to weigh both its advantages and disadvantages carefully. Consulting with a knowledgeable attorney can provide valuable insights tailored to individual circumstances, ensuring informed decisions are made regarding one’s financial future.

Frequently Asked Questions About Chapter 13 Bankruptcy

- What is Chapter 13 bankruptcy?

Chapter 13 bankruptcy allows individuals with regular income to develop a repayment plan over three to five years while retaining their assets. - How long does Chapter 13 bankruptcy stay on my credit report?

A Chapter 13 bankruptcy remains on your credit report for seven years from the date you file. - Can I keep my home if I file for Chapter 13?

Yes, you can keep your home as long as you comply with your court-approved repayment plan. - What types of debts are dischargeable under Chapter 13?

Many unsecured debts like credit card balances may be discharged after completing your repayment plan; however, student loans generally are not dischargeable. - Do I need an attorney to file for Chapter 13?

While it’s not legally required, hiring an attorney is highly recommended due to the complexity of the process. - Can I modify my repayment plan after filing?

Yes, modifications can be requested if there are significant changes in your financial situation. - What happens if I miss a payment during my repayment plan?

If you miss payments, you risk dismissal from your bankruptcy case or losing protections against creditors. - Is there any way out if my situation worsens after filing?

If your financial situation deteriorates significantly, you may convert your case to Chapter 7 or request modifications through the court.