Chase Bank, one of the largest financial institutions in the United States, offers a variety of checking accounts to cater to different financial needs. With its extensive network of branches and ATMs, as well as a suite of digital banking tools, Chase has become a popular choice for many consumers. However, like any financial product, Chase checking accounts come with their own set of advantages and disadvantages. This article will explore the pros and cons of Chase checking accounts in detail, providing insights that can help potential customers make informed decisions.

| Pros | Cons |

|---|---|

| Extensive branch and ATM network | Monthly service fees can be high |

| Sign-up bonuses for new customers | Low interest rates on savings |

| Robust online and mobile banking features | Fees for out-of-network ATM usage |

| Overdraft protection options available | Account closure risks for certain activities |

| Wide range of account types to choose from | Difficulty in customer service during peak times |

Extensive Branch and ATM Network

One of the standout features of Chase checking accounts is their extensive branch and ATM network.

- Accessibility: With over 4,700 branches and more than 15,000 ATMs across the U.S., customers can easily access their funds without incurring additional fees.

- Convenience: The widespread presence allows for easy in-person banking services, which is beneficial for those who prefer face-to-face interactions.

- Cardless Access: Customers can withdraw cash from ATMs without a card using their mobile device, enhancing convenience.

Monthly Service Fees Can Be High

While Chase offers numerous benefits, monthly service fees can be a significant drawback.

- Standard Fees: For example, the Chase Total Checking account has a monthly fee of $12, which can be waived under certain conditions like maintaining a minimum balance or setting up direct deposits.

- Additional Charges: Other accounts, such as the Premier Plus Checking account, have even higher fees ($25/month), which may not be justifiable for all consumers.

- Impact on Budgeting: These fees can add up over time, impacting overall budgeting and financial planning.

Sign-Up Bonuses for New Customers

Chase often provides attractive sign-up bonuses to entice new customers.

- Initial Incentives: New customers can earn bonuses ranging from $200 to $300 by meeting specific requirements such as making direct deposits within a set timeframe.

- Promotional Offers: These bonuses are a great way to kickstart your relationship with the bank and can provide immediate value.

- Encouragement to Switch Banks: Such offers may encourage customers to switch from other banks or open additional accounts.

Low Interest Rates on Savings

A common complaint among Chase account holders is the low interest rates on savings accounts linked to checking accounts.

- Competitive Disadvantage: Compared to online banks or credit unions that offer high-yield savings accounts, Chase’s rates are often uncompetitive.

- Long-Term Growth Impact: This can hinder long-term savings growth for customers who prefer to keep funds in savings rather than investing them elsewhere.

Robust Online and Mobile Banking Features

Chase provides a comprehensive suite of online and mobile banking features, making it easier for customers to manage their finances.

- User-Friendly App: The Chase mobile app allows users to check balances, transfer funds, pay bills, and deposit checks remotely.

- Zelle Integration: Users can easily send money to friends or family through Zelle directly within the app.

- Budgeting Tools: The app includes budgeting tools that help users track their spending and manage their finances effectively.

Fees for Out-of-Network ATM Usage

While Chase has many ATMs, using ATMs outside of its network incurs fees that can be burdensome.

- High Charges: Customers may face charges up to $3 per transaction when using non-Chase ATMs, plus any fees charged by the ATM owner.

- Inconvenience: This can be particularly inconvenient when traveling or in areas where Chase ATMs are not readily available.

Overdraft Protection Options Available

Chase offers various overdraft protection options, providing peace of mind for account holders.

- Linked Accounts: Customers can link their checking account to a savings account for automatic transfers in case of overdrafts, helping avoid overdraft fees.

- Overdraft Assist: This feature allows customers to overdraw their account by up to $50 without incurring an overdraft fee under certain conditions.

- Financial Safety Net: These options serve as a financial safety net for those who may occasionally miscalculate their spending.

Account Closure Risks for Certain Activities

Chase has been known to close accounts under specific circumstances, which poses a risk for some users.

- Monitoring Activities: The bank monitors account activities closely; unusual transactions or patterns may trigger an account review that could lead to closure.

- Customer Experiences: Many users have reported sudden account closures without prior notice or explanation, leading to frustration and inconvenience.

Wide Range of Account Types to Choose From

Chase offers various types of checking accounts tailored to different needs and lifestyles.

- Diverse Options: From student accounts to premium accounts with higher perks, customers can choose an account that best fits their financial situation.

- Flexibility in Features: Different accounts come with unique features like waived fees or enhanced interest rates based on customer needs and preferences.

- Adaptability: This variety allows customers to adapt their banking experience as their financial situations change over time.

Difficulty in Customer Service During Peak Times

While Chase provides robust customer service options, there are challenges during peak times that may affect user experience.

- Long Wait Times: Customers often report long wait times when calling customer service or visiting branches during busy hours.

