Condominium ownership has become an increasingly popular choice for many individuals and families, particularly in urban areas where housing prices are high and space is limited. This form of real estate ownership offers a unique blend of benefits and challenges that can significantly impact the lifestyle and financial situation of the owner. Understanding the pros and cons of condo ownership is crucial for potential buyers, especially those interested in finance, crypto, forex, and money markets, as it can influence investment decisions and long-term financial planning.

In this article, we will explore the various advantages and disadvantages of owning a condominium. We will provide a comprehensive overview to help you make an informed decision about whether condo living aligns with your financial goals and lifestyle preferences.

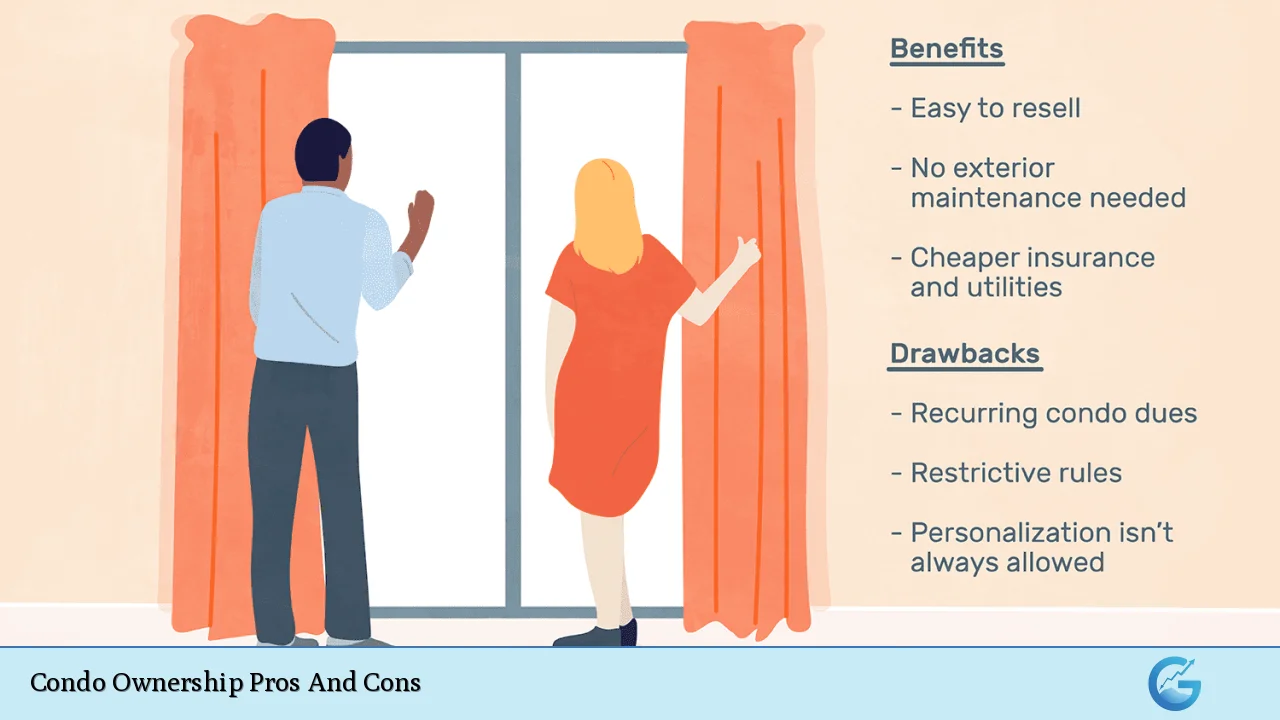

| Pros | Cons |

|---|---|

| Lower maintenance responsibilities | Less privacy due to shared spaces |

| Access to amenities | Monthly HOA fees can be high |

| Enhanced security features | Potential for HOA mismanagement |

| Community living opportunities | Restrictions on property modifications |

| Affordability compared to single-family homes | Special assessments for unexpected repairs |

| Building equity over time | Slower appreciation rates compared to houses |

| Potential rental income opportunities | Limited outdoor space and gardening options |

| Predictable monthly costs for budgeting | Group decision-making can be challenging |

Lower Maintenance Responsibilities

One of the most significant advantages of condo ownership is the reduced maintenance burden.

- Fewer chores: The homeowners association (HOA) typically handles exterior maintenance, landscaping, and common area upkeep, allowing owners to enjoy their homes without the hassle of yard work or repairs.

- Time-saving: This arrangement frees up time for residents to focus on personal interests or professional pursuits.

Access to Amenities

Condos often come with access to various amenities that enhance the living experience.

- Shared facilities: Many condominium complexes offer amenities such as swimming pools, fitness centers, clubhouses, and recreational areas that might be financially unfeasible for individual homeowners.

- Social opportunities: These amenities foster a sense of community among residents, providing opportunities for social interaction and engagement.

Enhanced Security Features

Security is another compelling advantage of condo living.

- Controlled access: Many condos feature secure entrances, surveillance systems, and sometimes even on-site security personnel, which can provide peace of mind for residents.

- Community safety: The close-knit nature of condo living often means neighbors watch out for each other, enhancing overall security.

Community Living Opportunities

Living in a condo promotes a sense of community that can be beneficial for many individuals.

- Social connections: Residents are more likely to meet their neighbors regularly, which can lead to friendships and a supportive community network.

- Organized events: HOAs often organize social events, fostering camaraderie among residents.

