Filing for bankruptcy is a significant decision that can have lasting impacts on an individual’s financial future. Chapter 13 bankruptcy, often referred to as a “wage earner’s plan,” is designed for individuals with a regular income who wish to repay their debts over time while retaining their assets. This chapter of the Bankruptcy Code allows debtors to create a structured repayment plan, typically lasting three to five years, under court supervision. While it offers several advantages, there are also notable disadvantages that potential filers must consider. This article delves into the pros and cons of Chapter 13 bankruptcy, providing a comprehensive understanding for those interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

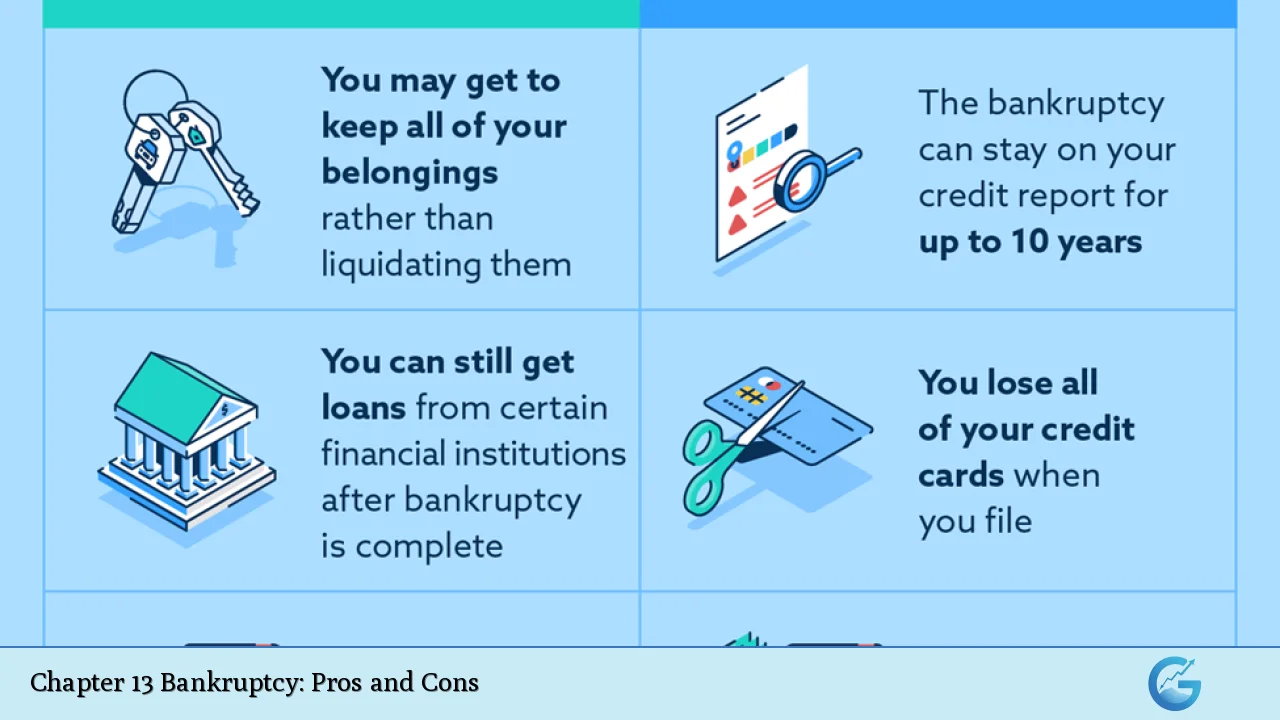

| Allows retention of valuable assets like homes and cars. | Long repayment period of three to five years. |

| Automatic stay halts collection actions from creditors. | Negative impact on credit score for up to seven years. |

| Structured repayment plan makes budgeting easier. | Not all debts are dischargeable (e.g., student loans). |

| Flexibility in repayment amounts based on income. | Requires regular income to qualify and maintain payments. |

| Potential discharge of remaining eligible debts after repayment period. | May require surrendering certain non-exempt assets. |

| Protection against foreclosure and repossession during the repayment period. | Complex process requiring court approval and legal guidance. |

| Opportunity to catch up on missed payments (e.g., mortgage arrears). | Increased scrutiny of finances and potential loss of privacy. |

Allows Retention of Valuable Assets

One of the most significant advantages of Chapter 13 bankruptcy is the ability to retain valuable assets. Unlike Chapter 7 bankruptcy, which may require the liquidation of assets to pay creditors, Chapter 13 allows individuals to keep their homes, cars, and other essential property as long as they adhere to the repayment plan.

