A charitable gift annuity (CGA) is a financial arrangement that allows individuals to make a substantial donation to a charity while receiving a fixed income stream for life in return. This type of planned giving combines philanthropy with financial benefits, making it an attractive option for many donors. The donor contributes assets—such as cash, stocks, or real estate— to a nonprofit organization, and in exchange, they receive regular payments for the rest of their lives. Once the donor passes away, the remaining assets are retained by the charity. While CGAs offer several advantages, they also come with notable disadvantages that potential donors should consider carefully.

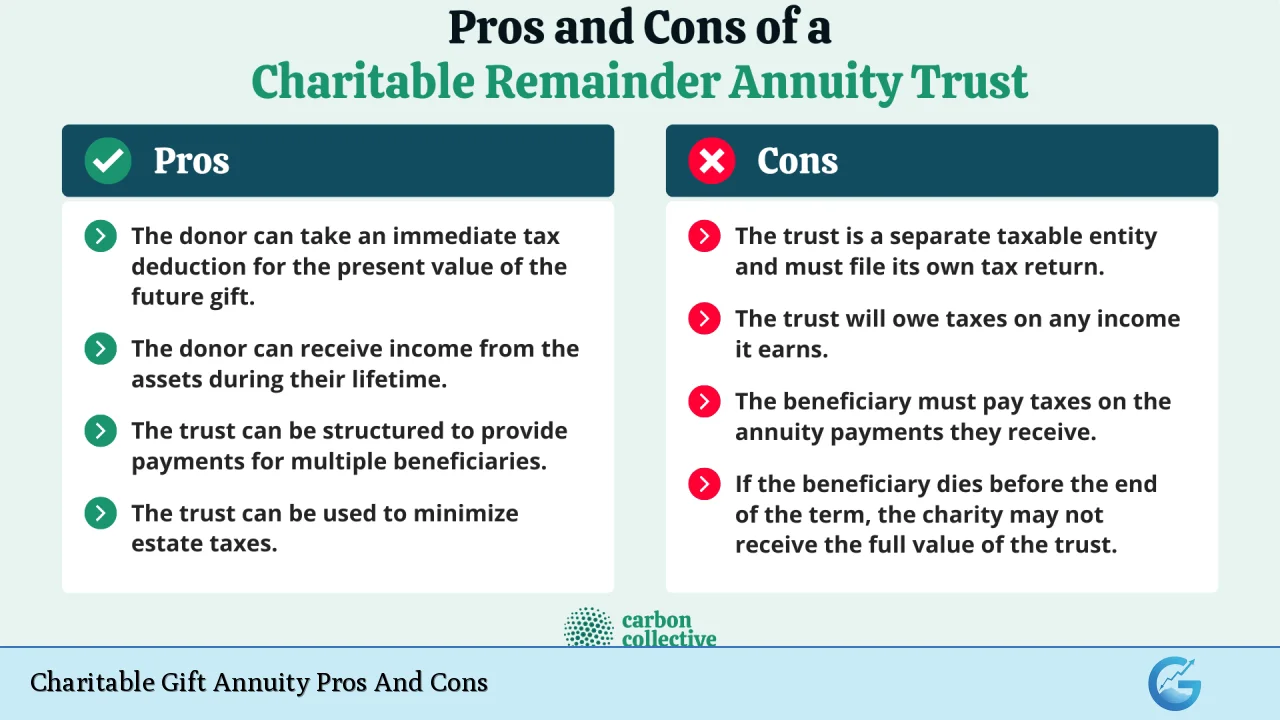

| Pros | Cons |

|---|---|

| Provides a steady income stream for life. | Irrevocable; once assets are donated, they cannot be reclaimed. |

| Offers immediate tax benefits, including a charitable deduction. | Fixed payments may not keep pace with inflation. |

| Part of the annuity payments may be tax-free. | Lower income rates compared to standard annuities. |

| Supports charitable causes and creates long-term impact. | Limited control over how the charity uses the donated funds. |

| Can reduce capital gains taxes if funded with appreciated assets. | Potentially lower liquidity due to the donation of assets. |

| No ongoing management fees for the donor. | Payments are not guaranteed by any government agency. |

Provides a Steady Income Stream for Life

One of the primary advantages of a charitable gift annuity is that it guarantees a steady income stream for the lifetime of the donor or designated beneficiaries. This can be particularly appealing for retirees who seek reliable cash flow without market volatility affecting their payments.

- Predictable Payments: Donors can expect fixed annual payments that do not fluctuate based on market conditions.

- Longevity Benefits: Older donors typically receive higher payout rates, which can provide significant financial support in later years.

Offers Immediate Tax Benefits

Another significant advantage is the immediate tax benefits associated with establishing a CGA. Donors can claim a charitable deduction for part of their contribution in the year they set up the annuity.

