Chapter 7 bankruptcy, often referred to as “liquidation bankruptcy,” is a legal process that provides individuals and businesses with an opportunity to eliminate most of their unsecured debts and start anew financially. This form of bankruptcy is designed for those who are unable to repay their debts and need a fresh financial start. However, like any major financial decision, filing for Chapter 7 bankruptcy comes with both advantages and disadvantages that must be carefully considered.

| Pros | Cons |

|---|---|

| Debt Discharge | Credit Score Impact |

| Quick Process | Asset Liquidation |

| Automatic Stay | Limited Debt Relief |

| Fresh Financial Start | Public Record |

| No Debt Repayment Plan | Employment and Housing Challenges |

| Exemptions Protection | Limited Filing Frequency |

| Creditor Harassment Stops | Potential Tax Consequences |

| Opportunity to Rebuild Credit | Ethical and Emotional Stress |

Advantages of Chapter 7 Bankruptcy

Debt Discharge

One of the most significant benefits of Chapter 7 bankruptcy is the discharge of eligible unsecured debts. This means that after the bankruptcy process is complete, you are no longer legally obligated to repay certain debts. Common types of dischargeable debts include:

- Credit card balances

- Medical bills

- Personal loans

- Utility bills

- Business debts (for sole proprietors)

This debt relief can provide a substantial financial burden lift, allowing individuals to regain control of their financial lives and start anew.

Quick Process

Compared to other forms of bankruptcy, such as Chapter 13, Chapter 7 is relatively quick. The entire process typically takes about 3-6 months from filing to discharge. This swift resolution allows debtors to move forward with their lives and begin rebuilding their financial health sooner. The timeline generally follows these steps:

- File bankruptcy petition

- Attend credit counseling

- 341 meeting of creditors (typically 30-45 days after filing)

- Potential asset liquidation by the trustee

- Discharge of eligible debts (usually 60-90 days after the 341 meeting)

Automatic Stay

Upon filing for Chapter 7 bankruptcy, an automatic stay goes into effect immediately. This legal protection prohibits most creditors from continuing collection efforts, including lawsuits, wage garnishments, and harassing phone calls. The automatic stay provides immediate relief from creditor pressure and allows debtors to focus on the bankruptcy process without constant stress from collection attempts.

Fresh Financial Start

Chapter 7 bankruptcy offers a chance for a clean slate financially. By discharging eligible debts, individuals can break free from the cycle of overwhelming debt and start rebuilding their financial lives. This fresh start can be particularly beneficial for those who have experienced significant financial setbacks due to job loss, medical issues, or other unforeseen circumstances.

No Debt Repayment Plan

Unlike Chapter 13 bankruptcy, which requires a 3-5 year repayment plan, Chapter 7 does not involve a structured repayment plan for discharged debts. Once the bankruptcy process is complete and eligible debts are discharged, there is no ongoing obligation to repay those debts. This aspect of Chapter 7 can be particularly advantageous for those with limited income or resources to fund a repayment plan.

Exemptions Protection

While Chapter 7 is often called “liquidation bankruptcy,” many filers can keep most or all of their property through exemptions. Bankruptcy exemptions vary by state but typically protect:

- A certain amount of equity in a primary residence

- Personal property up to specified values

- Retirement accounts

- Tools of the trade

These exemptions ensure that filers can maintain a basic standard of living and have the resources to rebuild their financial lives post-bankruptcy.

Creditor Harassment Stops

Filing for Chapter 7 bankruptcy puts an immediate stop to most creditor collection efforts. This includes ending harassing phone calls, letters, and legal actions from creditors. The peace of mind that comes from no longer being hounded by creditors can be invaluable for those struggling with overwhelming debt.

Opportunity to Rebuild Credit

While bankruptcy does have a significant initial impact on credit scores, it also provides an opportunity to rebuild credit from a clean slate. After discharge, individuals can begin taking steps to improve their credit, such as:

- Obtaining a secured credit card

- Making timely payments on remaining debts

- Monitoring credit reports for accuracy

With responsible financial management, many individuals see their credit scores begin to improve within 1-2 years after bankruptcy.

