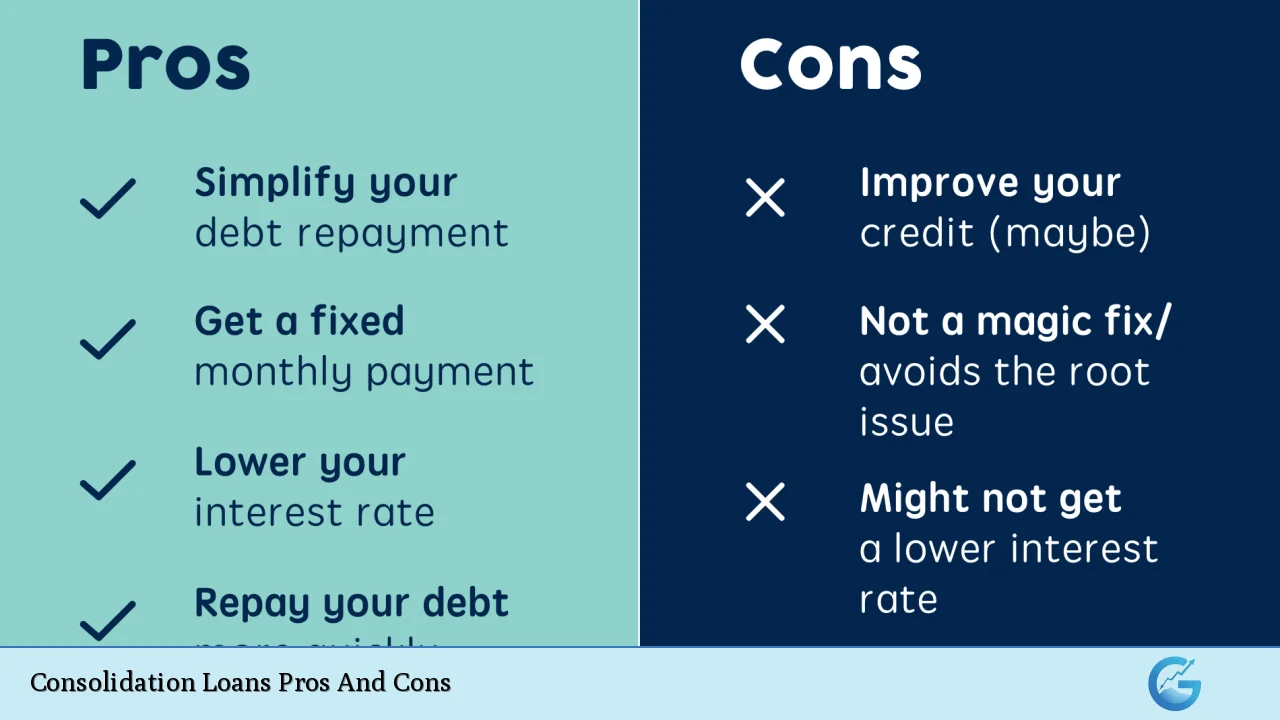

Debt consolidation loans have become a popular financial strategy for individuals seeking to manage their debt more effectively. This approach involves taking out a single loan to pay off multiple debts, such as credit cards, personal loans, and other obligations. By consolidating debts, borrowers can simplify their payment process, potentially lower their interest rates, and reduce the overall financial burden. However, while there are clear advantages to this strategy, there are also significant drawbacks that must be considered. This article will explore the pros and cons of consolidation loans in detail, helping readers to make informed decisions about their financial futures.

| Pros | Cons |

|---|---|

| Lower monthly payments | Potentially higher overall interest costs |

| Simplified finances with one payment | Risk of accumulating more debt |

| Improved credit score potential | Fees and penalties associated with loans |

| Fixed repayment schedule | Not suitable for all types of debt |

| Access to better loan terms with improved credit score | May require good credit for favorable rates |

| Potential for faster debt repayment | Longer repayment terms can extend debt duration |

| Reduced stress from managing multiple debts | Loss of benefits from original loans (e.g., rewards) |

Lower Monthly Payments

One of the most significant advantages of consolidation loans is the potential for lower monthly payments. When consolidating high-interest debts into a single loan with a lower interest rate, borrowers can reduce their monthly financial obligations.

- Lower Interest Rates: Consolidation loans often come with lower interest rates than existing debts, especially if the borrower has improved their credit score since taking out previous loans.

- Extended Loan Terms: By extending the loan term, borrowers can spread out payments over a longer period, resulting in lower monthly payments.

Simplified Finances with One Payment

Consolidation simplifies financial management by reducing multiple payments into a single monthly obligation.

- Easier Budgeting: With only one payment to track, borrowers can more easily manage their budgets and avoid missed payments.

- Reduced Administrative Burden: Consolidating debts means less time spent managing various accounts and due dates.

Improved Credit Score Potential

Consolidating debts can positively impact a borrower’s credit score over time.

- Lower Credit Utilization Ratio: Paying off multiple credit accounts reduces the total utilization ratio, which is beneficial for credit scores.

- Timely Payments: Making consistent payments on a consolidation loan can enhance credit history.

Fixed Repayment Schedule

Most consolidation loans come with fixed repayment terms.

- Predictable Payments: Borrowers benefit from knowing exactly how much they need to pay each month without fluctuations in interest rates or payment amounts.

