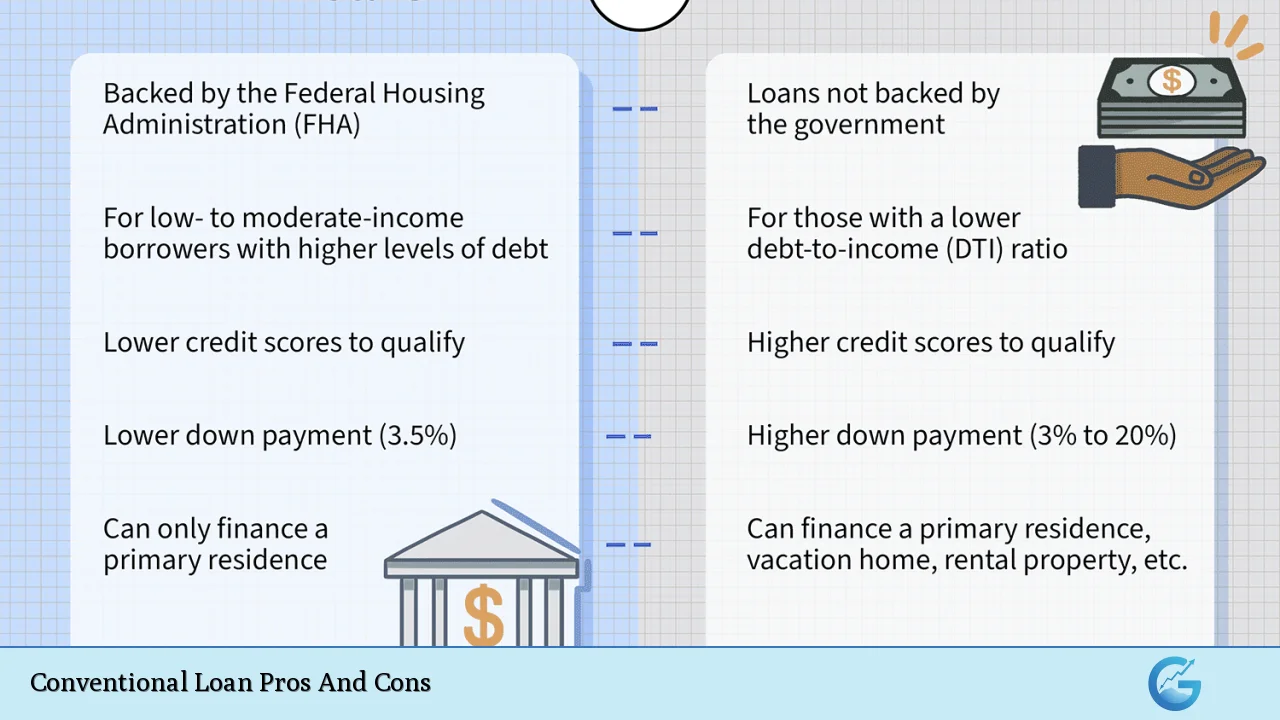

Conventional loans are a popular choice for homebuyers and real estate investors. They are defined as mortgages that are not insured or guaranteed by the federal government, unlike FHA, VA, or USDA loans. Conventional loans can be either conforming, which means they meet the guidelines set by government-sponsored enterprises like Fannie Mae and Freddie Mac, or non-conforming (jumbo loans) that exceed these limits. Understanding the pros and cons of conventional loans is crucial for potential borrowers who need to navigate the complexities of mortgage financing. This article delves into the advantages and disadvantages of conventional loans, providing a comprehensive overview for those interested in finance, real estate, and investment opportunities.

| Pros | Cons |

|---|---|

| Flexible loan options including fixed and adjustable rates | Strict eligibility requirements such as credit score and DTI ratio |

| Potentially lower overall costs compared to government-backed loans | Higher closing costs than some government loans |

| Cancellable private mortgage insurance (PMI) | PMI required if down payment is less than 20% |

| Wider range of property types eligible for financing | More paperwork and documentation required during application process |

| Faster processing times due to less regulatory oversight | Higher interest rates for borrowers with lower credit scores |

Flexible Loan Options Including Fixed and Adjustable Rates

Conventional loans offer borrowers a choice between fixed-rate and adjustable-rate mortgages (ARMs).

- Fixed-rate mortgages provide stability with consistent monthly payments throughout the loan term.

- Adjustable-rate mortgages typically start with lower initial rates that can fluctuate after a set period, potentially leading to lower payments in the early years.

This flexibility allows borrowers to select a loan type that aligns with their financial goals and risk tolerance.