Affordability Compared to Single-Family Homes

For many buyers, condos present a more affordable entry point into homeownership.

- Lower purchase prices: Condos generally cost less than single-family homes in similar locations, making them accessible to first-time buyers or those looking to downsize.

- Lower property taxes: Property taxes on condos are often lower due to their smaller size and shared land ownership.

Building Equity Over Time

Owning a condo allows individuals to build equity just like any other property.

- Mortgage payments: Each payment contributes to ownership rather than going toward rent.

- Long-term investment: Over time, as property values increase, owners can benefit from appreciation in their investment.

Potential Rental Income Opportunities

Condo ownership may also provide opportunities for generating rental income.

- Renting out units: Owners who move or travel frequently can rent their condos when they are not using them, creating an additional revenue stream.

- Investment potential: This aspect makes condos appealing not just as homes but also as investment properties.

Predictable Monthly Costs for Budgeting

The financial predictability associated with condo ownership is another advantage.

- Consistent fees: Monthly HOA fees cover maintenance and amenities, allowing owners to budget more effectively without worrying about unexpected repair costs.

- Financial planning: This predictability aids in long-term financial planning and stability.

Less Privacy Due to Shared Spaces

Despite the numerous advantages, condo ownership does have its drawbacks.

- Shared walls: Owners share walls with neighbors, which can lead to noise issues and reduced privacy.

- Frequent interactions: The close proximity may not suit everyone’s lifestyle preferences.

Monthly HOA Fees Can Be High

While HOA fees contribute to maintenance and amenities, they can also be a significant expense.

- Budget considerations: These fees can vary widely based on location and services offered; thus, potential buyers should factor them into their overall budget.

- Increased costs over time: Fees may increase annually as maintenance costs rise or new amenities are added.

Potential for HOA Mismanagement

The effectiveness of the HOA can greatly impact the living experience in a condominium community.

- Management issues: Poor management can lead to neglected common areas or unresolved disputes among residents.

- Accountability concerns: Owners may find it challenging to hold HOAs accountable if they do not operate transparently.

Restrictions on Property Modifications

Condo owners often face limitations regarding modifications to their units.

- HOA rules: Many HOAs enforce strict guidelines on renovations or alterations within individual units or shared spaces.

- Personal expression limitations: This can restrict owners’ ability to personalize their living spaces as they might wish.

Special Assessments for Unexpected Repairs

In addition to regular fees, owners may face unexpected financial burdens due to special assessments.

- Unexpected costs: If major repairs are needed (e.g., roof replacement), all owners may be required to contribute additional funds beyond regular dues.

- Financial strain: These assessments can create financial strain if not anticipated in budgeting plans.

Slower Appreciation Rates Compared to Houses

While condos can appreciate over time, they may do so at a slower rate than single-family homes.

- Market fluctuations: The value of a condo is often tied closely to the overall market conditions affecting similar properties in the area.

- Investment risk: If neighboring units decline in value or if the HOA fails financially, it could negatively impact individual unit values as well.

Limited Outdoor Space and Gardening Options

For those who enjoy gardening or outdoor activities, condos may present limitations.

- Shared outdoor areas: Most condos have limited private outdoor space; this could be disappointing for individuals who value having their own garden or yard.

- Common area restrictions: Owners may have restricted access or usage rights regarding common outdoor areas.

Group Decision-Making Can Be Challenging

Living in a community setting means that decisions about shared spaces must be made collectively.

- Consensus-building difficulties: Reaching agreement among diverse residents with differing opinions can be challenging and time-consuming.

- Potential conflicts: Disagreements over management decisions or community rules may lead to conflicts among residents.

In conclusion, condominium ownership presents both significant advantages and notable disadvantages. For those interested in finance-related investments such as real estate or looking for affordable housing options with reduced maintenance responsibilities, condos offer an appealing solution. However, potential buyers must carefully consider aspects such as privacy concerns, HOA dynamics, and associated fees before making a decision. Ultimately, understanding these factors will help prospective buyers align their housing choices with their financial goals and lifestyle preferences.

Frequently Asked Questions About Condo Ownership

- What are the main benefits of owning a condo?

Owning a condo provides lower maintenance responsibilities, access to shared amenities, enhanced security features, affordability compared to single-family homes, and opportunities for building equity. - What are common drawbacks of condo ownership?

The main drawbacks include less privacy due to shared spaces, potentially high HOA fees, restrictions on property modifications, special assessments for unexpected repairs, and slower appreciation rates compared to houses. - How do HOA fees work?

HOA fees are monthly charges paid by condo owners that cover maintenance of common areas and amenities; these fees can vary widely based on location and services provided. - Can I rent out my condo?

Many condos allow owners to rent out their units; however, it’s essential to check with the HOA regarding any specific rules or restrictions related to rentals. - What should I consider before buying a condo?

Potential buyers should evaluate HOA regulations, monthly fees, community rules regarding pets or renovations, soundproofing quality between units, and overall management effectiveness. - Aren’t condos typically more affordable than houses?

Yes! Condos generally have lower purchase prices compared to single-family homes in similar areas due to their compact nature. - What happens if I don’t pay my HOA fees?

If you fail to pay your HOA fees on time, the association may impose penalties or even place a lien on your unit which could lead to foreclosure. - Is there any potential risk involved with condo investments?

Yes! Condo investments carry risks such as dependence on overall market conditions affecting property values and potential issues arising from HOA mismanagement.