- Home Ownership: Individuals facing foreclosure can use Chapter 13 to catch up on missed mortgage payments while keeping their home.

- Vehicle Retention: Debtors can maintain possession of their vehicles by continuing to make payments under the approved plan.

This asset retention feature provides a crucial lifeline for individuals who have fallen behind but wish to regain financial stability without losing their most important possessions.

Automatic Stay Halts Collection Actions

Upon filing for Chapter 13 bankruptcy, an automatic stay goes into effect. This legal provision immediately stops all collection actions against the debtor.

- Protection from Creditors: Creditors cannot initiate lawsuits, wage garnishments, or repossessions during the bankruptcy process.

- Breathing Room: This pause allows debtors time to reorganize their finances without the constant pressure from creditors.

The automatic stay is particularly beneficial for those who need time to develop a feasible repayment plan without the fear of losing their assets or facing legal actions.

Structured Repayment Plan Makes Budgeting Easier

Chapter 13 bankruptcy offers a structured repayment plan that can simplify budgeting for debtors.

- Predictable Payments: Debtors make regular payments (typically monthly) based on their disposable income, which helps in managing finances effectively.

- Flexibility Based on Income: The repayment amounts can be adjusted depending on changes in income or expenses over time.

This structure not only aids in financial planning but also encourages responsible spending habits as individuals work towards becoming debt-free.

Flexibility in Repayment Amounts Based on Income

Another advantage of Chapter 13 is its flexibility regarding repayment amounts.

- Income-Based Payments: The court considers the debtor’s income when determining payment amounts, allowing adjustments if financial circumstances change.

- Negotiation Opportunities: Debtors may negotiate lower balances or interest rates with creditors through their attorney during the process.

This flexibility can significantly alleviate financial strain, making it easier for individuals to meet their obligations while maintaining necessary living expenses.

Potential Discharge of Remaining Eligible Debts After Repayment Period

At the conclusion of a successful Chapter 13 plan, any remaining eligible debts can be discharged.

- Fresh Start: This discharge provides individuals with a clean slate, free from certain debts that were not fully repaid during the plan.

- Encouragement for Compliance: Knowing that there is an end goal can motivate debtors to adhere strictly to their repayment plans.

This potential discharge is a powerful incentive for many individuals considering bankruptcy as a means to regain control over their financial lives.

Long Repayment Period

Despite its advantages, one significant downside of Chapter 13 bankruptcy is the lengthy repayment period required—typically three to five years.

- Extended Commitment: Debtors must commit to making regular payments over several years, which can be daunting for those eager for immediate relief.

- Financial Strain: The prolonged nature of this commitment may create ongoing financial stress as individuals must adhere to strict budgets while fulfilling other obligations.

This extended timeline can be challenging for many who are already struggling financially and seeking quicker resolutions.

Negative Impact on Credit Score

Filing for Chapter 13 bankruptcy has a detrimental effect on an individual’s credit score.

- Credit Report Duration: The bankruptcy will remain on your credit report for up to seven years from the date of filing, affecting your ability to secure loans or favorable interest rates during this time.

- Long-Term Consequences: While it may be less damaging than some other forms of debt resolution (like defaults or repossessions), it still poses significant challenges in rebuilding creditworthiness post-bankruptcy.

Individuals must be prepared for these long-term consequences when considering filing under Chapter 13.

Not All Debts Are Dischargeable

While Chapter 13 provides opportunities for debt relief, not all debts are eligible for discharge under this chapter.