- Financial Planning: A fixed schedule allows for better long-term financial planning and stability.

Access to Better Loan Terms with Improved Credit Score

If a borrower’s credit score has improved since they took out previous loans, they may qualify for better terms on a consolidation loan.

- Lower Rates: Improved credit scores often lead to lower interest rates on new loans.

- Flexible Terms: Borrowers may have access to more favorable repayment terms or conditions based on their improved financial standing.

Potential for Faster Debt Repayment

When structured correctly, consolidation loans can help borrowers pay off their debts more quickly.

- Focus on Principal Reduction: Lower interest rates mean that more of each payment goes toward reducing the principal balance rather than paying interest.

- Motivation to Pay Off Debt: The simplicity of one loan can motivate borrowers to prioritize repayment.

Reduced Stress from Managing Multiple Debts

Managing several debts can be stressful; consolidation alleviates this burden.

- Less Anxiety: Fewer debts mean less worry about missing payments or juggling multiple due dates.

- Clearer Financial Picture: Consolidation provides a clearer view of one’s financial situation by focusing on one loan instead of many.

Potentially Higher Overall Interest Costs

While monthly payments may decrease, the total cost of borrowing could increase over time due to extended loan terms or higher rates than expected.

- Longer Loan Terms: Extending the term may lead to paying more in interest over the life of the loan despite lower monthly payments.

- Higher Rates for Poor Credit: Borrowers with less-than-stellar credit may end up with higher rates than their original debts if they do not qualify for favorable terms.

Risk of Accumulating More Debt

One significant risk associated with consolidation is the potential to accumulate additional debt after consolidating existing obligations.

- Credit Card Usage: After paying off credit cards with a consolidation loan, some borrowers may be tempted to use those cards again, leading to increased debt levels.

- Financial Habits Matter: Without addressing underlying spending habits, borrowers may find themselves in a worse financial situation post-consolidation.

Fees and Penalties Associated with Loans

Consolidation loans often come with various fees that can negate some benefits.

- Origination Fees: Many lenders charge origination fees that can range from 1% to 10% of the total loan amount.

- Prepayment Penalties: Some lenders impose penalties if borrowers pay off their loans early, reducing flexibility in managing finances.

Not Suitable for All Types of Debt

Not every type of debt is eligible for consolidation through traditional loans.

- Secured vs. Unsecured Debt: Certain types of secured debts (like mortgages) cannot be consolidated using standard personal loans.

- Specific Lender Policies: Each lender has different policies regarding what types of debt they will consolidate, which may limit options for some borrowers.

May Require Good Credit for Favorable Rates

To secure the best rates on consolidation loans, borrowers often need good credit scores.

- Limited Options for Poor Credit: Those with poor credit may find it challenging to qualify for low-interest consolidation loans and might face higher rates instead.

- Credit Checks Impact Scores: Applying for multiple consolidation loans can temporarily impact credit scores due to hard inquiries by lenders.

Longer Repayment Terms Can Extend Debt Duration

While lower monthly payments are attractive, extending repayment terms can lead to prolonged debt duration and higher overall costs.

- Total Interest Paid Increases: A longer repayment term typically means paying more in total interest over time compared to shorter-term loans.

- Delayed Financial Freedom: Borrowers might find themselves in debt longer than anticipated if they choose extended terms without careful consideration of their overall financial strategy.

Loss of Benefits from Original Loans (e.g., Rewards)

Consolidating debts might result in losing certain benefits associated with original accounts that could have been advantageous in managing finances effectively.

- Rewards Programs Lost: If consolidating involves paying off rewards-based credit cards, borrowers could lose valuable points or cash-back opportunities.

- Promotional Rates Disappear: Some original loans offer promotional rates that are lost upon consolidation, potentially increasing costs unexpectedly.

In conclusion, while consolidation loans offer several advantages such as simplified payments and potentially lower interest rates, they also come with notable risks and disadvantages. Borrowers must weigh these pros and cons carefully against their unique financial situations before deciding whether this strategy is appropriate for them. It is crucial to consider not only immediate financial relief but also long-term implications on overall debt management and personal finance health.

Frequently Asked Questions About Consolidation Loans Pros And Cons

- What is a consolidation loan?

A consolidation loan combines multiple debts into one single loan, simplifying repayments and potentially lowering interest rates. - How does a consolidation loan affect my credit score?

Initially, applying for a new loan may cause a slight dip in your score; however, timely payments on the new loan can improve your score over time. - Can I consolidate secured debts?

Typically, secured debts like mortgages cannot be consolidated through standard personal loans; options like home equity lines may be available instead. - What types of debt can I consolidate?

You can consolidate various unsecured debts including credit card balances, medical bills, and personal loans. - Are there fees associated with consolidation loans?

Yes, many lenders charge origination fees or prepayment penalties that should be considered when evaluating options. - Is it possible to get a lower interest rate?

If you have improved your credit score since taking out your original debts, you may qualify for a lower interest rate on a consolidation loan. - What happens if I miss payments on my consolidation loan?

Missing payments could negatively impact your credit score and result in additional fees or penalties. - Can I still use my credit cards after consolidating?

You can use your credit cards after consolidating; however, it’s advisable not to accrue additional debt while managing existing obligations.