Strict Eligibility Requirements

While conventional loans provide various options, they come with stringent eligibility criteria.

- Credit Score: Most lenders require a minimum credit score of 620; however, higher scores can yield better interest rates.

- Debt-to-Income Ratio (DTI): Lenders generally prefer a DTI ratio below 43% to ensure that borrowers can manage their monthly payments effectively.

These requirements can limit access for individuals with lower credit scores or significant existing debt.

Potentially Lower Overall Costs Compared to Government-Backed Loans

One of the significant advantages of conventional loans is that they often have lower overall costs than government-backed options.

- Interest Rates: For borrowers with good credit, conventional loans may offer competitive interest rates.

- No Upfront Mortgage Insurance Premiums: Unlike FHA loans, which require an upfront mortgage insurance premium, conventional loans do not have this added cost.

This can make them more appealing for those looking to minimize their expenses over the life of the loan.

Higher Closing Costs Than Some Government Loans

Despite potentially lower overall costs, conventional loans often come with higher closing costs compared to government-backed loans.

- Closing Costs: These can include appraisal fees, title insurance, and lender fees that may not be as prevalent in FHA or VA loans.

Borrowers should be prepared for these expenses when budgeting for their home purchase.

Cancellable Private Mortgage Insurance (PMI)

A notable benefit of conventional loans is the ability to cancel private mortgage insurance (PMI) once sufficient equity is built in the home.

- Equity Requirement: Borrowers can request cancellation of PMI once they reach 20% equity in their home.

This feature contrasts sharply with FHA loans, where mortgage insurance remains for the life of the loan unless specific conditions are met.

PMI Required If Down Payment Is Less Than 20%

While PMI can be cancelled, it is still a drawback for many borrowers who cannot afford a 20% down payment.

- Increased Monthly Payments: If a borrower puts down less than 20%, they will have to pay PMI, which increases their monthly mortgage payment.

This added cost can be burdensome for first-time homebuyers or those with limited savings.

Wider Range of Property Types Eligible for Financing

Conventional loans are versatile in terms of property types they can finance.

- Investment Properties: Unlike some government-backed loans that require properties to be primary residences, conventional loans allow financing for second homes and investment properties.

This flexibility makes them an attractive option for real estate investors looking to expand their portfolios.

More Paperwork and Documentation Required During Application Process

The application process for conventional loans can be more demanding than that of government-backed options.

- Documentation Needs: Borrowers must provide extensive documentation including income verification, tax returns, and bank statements.

This requirement may deter some potential borrowers who prefer a simpler application process.

Faster Processing Times Due to Less Regulatory Oversight

Conventional loans often experience faster processing times compared to government-backed mortgages.

- Less Red Tape: With fewer regulatory hurdles, lenders can expedite approvals and closings.

This efficiency is particularly beneficial for buyers who need to close quickly on a property.

Higher Interest Rates for Borrowers With Lower Credit Scores

While conventional loans can offer low rates for well-qualified borrowers, those with lower credit scores may face higher interest rates.

- Risk Assessment: Lenders view lower credit scores as higher risk; thus, they may increase rates to mitigate potential losses.

Borrowers should consider improving their credit profile before applying to secure better loan terms.

In conclusion, conventional loans present both advantages and disadvantages that potential borrowers must carefully weigh. They offer flexibility in terms of loan options and property types while also requiring strict adherence to eligibility criteria. The ability to cancel PMI is a significant benefit; however, the need for thorough documentation and potential costs associated with lower down payments should not be overlooked. Understanding these factors will empower individuals interested in financing their homes or investing in real estate to make informed decisions aligned with their financial goals.

Frequently Asked Questions About Conventional Loans

- What is a conventional loan?

A conventional loan is a type of mortgage that is not backed by any government agency but rather offered by private lenders. - What are the typical requirements for obtaining a conventional loan?

Most lenders require a minimum credit score of 620 and a debt-to-income ratio below 43%. - Can I get a conventional loan with a low down payment?

Yes, some conventional loan programs allow down payments as low as 3%, but PMI will be required if it’s less than 20%. - Is private mortgage insurance necessary on all conventional loans?

No, PMI is only required if your down payment is less than 20%. - What types of properties can I finance with a conventional loan?

You can finance primary residences, second homes, and investment properties with conventional loans. - How long does it take to process a conventional loan?

The processing time can vary but is generally faster than government-backed loans due to less regulatory oversight. - Are interest rates higher on conventional loans?

Interest rates on conventional loans depend on your credit score; lower scores typically result in higher rates. - Can I cancel my PMI on a conventional loan?

Yes, you can request cancellation of PMI once you reach 20% equity in your home.