When considering home financing options, two of the most popular choices are Conventional Loans and FHA (Federal Housing Administration) Loans. Each type of loan has its own set of advantages and disadvantages that can significantly impact a borrower’s financial situation. Understanding these differences is crucial for potential homeowners, especially those navigating the complexities of real estate financing in today’s market. This article will provide a comprehensive overview of the pros and cons associated with both Conventional and FHA loans, helping you make an informed decision.

| Pros | Cons |

|---|---|

| Lower down payment options (as low as 3% for Conventional; 3.5% for FHA) | Higher mortgage insurance costs for FHA loans |

| More flexible loan terms and options with Conventional loans | Strict credit score requirements for Conventional loans (minimum 620) |

| Potentially lower overall costs with Conventional loans for high credit borrowers | FHA loans require upfront mortgage insurance premiums (MIP) |

| No property restrictions on Conventional loans | FHA loans have property standards that must be met |

| Faster closing times due to less red tape in Conventional loans | FHA loans may have lower loan limits based on location |

| Ability to remove PMI once equity reaches 20% in Conventional loans | Mortgage insurance on FHA loans lasts longer, depending on down payment |

| More options for refinancing with Conventional loans | Limited eligibility for certain properties with FHA loans (e.g., condos) |

| No government backing means more lender flexibility with Conventional loans | Conventional loans may have higher interest rates for lower credit scores |

Lower Down Payment Options

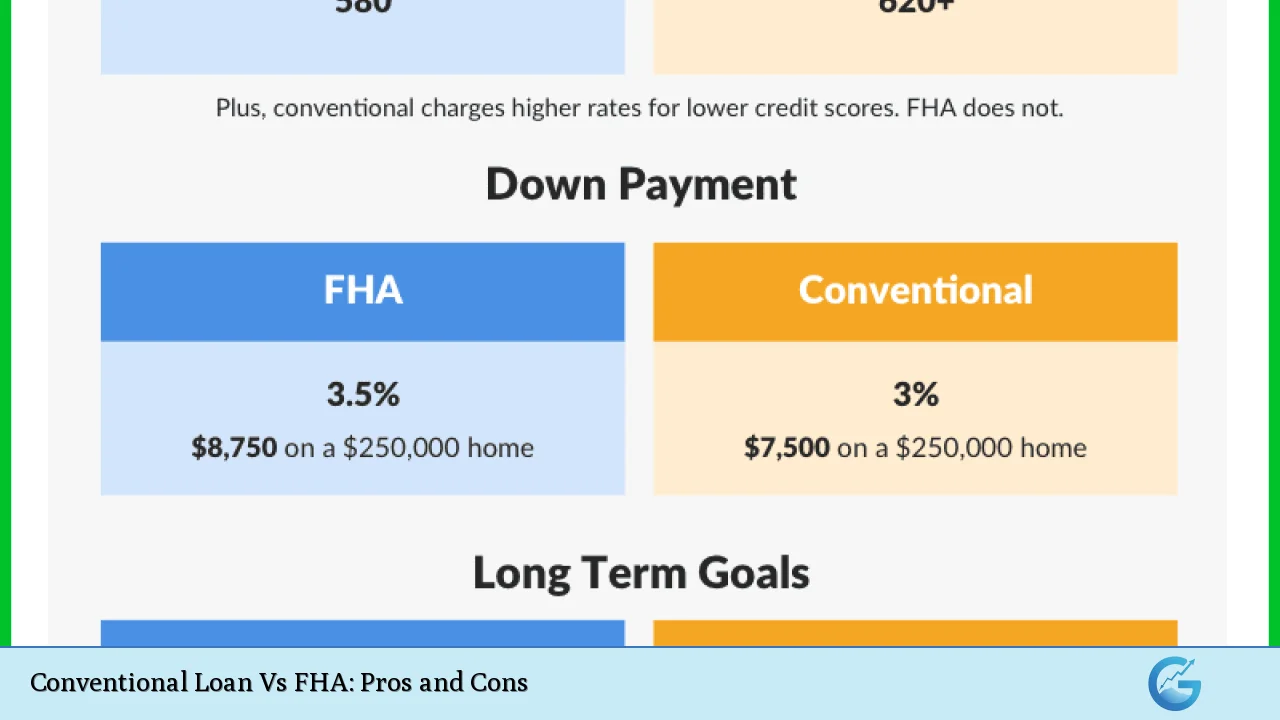

One of the most significant advantages of both loan types is their accessibility through lower down payment requirements.

- Conventional Loans: Borrowers can secure a Conventional loan with as little as 3% down, making it an attractive option for first-time buyers who may not have substantial savings.

- FHA Loans: Similarly, FHA loans require a minimum down payment of 3.5% if the borrower has a credit score of at least 580. This flexibility allows more individuals to enter the housing market.

