Debt consolidation is a financial strategy that involves combining multiple debts into a single loan, often with the aim of reducing monthly payments and simplifying financial management. This approach can be particularly appealing to individuals struggling with high-interest debts, such as those from credit cards or personal loans. By consolidating debt, borrowers can potentially lower their interest rates and streamline their repayment processes. However, while debt consolidation can offer several advantages, it also carries certain risks and drawbacks that must be carefully considered.

Understanding the pros and cons of debt consolidation is crucial for anyone considering this option. Below, we explore the various benefits and disadvantages associated with consolidating debt, providing a comprehensive overview for those interested in finance, including aspects relevant to crypto, forex, and money markets.

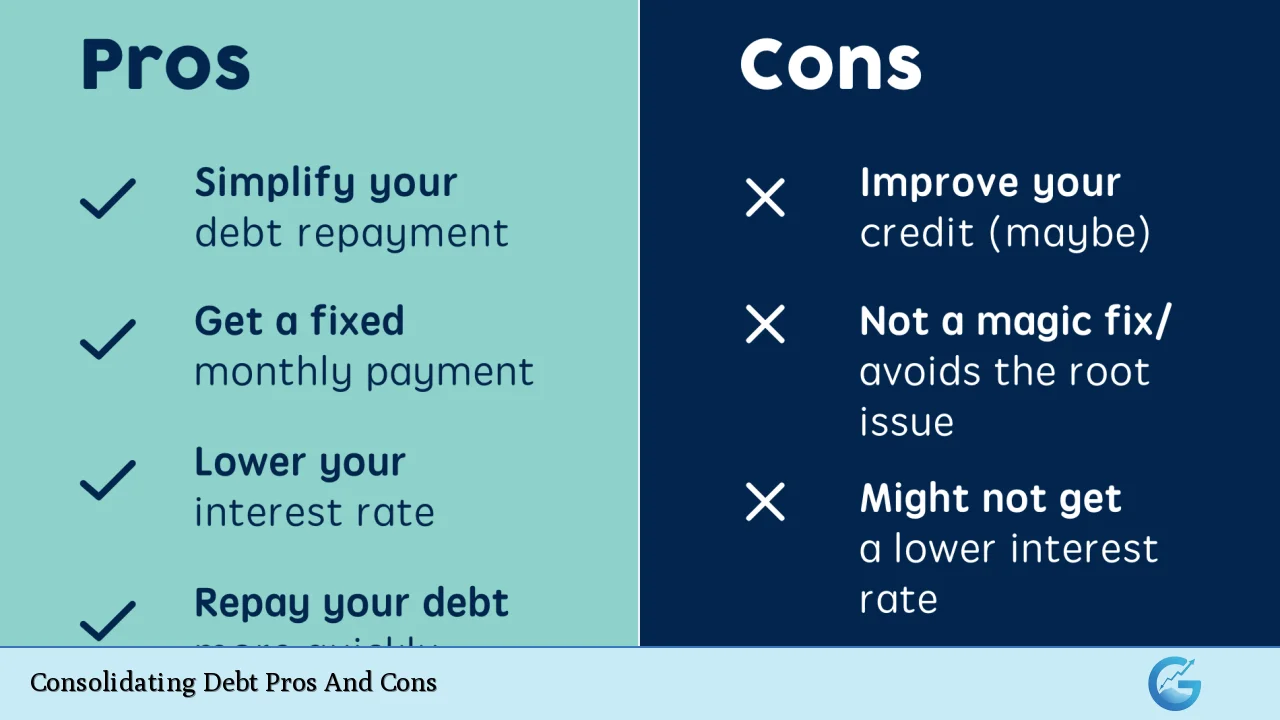

| Pros | Cons |

|---|---|

| Lower interest rates on consolidated loans | Potential for higher overall costs if not managed properly |

| Simplified payments with a single monthly obligation | May not address underlying financial habits leading to debt accumulation |

| Fixed repayment terms for better budgeting | Risk of accruing new debt if old habits persist |

| Improved credit score potential over time | Upfront costs and fees associated with consolidation loans |

| Faster debt repayment possibilities | Requires good credit to secure favorable loan terms |

| Reduced stress from managing multiple payments | May lead to loss of benefits from original loans (e.g., rewards points) |

| Potential for better cash flow management | Secured loans risk losing assets (e.g., home) if unable to pay |

Lower Interest Rates on Consolidated Loans

One of the primary advantages of debt consolidation is the potential for lower interest rates. Many borrowers find that consolidating high-interest debts into a single loan can significantly reduce the overall cost of borrowing. This is especially true for those who have accumulated credit card debt, which typically carries much higher interest rates than personal loans or home equity lines of credit.

- Savings on Interest: By securing a lower interest rate through consolidation, more of your monthly payment goes toward paying down the principal balance rather than interest.

- Long-Term Financial Benefits: Over time, this can lead to substantial savings and allow borrowers to pay off their debts more quickly.

Simplified Payments with a Single Monthly Obligation

Managing multiple debts can be overwhelming, particularly when each has different due dates and payment amounts. Debt consolidation simplifies this process by combining all debts into one monthly payment.

- Easier Financial Management: With only one payment to track, borrowers can better manage their finances and reduce the risk of missed payments.

- Reduced Stress: This streamlined approach can alleviate anxiety associated with juggling various creditors and payment schedules.

