Condominiums, commonly referred to as condos, are a popular form of housing that combines the benefits of homeownership with the convenience of rental living. They typically consist of individual units owned by residents, while common areas and amenities are shared among all owners. This unique structure presents a variety of advantages and disadvantages that potential buyers and investors must consider. Understanding these pros and cons is crucial for making informed decisions, especially for those interested in finance, real estate investment, and market dynamics.

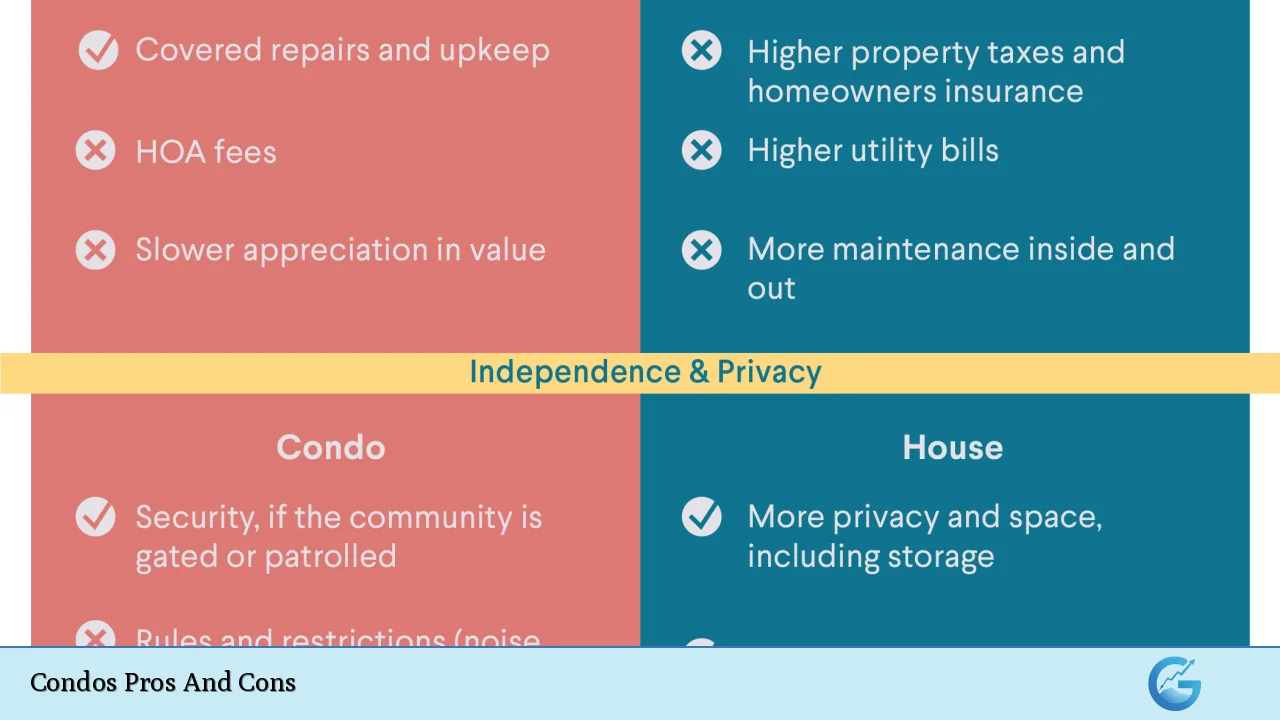

| Pros | Cons |

|---|---|

| Lower maintenance responsibilities | HOA rules can be restrictive |

| Access to amenities | Potential for rising HOA fees |

| Affordability compared to single-family homes | Less privacy due to shared walls |

| Enhanced security features | Investment risk linked to community performance |

| Social opportunities within the community | Limited outdoor space |

| Predictable monthly expenses | Special assessments for unexpected repairs |

| Potential for property appreciation | Higher interest rates on loans |

Lower Maintenance Responsibilities

One of the most significant advantages of condo living is the reduced maintenance burden.

- Exterior Maintenance: Most exterior upkeep, such as landscaping, snow removal, and building repairs, is handled by the homeowners association (HOA). This allows residents to enjoy their homes without the hassle of maintaining the property.

- Time Savings: For busy professionals or those who travel frequently, this means more free time and less worry about property upkeep.

Access to Amenities

Condos often come with a variety of amenities that enhance the living experience.

- Shared Facilities: Many condo communities offer features like swimming pools, fitness centers, parks, and community rooms.

- Cost Efficiency: These amenities are typically funded through HOA fees, making them more affordable than if individuals were to maintain them independently.

Affordability Compared to Single-Family Homes

Condos can be a more budget-friendly option for homebuyers.

- Lower Purchase Price: The cost of purchasing a condo is generally lower than that of a single-family home, making it an attractive option for first-time buyers or those looking to downsize.

- Reduced Property Taxes: Property taxes on condos are often lower than those on single-family homes due to their smaller size and shared land.

Enhanced Security Features

Many condo complexes provide enhanced security measures.

- Controlled Access: Features such as gated entrances, security cameras, and on-site personnel can offer peace of mind.