- Limited Availability: Although online support is available 24/7, response times may vary significantly based on demand at any given time.

Closing Thoughts

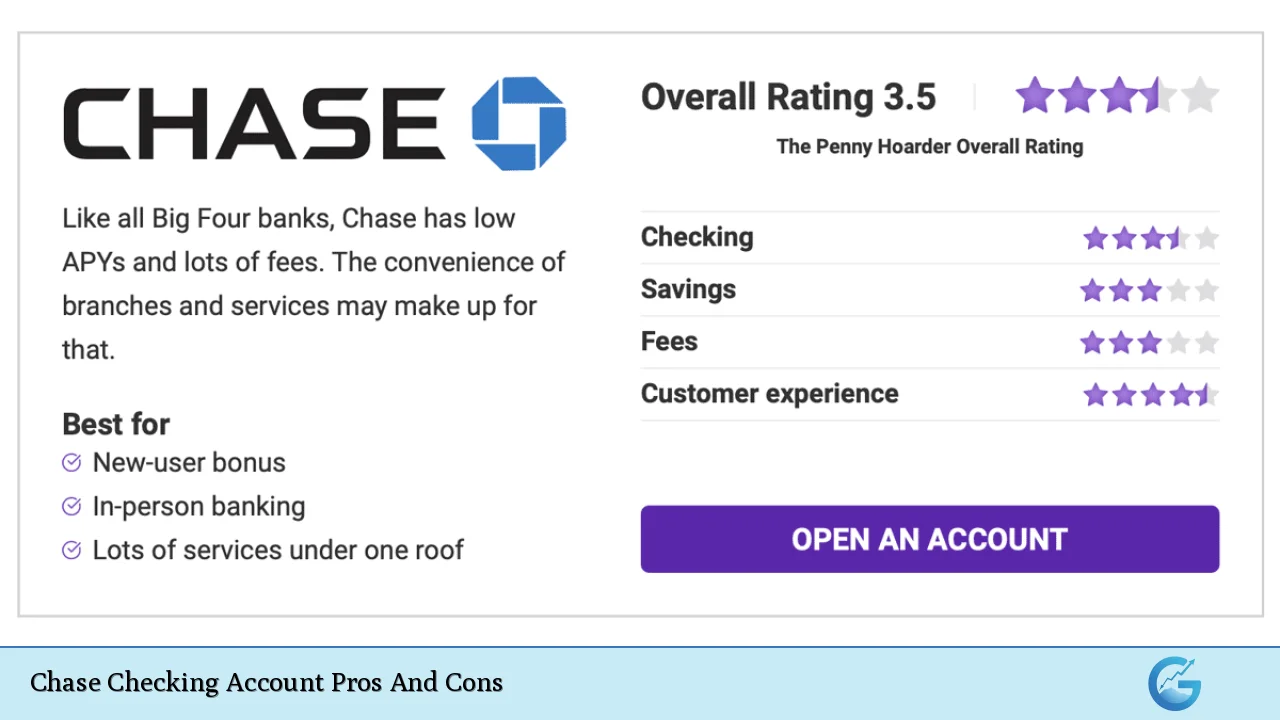

In conclusion, Chase checking accounts offer a mix of advantages and disadvantages that potential customers should carefully consider before opening an account. While the extensive branch network, robust online banking features, and attractive sign-up bonuses are compelling benefits, high monthly fees and low interest rates on savings present significant drawbacks. Additionally, risks associated with account closures and potential difficulties in customer service should not be overlooked.

Ultimately, individuals must evaluate these factors against their personal financial needs and preferences. By doing so, they can make an informed decision about whether a Chase checking account aligns with their financial goals.

Frequently Asked Questions About Chase Checking Accounts

- What is the minimum deposit required to open a Chase checking account?

The minimum deposit required varies by account type; however, many accounts have no minimum deposit requirement. - How can I avoid monthly service fees?

You can avoid monthly service fees by meeting certain criteria such as maintaining a minimum balance or setting up direct deposits. - Are there any sign-up bonuses available?

Yes, new customers may qualify for sign-up bonuses ranging from $200 to $300 when they meet specific requirements. - What happens if I overdraw my account?

If you overdraw your account but have overdraft protection linked to your savings account, funds will automatically transfer to cover the transaction. - Can I use non-Chase ATMs without incurring fees?

No, using non-Chase ATMs typically incurs fees; however, you may receive refunds on certain types of accounts. - Is there a mobile app available for managing my account?

Yes, Chase offers a highly-rated mobile app that allows you to manage your finances conveniently. - What should I do if my account is closed unexpectedly?

If your account is closed unexpectedly, contact Chase customer service immediately for clarification and assistance. - Does Chase offer any special accounts for students?

Yes, Chase provides student checking accounts designed specifically for younger customers with lower fees.