- Non-Dischargeable Obligations: Certain types of debts—such as student loans, most tax obligations, and child support—remain the responsibility of the debtor even after completing the repayment plan.

- Limited Relief Options: This limitation means that some individuals may still face significant financial burdens even after successfully completing their Chapter 13 plan.

Understanding which debts are non-dischargeable is crucial for anyone considering this form of bankruptcy.

Requires Regular Income to Qualify and Maintain Payments

To qualify for Chapter 13 bankruptcy, individuals must demonstrate a stable income sufficient to fund their repayment plan.

- Income Verification: Filers must provide detailed documentation regarding their income and expenses as part of the application process.

- Ongoing Income Requirement: Maintaining regular payments throughout the duration of the plan is essential; failure to do so can result in dismissal or conversion to Chapter 7 bankruptcy.

This requirement may pose challenges for those with irregular income streams or who are experiencing job instability.

May Require Surrendering Certain Non-Exempt Assets

While Chapter 13 allows retention of many assets, there may still be instances where surrendering certain non-exempt assets is necessary.

- Asset Evaluation: The court will assess all assets during the filing process; non-exempt items may need to be liquidated if they exceed allowable limits set by state law.

- Impact on Financial Recovery: Losing valuable assets can hinder an individual’s ability to recover financially post-bankruptcy and may affect their quality of life during and after the process.

Understanding asset exemptions is critical when considering filing under Chapter 13.

Complex Process Requiring Court Approval and Legal Guidance

The Chapter 13 bankruptcy process can be intricate and often requires legal assistance.

- Legal Representation Needed: Navigating court procedures and ensuring compliance with all requirements typically necessitates hiring an experienced attorney specializing in bankruptcy law.

- Court Supervision Required: All plans must receive court approval before implementation, adding another layer of complexity and potential delays in resolution.

This complexity can deter some individuals from pursuing this option despite its benefits due to concerns about navigating legal systems effectively.

Increased Scrutiny of Finances and Potential Loss of Privacy

Filing for Chapter 13 entails a thorough examination of an individual’s financial situation.

- Detailed Financial Disclosure: Debtors must disclose all aspects of their finances—including income sources, expenses, debts owed, and asset ownership—which can feel invasive.

- Public Record Implications: Bankruptcy filings become part of public record, potentially impacting personal privacy and leading to further scrutiny from creditors or employers in some cases.

Individuals should weigh these privacy concerns against the potential benefits when considering filing for Chapter 13 bankruptcy.

In conclusion, while Chapter 13 bankruptcy offers several significant advantages such as asset retention and structured repayments, it also presents notable disadvantages including long-term credit impacts and complex legal requirements. Individuals considering this path must carefully evaluate both sides before making a decision that could shape their financial future. Understanding these pros and cons will empower potential filers with knowledge as they navigate through challenging financial circumstances.

Frequently Asked Questions About Chapter 13 Bankruptcy

- What is Chapter 13 bankruptcy?

Chapter 13 bankruptcy allows individuals with regular income to create a repayment plan over three to five years while keeping their assets. - How long does a Chapter 13 bankruptcy stay on my credit report?

A Chapter 13 bankruptcy remains on your credit report for up to seven years from the date you filed. - Can I keep my home if I file for Chapter 13?

Yes, one major advantage is that you can keep your home by catching up on missed mortgage payments through your repayment plan. - What types of debts cannot be discharged under Chapter 13?

Certain debts like student loans, child support obligations, and most tax debts cannot be discharged through this process. - Do I need an attorney to file for Chapter 13?

While it’s not legally required, having an experienced attorney is highly recommended due to the complexities involved in filing. - What happens if I miss a payment during my repayment plan?

If you miss payments consistently without remedying them, your case could be dismissed or converted into a different type of bankruptcy. - How does filing affect my credit score?

Your credit score will likely drop due to filing; however, it may recover faster than other negative marks like defaults or repossessions. - Can I file again if I have previously filed?

You can file again after completing your previous case; however, specific timelines apply depending on your prior filings.