Fixed Repayment Terms for Better Budgeting

Debt consolidation often comes with fixed repayment terms, which can help borrowers plan their finances more effectively.

- Predictable Payments: Knowing exactly how much is due each month aids in budgeting and financial planning.

- End Date in Sight: Fixed terms provide a clear timeline for when the debt will be paid off, motivating borrowers to stay on track.

Improved Credit Score Potential Over Time

While taking out a new loan may initially cause a small dip in your credit score due to the hard inquiry, managing a consolidated loan responsibly can lead to improvements in your credit profile over time.

- Lower Credit Utilization Ratio: Paying off existing debts reduces your overall credit utilization ratio, positively impacting your score.

- On-Time Payments Boost Credit Health: Consistently making payments on time can further enhance your credit rating.

Faster Debt Repayment Possibilities

For many borrowers, consolidating debt can accelerate the path to becoming debt-free.

- Focus on Principal Reduction: With lower interest rates and fixed payments, borrowers may find they can pay off their debts faster than if they continued making minimum payments on multiple accounts.

- Strategic Use of Savings: Any savings from lower payments can be redirected toward additional principal payments, hastening debt elimination.

Potential for Better Cash Flow Management

Consolidating debt can improve cash flow by reducing monthly obligations or allowing for more manageable payment structures.

- More Disposable Income: Lower monthly payments free up cash that can be used for other expenses or savings goals.

- Financial Stability: Improved cash flow can help individuals avoid future borrowing and build an emergency fund.

Potential for Higher Overall Costs If Not Managed Properly

Despite its advantages, debt consolidation may lead to higher overall costs if not approached carefully.

- Longer Loan Terms May Increase Total Interest Paid: While monthly payments may decrease, extending the loan term could result in paying more interest over time.

- Hidden Fees: Some consolidation loans come with origination fees or other costs that could negate any savings achieved through lower interest rates.

May Not Address Underlying Financial Habits Leading to Debt Accumulation

Consolidation alone does not solve the root causes of financial distress.

- Temporary Solution: If poor spending habits are not addressed, borrowers may find themselves accumulating new debts after consolidating old ones.

- Need for Financial Discipline: It’s essential for individuals to develop better budgeting skills and financial habits post-consolidation to avoid repeating past mistakes.

Risk of Accruing New Debt If Old Habits Persist

One significant risk associated with debt consolidation is the temptation to incur new debts after feeling relief from previous obligations.

- Psychological Impact: The perceived freedom from old debts may lead some individuals to revert to previous spending patterns.

- Cycle of Debt: Without proper financial education and discipline, borrowers may end up worse off than before.

Upfront Costs and Fees Associated with Consolidation Loans

Many consolidation options come with fees that could impact overall savings.

- Origination Fees: Some lenders charge fees that could diminish the benefits of securing a lower interest rate.

- Costs of Closing Accounts: Paying off existing loans might incur additional costs or penalties depending on lender policies.

Requires Good Credit to Secure Favorable Loan Terms

Not all individuals qualify for low-interest consolidation loans.

- Credit Score Dependency: Those with poor credit may find it challenging to secure favorable terms or might face higher interest rates.

- Limited Options: Borrowers with low credit scores may have fewer options available, making it difficult to consolidate effectively.

May Lead to Loss of Benefits from Original Loans (e.g., Rewards Points)

Consolidating certain types of debts might result in losing valuable benefits associated with original loans or credit lines.

- Rewards Programs: For instance, paying off a rewards credit card could mean losing out on points that could have been accrued over time.

- Special Loan Features: Some loans offer unique features (like deferment options) that might not be available with a new consolidated loan.

Secured Loans Risk Losing Assets (e.g., Home) If Unable to Pay

If opting for secured loans as part of the consolidation process, there are inherent risks involved.

- Asset Risk: Using home equity or other assets as collateral means failing to make payments could lead to foreclosure or loss of those assets.

- Increased Financial Pressure: The stakes are higher when personal property is tied directly to repayment obligations.

In conclusion, while consolidating debt offers several potential benefits such as lower interest rates and simplified payments, it also presents significant risks that must be carefully weighed. Individuals considering this option should evaluate their financial habits and ensure they are prepared to manage their debts responsibly moving forward. Ultimately, successful debt management requires not just effective strategies like consolidation but also ongoing commitment to sound financial practices.

Frequently Asked Questions About Consolidating Debt

- What types of debts can be consolidated?

You can consolidate various types of unsecured debts including credit card balances, personal loans, medical bills, and sometimes student loans. - How does debt consolidation affect my credit score?

Initially, your score may dip slightly due to hard inquiries; however, responsible management of your new loan can improve your score over time. - Is it possible to consolidate secured debts?

Yes, you can consolidate secured debts like mortgages through refinancing options; however, this carries additional risks. - What should I consider before consolidating?

You should assess your current financial habits, compare interest rates offered by lenders, and understand any fees associated with new loans. - Can I still accumulate debt after consolidating?

Yes, if you do not change your spending habits post-consolidation; it’s crucial to develop better financial discipline. - Are there alternatives to debt consolidation?

Alternatives include negotiating directly with creditors for lower rates or exploring debt management plans through non-profit agencies. - How long does it take to see results from debt consolidation?

The timeline varies based on individual circumstances; however, many see improvements in cash flow and reduced stress within months. - Can I consolidate my student loans?

You can consolidate federal student loans through programs like Direct Consolidation Loans; private student loans may also be consolidated but vary by lender.