- Community Living: Living in close proximity to neighbors can also enhance safety, as residents often look out for one another.

Social Opportunities Within the Community

Condos foster a sense of community among residents.

- Social Events: Many HOAs organize social gatherings like barbecues or holiday parties, providing opportunities for residents to connect.

- Networking Potential: This communal atmosphere can be beneficial for networking and forming friendships.

Predictable Monthly Expenses

Condo living often comes with predictable financial obligations.

- HOA Fees: Monthly fees cover maintenance and amenities, allowing owners to budget effectively without unexpected costs related to upkeep.

- Financial Planning: This predictability is particularly appealing for those managing tight budgets or seeking stable investments.

Potential for Property Appreciation

Investing in a condo can lead to long-term financial benefits.

- Market Trends: While condos may appreciate at a slower rate than single-family homes, they still hold potential for value increase based on location and market demand.

- Equity Building: As owners pay down their mortgages, they build equity that can contribute to future financial stability or investment opportunities.

HOA Rules Can Be Restrictive

While HOAs provide benefits, they also impose certain restrictions that can be limiting.

- Regulations: Rules may govern everything from pet ownership to exterior modifications. Non-compliance can result in penalties or fines.

- Decision-Making Power: Residents may find themselves at odds with HOA decisions that affect their living conditions or property use.

Potential for Rising HOA Fees

While predictable fees are an advantage, they can also increase over time.

- Cost Increases: HOA fees may rise due to inflation or increased maintenance costs, impacting overall affordability.

- Budgeting Challenges: Homeowners must factor these potential increases into their long-term financial planning.

Less Privacy Due to Shared Walls

Condos often come with less privacy compared to single-family homes.

- Noise Concerns: Shared walls can lead to noise disturbances from neighbors, which may be a significant downside for some residents.

- Limited Personal Space: The close quarters may not suit individuals who value solitude or quiet living environments.

Investment Risk Linked to Community Performance

Investing in a condo carries inherent risks tied to the overall health of the community.

- Market Dependence: The value of a condo is influenced by the performance of other units within the complex. If one unit forecloses or loses value, it can negatively impact others.

- HOA Management Impact: Poor management by the HOA can lead to decreased property values and increased costs for residents.

Limited Outdoor Space

Many condos have restricted outdoor areas compared to standalone homes.

- Shared Green Spaces: Residents may have limited access to private outdoor areas, which can be a drawback for families or pet owners who desire more space.

- Urban Living Limitations: In urban settings where condos are prevalent, outdoor space is often at a premium, leading some buyers to seek alternatives in single-family homes or townhouses.

Special Assessments for Unexpected Repairs

In addition to regular fees, homeowners may face unexpected costs through special assessments.

- Emergency Repairs: If significant repairs are needed (e.g., roof replacement), all owners may be required to contribute additional funds beyond their regular HOA fees.

- Financial Strain: This unpredictability can strain budgets and complicate financial planning for homeowners who might not have set aside extra funds for such emergencies.

Higher Interest Rates on Loans

Financing a condo purchase may come with higher interest rates compared to single-family homes.

- Lender Concerns: Lenders often perceive condos as higher-risk investments due to shared ownership dynamics and potential market volatility.

- Cost Implications: This can result in higher monthly payments and overall borrowing costs for buyers looking at condos as investment properties or primary residences.

In conclusion, purchasing a condo offers both significant advantages and notable drawbacks. For individuals interested in investing in real estate or seeking affordable housing options with less maintenance responsibility, condos present an appealing choice. However, potential buyers must carefully consider factors such as HOA regulations, privacy issues, and investment risks associated with shared ownership. Understanding these dynamics will empower prospective homeowners and investors alike to make informed decisions that align with their financial goals and lifestyle preferences.

Frequently Asked Questions About Condos Pros And Cons

- What are the main advantages of buying a condo?

Condos offer lower maintenance responsibilities, access to amenities like pools and gyms, enhanced security features, affordability compared to single-family homes, and predictable monthly expenses. - What are common disadvantages associated with condo ownership?

The main drawbacks include restrictive HOA rules, potential rising fees, less privacy due to shared walls, investment risks tied to community performance, and limited outdoor space. - How do HOA fees impact condo ownership?

HOA fees cover maintenance and amenities but can increase over time. Homeowners should budget accordingly as these fees directly affect overall affordability. - Are condos a good investment?

Condos can appreciate in value over time but carry risks linked to market fluctuations and community management. It’s essential to evaluate location and market trends before investing. - What should I consider before buying a condo?

Prospective buyers should review HOA rules, assess financial health of the association, understand fee structures, evaluate location desirability, and consider personal lifestyle preferences. - How does living in a condo compare with renting an apartment?

Owning a condo provides equity building opportunities while renting typically offers flexibility without long-term commitment but lacks ownership benefits. - What types of amenities are commonly found in condos?

Amenities vary but often include swimming pools, fitness centers, communal lounges, parking facilities, security services, and landscaped gardens. - Can I modify my condo unit?

This depends on HOA regulations; many associations have strict guidelines regarding modifications. Always check before making changes.