Disadvantages of Chapter 7 Bankruptcy

Credit Score Impact

Filing for Chapter 7 bankruptcy can significantly lower your credit score, potentially by 100 points or more. This negative mark remains on your credit report for 10 years from the filing date, affecting your ability to obtain new credit, secure favorable interest rates, or even rent an apartment. While the impact lessens over time, it’s crucial to understand the long-term consequences on your creditworthiness.

Asset Liquidation

In Chapter 7 bankruptcy, non-exempt assets may be liquidated by the bankruptcy trustee to repay creditors. This could include:

- Second homes or investment properties

- Valuable collections or jewelry

- Non-essential vehicles

- Investments outside of protected retirement accounts

While exemptions protect many assets, the potential loss of valuable property is a significant consideration when filing for Chapter 7.

Limited Debt Relief

Not all debts can be discharged in Chapter 7 bankruptcy. Certain types of debts remain your responsibility even after bankruptcy, including:

- Most student loans

- Recent tax debts

- Child support and alimony

- Court-ordered restitution

- Debts obtained through fraud

Understanding which debts will and won’t be discharged is crucial when considering Chapter 7 bankruptcy.

Public Record

Bankruptcy filings are a matter of public record. This means that anyone, including potential employers, landlords, or creditors, can access information about your bankruptcy. While privacy laws restrict how this information can be used, the public nature of bankruptcy can be a concern for some individuals.

Employment and Housing Challenges

The bankruptcy on your credit report can create challenges in various aspects of life. Some potential issues include:

- Difficulty obtaining employment in certain fields, particularly finance

- Challenges renting an apartment or home

- Higher insurance premiums

- Difficulty opening new bank accounts

While discrimination based solely on bankruptcy is illegal in many contexts, the practical implications can still be significant.