However, while both options provide lower down payments, they come with different implications regarding mortgage insurance and overall costs.

Mortgage Insurance Costs

Mortgage insurance is a crucial aspect to consider when evaluating these loan types.

- Conventional Loans: If a borrower puts less than 20% down, they will typically need to pay Private Mortgage Insurance (PMI). However, once they reach 20% equity in their home, they can request the removal of PMI, effectively reducing their monthly payments.

- FHA Loans: FHA loans require both an upfront mortgage insurance premium (MIP) and annual premiums that must be paid throughout the life of the loan. This can lead to higher overall costs compared to conventional financing.

Credit Score Requirements

Credit scores play a pivotal role in determining eligibility and interest rates for both loan types.

- Conventional Loans: Generally require a minimum credit score of 620. Borrowers with higher scores may qualify for better interest rates and lower PMI costs.

- FHA Loans: Offer more lenient credit requirements, allowing scores as low as 500 with a higher down payment (10%). This makes FHA loans accessible to borrowers who may struggle to qualify for conventional financing due to poor credit history.

Interest Rates

Interest rates are another critical factor influencing the total cost of borrowing.

- Conventional Loans: Typically offer competitive rates for borrowers with good credit. However, those with lower scores may face higher rates due to perceived risk by lenders.

- FHA Loans: Often provide lower interest rates compared to conventional options, especially beneficial for borrowers with less-than-perfect credit. However, this advantage can be offset by the additional costs associated with MIP.

Property Standards and Restrictions

Both loan types have specific property requirements that borrowers must consider.

- Conventional Loans: There are generally fewer restrictions regarding property types. Borrowers can use these loans for various residential properties without stringent inspections or standards imposed by government agencies.

- FHA Loans: Require properties to meet certain safety standards set by the FHA. This can limit options for buyers interested in fixer-uppers or properties that do not meet these criteria.

Closing Times

The time it takes to close on a loan can significantly impact homebuyers eager to finalize their purchase.

- Conventional Loans: Often have faster closing times due to less bureaucratic oversight. Fewer parties are involved in the approval process, allowing lenders to expedite transactions.

- FHA Loans: May involve longer closing times because of additional paperwork and inspections required by the government-backed program.

Loan Limits

Loan limits vary by location and can affect purchasing power in certain markets.

- Conventional Loans: Generally have higher limits compared to FHA loans, allowing borrowers in high-cost areas to secure larger amounts needed for homes.

- FHA Loans: Set specific limits based on geographic location, which can restrict buyers in expensive markets from qualifying for sufficient funding through this option.

Refinancing Options

Refinancing is an essential consideration as financial situations change over time.

- Conventional Loans: Provide more variety in refinancing options, including cash-out refinances that allow homeowners to access equity built up in their property more flexibly.

- FHA Loans: While they also offer refinancing options, they may not provide as many choices or favorable terms compared to conventional alternatives.

Conclusion

Choosing between a Conventional Loan and an FHA Loan requires careful consideration of various factors including down payment requirements, mortgage insurance costs, credit score thresholds, interest rates, property standards, closing times, loan limits, and refinancing options.

Both types of financing have unique advantages that cater to different borrower needs. For those with strong credit histories and substantial down payments, Conventional Loans often present a more cost-effective solution over time. Conversely, FHA Loans serve as an excellent entry point into homeownership for individuals with lower credit scores or limited savings.

Ultimately, potential homeowners should evaluate their financial situation and long-term goals before deciding which loan type best fits their needs. Consulting with financial advisors or mortgage professionals can also provide valuable insights tailored to individual circumstances.

Frequently Asked Questions About Conventional Loan Vs FHA

- What is the main difference between FHA and Conventional loans?

The primary difference lies in their backing; FHA loans are insured by the government while Conventional loans are not. This affects eligibility criteria and associated costs. - Can I switch from an FHA loan to a Conventional loan?

Yes, borrowers can refinance from an FHA loan into a Conventional loan once they meet credit score and equity requirements. - Are interest rates higher on FHA loans?

No, FHA loans often have competitive interest rates; however, they come with additional mortgage insurance costs that may increase overall expenses. - What happens if I default on an FHA loan?

If you default on an FHA loan, the lender will file a claim with the FHA for reimbursement due to the insurance backing. - Is it easier to qualify for an FHA loan?

Yes, FHA loans generally have more lenient qualification criteria compared to Conventional loans. - What are typical closing costs associated with each type of loan?

Closing costs vary but are typically higher for FHA loans due to additional fees like MIP compared to Conventional mortgages. - Can I use gift funds for my down payment?

Yes, both FHA and some Conventional loan programs allow gift funds from family members or approved sources for down payments. - Do I need private mortgage insurance (PMI) with an FHA loan?

Yes, all FHA borrowers must pay MIP regardless of down payment size.