- Tax Deductions: The deduction amount is based on the present value of the future donation that will go to charity after the donor’s death.

- Tax-Free Payments: A portion of each payment received may be considered a tax-free return of principal until fully recovered.

Part of the Annuity Payments May Be Tax-Free

When funded with appreciated assets, CGAs can provide favorable tax treatment. This can help donors manage their tax liabilities effectively.

- Capital Gains Tax Reduction: Donors can avoid immediate capital gains taxes on appreciated assets by donating them directly instead of selling them first.

- Tax Strategy: The ability to receive partially tax-free income can be an effective strategy for high-net-worth individuals looking to optimize their tax situation.

Supports Charitable Causes and Creates Long-Term Impact

By establishing a CGA, donors are not only securing their financial future but also making a meaningful contribution to causes they care about.

- Legacy Building: The remaining funds after the donor’s death go directly to support charitable activities, ensuring that their legacy continues.

- Community Impact: Donors can support specific projects or initiatives within organizations they are passionate about, fostering positive change.

Can Reduce Capital Gains Taxes

Funding a charitable gift annuity with appreciated assets provides an opportunity to minimize capital gains tax exposure.

- Strategic Asset Management: Donors can transfer stocks or real estate without incurring immediate tax liabilities, allowing them to maximize their philanthropic impact while managing taxes effectively.

No Ongoing Management Fees for the Donor

Unlike other investment vehicles, CGAs typically do not involve ongoing management fees or administrative costs for donors.

- Cost Efficiency: This makes CGAs an appealing option for those who want to avoid additional expenses related to managing their donations.

Irrevocable; Once Assets Are Donated, They Cannot Be Reclaimed

A significant disadvantage of CGAs is that they are irrevocable. Once assets are transferred to the charity, donors cannot reclaim them.

- Permanent Decision: This means that donors must be certain about their decision and consider their future financial needs before committing.

Fixed Payments May Not Keep Pace with Inflation

While CGAs provide regular payments, these amounts are fixed and do not adjust for inflation over time.

- Purchasing Power Risk: As inflation rises, the real value of these payments may decrease, potentially impacting the donor’s standard of living in later years.

Lower Income Rates Compared to Standard Annuities

The income rates associated with charitable gift annuities tend to be lower than those offered by standard insurance annuities.

- Investment Comparison: For individuals primarily focused on maximizing returns, CGAs may not be as attractive as other investment options that offer higher yields.

Limited Control Over How the Charity Uses the Donated Funds

Once a CGA is established, donors have limited say in how their contributions are utilized by the charity.

- Fund Allocation: Charities often have discretion over fund allocation, which may not align with specific donor intentions regarding how their money should be used.

Potentially Lower Liquidity Due to the Donation of Assets

Donating assets through a CGA can lead to decreased liquidity since those funds are no longer available for personal use.

- Cash Flow Considerations: If unexpected expenses arise, donors may find themselves without access to cash that could have been generated from liquidating those assets instead.

Payments Are Not Guaranteed by Any Government Agency

Unlike some financial products backed by government guarantees, CGA payments depend on the financial health and stability of the issuing charity.

- Risk Assessment: Donors should carefully evaluate charities before committing to ensure they are financially sound and capable of fulfilling payment obligations over time.

In conclusion, charitable gift annuities present an intriguing blend of philanthropy and financial planning. They provide steady income streams and immediate tax benefits while supporting causes close to donors’ hearts. However, potential drawbacks such as irrevocability and fixed payment structures must be carefully weighed against these advantages.

For individuals interested in combining charitable giving with financial security in retirement or later life stages, understanding both sides of this arrangement is crucial. By doing so, donors can make informed decisions that align with their financial goals and philanthropic desires.

Frequently Asked Questions About Charitable Gift Annuities

- What is a charitable gift annuity?

A charitable gift annuity is an agreement between a donor and a nonprofit organization where the donor makes a substantial gift in exchange for guaranteed lifetime income payments. - How are payment amounts determined?

The payment amounts depend on factors such as the donor’s age and the size of the initial contribution; older donors generally receive higher payouts. - Are there any tax benefits?

Yes, donors can receive immediate tax deductions based on part of their donation and may enjoy tax-free portions of their annuity payments. - Can I change my mind after setting up a CGA?

No, contributions made through a CGA are irrevocable; once you donate your assets, you cannot reclaim them. - What happens if I pass away shortly after starting my CGA?

If you pass away soon after establishing your CGA, you will have received limited payments; however, more funds will remain for charity. - Can I fund my CGA with appreciated securities?

Yes, funding your CGA with appreciated securities can help minimize capital gains taxes associated with those assets. - Are my payments guaranteed?

CGA payments depend on the financial stability of the issuing charity; they are not guaranteed by any government agency. - Is there a minimum age or contribution amount required?

Most organizations require donors to be at least 60 years old and set minimum contributions typically starting around $5,000 or more.