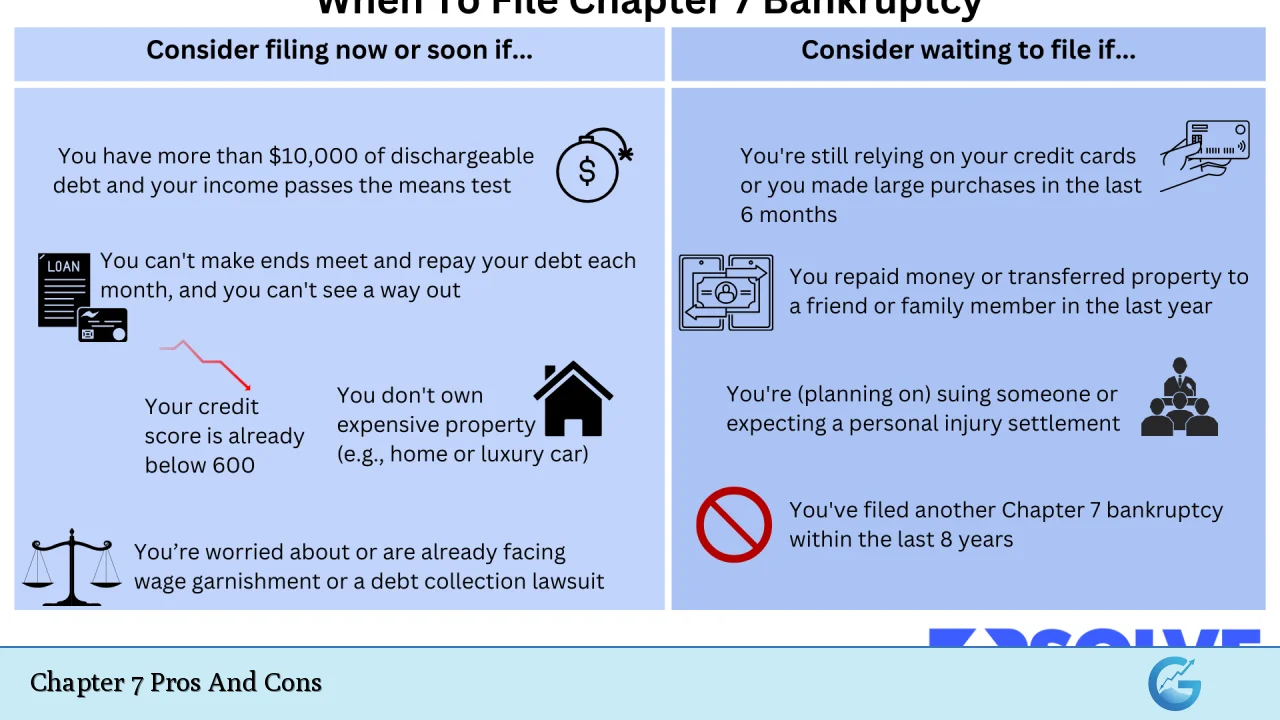

Limited Filing Frequency

Chapter 7 bankruptcy can only be filed once every eight years. This limitation means that if you experience financial difficulties again within that timeframe, you won’t have the option of Chapter 7 bankruptcy relief. It’s crucial to use the fresh start provided by bankruptcy wisely and develop strong financial habits to avoid future financial crises.

Potential Tax Consequences

While many debts are discharged in bankruptcy, there can be tax implications to consider. For example:

- Forgiven debt may be considered taxable income by the IRS

- Certain tax debts may not be dischargeable

- Bankruptcy may affect your ability to claim certain tax credits

Consulting with a tax professional is advisable to understand the potential tax consequences of filing for Chapter 7 bankruptcy.

Ethical and Emotional Stress

The decision to file for bankruptcy can be emotionally challenging. Many individuals struggle with feelings of failure, guilt, or shame associated with bankruptcy. Additionally, the process of disclosing personal financial information and attending court proceedings can be stressful. It’s important to consider the emotional impact and seek support when needed.

Closing Thoughts

Chapter 7 bankruptcy is a powerful tool for debt relief, offering a fresh financial start for those overwhelmed by unsecured debts. However, it comes with significant long-term consequences that must be carefully weighed. The decision to file for Chapter 7 bankruptcy should not be taken lightly and should involve careful consideration of all alternatives and consultation with financial and legal professionals.

For those struggling with debt, it’s crucial to explore all options, including debt consolidation, negotiation with creditors, and other forms of bankruptcy such as Chapter 13. Each financial situation is unique, and what works best for one individual may not be the optimal solution for another.

Ultimately, Chapter 7 bankruptcy can provide a path to financial recovery for those who truly need it. By understanding both the advantages and disadvantages, individuals can make an informed decision about whether Chapter 7 is the right choice for their financial future.

Frequently Asked Questions About Chapter 7 Pros And Cons

- How long does a Chapter 7 bankruptcy stay on my credit report?

A Chapter 7 bankruptcy remains on your credit report for 10 years from the filing date. However, its impact on your credit score typically diminishes over time. - Can I keep my house and car if I file for Chapter 7 bankruptcy?

It depends on your equity in these assets and your state’s exemption laws. Many filers can keep their primary residence and vehicle if they’re current on payments and the equity is within exemption limits. - Will I lose all my assets in Chapter 7 bankruptcy?

No, most Chapter 7 filers keep most or all of their assets due to exemptions. However, non-exempt assets may be liquidated to repay creditors. - Can I get credit after filing for Chapter 7 bankruptcy?

Yes, but it may be more difficult and come with higher interest rates initially. Many people can begin rebuilding credit within 1-2 years after discharge. - Will bankruptcy stop all collection efforts against me?

The automatic stay stops most collection efforts, but certain debts like child support may still be collected. The stay is temporary and lifts when the bankruptcy case closes. - Can I choose between Chapter 7 and Chapter 13 bankruptcy?

Not always. Eligibility for Chapter 7 depends on passing the means test, which assesses your income and expenses. If you don’t qualify for Chapter 7, Chapter 13 may be an option. - How often can I file for Chapter 7 bankruptcy?

You can file for Chapter 7 bankruptcy once every 8 years. This time limit is measured from the previous filing date, not the discharge date. - Will filing for Chapter 7 bankruptcy affect my spouse’s credit?

If you file individually, it shouldn’t directly affect your spouse’s credit. However, if you have joint debts or live in a community property state, there may be indirect effects.